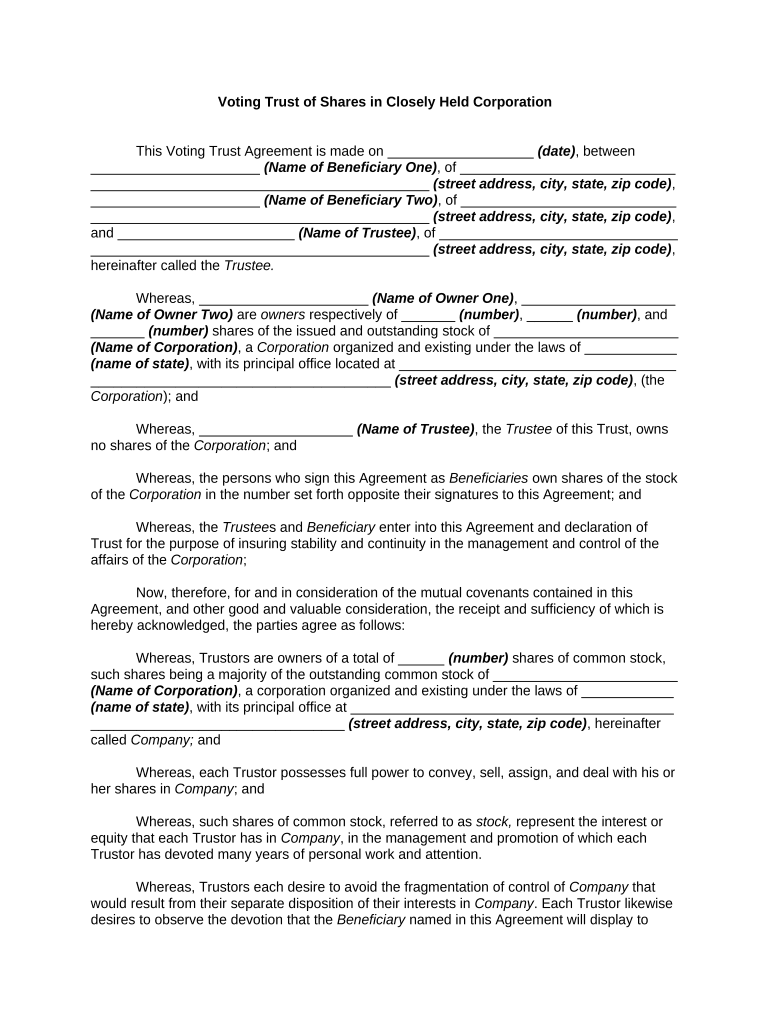

Voting Trust of Shares in Closely Held Corporation

This Voting Trust Agreement is made on ___________________ (date) , between

______________________ (Name of Beneficiary One) , of ____________________________

____________________________________________ (street address, city, state, zip code) ,

______________________ (Name of Beneficiary Two) , of ____________________________

____________________________________________ (street address, city, state, zip code) ,

and _______________________ (Name of Trustee) , of _______________________________

____________________________________________ (street address, city, state, zip code) ,

hereinafter called the Trustee.

Whereas, ______________________ (Name of Owner One) , ____________________

(Name of Owner Two) are owners respectively of _______ (number) , ______ (number) , and

_______ (number) shares of the issued and outstanding stock of ________________________

(Name of Corporation) , a Corporation organized and existing under the laws of ____________

(name of state) , with its principal office located at ____________________________________

_______________________________________ (street address, city, state, zip code) , (the

Corporation ); and

Whereas, ____________________ (Name of Trustee) , the Trustee of this Trust, owns

no shares of the Corporation ; and

Whereas, the persons who sign this Agreement as Beneficiaries own shares of the stock

of the Corporation in the number set forth opposite their signatures to this Agreement; and

Whereas, the Trustee s and Beneficiary enter into this Agreement and declaration of

Trust for the purpose of insuring stability and continuity in the management and control of the

affairs of the Corporation ;

Now, therefore, for and in consideration of the mutual covenants contained in this

Agreement, and other good and valuable consideration, the receipt and sufficiency of which is

hereby acknowledged, the parties agree as follows:

Whereas, Trustors are owners of a total of ______ (number) shares of common stock,

such shares being a majority of the outstanding common stock of ________________________

(Name of Corporation) , a corporation organized and existing under the laws of ____________

(name of state) , with its principal office at __________________________________________

_________________________________ (street address, city, state, zip code) , hereinafter

called Company; and

Whereas, each Trustor possesses full power to convey, sell, assign, and deal with his or

her shares in Company ; and

Whereas, such shares of common stock, referred to as stock, represent the interest or

equity that each Trustor has in Company , in the management and promotion of which each

Trustor has devoted many years of personal work and attention.

Whereas, Trustors each desire to avoid the fragmentation of control of Company that

would result from their separate disposition of their interests in Company . Each Trustor likewise

desires to observe the devotion that the Beneficiary named in this Agreement will display to

Company interests as a result of being inspired by a gift of stock at this time for the benefit of

the Beneficiary .

Now, therefore, for and in consideration of the mutual covenants contained in this

Agreement, and other good and valuable consideration, the receipt and sufficiency of which is

hereby acknowledged, the parties agree as follows:

1. Transfer in Trust

Trustors transfer and deliver to Trustee , in Trust, all of the shares of common stock

described in Exhibit A , which is attached and incorporated by reference. The receipt of the

stock is acknowledged by Trustee . The stock, together with any other property that may later

become subject to this Trust, shall constitute the Trust estate, and shall be held, administered,

and distributed by Trustee as provided in this Agreement.

2. Disposition of Principal and Income

Trustee shall hold, manage, invest, and reinvest the Trust estate, as provided in this

Agreement, shall collect and receive the income from the Trust estate, and, after deducting all

necessary expenses incident to the administration of this Trust, shall dispose of the principal

and income in the following manner:

A. Until stock or the interest that it represents is liquidated, as provided in this

Agreement, Trustee shall pay the income of the Trust estate as follows: (set forth

provisions regarding income during term of Trust) __________________________

______________________________________________________________________

______________________________________________________________________.

B. When stock or the interest that it represents has been liquidated, as provided in

this Agreement, Trustee shall dispose of the principal of the Trust as follows: ( set forth

provisions regarding final disposition of Trust estate) _______________________

______________________________________________________________________

______________________________________________________________________.

3. Irrevocability of Trust

This Trust is irrevocable and shall not be subject to amendment, alteration, or change.

No part of the principal or income of the Trust shall ever revert to or be used for the benefit of

any Trustor, be applied to the payment of premiums on policies of insurance on the life of any

Trustor, or be used to satisfy any legal obligations of any Trustor. Each Trustor renounces for

himself or herself and his or her estate any interest, either vested or contingent, including any

reversionary right or possibility of reverter, in the principal and income of the Trust, and any

power to determine or control, by alteration, amendment, revocation, or termination, or

otherwise, the beneficial enjoyment of the principal or income of the Trust. Any distribution to or

for the benefit of any Beneficiary is not intended to be, and shall not be, made in lieu of or in

discharge of any parental obligation of any Trustor.

4. Trustee’s Control of Company

Trustee shall be the holder of stock, which constitutes the majority of the shares issued

by Company with voting rights, and which therefore will vest Trustee with the control of

Company . Trustee shall have the right to vote stock as a unit, and not otherwise, at all meetings

of the stockholders of Company . By virtue of the right to vote stock, Trustee shall exercise

control of the management of all of the affairs of Company .

5. Sale of Company Stock

As the common stock of Company is so closely held that there has never been any

trading in it and therefore there is no established market value for the stock, Trustee shall hold

the stock intact as one fund and not sell or transfer any shares until the stock is sold in one

block at the same time, or until Company is finally liquidated. However, Trustee may, if Trustee

deems it advisable to do so, agree to merge Company with any other corporation. In connection

with any such merger Agreement in exchange for stock, Trustee may acquire shares in a new

corporation or shares of the corporation with which Company merges.

6. Joint Action with Other Shareholders

When the situation of Company is such that in Trustee 's opinion the interest of the Trust

would be benefited by Trustee 's acting in unison with other shareholders of Company , Trustee

shall have the power to join with other shareholders in concerted action for the advantage and

protection of the Trust estate. Accordingly, Trustee may participate in voting trusts ,

reorganization Agreements, and similar arrangements that Trustee may deem advantageous for

the protection of the Trust estate and shall have power to deposit and bind stock by any

Agreement Trustee may make in concurrence with other shareholders of Company .

7. Other Powers of Trustee

In addition to all other powers and discretions granted to or vested in Trustee by this

Agreement or by law, Trustee shall have the additional powers and discretions, to be exercised

only in a fiduciary capacity and primarily in the interest of the Beneficiary , to do all acts, institute

all proceedings, and exercise all rights and privileges in the management of the Trust estate as

if the absolute owner of the Trust estate, that Trustee may deem necessary or proper for the

conservation and protection of the Trust estate until stock is sold or the interest that it

represents is ultimately liquidated.

8. Distribution to Minors

Trustee in its sole discretion may pay any principal or income applicable to the use of a

minor, to the parent or guardian of the minor, to a person having care and control of the minor,

or directly to the minor, or Trustee may apply the same for the minor's benefit. Any payment so

made shall be a full and sufficient discharge of Trustee with respect to the same. Furthermore,

Trustee may accumulate for the benefit of any minor any part or all of the income applicable to

the use of the minor as Trustee in its sole discretion may deem advisable. The accumulated

income shall be paid to the minor on the minor's attaining the age of (e.g. 21) _____ years.

9. Expenses of Trust

Trustee shall pay or reserve sufficient funds to pay all expenses of management and

administration of the Trust estate, including Trustee ’s compensation, all of which shall be

charged to income of the Trust estate.

10. Allocation of Principal and Income

Dividends, interest, and other similar payments received in cash by Trustee shall

normally be considered income, whether ordinary or extraordinary and whether in the nature of

liquidating dividends or payments of dividends or payments on mining, oil, timber, or other

stocks or assets of a wasting nature, or a return of capital, or a distribution of realized capital

gains, or a distribution from depreciation or depletion reserves. Trustee shall so deal with such

payments irrespective of the character of the assets or account out of which they are paid or the

time when they shall have accrued or accumulated or shall have been earned, declared, or

payable, or the time for the determination of the persons entitled to them. Trustee shall have full

power and authority, in its absolute discretion, to allocate to principal the whole or any part of

any dividend or payment that in its opinion is extraordinary or in the nature of a liquidating

dividend or payment or a wasting asset dividend or payment or a return of capital or a

distribution from depreciation or depletion reserves. All determinations with respect to the

allocation of such dividends or payments, in whole or in part to principal, made in good faith by

Trustee , shall be final and binding on all persons interested in the Trust estate.

11. Compensation of Trustee

(Provide for Trustee’s compensation or waiver of compensation.) ______________

____________________________________________________________________________

12. Successor Trustees

On Trustee 's resignation or inability to continue to act as Trustee , Trustee shall appoint a

successor Trustee . On Trustee 's death before appointing a successor or other failure to appoint

a successor trustee, _____________________ (name of successor trustee) , of ___________

___________________________________________________________ (street address,

city, state, zip code) , is appointed as Successor Trustee . Any successor trustee shall have all

the duties and powers assumed and conferred in this Agreement on Trustee , including the

power in any successor trustee to appoint its own successor. The appointment of a successor

trustee shall be made by an acknowledged instrument delivered to the then living Beneficiaries

under this Trust.

13. Trustee’s Bond

No Trustee or successor Trustee shall be required to give any bond or other security.

14. Accounting

Trustee at any time shall be entitled to render to the current income Beneficiary or

Beneficiary of the Trust estate an account of Trustee 's acts and transactions with respect to the

income and principal of the Trust estate from the date of the creation of the Trust or from the

date of the last previous account of Trustee . The Beneficiary or Beneficiary shall have full power

and authority on behalf of all persons interested in the Trust to finally settle and adjust such

account. On the account being settled and adjusted to the satisfaction of the Beneficiary or

Beneficiary , it shall be final and conclusive on every person, regardless of whether in being, who

shall then or later be or become interested in either the income or the principal of the Trust

estate, with like effect as a judgment of a court having jurisdiction judicially settling the account

in an action in which Trustee and all persons having or claiming any interest in the Trust estate

were parties.

15. Trustee’s Acceptance; Law Governing Trust; Severability

This Trust has been accepted by Trustee and will be administered in _______________

(state) . The validity, construction, and all rights under this Trust shall be governed by the laws

of that state. If any provision of this Trust Agreement should be invalid or unenforceable, the

remaining provisions shall continue to be fully effective.

Trustors and Trustee have executed this Agreement at as of the day and year first above

written.

Witness our signatures this ________________ (date) .

______________________________

(Name & Signature of Trustee)

________________________

_________________________________ (Number of Shares Owned)

(Name & Signature of Beneficiary One)

_______________________

_________________________________ (Number of Shares Owned)

(Name & Signature of Beneficiary Two)

(Acknowledgments)

(Attach Exhibit)