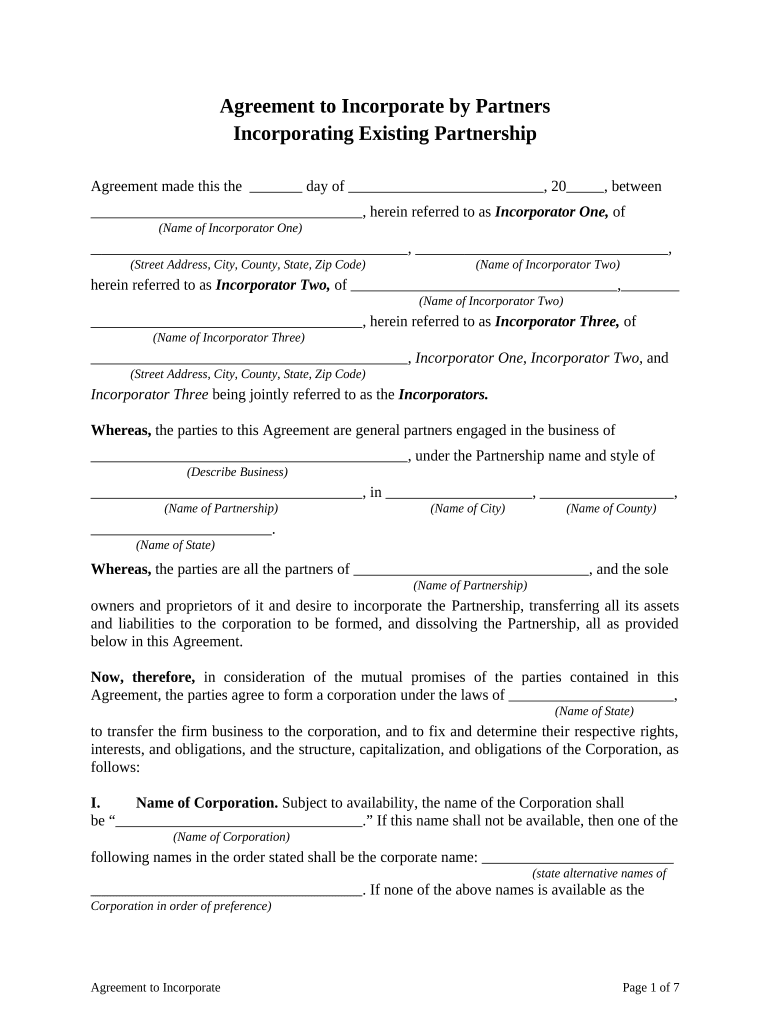

Agreement to Incorporate by Partners

Incorporating Existing Partnership

Agreement made this the day of , 20 , between

, herein referred to as Incorporator One, of

(Name of Incorporator One)

, ,

(Street Address, City, County, State, Zip Code) (Name of Incorporator Two)

herein referred to as Incorporator Two, of ,

(Name of Incorporator Two)

, herein referred to as Incorporator Three, of

(Name of Incorporator Three)

, Incorporator One, Incorporator Two, and

(Street Address, City, County, State, Zip Code)

Incorporator Three being jointly referred to as the Incorporators.

Whereas, the parties to this Agreement are general partners engaged in the business of

, under the Partnership name and style of

(Describe Business)

, in , ,

(Name of Partnership) (Name of City) (Name of County)

.

(Name of State)

Whereas, the parties are all the partners of , and the sole

(Name of Partnership)

owners and proprietors of it and desire to incorporate the Partnership , transferring all its assets

and liabilities to the corporation to be formed, and dissolving the Partnership, all as provided

below in this Agreement.

Now, therefore, in consideration of the mutual promises of the parties contained in this

Agreement, the parties agree to form a corporation under the laws of ,

(Name of State)

to transfer the firm business to the corporation, and to fix and determine their respective rights,

interests, and obligations, and the structure, capitalization, and obligations of the Corporation, as

follows:

I. Name of Corporation. Subject to availability, the name of the Corporation shall

be “ .” If this name shall not be available, then one of the

(Name of Corporation)

following names in the order stated shall be the corporate name:

(state alternative names of

. If none of the above names is available as the

Corporation in order of preference)

Agreement to Incorporate Page 1 of 7

name for the Corporation, then the corporate name shall be chosen as will most closely and

substantially resemble the Partnership name.

II. Purpose and Powers. The Corporation shall be formed to take over, assume, conduct,

and carry on the business now being conducted by the Partnership under the firm name of

, in , ,

(Name of Partnership) (Name of City) (Name of County)

, and to conduct such other lawful business or businesses as

(Name of State)

subsequently may from time to time be determined by the board of directors. The Corporation

shall have all general powers possessed by Corporations organized under (citation of statute),

including all powers necessary or convenient to effect any or all of the corporate purposes/as

follows:

A. To sue and be sued, complain and defend in its corporate name

B. To have a corporate seal, which may be altered at will, and to use it, or a facsimile

of it, by impressing or affixing it or in any other manner reproducing it;

C. To make and amend bylaws, not inconsistent with its articles of incorporation or

with the laws of this state, for managing the business and regulating the affairs of the

corporation;

D. To purchase, receive, lease or otherwise acquire, and own, hold, improve, use and

otherwise deal with, real or personal property, or any legal or equitable interest in

property, wherever located;

E. To sell, convey, mortgage, pledge, lease, exchange and otherwise dispose of all or

any part of its property;

F. To purchase, receive, subscribe for, or otherwise acquire; own, hold, vote, use,

sell, mortgage, lend, pledge or otherwise dispose of; and deal in and with shares or other

interests in, or obligations of, any other entity;

G. To make contracts and guarantees, incur liabilities, borrow money, issue its notes,

bonds and other obligations (which may be convertible into or include the option to

purchase other securities of the corporation), and secure any of its obligations by

mortgage or pledge of any of its property, franchises or income, and make contracts of

guaranty and suretyship which are necessary or convenient to the conduct, promotion or

attainment of the business of (i) a corporation all of the outstanding stock of which is

owned, directly or indirectly, by the contracting corporation, or (ii) a corporation which

owns, directly or indirectly, all of the outstanding stock of the contracting corporation, or

(iii) a corporation all of the outstanding stock of which is owned, directly or indirectly, by

a corporation which owns, directly or indirectly, all of the outstanding stock of the

contracting corporation, which contracts of guaranty and suretyship shall be deemed to be

necessary or convenient to the conduct, promotion or attainment of the business of the

Agreement to Incorporate Page 2 of 7

contracting corporation, and make other contracts of guaranty and suretyship which are

necessary or convenient to the conduct, promotion or attainment of the business of the

contracting corporation;

H. To lend money, invest and reinvest its funds, and receive and hold real and

personal property as security for repayment;

I. To be a promoter, partner, member, associate or manager of any partnership, joint

venture, trust or other entity;

J. To conduct its business, locate offices and exercise the powers granted by

within or without this state;

(cite appropriate statues of State’s Model Business Corporation Act)

K. To elect directors and appoint officers, employees and agents of the corporation,

define their duties, fix their compensation and lend them money and credit;

L. To pay pensions and establish pension plans, pension trusts, profit sharing plans,

share bonus plans, share option plans and benefit or incentive plans for any or all of its

current or former directors, officers, employees and agents;

M. To make donations for the public welfare or for charitable, scientific or

educational purposes;

N. To transact any lawful business that will aid governmental policy;

O. To make payments or donations, or do any other act, not inconsistent with law,

that furthers the business and affairs of the corporation.

III. Principal Office. The principal office for the transaction of the business of the

Corporation shall be located in , and .

(Name of County) ( Name of State)

IV. Capitalization. The authorized capital of the Corporation shall be $ of

authorized capital. The authorized capital stock of the Corporation shall be one class of common

stock.

V. Principal Office. The principal office for the transaction of the business of the

Corporation shall be located in , .

(Name of County) ( Name of State)

. VI. Signing Articles; First Directors. The parties to this Agreement, or so many of them as

may be necessary for the purpose, shall sign the Articles of Incorporation as Incorporators. The

persons named below shall be designated in the Articles of Incorporation as the first directors of

the Corporation and shall serve as such until their respective successors are duly elected and

qualified.

Agreement to Incorporate Page 3 of 7

VII. Officers. The Bylaws to be adopted at the first meeting of the Board of Directors shall

provide for the following corporate officers: President, Vice President, and Secretary-Treasurer.

The offices shall be filled by the Board of Directors at their first meeting by electing the

following-named persons, each of whom has agreed to serve in the indicated office for the term

designated in the Band at the salary shown after the person's name and until the person's

successor is duly elected and qualified:

Office Name of Officer Monthly Salary

President $

(Name)

Vice President $

(Name)

Secretary-Treasurer $

(Name)

VIII. Capitalization. The authorized capital of the Corporation shall be $ , and

the capital stock of the Corporation shall be shares of common stock with a par

(Number of Shares)

value of $ .

IX. Incorporation. The incorporators shall cause the Corporation to be formed within

days from the date of this Agreement, pursuant to .

(Number) (Citation of Statute)

X. Transfer of Partnership Assets to Corporation; Assumption of Obligations

Promptly after incorporation and the organizational meeting of the Corporation, the

incorporators, as co-partners, shall sell and transfer to the Corporation all the property and assets

of the Partnership and Partnership business, including inventory, fixtures, equipment, accounts

and notes receivable, bank deposits, good will, and all other personal property, both tangible and

intangible, and all real property or interests in the same, including leasehold interests and rentals,

and shall deliver to the Corporation all books of account and records of the Partnership, and shall

join in the execution of all the legal instruments necessary or appropriate to the accomplishment

of the sale and transfer. The Corporation, through its Directors and officers, shall accept the

assets and shall assume the obligations of the Partnership, if any, which may be outstanding at

the time of the transfer, including open and current accounts payable of the Partnership.

XI. Valuation of Partnership Assets; Exchange for Corporate Notes or Stock.

It is agreed that the fair market value of all the assets and property of the Partnership, less the

face amount of the Partnership obligations, if any, to be transferred to the Corporation, shall be

determined by from the books of account of the partnership

(Name of Accountant)

as of the date of transfer following incorporation. Such values shall be determined by standard

accounting practices and norms. The Corporation, through its Board of Directors, at the

organizational meeting or an adjourned session of such meeting, shall consider the account and

report of the accountants and, subject to reappraisal as provided below in this Agreement, shall

determine the value of the net assets and property so transferred as the value and worth of the

Agreement to Incorporate Page 4 of 7

same to the Corporation. Then the Corporation, through the Board of Directors, shall authorize

the issuance of common stock in exchange and payment for such property and assets to the

incorporators as provided below.

XII. Permit to Issue Shares; Stock Interests of Incorporators. The Corporation, through its

Directors, shall immediately after its organizational meeting authorize application to be made by

the Corporation to the of

(Name of Department, Title of Official) (Name of State)

for a permit to issue shares of stock in the Corporation in exchange for the assets and property of

the Partnership as follows:

Names of Incorporators Number of Shares Amount of Consideration

$

(Name) (Number)

$

(Name) (Number)

$

(Name) (Number)

The parties agree that the foregoing stock allocation fully and fairly represents their respective

net interests in the Partnership business and assets, and each party agrees to accept the number of

shares set opposite the party's name in full payment, satisfaction, and settlement of all the party's

interest in the Partnership and Partnership.

If the should determine that the fair

(Name of Department, Title of Official)

monetary value of the net assets of the Partnership to the Corporation is less than the amount

determined above, then, as a condition to issuance of a stock permit, the reappraised value as

fixed by such shall be accepted as the basis

(Name of Department, Title of Official)

for issuance of stock, and such adjustments in the number of shares issued shall be made as may

be appropriate. The proportion of stock to be issued to the several incorporators, as provided

above, shall remain the same.

XIII. Notices; Transfers; Partnership; Liabilities. The incorporators promptly shall cause all

necessary or appropriate legal notices to be given of the proposed transfer of Partnership assets

to the Corporation to be formed, and shall make all appropriate arrangements for the

determination of tax liabilities of the Partnership, including sales and use taxes, and for the

transfer of licenses and permits to the Corporation. The Corporation shall indemnify the

incorporators and each of them against all obligations and liabilities of the Partnership which are

transferred to and assumed by the Corporation at the time of transfer of Partnership assets.

XIV. Continuation of Partners in Corporate Business; Covenant not to Compete.

Following incorporation and the assumption of the Partnership business by the Corporation, each

of the incorporators shall continue with substantially the same duties and shall devote

substantially the same amount of time to the business as previously involved in the operation of

Agreement to Incorporate Page 5 of 7

the Partnership, subject to such changes as may be made in assignments and work schedules by

the Board of Directors. The incorporators shall receive no other salary for their services to the

Corporation than as provided in

Section V above. Each of the incorporators agrees that for a period of years after

(Number)

such incorporator ceases to be an officer or director or employee of the Corporation such

incorporator will not engage in the same or any similar kind of business in which the Corporation

may be engaged at the time of such incorporator's separation within a distance of

(Number)

miles of , .

(Name of City) (Name of State)

XV. Restriction on Stock Transfers. Each incorporator may, at the incorporator's election,

cause the stock to which the incorporator is entitled to be issued to the incorporator and the

incorporator's spouse or other member of the incorporator's immediate family, as joint tenants or

otherwise. In addition, an incorporator may, at the incorporator's option, cause a transfer of the

incorporator's stock, if held in the incorporator's own name, to the incorporator and the

incorporator's spouse or immediate relative. No incorporator, spouse, or member of the

incorporator's family shall otherwise assign, transfer, give, or sell any corporate stock except in

accordance with the stock transfer provisions to be inscribed on the stock certificates, in form

and content as set forth in the attached Exhibit A.

XVI. Employment of Attorney. The incorporators shall employ

(Name of Attorney)

as legal counsel for the following purposes:

A. To draft , Bylaws, application for a

(Articles of Incorporation)

permit to issue shares of stock, and notices, and any other documents or instruments

related to the transfer of the Partnership assets and business and the formation of this

Corporation under the laws of this state;

B. To perform all other legal services necessary or convenient to the change in

ownership and management of the business from a Partnership to a Corporation; and

C. To advise the incorporators and the Corporation with respect to each step

necessary in its organization and the accomplishment of the terms and provisions of this

Agreement.

The charges for all such legal services, fees of all state, county, and other public officials,

departments, and agencies, and all other necessary costs, including franchise tax, if any,

state certificate, and seal, shall be expenses of incorporation to be paid for by the

Corporation, but such part of the same as may be required to be paid prior to the

incorporation and organization of the Corporation shall be advanced out of Partnership

funds. Such advances shall be repaid by the Corporation to the Incorporators individually,

in proportion to their several proprietary interests as set forth above.

Agreement to Incorporate Page 6 of 7

WITNESS our signatures as of the day and date first above stated.

By: By:

(Signature of Incorporator One ) (Signature of Incorporator Two)

(Signature of Incorporator One ) (P rinted Name of Incorporator Two )

By:

(Signature of Incorporator Three )

(P rinted Name of Incorporator Three )

Agreement to Incorporate Page 7 of 7