Tax Sign in India

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your complete how-to guide - tax sign in india

Increase your workflows: tax sign in India

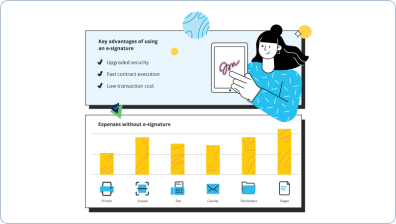

Nowadays, printing hard copies of documents and manual signing is absolutely nothing but wasting time and paper. People around the world are going paperless every day and replacing wet ink signatures with eSignatures.

airSlate SignNow makes using the tax sign in India simple and fast, all without you having to go somewhere from your office or home. Access an easy-to-use service with global compliance and high security standards.

Tax sign in India: how to launch

- Sign up for your account. Open the airSlate SignNow website, select Free trial to get started.

- Select a doc. Select the blue Upload Documents button and find a file from your internal memory or drag and drop one into the specified area.

- Change the template. Include new textual content, checkmarks, dates etc., that you can find on the left sidebar.

- Make your PDF interactive. Add smart fillable fields, dropdown lists, radio button groups, and more.

- Include a payment request. Click Settings > Request Payment.

- Double-check the your doc. Make sure everything is updated and accurate.

- Add signature fields. Include a Signature Field for each party you require.

- airSlate SignNow the PDF. Click the My Signature element and choose to draw, type, or upload a scanned picture of your autograph.

- Send the sample for signing. Select Invite to Sign and indicate recipient email(s) to send an eSignature request.

- Download your copy. Select Save and Close > Download (on the right sidebar) to save the PDF on your device.

Get beneficial tax sign in India with airSlate SignNow.

Start your Free trial right now and enhance your document workflows!

How it works

Rate your experience

What is the tax sign in India

The tax sign in India refers to the electronic signature used for various tax-related documents, including income tax returns, GST filings, and other financial declarations. This digital signature serves as a legally recognized method for individuals and businesses to authenticate their documents, ensuring that the information submitted is both secure and verifiable. The tax sign simplifies the filing process, allowing users to complete and submit their tax documents electronically without the need for physical signatures.

How to use the tax sign in India

Using the tax sign in India involves a straightforward process. First, users must ensure they have a registered digital signature certificate, which can be obtained from authorized certifying authorities. Once the certificate is acquired, users can upload their tax documents to an e-filing platform. After filling out the required fields, they can apply their digital signature to the document. This process can typically be completed on various devices, including computers and mobile devices, making it accessible and convenient for all users.

Steps to complete the tax sign in India

To complete the tax sign in India, follow these steps:

- Obtain a digital signature certificate from a recognized certifying authority.

- Choose an e-filing platform that supports tax submissions.

- Upload the necessary tax documents to the platform.

- Fill in all required information accurately.

- Apply your digital signature to the completed document.

- Review the document for accuracy before final submission.

- Submit the signed document electronically and retain a copy for your records.

Key elements of the tax sign in India

The tax sign in India includes several key elements that enhance its functionality and security. These elements include:

- Authentication: Ensures that the signatory is verified and authorized to sign the document.

- Integrity: Confirms that the document has not been altered after signing.

- Non-repudiation: Provides legal assurance that the signatory cannot deny having signed the document.

- Time-stamping: Records the exact time the document was signed, adding an additional layer of security.

Security & Compliance Guidelines

When using the tax sign in India, it is essential to adhere to security and compliance guidelines to protect sensitive information. Users should ensure that their digital signature certificates are kept secure and only used on trusted platforms. Regularly updating passwords and using two-factor authentication can enhance security. Additionally, users should be aware of the legal requirements for electronic signatures in their jurisdiction, ensuring compliance with relevant regulations.

Sending & Signing Methods (Web / Mobile / App)

There are various methods for sending and signing tax documents using the tax sign in India. Users can choose to complete the process via:

- Web platforms: Access e-filing websites through a browser for a full-featured experience.

- Mobile applications: Utilize dedicated apps that allow for document signing and submission on the go.

- Email: Send documents for signature via email, where recipients can eSign directly.

Each method offers flexibility and convenience, allowing users to manage their tax documents efficiently.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is the process for tax sign in India using airSlate SignNow?

The process for tax sign in India using airSlate SignNow is straightforward. Users can upload their tax documents, add necessary signatures, and send them securely for eSigning. This ensures compliance with Indian tax regulations while streamlining the signing process.

-

How much does airSlate SignNow cost for tax sign in India?

airSlate SignNow offers competitive pricing plans tailored for businesses in India. Depending on the features you need for tax sign in India, you can choose from various subscription options that provide flexibility and cost-effectiveness. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for tax sign in India?

airSlate SignNow provides a range of features for tax sign in India, including customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance efficiency and ensure that your tax documents are handled securely and professionally.

-

Is airSlate SignNow compliant with Indian tax regulations?

Yes, airSlate SignNow is fully compliant with Indian tax regulations. Our platform adheres to legal standards for electronic signatures, ensuring that your tax sign in India is valid and recognized by authorities. This compliance helps businesses avoid legal issues.

-

Can I integrate airSlate SignNow with other software for tax sign in India?

Absolutely! airSlate SignNow offers seamless integrations with various software applications commonly used in India. This allows for a more streamlined workflow when managing tax documents, making the tax sign in India process even more efficient.

-

What are the benefits of using airSlate SignNow for tax sign in India?

Using airSlate SignNow for tax sign in India provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform simplifies the signing process, allowing businesses to focus on their core activities while ensuring compliance with tax requirements.

-

How secure is airSlate SignNow for tax sign in India?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your documents during the tax sign in India process. This ensures that sensitive information remains confidential and secure from unauthorized access.

Tax sign in india

Trusted eSignature solution - tax sign in india

Related searches to tax sign in india

Join over 28 million airSlate SignNow users

Get more for tax sign in india

- Unlock the Power of Digital Signature Legitimateness ...

- Boost Your Planning in United States with Digital ...

- Unlocking Digital Signature Legitimateness for Planning ...

- Unlock the Power of Digital Signature Legitimateness ...

- Enhance your planning in India with the legitimacy of ...

- Unlock the Power of Digital Signature Legitimateness ...

- Unlocking Digital Signature Legitimateness for Planning ...

- Digital Signature Legitimateness for Purchasing in ...

The ins and outs of eSignature