Notice to Stop Credit Charge - Sign Online

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Excellent form management with airSlate SignNow

Get access to a rich form collection

Generate reusable templates

Collect signatures via links

Keep paperwork protected

Improve collaboration

eSign through API integrations

Quick-start guide on how to build, fill in, and sign notice to stop credit charge

Think of all the paper that you waste to print notice to stop credit charge, not counting the countless other documents that are dozens of pages long that your organization uses weekly. That's a lot of wasted paper. It directly correlates to wasted natural resources and, of course, as well as spending budget. With airSlate SignNow eSignature, you can go digital, reducing waste and raising efficiency.

Follow the steps listed below to edit and signal notice to stop credit charge quickly:

- Open your web browser and go to signnow.com.

- Sign up for a free trial or log in utilizing your electronic mail or Google/Facebook credentials.

- Click on User Avatar -> My Account at the top-right area of the webpage.

- Customize your User Profile by adding personal information and changing configurations.

- Create and manage your Default Signature(s).

- Return to the dashboard webpage.

- Hover over the Upload and Create button and choose the appropriate option.

- Click on the Prepare and Send option next to the document's title.

- Enter the email address and name of all signers in the pop-up window that opens.

- Make use of the Start adding fields menu to proceed to modify file and self sign them.

- Click on SAVE AND INVITE when you're done.

- Continue to customize your eSignature workflow employing advanced features.

It can't get any easier to sign a notice to stop credit charge than that. If creating, editing, signing and tracking numerous templates and forms sounds like an administrative burden for your company, give powerful eSignature by airSlate SignNow a try.

How it works

Rate your experience

What is the airslate inc charge

The airslate inc charge typically refers to a transaction associated with services provided by airSlate, Inc., a company known for its digital document automation solutions. This charge may appear on bank statements or credit card bills as a result of subscriptions or one-time payments for services related to document management, eSigning, and workflow automation. Understanding this charge is essential for users who engage with airSlate's offerings, ensuring clarity in financial transactions.

How to use the airslate inc charge

Using the airslate inc charge involves recognizing it as part of your financial interactions with airSlate, Inc. Users can track this charge by reviewing their billing statements and ensuring that it aligns with the services they have subscribed to or utilized. If assistance is needed, users can contact customer support for clarification on specific charges. Keeping detailed records of transactions can help in managing expenses related to digital document services.

Steps to complete the airslate inc charge

To effectively manage the airslate inc charge, follow these steps:

- Review your account details on the airSlate platform to confirm the services you are subscribed to.

- Check your billing statements for the specific charge to ensure it matches your usage.

- If discrepancies arise, gather relevant information and contact airSlate's customer service for resolution.

- Keep a record of all communication regarding the charge for future reference.

Security & Compliance Guidelines

When dealing with the airslate inc charge, it is crucial to adhere to security and compliance guidelines. Ensure that all transactions are conducted through secure channels, such as the official airSlate website or app. Regularly update passwords and monitor account activity for any unauthorized transactions. Understanding the privacy policies and compliance measures taken by airSlate can also provide peace of mind regarding the handling of personal and financial information.

Examples of using the airslate inc charge

Examples of the airslate inc charge can include monthly subscription fees for document automation services or one-time payments for specific features like advanced eSignature capabilities. Users may encounter this charge when they sign up for premium services or additional features that enhance their document management processes. Recognizing these examples helps users anticipate charges and manage their budgets effectively.

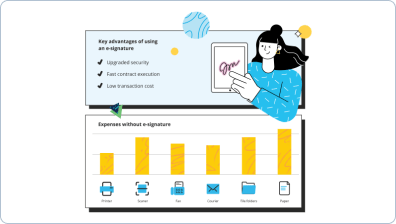

Digital vs. Paper-Based Signing

Understanding the differences between digital and paper-based signing is vital when considering the airslate inc charge. Digital signing through platforms like airSlate offers numerous advantages, including faster turnaround times, reduced costs, and enhanced security. In contrast, paper-based signing involves physical documents, which can lead to delays and increased expenses. Embracing digital solutions can streamline workflows and minimize the likelihood of unexpected charges associated with traditional signing methods.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

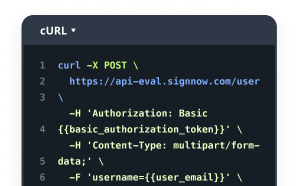

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is the airSlate Inc charge for using SignNow?

The airSlate Inc charge for using SignNow varies based on the subscription plan you choose. We offer several pricing tiers to accommodate different business needs, ensuring you get the best value for your investment. You can find detailed pricing information on our website to help you select the right plan.

-

What features are included in the airSlate Inc charge?

The airSlate Inc charge includes a variety of features designed to streamline your document management process. Key features include eSigning, document templates, team collaboration tools, and advanced security measures. These tools empower businesses to enhance productivity and efficiency.

-

Are there any hidden fees in the airSlate Inc charge?

No, there are no hidden fees in the airSlate Inc charge. We believe in transparency, so the price you see is the price you pay. Our pricing structure is straightforward, allowing you to budget effectively without unexpected costs.

-

How does the airSlate Inc charge compare to competitors?

The airSlate Inc charge is competitive when compared to other eSignature solutions in the market. We offer a cost-effective solution without compromising on features or quality. Our pricing reflects our commitment to providing value to our customers.

-

What are the benefits of choosing airSlate SignNow?

Choosing airSlate SignNow offers numerous benefits, including ease of use, affordability, and robust features. The airSlate Inc charge provides access to tools that simplify document workflows, making it easier for businesses to manage their signing processes. This leads to increased efficiency and reduced turnaround times.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow can be easily integrated with various applications to enhance your workflow. The airSlate Inc charge includes access to integration options with popular tools like Google Drive, Salesforce, and more. This flexibility allows you to customize your document management processes.

-

Is there a free trial available for airSlate SignNow?

Yes, we offer a free trial for airSlate SignNow, allowing you to explore our features before committing to the airSlate Inc charge. This trial period gives you the opportunity to assess how our solution fits your business needs. Sign up today to experience the benefits firsthand.

Notice to stop credit charge

Trusted eSignature solution - notice to stop credit charge

Join over 28 million airSlate SignNow users

Get more for notice to stop credit charge

- Unlock the Power of eSignature: free electronic ...

- Unlock the Power of eSignature: free electronic ...

- Unlock the Power of eSignature: free electronic ...

- Unlock the Power of eSignature: free electronic ...

- Unlock the Power of eSignature: free electronic ...

- Unlock the Power of eSignature: free electronic ...

- Unlock the Power of eSignature: free electronic ...

- Unlock the Power of eSignature: free eSign for lease ...

The ins and outs of eSignature