Guarantee Agreement - Sign Online

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Top-notch document management with airSlate SignNow

Gain access to a robust form library

Generate reusable templates

Collect signatures via secure links

Keep paperwork safe

Enhance collaboration

eSign via API integrations

Your complete how-to guide - guarantee agreement

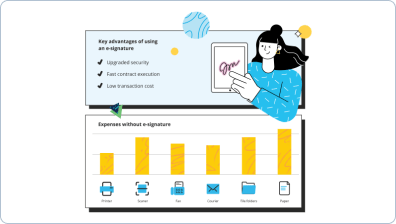

Nowadays, you probably won't find an organization that doesn't use contemporary technologies to atomize workflow. An electronic signature is not the future, but the present. Present day businesses using their turnover simply don't want to stop web-based programs that provide sophisticated data file management automation tools, including Sign Guarantee Agreement function.

How you can handle Sign Guarantee Agreement airSlate SignNow feature:

-

Once you get to our web site, Login or create your profile if you don't have one, it will take you a couple of seconds.

-

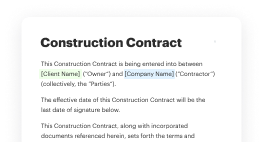

Upload the needed document or choose one from your library folders: Documents, Archive, Templates.

-

As a result of cloud-based storage compatibility, it is possible to quickly import the appropriate doc from recommended clouds with practically any device.

-

You'll discover your data file opened in the up-to-date PDF Editor where you can make modifications prior to move forward.

-

Type textual content, put in images, add annotations or fillable areas to be accomplished further.

-

Use My Signature button for self-signing or include Signature Fields to deliver the sign require to a single or multiple recipients.

-

Tap the DONE button when completed to go on with Sign Guarantee Agreement feature.

airSlate SignNow online platform is important to raise the effectiveness and output of most operational processes. Sign Guarantee Agreement is among the features that will help. Utilizing the web-based application nowadays is a basic need, not a competitive benefit. Try it now!

How it works

Rate your experience

What is the esignature guarantee reviews

The esignature guarantee reviews provide a comprehensive overview of the electronic signature guarantee process, which is essential for validating certain transactions, particularly in financial and legal contexts. An esignature guarantee serves as a confirmation that the signer’s identity has been verified and that they have the authority to sign the document. This process is crucial for preventing fraud and ensuring that agreements are legally binding.

Typically, an esignature guarantee is required for transactions such as transferring securities, opening bank accounts, or executing legal agreements. Understanding the nuances of esignature guarantees helps users navigate the requirements and ensures compliance with relevant laws.

How to use the esignature guarantee reviews

Using the esignature guarantee reviews involves understanding the specific requirements and processes associated with electronic signatures. Users can begin by reviewing the guidelines provided in the document, which outline the necessary steps for obtaining an esignature guarantee. This includes identifying the type of document that requires a guarantee and ensuring that all parties involved are aware of their roles in the signing process.

Once the requirements are clear, users can utilize airSlate SignNow to fill out the necessary forms, request signatures, and manage the document electronically. The platform allows for seamless collaboration, ensuring that all parties can participate in the signing process from anywhere, at any time.

Steps to complete the esignature guarantee reviews

Completing the esignature guarantee reviews involves several key steps:

- Identify the document that requires an esignature guarantee.

- Gather the necessary information and documentation needed for verification.

- Access airSlate SignNow and create an account if you do not already have one.

- Upload the document to the platform.

- Fill in the required fields and specify the signers.

- Send the document for signature, ensuring that all parties are notified.

- Once all signatures are obtained, securely store the completed document for future reference.

By following these steps, users can efficiently manage the esignature guarantee process and ensure compliance with legal requirements.

Legal use of the esignature guarantee reviews

The legal use of esignature guarantees is governed by various federal and state laws, including the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish the validity of electronic signatures and ensure that they hold the same legal weight as traditional handwritten signatures.

It is important for users to familiarize themselves with these regulations to ensure that their electronic signatures meet all legal requirements. This includes understanding the types of documents that can be signed electronically and the specific conditions under which an esignature guarantee is necessary.

Security & Compliance Guidelines

When using esignature guarantees, security and compliance are paramount. Users should ensure that the platform they choose, such as airSlate SignNow, adheres to industry-standard security protocols. This includes data encryption, secure access controls, and compliance with regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) when applicable.

Additionally, users should implement best practices for managing sensitive information, such as regularly updating passwords and monitoring access to signed documents. By prioritizing security and compliance, users can protect themselves and their transactions from potential risks.

Timeframes & Processing Delays

Understanding the timeframes associated with esignature guarantees is crucial for effective planning. The processing time can vary based on several factors, including the complexity of the document, the number of signers, and the responsiveness of the parties involved. Generally, electronic signatures can be obtained much faster than traditional methods, often within a few hours or days.

However, users should be aware that delays may occur if additional information is required for verification or if signers are unresponsive. To mitigate potential delays, it is advisable to communicate clearly with all parties involved and set expectations regarding timelines.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

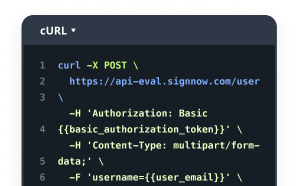

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What are esignature guarantee reviews?

Esignature guarantee reviews provide insights into the reliability and effectiveness of electronic signature solutions. These reviews help potential users understand how well a service meets their needs, including security, ease of use, and customer support.

-

How does airSlate SignNow compare in esignature guarantee reviews?

AirSlate SignNow consistently receives positive esignature guarantee reviews for its user-friendly interface and robust features. Customers appreciate its affordability and the ability to streamline document workflows, making it a preferred choice for businesses.

-

What features contribute to positive esignature guarantee reviews for airSlate SignNow?

Key features that enhance airSlate SignNow's esignature guarantee reviews include customizable templates, advanced security measures, and seamless integrations with popular applications. These features ensure that users can efficiently manage their document signing processes.

-

Are there any pricing options available for airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. The competitive pricing structure is often highlighted in esignature guarantee reviews, making it an attractive option for both small businesses and large enterprises.

-

What benefits do users report in esignature guarantee reviews?

Users frequently mention benefits such as time savings, improved document accuracy, and enhanced collaboration in their esignature guarantee reviews. These advantages contribute to a more efficient workflow and higher overall satisfaction with the service.

-

Can airSlate SignNow integrate with other software?

Absolutely! AirSlate SignNow offers integrations with various software applications, which is often praised in esignature guarantee reviews. This capability allows users to connect their existing tools and streamline their document management processes.

-

Is airSlate SignNow secure for electronic signatures?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards. This commitment to security is frequently highlighted in esignature guarantee reviews, reassuring users about the safety of their documents.

Guarantee agreement

Trusted eSignature solution - guarantee agreement

Join over 28 million airSlate SignNow users

Get more for guarantee agreement

- Explore popular eSignature features: secure sign

- Explore popular eSignature features: secure signature

- Enjoy Flexible eSignature Workflows: send a document ...

- Find All You Need to Know: send a PDF for signature

- Explore popular eSignature features: send an electronic ...

- Enjoy Flexible eSignature Workflows: send a document ...

- Enjoy Flexible eSignature Workflows: send a document ...

- Enjoy Flexible eSignature Workflows: send documents to ...

The ins and outs of eSignature