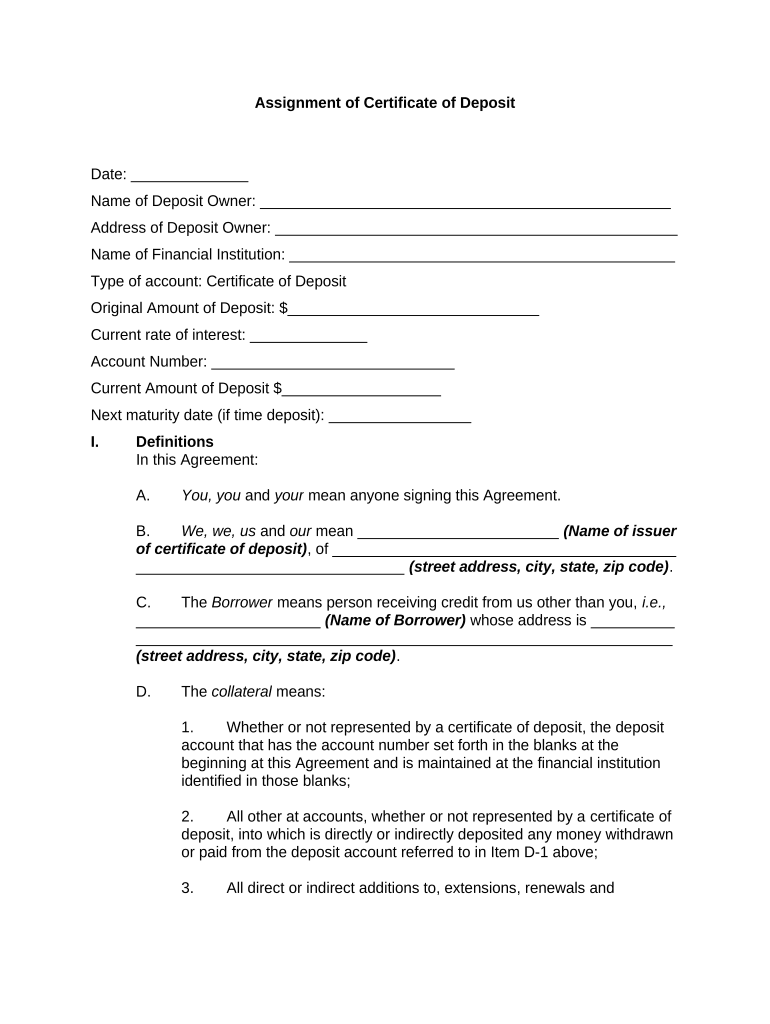

Assignment of Certificate of Deposit

Date: ______________

Name of Deposit Owner: _________________________________________________

Address of Deposit Owner: ________________________________________________

Name of Financial Institution: ______________________________________________

Type of account: Certificate of Deposit

Original Amount of Deposit: $______________________________

Current rate of interest: ______________

Account Number: _____________________________

Current Amount of Deposit $___________________

Next maturity date (if time deposit): _________________

I. Definitions

In this Agreement:

A. You, you and your mean anyone signing this Agreement.

B. We, we, us and our mean ________________________ (Name of issuer

of certificate of deposit) , of _________________________________________

________________________________ (street address, city, state, zip code) .

C. The Borrower means person receiving credit from us other than you, i.e.,

______________________ (Name of Borrower) whose address is __________

________________________________________________________________

(street address, city, state, zip code) .

D. The collateral means:

1. Whether or not represented by a certificate of deposit, the deposit

account that has the account number set forth in the blanks at the

beginning at this Agreement and is maintained at the financial institution

identified in those blanks;

2. All other at accounts, whether or not represented by a certificate of

deposit , into which is directly or indirectly deposited any money withdrawn

or paid from the deposit account referred to in Item D-1 above;

3. All direct or indirect additions to, extensions, renewals and

replacements of, increases in, interest, dividends and other income on

account of and proceeds at any sale or other disposition of or of any

collection on account of any deposit account referred to Items D-1 or D-2

above; and

D. All certificates of deposit, passbooks and other instruments and

records representing or otherwise relating to any deposit account referred

to in Items D-1 or D-2 above or anything referred to in Item D-3 above.

II. Security

To secure the payment of all indebtedness from you or the Borrower to us

existing now or coming into existence in the future, you give us a security

interest in the collateral and assign it to us. A person who has a security interest

in property has a number of rights depending on what the property is -- for

example, if the property is a certificate of deposit , the right under certain

circumstances to sell it or collect any money payable on account of it. To assign

property means to transfer rights in it.

III. Reduction in Rate

The rate of interest or effective rate at interest (taking into account the effect of

compounding) paid in connection with any deposit account included in the collateral will

be reduced to the rate necessary to comply with any law or regulation requiring the rate

of interest or effective rate of interest to be at least a specified percentage (such as 1%)

below the rate of interest paid in connection with any indebtedness the payment of

which is secured by the collateral. If the rate of interest or effective rate of interest paid

in connection with any deposit account included in the collateral is reduced as provided

in the preceding sentence, it need not be increased except at a time it would be

subject to change if It were not included in the collateral. Some assurances about the

collateral. You assure us that no one other than you owns any of the collateral or has

any claim to any of it.

IV. Delivering Instruments and Records

You are delivering to us all certificates of deposit, passbooks and other

instruments and records included in the collateral and received by you, and you assure

us that each of them is genuine and what it appears to be.

V. Care of Instruments and Records

We will have taken reasonable care at any certificate of deposit , passbook of

other instrument or record included in the collateral and delivered to us if we treat it in

basically the same way as we treat our own property of the same sort.

