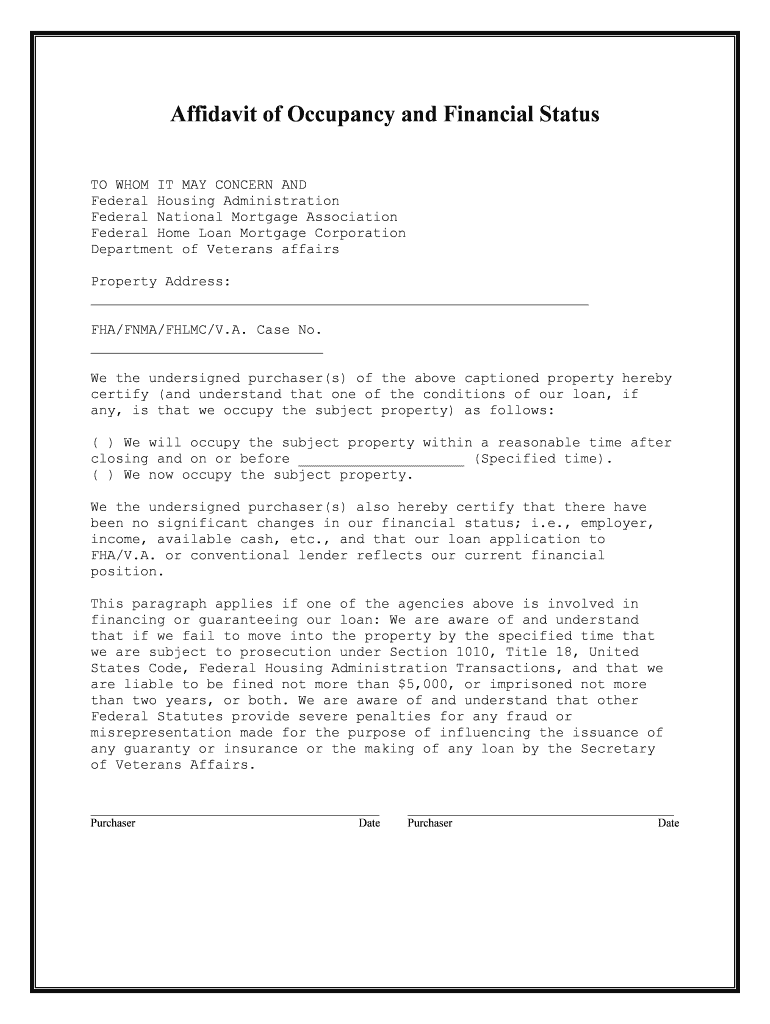

Fill and Sign the And that Our Loan Application to Form

Useful suggestions for preparing your ‘ And That Our Loan Application To’ online

Are you fed up with the complexities of handling documents? Look no further than airSlate SignNow, the top electronic signature solution for individuals and businesses. Say farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the extensive features integrated into this user-friendly and budget-friendly platform and transform your approach to document management. Whether you need to approve forms or gather electronic signatures, airSlate SignNow manages everything effortlessly, requiring just a few clicks.

Follow this detailed guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘ And That Our Loan Application To’ in the editor.

- Click Me (Fill Out Now) to finish the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a multi-use template.

There's no need to worry if you need to collaborate with others on your And That Our Loan Application To or send it for notarization—our solution provides you with everything you need to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is airSlate SignNow and how does it relate to our loan application process?

airSlate SignNow is a powerful eSignature solution that streamlines the document signing process, making it ideal for our loan application to be completed efficiently. By using airSlate SignNow, businesses can easily send, sign, and manage loan documents, ensuring a smoother experience for all parties involved.

-

How does airSlate SignNow enhance our loan application to customers?

Using airSlate SignNow for our loan application to customers allows for quick and secure electronic signatures, reducing turnaround time. This efficiency not only enhances customer satisfaction but also increases the likelihood of closing deals faster.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes. Our loan application to clients can benefit from scalable options that suit varying needs, ensuring you only pay for the features that are essential for your operations.

-

Can airSlate SignNow integrate with our existing systems for loan applications?

Yes, airSlate SignNow seamlessly integrates with a variety of platforms and tools, making it easy to incorporate into our loan application to existing workflows. This integration ensures that you can manage loan documents effortlessly alongside your current systems.

-

What security measures does airSlate SignNow implement for our loan application to protect sensitive data?

airSlate SignNow prioritizes security with features like encryption, secure storage, and compliance with industry standards. This means that our loan application to clients is safeguarded against unauthorized access, ensuring peace of mind for both businesses and applicants.

-

Is it easy for clients to use airSlate SignNow for their loan applications?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple for clients to sign our loan application to documents from any device. This ease of use enhances the customer experience and encourages timely responses.

-

What features does airSlate SignNow offer that support our loan application process?

airSlate SignNow includes features like customizable templates, automated reminders, and real-time tracking that support our loan application to process. These tools not only improve efficiency but also help keep all parties informed about the status of their applications.

The best way to complete and sign your and that our loan application to form

Find out other and that our loan application to form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles