Important Information

Plan Administration and Operation

December 2005

DOL Expands and Simplifies Voluntary Fiduciary Correction

(VFC) Program

WHO'S AFFECTED The Voluntary Fiduciary Correction (VFC) Program is available to anyone

who may be liable for certain fiduciary violations under the Employee Retirement Income

Security Act (ERISA), including employee benefit plan sponsors, officers, trustees, plan

administrators or other parties-in-interest.

The information in this publication does not apply to plans that are not subject to ERISA, such as

governmental and nonelecting church plans, non-ERISA 403(b) programs, 457 plans, and nonqualified executive benefit plans that are not subject to ERISA.

BACKGROUND AND SUMMARY In 2000, the Department of Labor (DOL) created the

Voluntary Fiduciary Correction (VFC) Program. This program allows plan sponsors and

fiduciaries to voluntarily correct certain fiduciary violations and avoid civil and criminal penalties.

In 2002, the DOL made revisions to this program, which included the addition of a prohibited

transaction class exemption to provide excise tax relief for four specific transactions.

In April 2005, the DOL's Employee Benefits Security Administration (EBSA) made additional

changes to the VFC Program to simplify the submission process and expand the availability of the

program. The revised Program now:

• Provides a model application form;

• Simplifies the calculation of correction amounts;

• Requires reduced documentation for certain transactions;

• Formally includes delinquent loan repayments in the list of covered transactions and covers

three additional transactions: 1) participant loans in excess of the plan limit on loan

amounts; 2) participant loans in excess of the plan limit on loan duration; and 3) holding of

an illiquid asset previously purchased by a plan.

At the same time, the DOL proposed a new prohibited transaction class exemption for a plan’s

purchase of certain assets that have become illiquid.

The changes to the VFC Program are currently just proposed and are therefore still subject to

change, but they are also effective immediately. However, the prohibited transaction exemption is

not yet available.

ACTION AND NEXT STEPS Plan fiduciaries and their legal counsel should decide whether to

review plan transactions to determine if they meet all ERISA standards. If violations have

©2005, The Prudential Insurance Company of America, all rights reserved.

�occurred, the individuals responsible should discuss the VFC Program with their legal counsel to

determine if it is an appropriate option for their situation.

IN THIS ISSUE

Program Eligibility

Revised Procedure for VFC Program Correction

Relief from Excise Taxes for Certain Distributions

Limitations to the VFC Program

Additional Information about Correction of Delinquent Contributions

Next Steps

RELATED DOCUMENTS

Glossary of Special VFC Terms

Eligible Transactions and Corrections Under the VFC Program

Model Application Form

List of EBSA Regional Offices

The Department of Labor’s (DOL) Employee Benefits Security Administration has revised the

Voluntary Fiduciary Correction (VFC) Program. This program allows certain persons (including

fiduciaries, plan sponsors, parties in interest or other persons in a position to make corrections) to

voluntarily correct certain breaches of fiduciary responsibilities.

ERISA sets forth the responsibilities of employee benefit plan fiduciaries. A fiduciary who

breaches any of these responsibilities is personally liable for any losses to the plan as a result of

that transaction, and must restore to the plan any profits he made through the use of those assets. A

fiduciary may also be liable for a co-fiduciary’s breach, or for knowing participation in a fiduciary

breach.

Before the creation of the VFC Program, fiduciary breaches were generally corrected through

consultation and negotiation with the DOL, resulting in a penalty of 20% of a negotiated amount.

Through the VFC Program, a fiduciary breach (or possible breach) may be corrected without prior

negotiation with the DOL. If all the requirements of the program are met, the DOL will not initiate

a civil investigation or civil action with respect to the breach, and will not impose the 20% penalty.

Program Eligibility

The VFC Program can only be used if a plan representative has not received oral or written

notification of an investigation of the plan (or notice of intent to conduct an investigation) by the

DOL, or other Federal agency (i.e., IRS, Securities and Exchange Commission, or Pension Benefit

Guaranty Corporation). However, if the DOL has contacted a plan representative about a

complaint that is not related to the transaction to be corrected, the VFC Program is still available.

The VFC Program cannot be used if there is any evidence of potential criminal violations.

©2005, The Prudential Insurance Company of America, all rights reserved.

Page 2

�Revised Procedure for VFC Program Correction

A number of changes have been made to the program to encourage its use. The steps a fiduciary

must take to correct a breach through the revised VFC Program are described below.

STEP 1: Determine if identified violations can be corrected under the VFC Program.

Three types of prohibited transactions have been added to the list of transactions to be corrected.

In addition, delinquent participant loan repayments have formally been added to the list of eligible

transactions. Fiduciaries can now correct the following prohibited transactions under the VFC

Program:

1. Delinquent Participant Contributions and Loan Repayments to Retirement Plans.

2. Delinquent Participant Contributions to Insured Welfare Plans.

3. Delinquent Participant Contributions to Welfare Plan Trusts.

4. Loan at Fair Market Interest Rate to a Party in Interest.

5. Loan at Below-Market Interest Rate to a Party in Interest.

6. Loan at Below-Market Interest Rate to a Person Who is Not a Party in Interest.

7. Loan at Below-Market Interest Rate Solely Due to a Delay in Perfecting the Plan’s Security

Interest.

8. Loan Amount in Excess of Plan Limitations (new).

9. Loan Duration in Excess of Plan Limitations (new).

10. Purchase of an Asset (Including Real Property) by a Plan from a Party in Interest.

11. Sale of an Asset (Including Real Property) by a Plan to a Party in Interest.

12. Sale and Leaseback of Real Property to Employer.

13. Purchase of an Asset (Including Real Property) By a Plan from a Person Who is Not a Party in

Interest at a Price Other Than Fair Market Value.

14. Sale of an Asset (Including Real Property) By a Plan to a Person Who is Not a Party in Interest

at a Price Other Than Fair Market Value.

15. Holding of an Illiquid Asset Previously Purchased by a Plan (new).

16. Payment of Benefits Without Properly Valuing Plan Assets on Which Payment is Based.

17. Duplicative, Excessive, or Unnecessary Compensation Paid by a Plan.

18. Payment of Dual Compensation to a Plan Fiduciary.

STEP 2: Use the VFC Program method of correction.

The program provides specific correction methods for each of the 18 covered transactions. It

also provides detailed guidance for determining the amount to be restored to the plan, including

calculation of lost earnings, if any. The appropriate correction must be made before the VFC

application is submitted. Unlike the IRS correction program (EPCRS), there is no ability to

negotiate a correction method under the VFC Program.

The correction methods relating to retirement plans, including the calculation

methods for plan losses or earnings, are described in the document titled “Eligible Transactions

and Corrections Under the VFC Program.” The revised VFC Program contains simplified

calculation methods for determining lost earnings, including an Online Calculator to automatically

perform calculations.

The cost of the correction cannot be paid from plan assets.

©2005, The Prudential Insurance Company of America, all rights reserved.

Page 3

�STEP 3: File an application with the appropriate EBSA Regional Office.

The DOL has now provided a model application form that filers may use to assist with

submissions. Although filers are not required to use this form, the DOL encourages its use to

avoid common errors that result in processing delays and rejections. The form provides an outline

of the information and supplemental documentation that must be submitted, as well as the required

Penalty of Perjury Statement, which has also been simplified.

A plan fiduciary, plan sponsor, party in interest, or other person who is in a position to correct a

fiduciary breach must prepare the VFC Program application. An attorney or accountant

authorized to represent one of these persons may also prepare the application. Each application

must include the name, address and telephone number of a contact person who

is authorized to respond to questions from the EBSA.

The revised program simplifies the application process by:

• Not requiring applicants to provide information regarding the plan's fidelity bond; and

• Permitting filers to provide summary documentation when delinquent participant

contributions or loan repayments are being corrected and either: (1) the amount involved is

$50,000 or less, or (2) the amount involved is more than $50,000 but the contributions were

remitted within 180 days of their due dates.

Each application must include

• A detailed narrative describing the error and the corrective action;

• Supporting documentation, such as copies of relevant plan documents, documentation

establishing Lost Earnings and Restoration of Profits amounts, if applicable, and proof of

payment;

• A Penalty of Perjury Statement; and

• A completed and signed Checklist.

The application must be sent to the appropriate EBSA Regional Office. We have provided a list of

the EBSA Regional Offices in a separate document.

STEP 4. No-Action Letter

If the application meets all requirements of the program, EBSA will issue a no-action letter. This

letter states that EBSA will not conduct a civil investigation or assess the 20% penalty regarding

the transaction(s) corrected under the VFC Program. However, the no-action letter does not

prevent EBSA from investigating to ensure the VFC Program application was factual and

complete, and that the corrective action was taken.

Relief from Excise Taxes for Certain Transactions

The IRS generally imposes a 15% excise tax when a prohibited transaction occurs. Although the

VFC Program prevents the imposition of the DOL's 20% penalty, the IRS excise tax is generally

still imposed. However, the IRS will not impose the 15% excise tax for four specific transactions

if certain requirements are met.

The four transactions that are eligible for the excise tax relief are:

©2005, The Prudential Insurance Company of America, all rights reserved.

Page 4

�•

•

•

•

Delinquent participant contributions and/or loan repayments to pension plans, if the

contributions or loan repayments are submitted no more than 180 days late.

Loans at fair market interest rate to a party in interest with respect to the plan.

Purchase or sale of an asset (including real property) between a plan and a party in interest

at fair market value.

Sale and leaseback of real property to the employer.

Prohibited transactions that do not fall into one of these four categories are not exempt from the

excise tax, even if corrected under the VFC Program.

For any of these four prohibited transactions to qualify for the excise tax exemption, all of the

following requirements must be met:

• The transaction is corrected under the VFC Program, and the applicant receives a no-action

letter.

• With respect to the last three transactions described above, the plan assets involved in the

transaction did not exceed 10% of the fair market value (as defined in the “Glossary of

Special VFC Terms”) of all plan assets at the time of the transaction. In addition, the

transaction was at least as favorable to the plan as the terms available in arms-length

transactions between unrelated parties.

• The transaction was not part of an agreement, arrangement or understanding designed to

benefit a party in interest.

• The applicant has not used the VFC Program and received excise tax relief for a similar

type of transaction for the three-year period before the date of submission of the VFC

application.

• Interested persons are given a notice within 60 calendar days after the date the VFC

application is submitted.

To meet the notice requirement:

• The notice must include an objective description of the transaction and the steps taken to

correct it.

• The notice must be written in a manner that the average plan participant or beneficiary can

understand.

• The notice must provide for a 30-calendar day period in which interested persons can

provide comments to EBSA. The comment period begins on the day the notice is

distributed.

• Within 60 days of the VFC submission, EBSA is given a copy of the notice, including

the date it was distributed.

The cost of preparing and distributing the notice cannot be paid from plan assets.

The notice can be distributed by a bulletin board posting where it is reasonable to believe all

interested persons will see it, by sending it through regular mail or electronic mail, or by any

combination of methods.

At the same time that the DOL revised the VFC Program, it also issued a proposed prohibited

transaction class exemption to provide excise tax relief for a fifth transaction. The proposed

exemption would apply to a plan’s purchase of certain assets that have become illiquid, and/or the

sale of these assets to a party in interest, provided the plan receives the higher of the fair market

©2005, The Prudential Insurance Company of America, all rights reserved.

Page 5

�value at the time of correction, or its original purchase price, plus incidental costs. However,

excise tax relief for this transaction is not available until the DOL issues final rules on this

exemption.

Limitations to the VFC Program

A no-action letter promises only that EBSA will not investigate or assess a penalty for the specific

breach described in the VFC Program application. EBSA can still take any of the following

actions:

• Conduct a criminal investigation of the transaction;

• Make appropriate referrals of criminal violations;

• Seek to remove any person responsible for the transaction from positions of responsibility

with respect to the plan;

• Refer information about the transaction to the IRS;

• Impose penalties for failure or refusal to file a timely, complete, and accurate annual Form

5500.

Use of the VFC Program and receipt of a no-action letter does not prevent a government agency

other than EBSA from taking enforcement action regarding the breach.

Additional Information about Correction of Delinquent Contributions

Due to the number of inquiries received, the DOL has published a list of frequently asked

questions about the VFC Program correction method for delinquent contributions. The list is

available at http://www.dol.gov/ebsa/faqs/faq_vfcp2.html.

Next Steps

Plan fiduciaries and their legal counsel should decide whether to review plan transactions to ensure

no ERISA requirements have been violated. If fiduciary breaches have occurred, the individuals

responsible should discuss the VFC Program with their legal counsel to determine if it is

appropriate for their situation.

Pension Analyst by Prudential Retirement

The Pension Analyst is published by Prudential Retirement, a Prudential Financial business, to provide clients

with up-to-date information on current legislation and regulatory developments affecting qualified retirement plans.

This publication is distributed with the understanding that Prudential Retirement is not rendering legal advice.

Plan sponsors should consult their attorneys about the application of any law to their retirement plans. Prudential

Financial is a service mark of The Prudential Insurance Company of America, Newark, NJ and its affiliates.

Editor: Mitzi Romano

(860) 534-2768

©2005, The Prudential Insurance Company of America, all rights reserved.

Page 6

�

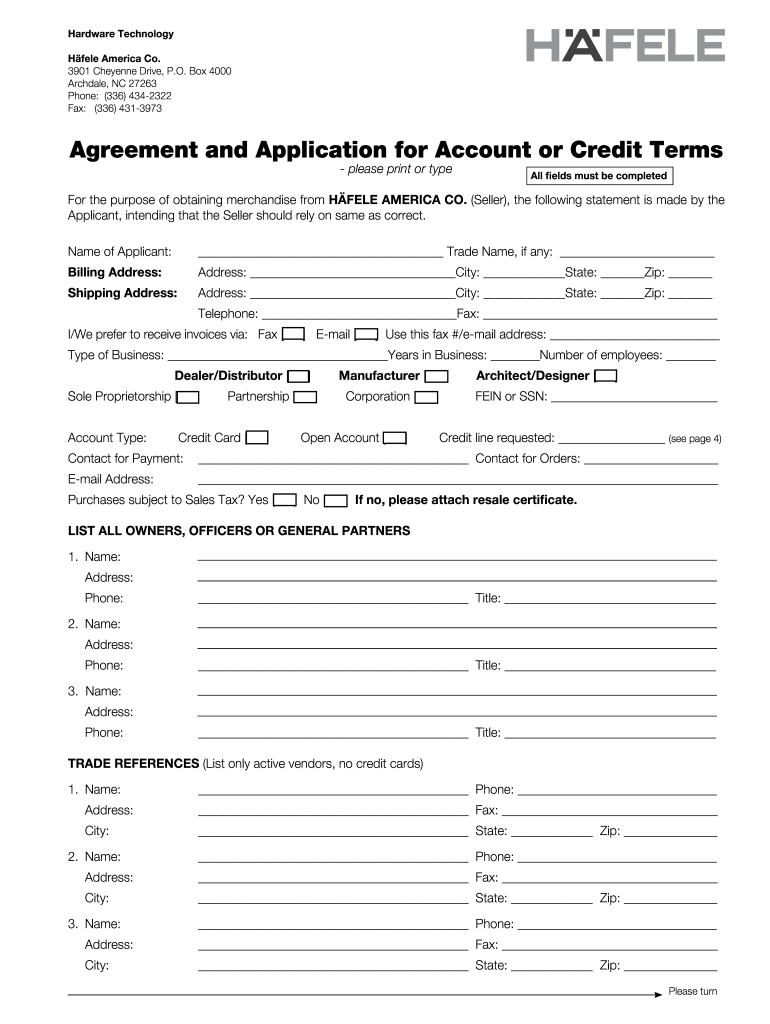

Helpful suggestions for finalizing your ‘Agreement And Application For Account Or Credit Terms’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Utilize the robust features embedded in this user-friendly and budget-friendly platform to transform your paperwork administration. Whether you require approval of forms or to collect eSignatures, airSlate SignNow simplifies it all with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Agreement And Application For Account Or Credit Terms’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for additional parties (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you have to collaborate with others on your Agreement And Application For Account Or Credit Terms or send it for notarization—our platform provides everything you need to accomplish these tasks. Register for an account with airSlate SignNow today and take your document management to new levels!