VI. Promises

A. You must promptly:

1. Deliver to us any certificate of deposit , passbook or other

instrument or record included in the collateral and received by you,

2. Pay any tax on the ownership of any of the collateral and

3. Sign any document we want signed to protect our interest in any at

the collateral.

B. Without first obtaining our consent in writing, you must not:

1. Sell, give away or in any other way dispose of any of the collateral,

2. Permit anyone other than you or us have any claim to any of the

collateral or

3. Do anything that would adversely affect our interest in any of the

collateral.

C. Also. without first obtaining our consent in writing, you must not:

1. Ask for or collect any of the collateral,

2. Extend or renew any of the collateral,

3. Agree to any change in any Agreement applicable to any other

collateral,

4. Make or settle any claim relating to any of the collateral,

5. Bring, conduct or settle any legal proceeding relating to any of the

collateral,

6. Waive any right relating to any of the collateral,

7. Sign, deliver or make any request or order for any withdrawal or

payment relating to any at the collateral,

8. Acknowledge receipt of any of the collateral or

9. Sign your name to endorse any check or other order for any

payment relating to any of the collateral.

VII. Amounts Paid by Us

We can, but we do not have to,

A. Pay any tax on the ownership of any of the collateral if you do not pay it

and

B. Make any payment we believe necessary to eliminate any claim to any of

the collateral superior to our interest in it. When we ask you to do so, you must

immediately pay us any amount we pay under this section and interest at the rate

of _______% a year on the portion of that amount not yet paid to us.

VIII. Revocation of Authority

If you have previously authorized anyone to make withdrawals from any deposit

account included in the collateral or to do any other thing concerning any of the

collateral, you revoke that authority.

IX. Default

A. A default under this Agreement occurs if:

1. Any indebtedness from you or the Borrower to us existing now or

coming into existence in the future is not paid by the day it becomes due -

even though a late charge would not be imposed until later,

2. You violate any provision of this Agreement or of any other

Agreement with us existing now or coming into existence in the future,

3. Borrower violates any provision of any Agreement with us existing

now or coming into existence in the future,

4. You die or become incompetent or insolvent

5. The Borrower dies or becomes incompetent or insolvent,

6. Any proceeding under any bankruptcy law or other law concerning

the relief of debtors is started by or against you or the Borrower,

7. We discover that in this Agreement, any other Agreement with us

existing now or coming into existence in the future or any application you

have made or make to us for credit you made any false or misleading

statement about an important matter,

8. We discover that in any Agreement with us existing now or coming

into existence in the future or any application the Borrower has made or

makes to us for credit the Borrower made any false or misleading

statement about an important matter,

9. We reasonably believe that any indebtedness from you

or the Borrower to us existing now or coming into existence in the future

will not be paid by the day it becomes due, or

10. We reasonably believe that something seriously affects the value to

us of any property in which any interest has been or is given to secure the

payment of any indebtedness from you or the Borrower to us existing now

or earning into existence in the future.

B. If default occurs. If any default under this Agreement occurs, we can:

1. Sell any of the collateral,

2. Take any action described in the third sentence of the

section entitled Promises even if doing so would result in a penalty

being imposed by the financial institution at which any deposit included in

the collateral is maintained, and

3. Exercise any right given us by applicable law.

X. Sale

At least 10 days before we sell any of the collateral, we will send you a notice of

the proposed sale if we are required by applicable law to do so. We will send the notice

10 your current address shown in cur records concerning this Agreement. We can send

it by regular mail. To redeem any at the collateral before we sell it, you may pay us all

amounts the payment of which is secured by the collateral, including those described in

the first sentence of the next section. To redeem any of the collateral means to get it

back. Expenses of sate or collection and application of money received from sale or

collection. You must pay us any amount we pay for selling any of the collateral,

arranging for the sale of any of the collateral or collecting any of the collateral. We will

apply any money we receive as a result of the sale or collection as required by

applicable law - for example, to (1) amounts described in the first sentence of this

section, and (2) other amounts the payment of which is secured by the collateral and

that are not yet paid. We can apply the money to those other amounts in any order we

choose, whether or not they are then due.

XI. Authorization.

You irrevocably authorize us, whether or not any default under this Agreement has

occurred, to do any of the things described in the Section entitled Promises.

XII. Liabilities and Expenses.

You must pay us any liability or expense we incur in connection with our interest

in any at the collateral. For example, if we hire an attorney to defend or enforce any of

our rights in any of the collateral or to perform any other legal service in connection with

any of the collateral, you must pay us the attorney's fee and all legal expenses we pay

in connection with the defense, enforcement or other legal service. Agreement. You

agree to be bound by all provisions of this Agreement.

Witness the signature of the Deposit Owner this the ________________ (date) .

__________________________

(Printed Name of Deposit Owner)

__________________________

(Signature of Deposit Owner)

(Acknowledgment form may vary by state)

State of _____________________

County of ___________________

Personally appeared before me, the undersigned authority in and for the said

County and State, on this __________________ (date) , within my jurisdic tion, the

within-named ____________________ (Name of Deposit Owner) , who acknowledged

that he executed the above and foregoing instrument.

________________________________

NOTARY PUBLIC

My Commission Expires:

____________________

Valuable tips for preparing your ‘Assignment Deposit Form’ online

Are you exhausted from dealing with paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the monotonous process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the powerful features built into this user-friendly and budget-friendly platform and transform your document management strategy. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages it all seamlessly, needing just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Assignment Deposit Form’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for others (if needed).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to work with your colleagues on your Assignment Deposit Form or send it for notarization—our platform provides all the tools you need to accomplish such tasks. Register with airSlate SignNow today and take your document management to the next level!