Sign Limited Partnership Agreement

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Superior document management with airSlate SignNow

Gain access to a robust form library

Generate reusable templates

Collect signatures through secure links

Keep forms safe

Enhance collaboration

eSign through API integrations

Quick-start guide on how to create, complete, and sign limited partnership agreement

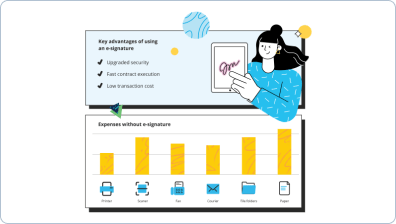

Think of all the paper that you waste to print limited partnership agreement, not counting the countless other documents that are dozens of pages long that your organization uses weekly. That's a lot of wasted paper. It directly correlates to wasted natural resources and, of course, as well as spending budget. With airSlate SignNow eSignature, you can go paperless, eliminating waste and improving productivity.

Follow the steps listed below to edit and sign limited partnership agreement in minutes:

- Open your web browser and visit signnow.com.

- Join for a free trial or log in with your email or Google/Facebook credentials.

- Click User Avatar -> My Account at the top-right corner of the page.

- Personalize your User Profile with your personal information and altering settings.

- Design and manage your Default Signature(s).

- Get back to the dashboard page.

- Hover over the Upload and Create button and select the needed option.

- Click the Prepare and Send key next to the document's name.

- Type the email address and name of all signers in the pop-up box that opens.

- Use the Start adding fields option to proceed to edit document and self sign them.

- Click SAVE AND INVITE when completed.

- Continue to fine-tune your eSignature workflow employing more features.

It can't get any easier to sign a limited partnership agreement than that. If creating, editing, signing and tracking numerous documents and forms seems like an administrative burden for your teams, give advanced eSignature by airSlate SignNow a try.

How it works

Rate your experience

What is the partnership agreement email

A partnership agreement email is a digital communication that outlines the terms and conditions of a partnership between two or more parties. This document is essential for establishing a clear understanding of each partner's roles, responsibilities, and contributions. It typically includes details such as profit-sharing ratios, decision-making processes, and dispute resolution methods. By using airSlate SignNow, users can create, send, and eSign this agreement electronically, ensuring that all parties have access to the document and can review it conveniently.

How to use the partnership agreement email

To effectively use a partnership agreement email, start by drafting the agreement using a partnership agreement template. Once the document is prepared, upload it to airSlate SignNow. From there, you can fill in the necessary details, such as partner names, business structure, and specific terms. After completing the document, you can send it for signature to all involved parties. Each partner will receive an email notification prompting them to review and eSign the agreement, streamlining the process and maintaining a clear record of the transaction.

Steps to complete the partnership agreement email

Completing a partnership agreement email involves several straightforward steps:

- Draft the partnership agreement using a reliable template.

- Log into your airSlate SignNow account and upload the document.

- Fill in all required fields, including partner details and specific terms.

- Review the document for accuracy and completeness.

- Send the document for signature to all partners via email.

- Monitor the signing process through your airSlate SignNow dashboard.

- Once all parties have signed, securely store the completed agreement for future reference.

Key elements of the partnership agreement email

Essential components of a partnership agreement email include:

- Partner Information: Names and contact details of all partners involved.

- Business Purpose: A clear statement outlining the objectives of the partnership.

- Capital Contributions: Details on the financial or material contributions made by each partner.

- Profit and Loss Distribution: How profits and losses will be shared among partners.

- Decision-Making Process: Procedures for making decisions and resolving disputes.

- Duration of Partnership: The time frame for which the partnership is established.

Legal use of the partnership agreement email

Using a partnership agreement email legally requires adherence to state laws governing partnerships. Each state may have specific regulations regarding the formation and operation of partnerships. It is advisable to consult a legal professional to ensure that the agreement complies with local laws and adequately protects the interests of all partners. By utilizing airSlate SignNow for eSigning, users can ensure that their agreements are legally binding and securely stored, providing peace of mind for all parties involved.

Security & Compliance Guidelines

When handling partnership agreements electronically, security and compliance are paramount. airSlate SignNow employs advanced encryption methods to protect sensitive information during transmission and storage. Users should ensure that all parties involved in the partnership agreement have secure access to their email and airSlate SignNow accounts. Additionally, it is essential to maintain compliance with applicable laws, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, which validates the use of electronic signatures in business transactions.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

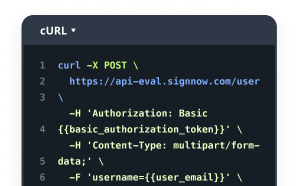

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is a partnership agreement email?

A partnership agreement email is a formal communication that outlines the terms and conditions of a partnership between two or more parties. It serves as a digital record of the agreement and can be easily shared and signed using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with partnership agreement emails?

airSlate SignNow simplifies the process of creating, sending, and signing partnership agreement emails. With its user-friendly interface, you can quickly draft your agreement, send it for eSignature, and track its status, ensuring a smooth partnership setup.

-

What are the pricing options for using airSlate SignNow for partnership agreement emails?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small startup or a large enterprise, you can choose a plan that allows you to send unlimited partnership agreement emails and access advanced features at a competitive price.

-

Are there any features specifically designed for partnership agreement emails?

Yes, airSlate SignNow includes features tailored for partnership agreement emails, such as customizable templates, automated reminders, and secure storage. These features help streamline the signing process and ensure that all parties are on the same page.

-

Can I integrate airSlate SignNow with other tools for partnership agreement emails?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your partnership agreement emails alongside your existing workflows. This integration enhances productivity and ensures that your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for partnership agreement emails?

Using airSlate SignNow for partnership agreement emails offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. By digitizing your agreements, you can focus more on building partnerships rather than getting bogged down by administrative tasks.

-

Is it easy to track the status of partnership agreement emails sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all partnership agreement emails you send. You can easily see who has viewed, signed, or declined the agreement, allowing you to follow up promptly and keep the process moving forward.

Limited partnership agreement

Trusted eSignature solution - limited partnership agreement

Join over 28 million airSlate SignNow users

Get more for limited partnership agreement

- Explore popular eSignature features: Microsoft eSign

- Explore popular eSignature features: mobile e signature

- Explore popular eSignature features: mobile signatures

- Explore Your Digital Signature – Questions Answered: ...

- Enjoy Flexible eSignature Workflows: Office 365 ...

- Explore popular eSignature features: Office 365 ...

- Explore popular eSignature features: official ...

- Streamline Your Contract Lifecycle: online contract ...

The ins and outs of eSignature