Fill and Sign the Charitable Contribution Payroll Deduction Form

Useful suggestions for completing your ‘Charitable Contribution Payroll Deduction Form’ online

Fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can easily complete and sign paperwork online. Utilize the comprehensive tools integrated into this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Access your account or initiate a free trial with our service.

- Select +Create to upload a file from your device, cloud, or our form library.

- Open your ‘Charitable Contribution Payroll Deduction Form’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite configurations to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don't be concerned if you need to collaborate with your colleagues on your Charitable Contribution Payroll Deduction Form or send it for notarization—our service provides everything required to achieve such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

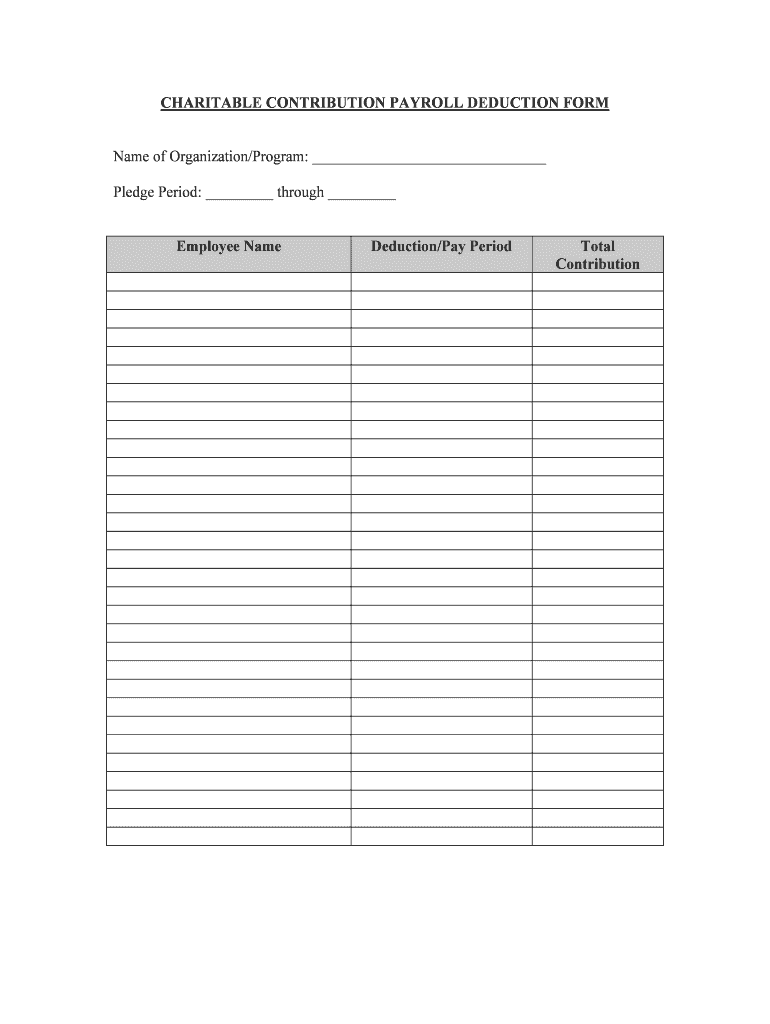

What is a CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM?

A CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORM is a document that allows employees to authorize their employer to deduct a specified amount from their paycheck for charitable donations. This form simplifies the process of giving and enables organizations to streamline their payroll deductions for charitable contributions.

-

How can airSlate SignNow help with CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS. With its user-friendly interface and secure eSignature capabilities, organizations can easily manage employee contributions and ensure compliance with charity donation regulations.

-

Is there a cost associated with using airSlate SignNow for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS?

Yes, airSlate SignNow offers various pricing plans tailored to meet different organizational needs. These plans include features that simplify the handling of CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS, making it a cost-effective solution for businesses looking to enhance their payroll deduction processes.

-

What features does airSlate SignNow offer for managing CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS. These features streamline the documentation process, reduce errors, and enhance overall efficiency for organizations managing charitable contributions.

-

Are CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS customizable with airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS to meet their specific needs. Organizations can add their branding, adjust fields, and tailor the form to fit their payroll deduction policies seamlessly.

-

Can airSlate SignNow integrate with existing payroll systems for CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS?

Yes, airSlate SignNow offers integration capabilities with various payroll systems, making it easy to manage CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS. This ensures that deductions are processed smoothly, enhancing the overall efficiency of payroll management.

-

How does airSlate SignNow ensure the security of CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS?

Security is a top priority at airSlate SignNow. We employ advanced encryption and compliance measures to protect CHARITABLE CONTRIBUTION PAYROLL DEDUCTION FORMS, ensuring that sensitive employee and donation information remains confidential and secure throughout the signing process.

The best way to complete and sign your charitable contribution payroll deduction form

Find out other charitable contribution payroll deduction form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles