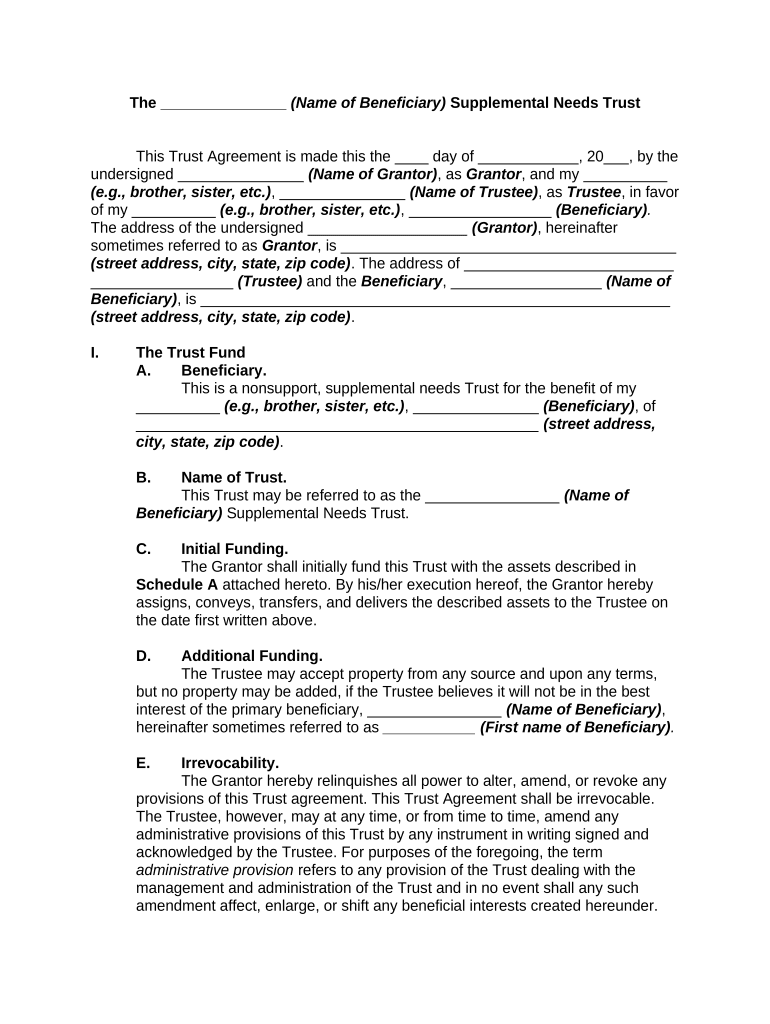

The _______________ (Name of Beneficiary) Supplemental Needs Trust

This Trust Agreement is made this the ____ day of ____________, 20___, by the

undersigned _______________ (Name of Grantor) , as Grantor , and my __________

(e.g., brother, sister, etc.) , _______________ (Name of Trustee) , as Trustee , in favor

of my __________ (e.g., brother, sister, etc.) , _________________ (Beneficiary) .

The address of the undersigned ___________________ (Grantor) , hereinafter

sometimes referred to as Grantor , is ________________________________________

(street address, city, state, zip code) . The address of _________________________

_________________ (Trustee) and the Beneficiary , __________________ (Name of

Beneficiary) , is ________________________________________________________

(street address, city, state, zip code) .

I. The Trust Fund

A. Beneficiary.

This is a nonsupport, supplemental needs Trust for the benefit of my

__________ (e.g., brother, sister, etc.) , _______________ (Beneficiary) , of

________________________________________________ (street address,

city, state, zip code) .

B. Name of Trust.

This Trust may be referred to as the ________________ (Name of

Beneficiary) Supplemental Needs Trust.

C. Initial Funding.

The Grantor shall initially fund this Trust with the assets described in

Schedule A attached hereto. By his/her execution hereof, the Grantor hereby

assigns, conveys, transfers, and delivers the described assets to the Trustee on

the date first written above.

D. Additional Funding.

The Trustee may accept property from any source and upon any terms,

but no property may be added, if the Trustee believes it will not be in the best

interest of the primary beneficiary, ________________ (Name of Beneficiary) ,

hereinafter sometimes referred to as ___________ (First name of Beneficiary) .

E. Irrevocability.

The Grantor hereby relinquishes all power to alter, amend, or revoke any

provisions of this Trust agreement. This Trust Agreement shall be irrevocable.

The Trustee, however, may at any time, or from time to time, amend any

administrative provisions of this Trust by any instrument in writing signed and

acknowledged by the Trustee. For purposes of the foregoing, the term

administrative provision refers to any provision of the Trust dealing with the

management and administration of the Trust and in no event shall any such

amendment affect, enlarge, or shift any beneficial interests created hereunder.

II. The Trust Purpose

The purpose of this Trust is to supplement, but not to supplant, whatever benefits

and services ___________ (First name of Beneficiary) may from time to time be

eligible to receive by reason of age, disability, or other factors, from federal, state, and

local governmental and charitable sources. This undersigned Grantor has entered into

this Trust with the recognition that governmental and charitable programs, in

themselves, contain many gaps that, if unaddressed, will greatly reduce the possibility

of ___________ (First name of Beneficiary) maintaining himself as independently as

possible and having the capacity to meet his/her future needs for residential, personal,

and other nonmedical services. It is, therefore, my intent and direction that the Trustee

use the principal and income of the Trust to provide ___________ (First name of

Beneficiary) with those benefits and services, and only those benefits and services,

that, in the Trustee's judgment, are not otherwise available to ___________ (First

name of Beneficiary) from other sources as or when needed for his/her welfare.

Without limiting the discretion of the Trustee to take whatever actions it may consider

necessary for ___________’s (First name of Beneficiary) welfare, in accordance with

the Trust purposes, Grantor desires that the Trust be used in ways that will best enable

___________ (First name of Beneficiary) to lead as normal, comfortable, and fulfilling

a life as possible.

III. Payment of Income and Principal

The Trustee may pay to ___________ (First name of Beneficiary) or may pay

on his/her behalf as much of the income or principal of the Trust as it shall determine in

its sole and non-reviewable discretion to be necessary for ___________’s (First name

of Beneficiary) care and well being. The Trustee may make the payments at any time,

in any amounts and proportions, and for any purposes as the Trustee considers

advisable, taking into account any factors he considers appropriate and having regard

for the purposes of the Trust described above in Section II. Neither ___________

(First name of Beneficiary) nor any person acting on his/her behalf as guardian,

conservator, guardian ad litem, attorney, or agent, except for the Trustee alone, shall

have any right, power, or authority to liquidate the Trust, in whole or in part, or to require

payments from the Trust for any purpose. The Trustee is directed to conserve and

accumulate the Trust estate to the extent feasible, due to the unforeseeability of

___________’s (First name of Beneficiary) future needs. However, accumulation or

use of the Trust is to be determined solely on the basis of the needs of ___________

(First name of Beneficiary) , without regard to the interests of the possible future

beneficiaries.

IV. Termination of the Trust

A. Distribution upon death of ___________ (First name of Beneficiary) .

This Trust shall terminate upon ___________’s (First name of Beneficiary)

death, at which time the Trustee shall:

1. Pay the Trust property and undistributed income as ___________

(First name of Beneficiary) may appoint by will to any person or not-for-

profit association; and

2. Pay the remaining principal and undistributed income to my

spouse, ________________ (Name of Spouse) . If he/she does not

survive ___________ (First name of Beneficiary) , the Trustee shall pay

such principal and undistributed income to my issue, per stirpes.

B. Distribution if no beneficiary living.

If at any time no person is living who is eligible to receive property under

the foregoing provisions of this Trust, the Trustee shall pay the remaining

property to the persons who would be entitled to receive ___________’s (First

name of Beneficiary) property under the laws of _____________ (Name of

State) then in force and in the proportions prescribed by such laws as if

___________ (First name of Beneficiary) had then died intestate, a resident of

_______________ (Name of State) , and not survived by a spouse.

C. Payments to persons under twenty-five or unable to manage their

affairs.

If a person becomes entitled to any income or principal before reaching

the age of twenty-five years, or while, in the Trustee's opinion, a beneficiary is

unable to manage his/her affairs because of physical condition or mental

incapacity, whether or not he/she has any legal guardian or conservator: (i) the

Trustee may pay all or any part of the property to the person or use or distribute it

for his/her benefit without liability to see to the application of the payment; and (ii)

if the Trustee elects to set apart a separate Trust, the Trustee may accumulate or

retain all or any part of the property or income therefrom in Trust and later may

pay it as provided in clause (i). When the person under the age of twenty-five

years reaches that age, or when the Trustee considers the incapacitated person

to be able to manage his/her affairs, the Trustee shall pay the remaining principal

and undistributed income held for such person to the person. If a person for

whom property is held in Trust under clause (ii) dies, the Trustee shall pay the

remaining Trust property to the person's issue then living, per stirpes, or, if none,

to the issue then living per stirpes of the person's parent, or if none, to the

person's estate. This Paragraph IV-C shall not apply to ___________ (First

name of Beneficiary) interest in the Trust during his/her life.

V. The Trustee

A. Appointment of Trustee.

1. At present, the Trustee is ______________ (Name of Trustee) .

The term Trustee includes the original Trustee and all successor or

additional Trustees.

2. If ______________ (Name of Trustee) is unable to serve as

Trustee hereunder, I hereby appoint my __________ (e.g., brother,

sister, etc.) , ______________ (Name of Successor Trustee) of

____________________________________________ (street address,

city, state, zip code) to serve as successor Trustee hereunder. I may

appoint successor and additional Trustees; otherwise, successor Trustees

shall be and additional Trustees may be appointed as follows:

a. By the remaining Trustee or Trustees, or, if none, by the

resigning Trustee; or,

b. If there is no remaining or resigning Trustee, by a majority of

my legally competent issue then living.

3. ___________ (First name of Beneficiary) may not serve as

Trustee. A successor Trustee need not be appointed if at least one

Trustee continues to serve.

4. The appointment of a Trustee shall be effective upon acceptance.

B. Removal or resignation of Trustee.

1. I may remove any Trustee by notice to that Trustee. After my death

or incapacity any Trustee may be removed on thirty days' notice to that

Trustee by a majority of my legally competent issue then living, provided

that after such removal there shall be an independent Trustee serving. An

independent Trustee is an individual or an institution who has no beneficial

interest in the Trust, who is a bank or Trust company, a professional

Trustee, investment advisor or manager, investment banker, accountant,

or lawyer, and who is not related or subordinate to ___________ (First

name of Beneficiary) or his/her spouse, if any, or any of his/her children

as defined in section 672(c) of the Internal Revenue Code of 1986, as

amended.

2. A Trustee may resign by giving thirty days' notice to me, or, if I am

not then living and legally competent, to a majority of my legally

competent issue then living, or, if there are no persons so qualified, to the

remaining or succeeding Trustee, provided that the resignation of a

sole remaining Trustee shall become effective only upon the

appointment and acceptance of a successor Trustee.

3. A Trustee shall cease to serve in the event of his/her incapacity.

A Trustee's incapacity shall be established by (i) a certificate signed

by two licensed physicians and delivered to the Trustee being

removed and the remaining Trustees or, if no Trustee is then

remaining, to the succeeding Trustee, stating that the Trustee is

not capable of managing the financial affairs of the Trust or (ii) the

appointment of a guardian or conservator for the Trustee.

C. Additional Trustee provisions.

1. Each appointment, removal, resignation, acceptance, or notice

under this Section V shall be in writing and, without affecting the

validity of any action, copies shall be given to all the Trustees. Any notice

may be waived by the person to whom it is to be given.

2. Each successor or additional Trustee, whether or not named by

me, shall have all the rights and powers of the original Trustee,

except as limited by this agreement or by law. Title to the Trust fund

shall vest in each successor or additional Trustee by virtue of the

Trustee's appointment and acceptance without any further

instrument of transfer or conveyance.

3. When there is a vacancy, the remaining Trustee or Trustees shall

act alone until the vacancy has been filled, unless disqualified from

acting by this Agreement or by law. During the absence or disability of any

Trustee, the remaining Trustee or Trustees, except where

disqualified, may act alone subject to any limitations imposed in writing

by the absent or disabled Trustee.

4. Anyone dealing with the Trust property may rely on a writing signed

by any Trustee as to the Trustee's authority to act on behalf of the Trust.

D. General Powers of Trustee.

In addition to all common law and statutory authority, the Trustee, except

as otherwise provided, shall have power without approval of any court and in any

manner it considers advisable:

1. To retain any property in the form in which it is received;

2. To repair, insure, or otherwise care for any tangible personal

property and to pay any shipping or other expenses relating to the

property as the Trustee deems advisable;

3. To abandon any property the Trustee considers worthless;

4. To invest income and principal without being subject to legal

limitations on investments by fiduciaries;

5. To sell, mortgage, exchange, lease, or otherwise dispose of or

encumber any property on any terms, no purchaser being bound to

see to the application of any proceeds and whether or not the effect

thereof extends beyond the term of this Trust;

6. To keep property in the name of a nominee;

7. To pay, compromise, or contest claims or controversies involving

the Trust, including claims for taxes;

8. To determine what part of the Trust property is income and what

part is principal;

9. To exercise all the rights that may be exercised by any security

holder in an individual capacity and to delegate any such rights;

10. To borrow any amounts;

11. To allot in or toward satisfaction of any payment, distribution, or

division, pro rata or non-pro rata, any property in the estate at the

then current fair market value determined by the Trustee;

12 To hold Trusts and shares undivided or at any time to hold the

same or any of them separate; and

13. To retain any investment counsel and advisors, accountants,

depositories, custodians, brokers, attorneys, and agents and to pay

them the usual compensation for their services, to accept and act upon

the recommendations of investment counsel and advisors, and to

delegate to any investment counsel and advisors, custodians, brokers,

or agents retained by the Trustee any ministerial or discretionary

powers.

E. Bonds and Accounts.

1. No Trustee shall be required to give bond, or, if a bond is required

by law, no sureties on the bond shall be required.

2. Any account of the Trustee assented to in writing by me or, if I am

not living and legally competent, by my spouse, or, if he/she has died or is

not available, by a guardian, conservator, or attorney-in-fact for

___________ (First name of Beneficiary) , shall be conclusive, except for

fraud or manifest error, on all parties in interest, whether or not of full age

or in being or ascertained. Nothing in this paragraph shall be construed to

give anyone the power or right to enlarge or shift the beneficial interest of

any beneficiary. If a person whose assent would be required if legally

competent is under guardianship or conservatorship, the guardian or

conservator may act on behalf of the person and the guardian's or

conservator's assent shall be required. The failure of any person to object

to any account by a writing mailed to the Trustee within sixty days after the

mailing of a copy of the account to that person shall be conclusively

deemed an assent by that person. The Trustee may present any Trust

accounts for allowance to a court of competent jurisdiction, and no

guardian ad litem shall be appointed in that proceeding.

F. Delegation among Trustees.

Any Trustee may delegate to any other Trustee acting under this

instrument, if any, the power to exercise any or all powers granted the Trustee in

this Agreement, including those that are discretionary. The Trustee may revoke

any such delegation at will. The delegation of any such power, as well as the

revocation of any such delegation, shall be evidenced by an instrument in writing

executed by the delegating Trustee. So long as any delegation is in effect, any of

the delegated powers may be exercised by the Trustee receiving such delegation

with the same force and effect as if the delegating Trustee had personally joined

in the exercise of such power.

G. The Trustee's fee.

The Trustee shall be entitled to fair and reasonable compensation for the

services the Trustee renders a beneficiary or the Trust. The amount of

compensation shall be an amount equal to the customary and prevailing charges

for services of a similar nature during the same period of time and in the same

geographic locale. The Trustee shall be reimbursed for the reasonable costs and

expenses incurred in connection with the Trustee's fiduciary duties performed

under this Agreement.

H. Majority required for control.

The concurrence and joinder of a majority of the Trustees, if more than

one Trustee is acting, shall control in all matters pertaining to the administration

of the Trust created under this Agreement. If only two Trustees are acting, the

concurrence and joinder of both shall be required. When more than two Trustees

are acting, any dissenting or abstaining Trustee may be absolved from personal

liability by registering a dissent or abstention with the records of the Trust;

the dissenting Trustee shall thereafter act with the other Trustees in any manner

necessary or appropriate to effectuate the decision of the majority.

I. Real property and environmental matters.

The Trustee shall have the following rights and powers with regard to real

property, operating businesses, and environmental matters:

1. The right to inspect all real property and business Trust assets and

to require the Trust to pay reasonable costs of determining the

existence and nature of any real or potential hazardous wastes on or in

such real property prior to accepting the role and responsibility of

Trustee hereunder.

2. As Trustee, the right and power to inspect all real property Trust

assets and to take all and any reasonable steps, at Trust expense,

to prevent, stop, or abate any actions or conditions that constitute or

may constitute violations of any environmental legislation or regulation.

The Trustee shall also be held harmless and indemnified with regard to

any claims that may arise with regard to real property or business Trust assets,

regardless of when allegedly violative actions were taken with regard to such real

property and regardless of by whom such actions were taken. The Trustee shall

similarly be held harmless and indemnified for any liability or costs or expenses

that may arise from hazardous waste and other environmental legislation or

litigation. It is the Grantor's intent and direction that the Trustee suffer no

personal financial exposure or risk on account of such environmental issues

while serving as Trustee.

VI. Beneficiaries Interests’ and Powers

A. Interests of beneficiaries not to be alienated.

The interest of any beneficiary under this Agreement shall not be subject

to assignment, alienation, pledge, attachment, or claims of creditors.

B. Disclaimers.

In addition to any power to disclaim conferred by law, any beneficiary

(including the executor or administrator of a beneficiary's estate) may disclaim in

whole or in part any power or interest granted to the beneficiary under this

Agreement. If a beneficiary disclaims any interest before having received any

benefits of the interest, then the property subject to the interest shall pass as if

the beneficiary had died before becoming entitled to it. If a beneficiary releases

any interest after having received any benefits of the interest, then the property

subject to the interest shall pass as if the beneficiary had then died.

C. Payments for beneficiaries.

1. Income payable to a person and income or principal that in the

discretion of the Trustee may be paid to a person may be used by

the Trustee for the person's benefit whether or not that person is legally

competent or under conservatorship or guardianship.

2. Payments of any amount to be made to a minor may be made to a

custodian for the minor under the _______________ (Name of State) ’s

Uniform Transfers to Minors Act or any similar statute.

3. If property becomes payable to the estate of any person and the

Trustee believes there is no duly appointed fiduciary and that none

is contemplated, the Trustee may, upon being furnished suitable

indemnity, make payment to the persons who the Trustee believes are

entitled to the payment, without liability to see to the application of

the payment.

D. Powers of appointment.

Any power of appointment by will granted under this Agreement can be

exercised only by will by specific reference to this Agreement and the power to

be exercised and shall include the right to appoint all or part of the

property subject to the power, to appoint outright, to give to the appointee or

appointees different types of interests and general or limited powers of appointment,

to appoint in Trust and create separate Trusts, to appoint a new Trustee or

Trustees, and to give a Trustee or Trustees discretion to pay or apply income

and principal within the class of permissible appointees.

VII. Definitions and Condition

A. Income.

Income means net income and accumulated income not added to

principal. Undistributed income at the termination of the income interest to which

it relates shall be dealt with as if accrued and received thereafter.

B. Adopted children.

The words child and issue and the like include persons adopted in their

minority and persons tracing descent through one or more such adopted

persons in all respects as if descended by blood and include persons descended

by blood, unless adopted while under the age of one year old by someone other

than a step-parent, grandparent, aunt or uncle, or guardian named by the

adopted person's natural parent.

C. Survival.

Where it is required by this agreement that any person shall have survived

another, that requirement means that the person shall have survived the other

person by at least thirty days.

D. Rule against perpetuities.

Regardless of any other provisions contained in this agreement, all Trusts

under this Agreement shall terminate no later than twenty-one years after the

death of ___________ (First name of Beneficiary) .

E. Governing law and construction.

This Agreement shall be construed, governed, and administered in

accordance with the laws of the _____________ (Name of State) . The headings

of the paragraphs of this Agreement are inserted for convenience only and shall

not affect its construction. In the construction of this agreement the gender of

pronouns and the singular or plural form of words shall be disregarded where

appropriate. References to provisions of the Internal Revenue Code shall be

deemed to include any corresponding provisions of subsequent federal tax laws.

F. Effective date.

This instrument shall take effect when signed by both myself and the

Trustee.

Witness the execution hereof under seal as of the date first written above.

_____________________

______________ , Grantor

______________________

_______________ , Trustee

Acknowledgements

Schedule

Schedule A