Fill and Sign the Fillable Online Kansas Business Tax Application Part 1 Fax Form

Useful suggestions for finalizing your ‘Fillable Online Kansas Business Tax Application Part 1 Fax ’ online

Are you fed up with the inconvenience of handling paperwork? Your search ends here with airSlate SignNow, the premier electronic signature service for individuals and organizations. Bid farewell to the monotonous procedure of printing and scanning files. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the extensive features included in this user-friendly and cost-effective platform and transform your method of managing documents. Whether you need to authorize forms or collect digital signatures, airSlate SignNow takes care of everything easily, needing just a few clicks.

Follow this detailed guide:

- Sign in to your account or register for a free trial of our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Fillable Online Kansas Business Tax Application Part 1 Fax ’ in the editor.

- Click Me (Fill Out Now) to get the document ready on your end.

- Add and assign fillable fields for others (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you have to collaborate with others on your Fillable Online Kansas Business Tax Application Part 1 Fax or send it for notarization—our solution provides you with all the tools necessary to complete such tasks. Register with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

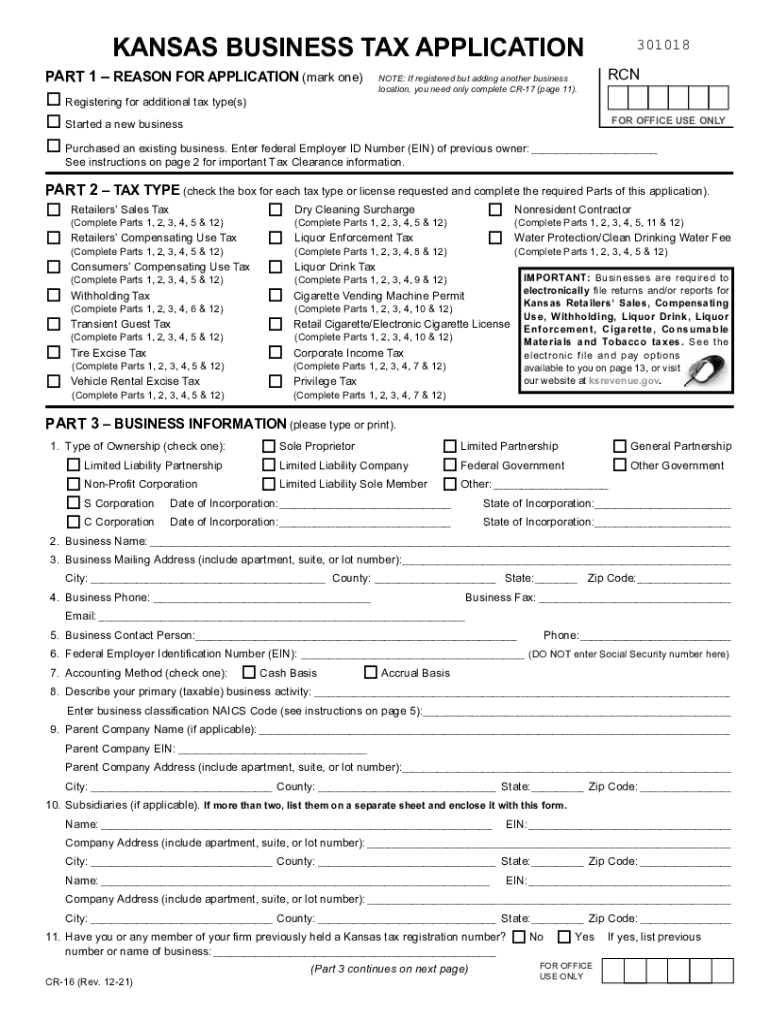

What is the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax?

The Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax is a digital form that allows businesses in Kansas to complete and submit their tax applications conveniently online. This form can be filled out, saved, and faxed directly to the appropriate tax authority, streamlining the application process.

-

How does airSlate SignNow enhance the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax experience?

airSlate SignNow enhances the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax by providing a user-friendly interface that simplifies the filling and signing process. With features like electronic signatures and document tracking, businesses can ensure their applications are submitted quickly and securely.

-

Is there a cost associated with using the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax via airSlate SignNow?

Yes, while the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax can be accessed digitally, using airSlate SignNow may involve a subscription fee based on the features you choose. However, the cost is often offset by the time saved and the increased efficiency in handling tax paperwork.

-

Can I integrate the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax with other tools?

Absolutely! airSlate SignNow allows seamless integration with various business tools and applications, making it easy to incorporate the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax into your existing workflows. This ensures that your tax application process is both efficient and cohesive with your other business operations.

-

What are the key benefits of using the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax?

Using the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. airSlate SignNow's platform also provides secure storage and easy access to your documents whenever you need them.

-

How secure is the Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax process?

The Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax process is highly secure, as airSlate SignNow employs advanced encryption and security protocols to protect your sensitive information. You can confidently complete and send your tax applications, knowing your data is safe.

-

Can I track the status of my Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax. You can receive notifications when your document is viewed, signed, or completed, giving you peace of mind throughout the submission process.

Find out other fillable online kansas business tax application part 1 fax form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles