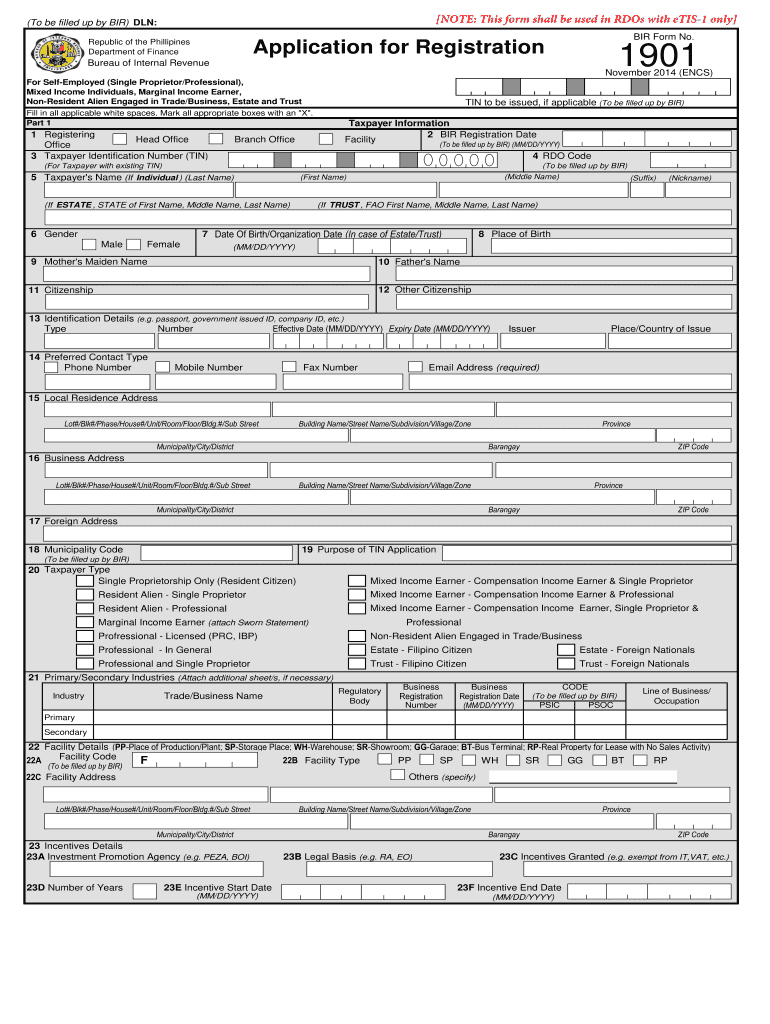

Fill and Sign the Bbir Formb 1901 Etis 1 Only

Useful suggestions for finalizing your ‘Bbir Formb 1901 Etis 1 Only’ online

Are you exhausted by the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the tedious task of printing and scanning documents. With airSlate SignNow, you can smoothly complete and sign documents online. Utilize the powerful features packed into this user-friendly and cost-effective platform to transform your document management strategy. Whether you need to sign forms or collect signatures, airSlate SignNow manages everything effortlessly, with merely a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or enroll for a complimentary trial of our service.

- Click +Create to upload a document from your device, cloud storage, or our form repository.

- Access your ‘Bbir Formb 1901 Etis 1 Only’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from additional parties.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Bbir Formb 1901 Etis 1 Only or send it for notarization—our solution has everything you require to complete these tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the 1901 Bir Form and how does it work with airSlate SignNow?

The 1901 Bir Form is a standardized document used for various business transactions that require electronic signatures. With airSlate SignNow, you can easily send, sign, and manage the 1901 Bir Form, ensuring that your documents are securely signed and legally binding. Our platform simplifies the process, allowing you to focus on your business operations.

-

Is there a cost associated with using the 1901 Bir Form through airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans that include access to the 1901 Bir Form and other document signing features. You can choose a plan that fits your business needs, whether you're a small business or a large enterprise. Our cost-effective solutions ensure that you get the most value for your investment.

-

What features does airSlate SignNow offer for managing the 1901 Bir Form?

airSlate SignNow provides a range of features for the 1901 Bir Form, including customizable templates, real-time tracking of document status, and automated reminders for signatories. These features streamline the signing process, making it faster and more efficient for businesses to complete transactions.

-

How can airSlate SignNow improve the signing experience for the 1901 Bir Form?

With airSlate SignNow, the signing experience for the 1901 Bir Form is enhanced through user-friendly interfaces and mobile compatibility. Signers can complete the form anytime, anywhere, using their preferred devices, which increases convenience and speeds up the overall process. This means less time spent on paperwork and more focus on your business.

-

Are there integrations available for the 1901 Bir Form with other applications?

Yes, airSlate SignNow supports various integrations that allow you to connect the 1901 Bir Form with popular applications like Google Drive, Dropbox, and CRM systems. These integrations facilitate seamless document management and enhance your workflow, making it easier to handle all your signing processes in one place.

-

What benefits does using airSlate SignNow for the 1901 Bir Form provide?

Using airSlate SignNow for the 1901 Bir Form offers numerous benefits, including enhanced security, reduced turnaround time for document signing, and improved compliance. By digitizing the signing process, businesses can minimize errors and ensure that all signatures are collected efficiently and securely.

-

Can I customize the 1901 Bir Form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the 1901 Bir Form to meet your specific needs. You can add fields, adjust document layouts, and include branding elements to align with your company's identity, ensuring that every document reflects your professionalism.

Find out other bbir formb 1901 etis 1 only

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles