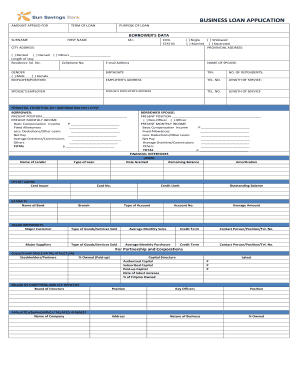

Fill and Sign the Business Loan Application Sun Savings Bank Sunsavings Form

Essential tips for preparing your ‘Business Loan Application Sun Savings Bank Sunsavings’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and organizations. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and approve paperwork online. Leverage the powerful features available in this user-friendly and budget-friendly platform and transform your paperwork management strategy. Whether you require endorsements on forms or need to collect eSignatures, airSlate SignNow simplifies the process, requiring just a few clicks.

Adhere to this comprehensive guide:

- Log into your account or initiate a free trial of our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Business Loan Application Sun Savings Bank Sunsavings’ in the editor.

- Click Me (Fill Out Now) to configure the document on your end.

- Add and designate fillable fields for others (if necessary).

- Move forward with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to work with others on your Business Loan Application Sun Savings Bank Sunsavings or send it for notarization—our solution has everything you need to accomplish those tasks. Sign up with airSlate SignNow today and enhance your document management to a higher level!

FAQs

-

What is the Business Loan Application process at Sun Savings Bank Sunsavings?

The Business Loan Application at Sun Savings Bank Sunsavings is designed to be straightforward and efficient. To apply, you’ll need to provide necessary documents including financial statements, business plans, and personal identification. Once submitted, our team will review your application and get back to you promptly.

-

What are the benefits of using the Business Loan Application at Sun Savings Bank Sunsavings?

Using the Business Loan Application at Sun Savings Bank Sunsavings offers several benefits, including competitive interest rates, flexible repayment terms, and personalized support from our dedicated loan officers. This application process is streamlined to ensure you can secure funding quickly and efficiently to grow your business.

-

Are there any fees associated with the Business Loan Application at Sun Savings Bank Sunsavings?

Yes, there may be associated fees with the Business Loan Application at Sun Savings Bank Sunsavings, such as processing fees or closing costs. However, we aim to keep these costs transparent and competitive, ensuring that you understand all potential expenses before moving forward with your application.

-

What documents do I need to complete the Business Loan Application at Sun Savings Bank Sunsavings?

To complete the Business Loan Application at Sun Savings Bank Sunsavings, you typically need to provide documents such as your business financial statements, tax returns, and proof of business ownership. Additional documentation may be required based on your specific business needs and loan amount.

-

How long does it take to get approved for a Business Loan Application at Sun Savings Bank Sunsavings?

The approval time for a Business Loan Application at Sun Savings Bank Sunsavings can vary, but many applicants receive a decision within a few business days. Factors such as the completeness of your application and the complexity of your financial situation can influence the timeline.

-

Can I apply for a Business Loan Application at Sun Savings Bank Sunsavings online?

Yes, you can conveniently apply for a Business Loan Application at Sun Savings Bank Sunsavings online. Our user-friendly platform allows you to fill out the application and upload required documents from the comfort of your home or office, streamlining the process signNowly.

-

What types of businesses are eligible for a Business Loan Application at Sun Savings Bank Sunsavings?

Various types of businesses can apply for a Business Loan Application at Sun Savings Bank Sunsavings, including startups, established companies, and non-profits. Each application is reviewed individually, considering your business model, financial health, and specific funding needs.

Find out other business loan application sun savings bank sunsavings form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles