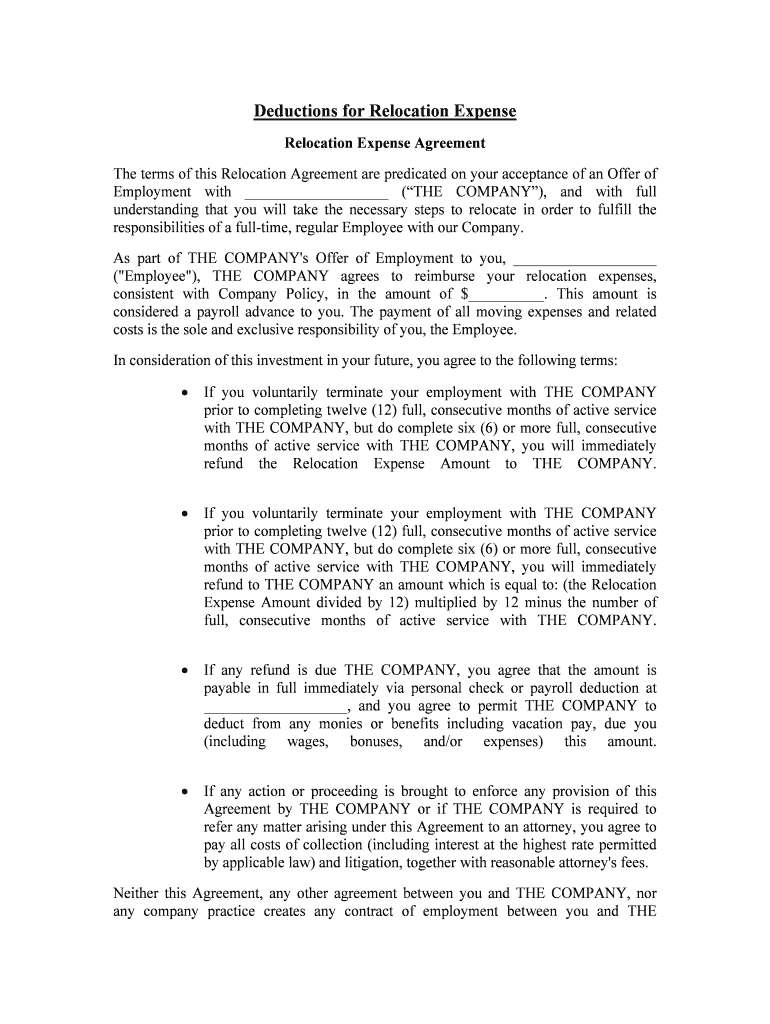

Fill and Sign the Deductions for Relocation Expense Form

Useful tips for finishing your ‘Deductions For Relocation Expense’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Take advantage of the extensive features incorporated into this user-friendly and cost-effective platform and transform your method of paperwork management. Whether you need to approve documents or gather eSignatures, airSlate SignNow manages it seamlessly, with just a few clicks.

Adhere to these comprehensive steps:

- Sign in to your account or initiate a free trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our form collection.

- Access your ‘Deductions For Relocation Expense’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don't worry if you need to collaborate with your colleagues on your Deductions For Relocation Expense or send it for notarization—our platform provides everything you require to accomplish these tasks. Create an account with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What are the deductions for relocation expense that I can claim?

Deductions for relocation expense generally include costs related to moving your household items, travel expenses for your family, and temporary lodging. These deductions can help reduce your taxable income, making it essential to understand what's eligible. Using airSlate SignNow can streamline the documentation process for these expenses.

-

How can airSlate SignNow help with managing relocation expense documents?

airSlate SignNow offers an easy-to-use platform that allows you to send, eSign, and store all documents related to your deductions for relocation expense securely. By digitizing your paperwork, you can ensure that all necessary documents are readily available and easily organized. This efficiency can simplify your tax filing process.

-

Are there any fees associated with using airSlate SignNow for relocation expenses?

airSlate SignNow provides a cost-effective solution for managing your deductions for relocation expense with various pricing plans. Each plan is designed to cater to different needs, ensuring that you only pay for the features you require. Additionally, the potential savings on your taxes may outweigh the costs associated with the service.

-

What features does airSlate SignNow offer to assist with relocation expense documentation?

With airSlate SignNow, you can create templates, track document status, and collaborate with team members to gather all necessary information related to your deductions for relocation expense. The platform's electronic signature feature allows for quick approvals, making the entire process more efficient. These features are designed to simplify your documentation workflow.

-

Can I integrate airSlate SignNow with other tools to manage my relocation expenses?

Yes, airSlate SignNow seamlessly integrates with various tools and platforms, allowing you to manage your deductions for relocation expense more effectively. You can connect with accounting software, CRM systems, and more to centralize your expense tracking. This integration ensures that all your financial data is in one place for easier management.

-

How does airSlate SignNow ensure the security of my relocation expense documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents related to your deductions for relocation expense. The platform employs industry-standard encryption and secure access controls to protect your data. This commitment to security helps to ensure that your information remains confidential and safe.

-

Can I use airSlate SignNow for international relocation expenses?

Yes, airSlate SignNow can be used to manage documentation for both domestic and international deductions for relocation expense. The platform's flexibility allows you to handle various types of relocation scenarios while ensuring compliance with tax regulations. This makes it an ideal solution for businesses and individuals relocating across borders.

The best way to complete and sign your deductions for relocation expense form

Find out other deductions for relocation expense form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles