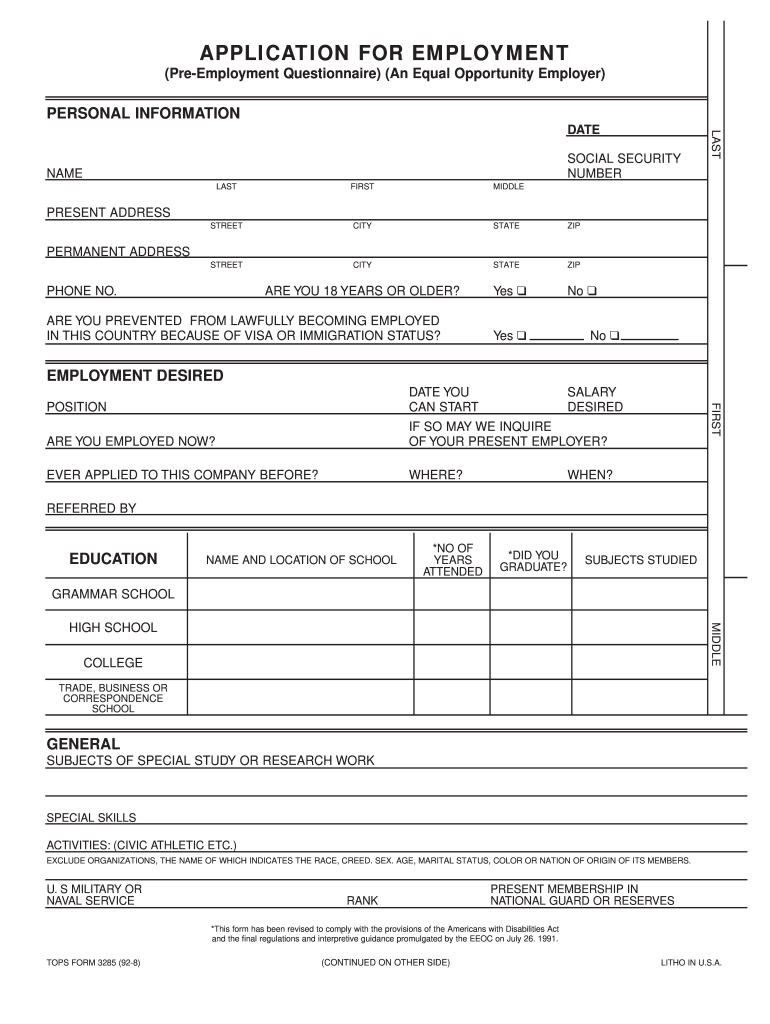

APPLICATION FOR EMPLOYMENT

(Pre-Employment Questionnaire) (An Equal Opportunity Employer)

PERSONAL INFORMATION

SOCIAL SECURITY

NUMBER

NAME

LAST

FIRST

MIDDLE

STREET

CITY

STATE

ZIP

STREET

CITY

STATE

ZIP

Yes u

LAST

DATE

No u

PRESENT ADDRESS

PERMANENT ADDRESS

PHONE NO.

ARE YOU 18 YEARS OR OLDER?

ARE YOU PREVENTED FROM LAWFULLY BECOMING EMPLOYED

IN THIS COUNTRY BECAUSE OF VISA OR IMMIGRATION STATUS?

Yes u

No u

EMPLOYMENT DESIRED

DATE YOU

CAN START

SALARY

DESIRED

ARE YOU EMPLOYED NOW?

IF SO MAY WE INQUIRE

OF YOUR PRESENT EMPLOYER?

EVER APPLIED TO THIS COMPANY BEFORE?

WHERE?

FIRST

POSITION

WHEN?

REFERRED BY

EDUCATION

NAME AND LOCATION OF SCHOOL

*NO OF

YEARS

ATTENDED

*DID YOU

GRADUATE?

SUBJECTS STUDIED

GRAMMAR SCHOOL

MIDDLE

HIGH SCHOOL

COLLEGE

TRADE, BUSINESS OR

CORRESPONDENCE

SCHOOL

GENERAL

SUBJECTS OF SPECIAL STUDY OR RESEARCH WORK

SPECIAL SKILLS

ACTlVITIES: (CIVIC ATHLETIC ETC.)

EXCLUDE ORGANIZATIONS, THE NAME OF WHICH INDICATES THE RACE, CREED. SEX. AGE, MARITAL STATUS, COLOR OR NATION OF ORIGIN OF ITS MEMBERS.

U. S MILITARY OR

NAVAL SERVICE

RANK

PRESENT MEMBERSHIP IN

NATIONAL GUARD OR RESERVES

*This form has been revised to comply with the provisions of the Americans with Disabilities Act

and the final regulations and interpretive guidance promulgated by the EEOC on July 26. 1991.

TOPS FORM 3285 (92-8)

(CONTINUED ON OTHER SIDE)

LITHO IN U.S.A.

�FORMER EMPLOYERS (LIST BELOW LAST THREE EMPLOYERS, STARTING WITH LAST ONE FIRST).

DATE

MONTH AND YEAR

NAME AND ADDRESS OF EMPLOYER

SALARY

POSITION

REASON FOR LEAVING

FROM

TO

FROM

TO

FROM

TO

FROM

TO

WHICH OF THESE JOBS DlD YOU LIKE BEST?

WHAT DlD YOU LIKE MOST ABOUT THIS JOB?

REFERENCES: GIVE THE NAMES OF THREE PERSONS NOT RELATED TO YOU, WHOM YOU HAVE KNOWN AT LEAST ONE YEAR.

NAME

ADDRESS

YEARS

ACQUAINTED

BUSINESS

1

2

3

THE FOLLOWING STATEMENT APPLIES IN: MARYLAND & MASSACHUSETTS. [Fill in name of state.)

IT IS UNLAWFUL IN THE STATE OF ________________________ TO REQUIRE OR ADMINISTER A LIE DETECTOR TEST

AS A CONDITION OF EMPLOYMENT OR CONTINUED EMPLOYMENT. AN EMPLOYER WHO VIOLATES THIS LAW SHALL

BE SUBJECT TO CRIMINAL PENALTIES AND CIVIL LIABILITY.

Signature of Applicant

IN CASE OF

EMERGENCY NOTIFY

NAME

ADDRESS

PHONE NO.

"I CERTIFY THAT ALL THE INFORMATION SUBMITTED BY ME ON THIS APPLICATION IS TRUE AND COMPLETE, AND I UNDERSTAND THAT

IF ANY FALSE INFORMATION, OMISSIONS, OR MISREPRESENTATIONS ARE DISCOVERED, MY APPLICATION MAY BE REJECTED AND, IF I

AM EMPLOYED. MY EMPLOYMENT MAY BE TERMINATED AT ANY TIME.

IN CONSIDERATION OF MY EMPLOYMENT, I AGREE TO CONFORM TO THE COMPANY'S RULES AND REGULATIONS, AND I AGREE THAT

MY EMPLOYMENT AND COMPENSATION CAN BE TERMINATED, WITH OR WITHOUT CAUSE. AND WITH OR WITHOUT NOTICE, AT ANY

TIME, AT EITHER MY OR THE COMPANY'S OPTION. I ALSO UNDERSTAND AND AGREE THAT THE TERMS AND CONDITIONS OF MY

EMPLOYMENT MAY BE CHANGED, WITH OR WITHOUT CAUSE, AND WITH OR WITHOUT NOTICE, AT ANY TIME BY THE COMPANY. I

UNDERSTAND THAT NO COMPANY REPRESENTATIVE, OTHER THAN IT'S PRESIDENT, AND THEN ONLY WHEN IN WRONG AND SIGNED

BY THE PRESIDENT, HAS ANY AUTHORITY TO ENTER INTO ANY AGREEMENT FOR EMPLOYMENT FOR ANY SPECIFIC PERIOD OF TIME,

OR TO MAKE ANY AGREEMENT CONTRARY TO THE FOREGOING.

DATE

SIGNATURE

DO NOT WRITE BELOW THIS LINE

INTERVIEWED BY:

DATE:

REMARKS:

NEATNESS

ABILITY

HIRED: u Yes u No

POSITION

SALARY/WAGE

APPROVED:

DEPT.

DATE REPORTING TO WORK

1.

EMPLOYMENT MANAGER

2.

3

DEPT. HEAD

GENERAL MANAGER

This form has been designed to strictly comply with State and Federal fair employment practice laws prohibiting employment discrimination. This Application for Employment Form

is sold for general use throughout the United States. TOPS assumes no responsibility for the inclusion in said form of any questions which, when asked by the Employer of the

Job Applicant, may violate State and/or Federal Law.

�We welcome your application for employment at Southern Platte Fire Protection

District (hereinafter referred to as the Company). We are proud that our success

is the result of the quality and caliber of our employees. In pursuit of excellence,

we require, as a condition of employment, all applicants must consent to and

authorize a pre-employment verification of the background information

submitted on their applications and resumes.

The following information is used for identification

purposes in verifying background information.

Printed Name______________________ Date__________

Signature________________________________________

SS#____________________________________________

List any cities and states where you previously resided:

_________________________________________________

_________________________________________________

_________________________________________________

_________________________________________________

�DISCLOSURE

AND

AUTHORIZATION

[IMPORTANT

-‐-‐

PLEASE

READ

CAREFULLY

BEFORE

SIGNING

AUTHORIZATION]

DISCLOSURE

REGARDING

BACKGROUND

INVESTIGATION

Southern Platte Fire Protection District

(“the

Company”)

may

obtain

information

about

you

for

employment

purposes

from

a

third

party

consumer

reporting

agency.

Thus,

you

may

be

the

subject

of

a

“consumer

report”

and/or

an

“investigative

consumer

report”

which

may

include

information

about

your

character,

general

reputation,

personal

characteristics,

and/or

mode

of

living,

and

which

can

involve

personal

interviews

with

sources

such

as

your

neighbors,

friends,

or

associates.

These

reports

may

contain

information

regarding

your

credit

history,

criminal

history,

social

security

number

validation,

motor

vehicle

records

(“driving

records”),

verification

of

your

education

or

employment

history,

or

other

background

checks.

Credit

history

will

only

be

requested

where

such

information

is

substantially

related

to

the

duties

and

responsibilities

of

the

position

for

which

you

are

applying.

You

have

the

right,

upon

written

request

made

within

a

reasonable

time,

to

request

whether

a

consumer

report

has

been

requested

and

compiled

about

you,

and

disclosure

of

the

nature

and

scope

of

any

investigative

consumer

report

and

to

request

a

copy

of

your

report.

Please

be

advised

that

the

nature

and

scope

of

the

most

common

form

of

investigative

consumer

report

obtained

with

regard

to

applicants

for

employment

is

an

investigation

into

your

education

and/or

employment

history

conducted

by

Validity

Screening

Solutions,

PO

Box

860443,

Shawnee,

KS

66286-‐0443,

866.915.0792,

www.validityscreening.com,

or

another

outside

organization.

The

scope

of

this

notice

and

authorization

is

all-‐encompassing,

however,

allowing

the

Company

to

obtain

from

any

outside

organization

all

manner

of

consumer

reports

and

investigative

consumer

reports

now

and

throughout

the

course

of

your

employment

to

the

extent

permitted

by

law.

As

a

result,

you

should

carefully

consider

whether

to

exercise

your

right

to

request

disclosure

of

the

nature

and

scope

of

any

investigative

consumer

report.

New

York

and

Maine

applicants

or

employees

only:

You

have

the

right

to

inspect

and

receive

a

copy

of

any

investigative

consumer

report

requested

by

Southern Platte Fire Protection District

by

contacting

the

consumer

reporting

agency

identified

above

directly.

You

may

also

contact

the

Company

to

request

the

name,

address

and

telephone

number

of

the

nearest

unit

of

the

consumer

reporting

agency

designated

to

handle

inquiries,

which

the

Company

shall

provide

within

5

days.

New

York

applicants

or

employees

only:

Upon

request,

you

will

be

informed

whether

or

not

a

consumer

report

was

requested

by

Southern Platte Fire Protection District ,

and

if

such

report

was

requested,

informed

of

the

name

and

address

of

the

consumer

reporting

agency

that

furnished

the

report.

By

signing

below,

you

also

acknowledge

receipt

of

Article

23-‐A

of

the

New

York

Correction

Law.

Oregon

applicants

or

employees

only:

Information

describing

your

rights

under

federal

and

Oregon

law

regarding

consumer

identity

theft

protection,

the

storage

and

disposal

of

your

credit

information,

and

remedies

available

should

you

suspect

or

find

that

the

Company

has

not

maintained

secured

records

is

available

to

you

upon

request.

Washington

State

applicants

or

employees

only:

You

also

have

the

right

to

request

from

the

consumer

reporting

agency

a

written

summary

of

your

rights

and

remedies

under

the

Washington

Fair

Credit

Reporting

Act.

ACKNOWLEDGMENT

AND

AUTHORIZATION

I

acknowledge

receipt

of

the

DISCLOSURE

REGARDING

BACKGROUND

INVESTIGATION

and

A

SUMMARY

OF

YOUR

RIGHTS

UNDER

THE

FAIR

CREDIT

REPORTING

ACT

and

certify

that

I

have

read

and

understand

both

of

those

documents.

I

hereby

authorize

the

obtaining

of

“consumer

reports”

and/or

“investigative

consumer

reports”

by

the

Company

at

any

time

after

receipt

of

this

authorization

and

throughout

my

employment,

if

applicable.

To

this

end,

I

hereby

authorize,

without

reservation,

any

law

enforcement

agency,

administrator,

state

or

federal

agency,

institution,

school

or

university

(public

or

private),

information

service

bureau,

employer,

or

insurance

company

to

furnish

any

and

all

background

information

requested

by

Validity

Screening

Solutions,

PO

Box

860443,

Shawnee,

KS

66286-‐0443,

866.915.0792,

www.validityscreening.com,

another

outside

organization

acting

on

behalf

of

the

Company,

and/or

the

Company

itself.

I

agree

that

a

facsimile

(“fax”),

electronic

or

photographic

copy

of

this

Authorization

shall

be

as

valid

as

the

original.

New

York

applicants

or

employees

only:

By

signing

below,

you

also

acknowledge

receipt

of

Article

23-‐A

of

the

New

York

Correction

Law.

Minnesota

and

Oklahoma

applicants

or

employees

only:

Please

check

this

box

if

you

would

like

to

receive

a

copy

of

a

consumer

report

if

one

is

obtained

by

the

)

Company.

(Must

include

email

address:

California

applicants

or

employees

only:

By

signing

below,

you

also

acknowledge

receipt

of

the

NOTICE

REGARDING

BACKGROUND

INVESTIGATION

PURSUANT

TO

CALIFORNIA

LAW.

Please

check

this

box

if

you

would

like

to

receive

a

copy

of

an

investigative

consumer

report

or

consumer

credit

report

at

no

charge

if

one

is

obtained

by

the

Company

whenever

you

have

a

right

to

receive

such

a

copy

under

California

law.

www.validityscreening.com/Site/PrivacyPolicy

)

(Must

include

email

address:

Signature:

Last

Name

BACKGROUND

INFORMATION

Date:

First

Other

Names/Alias

Date

of

Birth

(mm/dd/yyyy)

Present

Address

[1][2]

Driver’s

License

#

Middle

[2]

Social

Security

#

[1][2]

[2]

State

of

Driver’s

License

Telephone

#

(Primary)

City/State/Zip

[1]

[2]

This

information

will

be

used

for

background

screening

purposes

only

and

will

not

be

used

as

hiring

criteria.

In

Utah,

this

information

may

only

be

collected

a)

when

extending

a

conditional

offer

of

employment

or

b)

at

the

time

the

background

report

will

be

run.

3

V

1.0

(Issued:

November

2012)

�Para información en español, visite www.consumerfinance.gov/learnmore o escribe a la

Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

A Summary of Your Rights Under the Fair Credit Reporting Act

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of

information in the files of consumer reporting agencies. There are many types of consumer

reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell

information about check writing histories, medical records, and rental history records). Here is

a summary of your major rights under the FCRA. For more information, including information

about additional rights, go to www.consumerfinance.gov/learnmore or write to: Consumer

Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

• You must be told if information in your file has been used against you. Anyone who uses a

credit report or another type of consumer report to deny your application for credit, insurance,

or employment – or to take another adverse action against you – must tell you, and must give

you the name, address, and phone number of the agency that provided the information.

• You have the right to know what is in your file. You may request and obtain all the

information about you in the files of a consumer reporting agency (your “file disclosure”). You

will be required to provide proper identification, which may include your Social Security

number. In many cases, the disclosure will be free. You are entitled to a free file disclosure if:

• a person has taken adverse action against you because of information in your credit report;

• you are the victim of identity theft and place a fraud alert in your file;

• your file contains inaccurate information as a result of fraud;

• you are on public assistance;

• you are unemployed but expect to apply for employment within 60 days.

In addition, all consumers are entitled to one free disclosure every 12 months upon request

from each nationwide credit bureau and from nationwide specialty consumer reporting

agencies. See www.consumerfinance.gov/learnmore for additional information.

• You have the right to ask for a credit score. Credit scores are numerical summaries of your

credit-worthiness based on information from credit bureaus. You may request a credit score

from consumer reporting agencies that create scores or distribute scores used in residential

real property loans, but you will have to pay for it. In some mortgage transactions, you will

receive credit score information for free from the mortgage lender.

• You have the right to dispute incomplete or inaccurate information. If you identify

information in your file that is incomplete or inaccurate, and report it to the consumer

reporting agency, the agency must investigate unless your dispute is frivolous. See

www.consumerfinance.gov/learnmore for an explanation of dispute procedures.

• Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable

information. Inaccurate, incomplete or unverifiable information must be removed or

corrected, usually within 30 days. However, a consumer reporting agency may continue to

report information it has verified as accurate.

�• Consumer reporting agencies may not report outdated negative information. In most

cases, a consumer reporting agency may not report negative information that is more than

seven years old, or bankruptcies that are more than 10 years old.

• Access to your file is limited. A consumer reporting agency may provide information about

you only to people with a valid need – usually to consider an application with a creditor,

insurer, employer, landlord, or other business. The FCRA specifies those with a valid need for

access.

• You must give your consent for reports to be provided to employers. A consumer reporting

agency may not give out information about you to your employer, or a potential employer,

without your written consent given to the employer. Written consent generally is not required

in the trucking industry. For more information, go to www.consumerfinance.gov/learnmore.

• You may limit “prescreened” offers of credit and insurance you get based on information in

your credit report. Unsolicited “prescreened” offers for credit and insurance must include a

toll-free phone number you can call if you choose to remove your name and address from the

lists these offers are based on. You may opt-out with the nationwide credit bureaus at 1-888567-8688.

• You may seek damages from violators. If a consumer reporting agency, or, in some cases, a

user of consumer reports or a furnisher of information to a consumer reporting agency

violates the FCRA, you may be able to sue in state or federal court.

• Identity theft victims and active duty military personnel have additional rights. For more

information, visit www.consumerfinance.gov/learnmore.

�States may enforce the FCRA, and many states have their own consumer reporting laws.

In some cases, you may have more rights under state law. For more information, contact

your state or local consumer protection agency or your state Attorney General. For

information about your federal rights, contact:

TYPE OF BUSINESS:

1.a. Banks, savings associations, and credit unions with total assets of

over $10 billion and their affiliates.

b. Such affiliates that are not banks, savings associations, or credit

unions also should list, in addition to the CFPB

CONTACT:

a. Consumer Financial Protection Bureau

1700 G Street NW

Washington, DC 20552

b. Federal Trade Commission: Consumer Response Center – FCRA

Washington, DC 20580

(877) 382-4357

2. To the extent not included in item 1 above:

a. National banks, federal savings associations, and federal branches

and federal agencies of foreign banks

a. Office of the Comptroller of the Currency

Customer Assistance Group

1301 McKinney Street, Suite 3450

Houston, TX 77010-9050

b. State member banks, branches and agencies of foreign banks (other

than federal branches, federal agencies, and Insured State Branches of

Foreign Banks), commercial lending companies owned or controlled

by foreign banks, and organizations operating under section 25 or 25A

of the Federal Reserve Act

b. Federal Reserve Consumer Help Center

P.O. Box 1200

Minneapolis, MN 55480

c. Nonmember Insured Banks, Insured State Branches of Foreign

Banks, and insured state savings associations

c. FDIC Consumer Response Center

1100 Walnut Street, Box #11

Kansas City, MO 64106

d. Federal Credit Unions

d. National Credit Union Administration

Office of Consumer Protection (OCP)

Division of Consumer Compliance and Outreach (DCCO)

1775 Duke Street

Alexandria, VA 22314

Asst. General Counsel for Aviation Enforcement & Proceedings

Aviation Consumer Protection Division

Department of Transportation

1200 New Jersey Avenue, S. E.

Washington, DC 20590

Office of Proceedings, Surface Transportation Board

Department of Transportation

395 E Street, S.W.

Washington, DC 20423

Nearest Packers and Stockyards Administration area supervisor

3. Air carriers

4. Creditors Subject to Surface Transportation Board

5. Creditors Subject to Packers and Stockyards Act. 1921

6. Small Business Investment Companies

7. Brokers and Dealers

8. Federal Land Banks, Federal Land Bank Associations, Federal

Intermediate Credit Banks, and Production Credit Associations

9. Retailers, Finance Companies, and All Other Creditors Not Listed

Above

(Updated: November 2012)

Associate Deputy Administrator for Capital Access

United States Small Business Administration

406 Third Street, SW, 8th Floor

Washington, DC 20416

Securities and Exchange Commission

100 F St, N.E.

Washington, DC 20549

Farm Credit Administration

1501 Farm Credit Drive

McLean, VA 22102-5090

FTC Regional Office for region in which the creditor operates or

Federal Trade Commission: Consumer Response Center – FCRA

Washington, DC 20580

(877) 382-4357

�Para información en español, visite www.consumerfinance.gov/learnmore o escribe a la

Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

Remedying the Effects of Identity Theft

You are receiving this information because you have notified a consumer reporting

agency that you believe you are a victim of identity theft. Identity theft occurs when someone

uses your name, Social Security number, date of birth, or other identifying information,

without authority, to commit fraud. For example, someone may have committed identity

theft by using your personal information to open a credit card account or get a loan in your

name. For more information, visit www.consumerfinance.gov/learnmore or write to:

Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

The Fair Credit Reporting Act (FCRA) gives you specific rights when you are, or believe

that you are, the victim of identity theft. Here is a brief summary of the rights designed to help

you recover from identity theft.

1.

You have the right to ask that nationwide consumer reporting agencies place

“fraud alerts” in your file to let potential creditors and others know that you may

be a victim of identity theft. A fraud alert can make it more difficult for someone to get

credit in your name because it tells creditors to follow certain procedures to protect you. It also

may delay your ability to obtain credit. You may place a fraud alert in your file by calling just one

of the three nationwide consumer reporting agencies. As soon as that agency processes your

fraud alert, it will notify the other two, which then also must place fraud alerts in your file.

•

•

•

Equifax: 1.888.766.0008; www.equifax.com

Experian: 1.888.397.3742; www.experian.com

TransUnion: 1.800.680.7289; www.transunion.com

An initial fraud alert stays in your file for at least 90 days. An extended alert stays in your file for

seven years. To place either of these alerts, a consumer reporting agency will require you to

provide appropriate proof of your identity, which may include your Social Security number. If

you ask for an extended alert, you will have to provide an identity theft report. An identity theft

report includes a copy of a report you have filed with a federal, state, or local law enforcement

agency, and additional information a consumer reporting agency may require you to submit. For

more detailed information about the identify theft report, visit

www.consumerfinance.gov/learnmore.

2.

You have the right to free copies of the information in your file (your “file disclosure”).

An initial fraud alert entitles you to a copy of all the information in your file at each of the three

nationwide agencies, and an extended alert entitles you to two free file disclosures in a 12month period following the placing of the alert. These additional disclosures may help you

detect signs of fraud, for example, whether fraudulent accounts have been opened in your

name or whether someone has reported a change in your address. Once a year, you also have

�the right to a free copy of the information in your file at any consumer reporting agency, if you

believe it has inaccurate information due to fraud, such as identity theft. You also have the

ability to obtain additional free file disclosures under other provisions of the FCRA. See

www.consumerfinance.gov/learnmore.

3.

You have the right to obtain documents relating to fraudulent transactions

made or accounts opened using your personal information. A creditor or other

business must give you copies of applications and other business records relating to

transactions and accounts that resulted from the theft of your identity, if you ask for them in

writing. A business may ask you for proof of your identity, a police report, and an affidavit

before giving you the documents. It may also specify an address for you to send your request.

Under certain circumstances, a business can refuse to provide you with these documents. See

www.consumerfinance.gov/learnmore.

4.

You have the right to obtain information from a debt collector. If you ask, a debt

collector must provide you with certain information about the debt you believe was incurred

in your name by an identity thief – like the name of the creditor and the amount of the debt.

5.

If you believe information in your file results from identity theft, you have the right to

ask that a consumer reporting agency block that information from your file. An identity thief

may run up bills in your name and not pay them. Information about the unpaid bills may appear

on your consumer report. Should you decide to ask a consumer reporting agency to block the

reporting of this information, you must identify the information to block, and provide the

consumer reporting agency with proof of your identity and a copy of your identity theft report.

The consumer reporting agency can refuse or cancel your request for a block if, for example, you

don’t provide the necessary documentation, or where the block results from an error or a

material misrepresentation of fact made by you. If the agency declines or rescinds the block, it

must notify you. Once a debt resulting from identity theft has been blocked, a person or

business with notice of the block may not sell, transfer, or place the debt for collection.

6.

You also may prevent businesses from reporting information about you to

consumer reporting agencies if you believe the information is the result of identity theft.

To do so, you must send your request to the address specified by the business that reports

the information to the consumer reporting agency. The business will expect you to identify

what information you do not want reported and to provide an identity theft report.

To learn more about identity theft and how to deal with its consequences, visit

www.consumerfinance.gov/learnmore, or write to the Consumer Financial Protection

Bureau. You may have additional rights under state law. For more information, contact your

local consumer protection agency or your state Attorney General.

In addition to the new rights and procedures to help consumers deal with the effects

of identity theft, the FCRA has many other important consumer protections. They are

described in more detail at www.consumerfinance.gov/learnmore.

(Updated: November 2012)

