Department of the Treasury

Internal Revenue Service

Publication 529

Contents

What's New . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Reminders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Cat. No. 15056o

Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Miscellaneous

Deductions

Deductions Subject to the 2% Limit . . . . . . . . . . . . 2

Unreimbursed Employee Expenses . . . . . . . . . . . 2

Other Expenses . . . . . . . . . . . . . . . . . . . . . . . . . 8

For use in preparing

2013 Returns

Deductions Not Subject to the 2% Limit . . . . . . . . 12

List of Deductions . . . . . . . . . . . . . . . . . . . . . . . 12

Nondeductible Expenses . . . . . . . . . . . . . . . . . . . 14

List of Nondeductible Expenses . . . . . . . . . . . . . 14

How To Report . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

How To Get Tax Help . . . . . . . . . . . . . . . . . . . . . . 18

Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

What's New

Standard mileage rate. The 2013 rate for business use

of a vehicle is 561 2 cents per mile.

Reminders

Future developments. For the latest information about

developments related to Publication 529, such as legislation enacted after it was published, go to www.irs.gov/

pub529.

Photographs of missing children. The Internal Revenue Service is a proud partner with the National Center for

Missing and Exploited Children. Photographs of missing

children selected by the Center may appear in this publication on pages that would otherwise be blank. You can

help bring these children home by looking at the photographs and calling 1-800-THE-LOST (1-800-843-5678) if

you recognize a child.

Introduction

This publication explains which expenses you can claim

as miscellaneous itemized deductions on Schedule A

(Form 1040 or Form 1040NR). You must reduce the total

of most miscellaneous itemized deductions by 2% of your

adjusted gross income. This publication covers the following topics.

Deductions subject to the 2% limit.

Get forms and other Information

faster and easier by

Internet at IRS.gov

Nov 13, 2013

Deductions not subject to the 2% limit.

Expenses you cannot deduct.

�How to report your deductions.

Some of the deductions previously discussed in this

publication are adjustments to income rather than miscellaneous deductions. These include certain employee

business expenses that must be listed on Form 2106 or

Form 2106-EZ and some that are entered directly on

Form 1040. Those deductions, which are discussed in

Publication 463, Travel, Entertainment, Gift, and Car Expenses, include employee business expenses of officials

paid on a fee basis and performing artists.

Note. Generally, nonresident aliens are allowed miscellaneous itemized deductions to the extent they are directly related to income which is effectively connected

with the conduct of a trade or business within the United

States.

You must keep records to verify your deductions.

You should keep receipts, canceled checks, subRECORDS stitute checks, financial account statements, and

other documentary evidence. For more information on recordkeeping, see Publication 552, Recordkeeping for Individuals.

Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions.

You can write to us at the following address:

Internal Revenue Service

Tax Forms and Publications Division

1111 Constitution Ave. NW, IR-6526

Washington, DC 20224

We respond to many letters by telephone. Therefore, it

would be helpful if you would include your daytime phone

number, including the area code, in your correspondence.

You can send your comments from www.irs.gov/

formspubs. Click on “More Information” and then on

“Comment on Tax Forms and Publications.”

Although we cannot respond individually to each comment received, we do appreciate your feedback and will

consider your comments as we revise our tax products.

Ordering forms and publications. Visit www.irs.gov/

formspubs to download forms and publications, call

1-800-TAX-FORM (1-800-829-3676), or write to the address below and receive a response within 10 days after

your request is received.

Internal Revenue Service

1201 N. Mitsubishi Motorway

Bloomington, IL 61705-6613

Tax questions. If you have a tax question, check the

information available on IRS.gov or call 1-800-829-1040.

We cannot answer tax questions sent to either of the

above addresses.

Useful Items

You may want to see:

Publication

463 Travel, Entertainment, Gift, and Car Expenses

525 Taxable and Nontaxable Income

535 Business Expenses

587 Business Use of Your Home (Including Use by

Daycare Providers)

946 How To Depreciate Property

Form (and Instructions)

Schedule A (Form 1040) Itemized Deductions

2106 Employee Business Expenses

2106-EZ Unreimbursed Employee Business

Expenses

See How To Get Tax Help near the end of this publication

for information about getting these publications and forms.

Deductions Subject

to the 2% Limit

You can deduct certain expenses as miscellaneous itemized deductions on Schedule A (Form 1040 or Form

1040NR). You can claim the amount of expenses that is

more than 2% of your adjusted gross income. You figure

your deduction on Schedule A by subtracting 2% of your

adjusted gross income from the total amount of these expenses. Your adjusted gross income is the amount on

Form 1040, line 38, or Form 1040NR, line 37.

Generally, you apply the 2% limit after you apply any

other deduction limit. For example, you apply the 50% (or

80%) limit on business-related meals and entertainment

(discussed later under Travel, Transportation, Meals, En

tertainment, Gifts, and Local Lodging) before you apply

the 2% limit.

Deductions subject to the 2% limit are discussed in the

following three categories.

Unreimbursed employee expenses (Schedule A

(Form 1040), line 21 or Schedule A (Form 1040NR),

line 7).

Tax preparation fees (Schedule A (Form 1040),

line 22 or Schedule A (Form 1040NR), line 8).

Other expenses (Schedule A (Form 1040), line 23 or

Schedule A (Form 1040NR), line 9).

Unreimbursed Employee Expenses

Generally, the following expenses are deducted on

Schedule A (Form 1040), line 21, or Schedule A (Form

1040NR), line 7.

Page 2

Publication 529 (2013)

�You can deduct only unreimbursed employee expenses that are:

Paid or incurred during your tax year,

For carrying on your trade or business of being an employee, and

Ordinary and necessary.

An expense is ordinary if it is common and accepted in

your trade, business, or profession. An expense is necessary if it is appropriate and helpful to your business. An

expense does not have to be required to be considered

necessary.

You may be able to deduct the following items as unreimbursed employee expenses.

Business bad debt of an employee.

Business liability insurance premiums.

Damages paid to a former employer for breach of an

employment contract.

Depreciation on a computer your employer requires

you to use in your work.

Dues to a chamber of commerce if membership helps

you do your job.

Dues to professional societies.

Educator expenses.

Home office or part of your home used regularly and

exclusively in your work.

Job search expenses in your present occupation.

Laboratory breakage fees.

Legal fees related to your job.

Licenses and regulatory fees.

Malpractice insurance premiums.

Medical examinations required by an employer.

Work clothes and uniforms if required and not suitable

for everyday use.

Work-related education.

Business Bad Debt

A business bad debt is a loss from a debt created or acquired in your trade or business. Any other worthless debt

is a business bad debt only if there is a very close relationship between the debt and your trade or business when

the debt becomes worthless.

A debt has a very close relationship to your trade or

business of being an employee if your main motive for incurring the debt is a business reason.

Example. You make a bona fide loan to the corporation you work for. It fails to pay you back. You had to make

the loan in order to keep your job. You have a business

bad debt as an employee.

More information. For more information on business

bad debts, see chapter 10 in Publication 535. For information on nonbusiness bad debts, see chapter 4 in Publication 550, Investment Income and Expenses.

Business Liability Insurance

You can deduct insurance premiums you paid for protection against personal liability for wrongful acts on the job.

Damages for Breach of Employment

Contract

If you break an employment contract, you can deduct

damages you pay your former employer if the damages

are attributable to the pay you received from that employer.

Depreciation on Computers

You can claim a depreciation deduction for a computer

that you use in your work as an employee if its use is:

Occupational taxes.

For the convenience of your employer, and

Passport for a business trip.

Required as a condition of your employment.

Repayment of an income aid payment received under

an employer's plan.

Research expenses of a college professor.

Rural mail carriers' vehicle expenses.

Subscriptions to professional journals and trade magazines related to your work.

Tools and supplies used in your work.

Travel, transportation, meals, entertainment, gifts, and

local lodging related to your work.

Union dues and expenses.

Publication 529 (2013)

For the convenience of your employer. This means

that your use of the computer is for a substantial business

reason of your employer. You must consider all facts in

making this determination. Use of your computer during

your regular working hours to carry on your employer's

business is generally for the convenience of your employer.

Required as a condition of your employment. This

means that you cannot properly perform your duties without the computer. Whether you can properly perform your

duties without it depends on all the facts and circumstances. It is not necessary that your employer explicitly requires you to use your computer. But neither is it enough

Page 3

�that your employer merely states that your use of the item

is a condition of your employment.

Dues to Chambers of Commerce and

Professional Societies

Example. You are an engineer with an engineering

firm. You occasionally take work home at night rather than

work late at the office. You own and use a computer that is

similar to the one you use at the office to complete your

work at home. Since your use of the computer is not for

the convenience of your employer and is not required as a

condition of your employment, you cannot claim a depreciation deduction for it.

You may be able to deduct dues paid to professional organizations (such as bar associations and medical associations) and to chambers of commerce and similar organizations, if membership helps you carry out the duties of

your job. Similar organizations include:

Boards of trade,

Business leagues,

Which depreciation method to use. The depreciation

method you use depends on whether you meet the

more-than-50%-use test.

Civic or public service organizations,

More-than-50%-use test met. You meet this test if

you use the computer more than 50% in your work. If you

meet this test, you can claim accelerated depreciation under the General Depreciation System (GDS). In addition,

you may be able to take the section 179 deduction for the

year you place the item in service.

Trade associations.

More-than-50%-use test not met. If you do not meet

the more-than-50%-use test, you are limited to the straight

line method of depreciation under the Alternative Depreciation System (ADS). You also cannot claim the section

179 deduction. (But if you use your computer in a home

office, see the exception below.)

Investment use. Your use of a computer in connection with investments (described later under Other Expen

ses) does not count as use in your work. However, you

can combine your investment use with your work use in

figuring your depreciation deduction.

Exception for computer used in a home office.

The more-than-50%-use test does not apply to a computer used only in a part of your home that meets the requirements described later under Home Office. You can

claim accelerated depreciation using GDS for a computer

used in a qualifying home office, even if you do not use it

more than 50% in your work. You also may be able to take

a section 179 deduction for the year you place the computer in service. See Computer used in a home office under How To Report, later.

More information. For more information on depreciation and the section 179 deduction for computers and

other items used in a home office, see Business Furniture

and Equipment in Publication 587. Publication 946 has

detailed information about the section 179 deduction and

depreciation deductions using GDS and ADS.

Reporting your depreciation deduction. See How To

Report, later, for information about reporting a deduction

for depreciation.

You must keep records to prove your percentage

of business and investment use.

RECORDS

Page 4

Real estate boards, and

Lobbying and political activities. You may not be able

to deduct that part of your dues that is for certain lobbying

and political activities. See Lobbying Expenses under

Nondeductible Expenses, later.

Educator Expenses

If you were an eligible educator in 2013, you can deduct

up to $250 of qualified expenses you paid in 2013 as an

adjustment to gross income on Form 1040, line 23, rather

than as a miscellaneous itemized deduction. If you file

Form 1040A, you can deduct these expenses on line 16. If

you and your spouse are filing jointly and both of you were

eligible educators, the maximum deduction is $500. However, neither spouse can deduct more than $250 of his or

her qualified expenses.

Eligible educator. An eligible educator is a kindergarten

through grade 12 teacher, instructor, counselor, principal,

or aide in school for at least 900 hours during a school

year.

Qualified expenses. Qualified expenses include ordinary and necessary expenses paid in connection with

books, supplies, equipment (including computer equipment, software, and services), and other materials used in

the classroom. An ordinary expense is one that is common and accepted in your educational field. A necessary

expense is one that is helpful and appropriate for your

profession as an educator. An expense does not have to

be required to be considered necessary.

Qualified expenses do not include expenses for home

schooling or for nonathletic supplies for courses in health

or physical education. You must reduce your qualified expenses by the following amounts.

Excludable U.S. series EE and I savings bond interest

from Form 8815.

Nontaxable qualified state tuition program earnings.

Nontaxable earnings from Coverdell education savings accounts.

Publication 529 (2013)

�Any reimbursements you received for those expenses

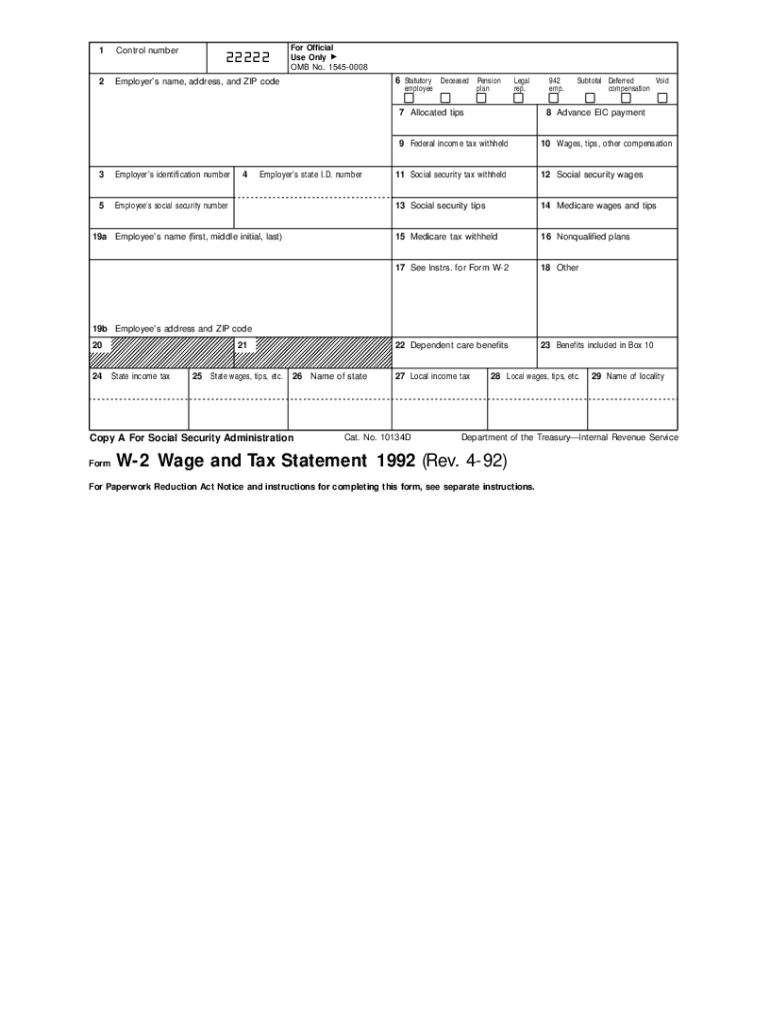

that were not reported to you on your Form W-2,

box 1.

Educator expenses over limit. If you were an educator

in 2013 and you had qualified expenses that you cannot

take as an adjustment to gross income, you can deduct

the rest as an itemized deduction subject to the 2% limit.

Home Office

If you use a part of your home regularly and exclusively for

business purposes, you may be able to deduct a part of

the operating expenses and depreciation of your home.

You can claim this deduction for the business use of a

part of your home only if you use that part of your home

regularly and exclusively:

As your principal place of business for any trade or

business,

As a place to meet or deal with your patients, clients,

or customers in the normal course of your trade or

business, or

In the case of a separate structure not attached to

your home, in connection with your trade or business.

The regular and exclusive business use must be for the

convenience of your employer and not just appropriate

and helpful in your job.

Principal place of business. If you have more than one

place of business, the business part of your home is your

principal place of business if:

You use it regularly and exclusively for administrative

or management activities of your trade or business,

and

You have no other fixed location where you conduct

substantial administrative or management activities of

your trade or business.

Otherwise, the location of your principal place of business generally depends on the relative importance of the

activities performed at each location and the time spent at

each location.

You should keep records that will give the information needed to figure the deduction according

RECORDS to these rules. Also keep canceled checks, substitute checks, or account statements and receipts of the

expenses paid to prove the deductions you claim.

More information. See Publication 587 for more detailed

information and a worksheet for figuring the deduction.

Job Search Expenses

You can deduct certain expenses you have in looking for

a new job in your present occupation, even if you do not

get a new job. You cannot deduct these expenses if:

There was a substantial break between the ending of

your last job and your looking for a new one, or

You are looking for a job for the first time.

Employment and outplacement agency fees. You can

deduct employment and outplacement agency fees you

pay in looking for a new job in your present occupation.

Employer pays you back. If, in a later year, your employer pays you back for employment agency fees, you

must include the amount you receive in your gross income

up to the amount of your tax benefit in the earlier year.

See Recoveries in Publication 525.

Employer pays the employment agency. If your

employer pays the fees directly to the employment agency

and you are not responsible for them, you do not include

them in your gross income.

Résumé. You can deduct amounts you spend for preparing and mailing copies of a résumé to prospective employers if you are looking for a new job in your present occupation.

Travel and transportation expenses. If you travel to an

area and, while there, you look for a new job in your

present occupation, you may be able to deduct travel expenses to and from the area. You can deduct the travel

expenses if the trip is primarily to look for a new job. The

amount of time you spend on personal activity compared

to the amount of time you spend in looking for work is important in determining whether the trip is primarily personal or is primarily to look for a new job.

Even if you cannot deduct the travel expenses to and

from an area, you can deduct the expenses of looking for

a new job in your present occupation while in the area.

You can choose to use the standard mileage rate to figure your car expenses. The 2013 rate for business use of

a vehicle is 561 2 cents per mile. See Publication 463 for

more information on travel and car expenses.

Legal Fees

You can deduct legal fees related to doing or keeping your

job.

Licenses and Regulatory Fees

You can deduct the amount you pay each year to state or

local governments for licenses and regulatory fees for

your trade, business, or profession.

Occupational Taxes

You can deduct an occupational tax charged at a flat rate

by a locality for the privilege of working or conducting a

business in the locality. If you are an employee, you can

claim occupational taxes only as a miscellaneous deduction subject to the 2% limit; you cannot claim them as a

deduction for taxes elsewhere on your return.

You are looking for a job in a new occupation,

Publication 529 (2013)

Page 5

�Repayment of Income Aid Payment

An “income aid payment” is one that is received under an

employer's plan to aid employees who lose their jobs because of lack of work. If you repay a lump-sum income aid

payment that you received and included in income in an

earlier year, you can deduct the repayment.

Research Expenses of a College Professor

If you are a college professor, you can deduct your research expenses, including travel expenses, for teaching,

lecturing, or writing and publishing on subjects that relate

directly to your teaching duties. You must have undertaken the research as a means of carrying out the duties

expected of a professor and without expectation of profit

apart from salary. However, you cannot deduct the cost of

travel as a form of education.

Rural Mail Carriers' Vehicle Expenses

If your expenses to use a vehicle in performing services

as a rural mail carrier are more than the amount of your reimbursements, you can deduct the unreimbursed expenses. See chapter 4 of Publication 463 for more information.

Tools Used in Your Work

Generally, you can deduct amounts you spend for tools

used in your work if the tools wear out and are thrown

away within 1 year from the date of purchase. You can depreciate the cost of tools that have a useful life substantially beyond the tax year. For more information about depreciation, see Publication 946.

Travel, Transportation, Meals,

Entertainment, Gifts, and Local Lodging

If you are an employee and have ordinary and necessary

business-related expenses for travel away from home, local transportation, entertainment, and gifts, you may be

able to deduct these expenses. Generally, you must file

Form 2106 or Form 2106-EZ to claim these expenses.

Travel expenses. Travel expenses are those incurred

while traveling away from home for your employer. You

can deduct travel expenses paid or incurred in connection

with a temporary work assignment. Generally, you cannot

deduct travel expenses paid or incurred in connection with

an indefinite work assignment.

Travel expenses may include:

The cost of getting to and from your business destination (air, rail, bus, car, etc.),

Meals and lodging while away from home,

Taxi fares,

Baggage charges, and

Cleaning and laundry expenses.

Page 6

Travel expenses are discussed more fully in chapter 1

of Publication 463.

Temporary work assignment. If your assignment or

job away from home in a single location is realistically expected to last (and does in fact last) for 1 year or less, it is

temporary, unless there are facts and circumstances that

indicate it is not.

Indefinite work assignment. If your assignment or

job away from home in a single location is realistically expected to last for more than 1 year, it is indefinite, whether

or not it actually lasts for more than 1 year.

If your assignment or job away from home in a single

location is realistically expected to last for 1 year or less,

but at some later date it is realistically expected to exceed

1 year, it will be treated as temporary (in the absence of

facts and circumstances indicating otherwise) until the

date that your realistic expectation changes, and it will be

treated as indefinite after that date.

Federal crime investigation and prosecution. If

you are a federal employee participating in a federal crime

investigation or prosecution, you are not subject to the

1-year rule for deducting temporary travel expenses. This

means that you may be able to deduct travel expenses

even if you are away from your tax home for more than 1

year.

To qualify, the Attorney General must certify that you

are traveling:

For the Federal Government,

In a temporary duty status, and

To investigate, prosecute, or provide support services

for the investigation or prosecution of a federal crime.

Armed Forces reservists traveling more than 100

miles from home. If you are a member of a reserve component of the Armed Forces of the United States and you

travel more than 100 miles away from home in connection

with your performance of services as a member of the reserves, you can deduct some of your travel expenses as

an adjustment to gross income rather than as a miscellaneous itemized deduction. The amount of expenses you

can deduct as an adjustment to gross income is limited to

the regular federal per diem rate (for lodging, meals, and

incidental expenses) and the standard mileage rate (for

car expenses) plus any parking fees, ferry fees, and tolls.

The balance, if any, is reported on Schedule A.

You are a member of a reserve component of the

Armed Forces of the United States if you are in the Army,

Naval, Marine Corps, Air Force, Coast Guard Reserve,

the Army National Guard of the United States, the Air National Guard of the United States, or the Reserve Corps of

the Public Health Service.

For more information on travel expenses, see Publication 463.

Local transportation expenses. Local transportation

expenses are the expenses of getting from one workplace

to another when you are not traveling away from home.

Publication 529 (2013)

�They include the cost of transportation by air, rail, bus,

taxi, and the cost of using your car.

You can choose to use the standard mileage rate to figure your car expenses. The 2013 rate for business use of

a vehicle is 561 2 cents per mile.

!

CAUTION

In general, the costs of commuting between your

residence and your place of business are nonde

ductible.

Work at two places in a day. If you work at two places in a day, whether or not for the same employer, you

can generally deduct the expenses of getting from one

workplace to the other.

Temporary work location. You can deduct expenses

incurred in going between your home and a temporary

work location if at least one of the following applies.

The work location is outside the metropolitan area

where you live and normally work.

You have at least one regular work location (other

than your home) for the same trade or business. (If

this applies, the distance between your home and the

temporary work location does not matter.)

For this purpose, a work location is generally considered temporary if your work there is realistically expected

to last (and does in fact last) for 1 year or less. It is not

temporary if your work there is realistically expected to

last for more than 1 year, even if it actually lasts for 1 year

or less. If your work there initially is realistically expected

to last for 1 year or less, but later is realistically expected

to last for more than 1 year, the work location is generally

considered temporary until the date your realistic expectation changes and not temporary after that date. For more

information, see chapter 1 of Publication 463.

Gift expenses. You can generally deduct up to $25 of

business gifts you give to any one individual during the

year. The following items do not count toward the $25

limit.

Identical, widely distributed items costing $4 or less

that have your name clearly and permanently imprinted.

Signs, racks, and promotional materials to be displayed on the business premises of the recipient.

Local lodging. If your employer provides or requires you

to obtain lodging while you are not traveling away from

home, you can deduct the cost of the lodging if it is:

on a temporary basis,

necessary for you to participate in or be available for a

business meeting or employer function, and

the costs are ordinary and necessary, but not lavish or

extravagant.

If your employer provides the lodging or reimburses

you for the cost of the lodging, you can deduct the cost

only if the value or the reimbursement is included in your

gross income because it is reported as wages on your

Form W-2.

Additional information. See Publication 463 for more

information on travel, transportation, meal, entertainment,

and gift expenses, and reimbursements for these expenses.

Union Dues and Expenses

You can deduct dues and initiation fees you pay for union

membership.

Home office. You can deduct expenses incurred in

going between your home and a workplace if your home is

your principal place of business for the same trade or

business. (In this situation, whether the other workplace is

temporary or regular and its distance from your home do

not matter.) See Home Office, earlier, for a discussion on

the use of your home as your principal place of business.

You can also deduct assessments for benefit payments

to unemployed union members. However, you cannot deduct the part of the assessments or contributions that provides funds for the payment of sick, accident, or death

benefits. Also, you cannot deduct contributions to a pension fund even if the union requires you to make the contributions.

Meals and entertainment. Generally, you can deduct

entertainment expenses (including entertainment-related

meals) only if they are directly related to the active conduct of your trade or business. However, the expense only

needs to be associated with the active conduct of your

trade or business if it directly precedes or follows a substantial and bona fide business-related discussion.

You can deduct only 50% of your business-related

meal and entertainment expenses unless the expenses

meet certain exceptions. You apply this 50% limit before

you apply the 2%-of-adjusted-gross-income limit.

You may not be able to deduct amounts you pay to the

union that are related to certain lobbying and political activities. See Lobbying Expenses under Nondeductible Ex

penses, later.

Meals when subject to “hours of service” limits.

You can deduct 80% of your business-related meal expenses if you consume the meals during or incident to any

period subject to the Department of Transportation's

“hours of service” limits. You apply this 80% limit before

you apply the 2%-of-adjusted-gross-income limit.

Publication 529 (2013)

Work Clothes and Uniforms

You can deduct the cost and upkeep of work clothes if the

following two requirements are met.

You must wear them as a condition of your employment.

The clothes are not suitable for everyday wear.

Page 7

�It is not enough that you wear distinctive clothing.

The clothing must be specifically required by your

CAUTION

employer. Nor is it enough that you do not, in fact,

wear your work clothes away from work. The clothing

must not be suitable for taking the place of your regular

clothing.

!

Examples of workers who may be able to deduct the

cost and upkeep of work clothes are: delivery workers,

firefighters, health care workers, law enforcement officers,

letter carriers, professional athletes, and transportation

workers (air, rail, bus, etc.).

Musicians and entertainers can deduct the cost of theatrical clothing and accessories that are not suitable for

everyday wear.

However, work clothing consisting of white cap, white

shirt or white jacket, white bib overalls, and standard work

shoes, which a painter is required by his union to wear on

the job, is not distinctive in character or in the nature of a

uniform. Similarly, the costs of buying and maintaining

blue work clothes worn by a welder at the request of a

foreman are not deductible.

Protective clothing. You can deduct the cost of protective clothing required in your work, such as safety shoes

or boots, safety glasses, hard hats, and work gloves.

Examples of workers who may be required to wear

safety items are: carpenters, cement workers, chemical

workers, electricians, fishing boat crew members, machinists, oil field workers, pipe fitters, steamfitters, and truck

drivers.

Military uniforms. You generally cannot deduct the cost

of your uniforms if you are on full-time active duty in the

armed forces. However, if you are an armed forces reservist, you can deduct the unreimbursed cost of your uniform if military regulations restrict you from wearing it except while on duty as a reservist. In figuring the deduction,

you must reduce the cost by any nontaxable allowance

you receive for these expenses.

If local military rules do not allow you to wear fatigue

uniforms when you are off duty, you can deduct the

amount by which the cost of buying and keeping up these

uniforms is more than the uniform allowance you receive.

If you are a student at an armed forces academy, you

cannot deduct the cost of your uniforms if they replace

regular clothing. However, you can deduct the cost of insignia, shoulder boards, and related items.

You can deduct the cost of your uniforms if you are a

civilian faculty or staff member of a military school.

Work-Related Education

You can deduct expenses you have for education, even if

the education may lead to a degree, if the education

meets at least one of the following two tests.

It maintains or improves skills required in your present

work.

Page 8

It is required by your employer or the law to keep your

salary, status, or job, and the requirement serves a

business purpose of your employer.

You cannot deduct expenses you have for education,

even though one or both of the preceding tests are met, if

the education:

Is needed to meet the minimum educational requirements to qualify you in your trade or business, or

Is part of a program of study that will lead to qualifying

you in a new trade or business.

If your education qualifies, you can deduct expenses

for tuition, books, supplies, laboratory fees, and similar

items, and certain transportation costs.

If the education qualifies you for a new trade or business, you cannot deduct the educational expenses even if

you do not intend to enter that trade or business.

Travel as education. You cannot deduct the cost of

travel that in itself constitutes a form of education. For example, a French teacher who travels to France to maintain

general familiarity with the French language and culture

cannot deduct the cost of the trip as an educational expense.

More information. See Publication 970, Tax Benefits for

Education, for a complete discussion of the deduction for

work-related education expenses.

Education Expenses During Unemployment

If you stop working for a year or less in order to get education in order to maintain or improve skills needed in your

present work and then return to the same general type of

work, your absence is considered temporary. Education

that you get during a temporary absence is qualifying

work-related education if it maintains or improves skills

needed in your present work.

Tax Preparation Fees

You can usually deduct tax preparation fees on the return

for the year in which you pay them. Thus, on your 2013 return, you can deduct fees paid in 2013 for preparing your

2012 return. These fees include the cost of tax preparation software programs and tax publications. They also include any fee you paid for electronic filing of your return.

See Tax preparation fees under How To Report, later.

Other Expenses

You can deduct certain other expenses as miscellaneous

itemized deductions subject to the 2%-of-adjusted-gross-income limit. On Schedule A (Form 1040),

line 23, or Schedule A (Form 1040NR), line 9, you can deduct the ordinary and necessary expenses that you pay:

1. To produce or collect income that must be included in

your gross income,

Publication 529 (2013)

�2. To manage, conserve, or maintain property held for

producing such income, or

3. To determine, contest, pay, or claim a refund of any

tax.

You can deduct expenses you pay for the purposes in (1)

and (2) above only if they are reasonable and closely related to these purposes.

These other expenses include the following items.

Appraisal fees for a casualty loss or charitable contribution.

Casualty and theft losses from property used in performing services as an employee.

Casualty and Theft Losses

You can deduct a casualty or theft loss as a miscellaneous itemized deduction subject to the 2% limit if you used

the damaged or stolen property in performing services as

an employee. First report the loss in Section B of Form

4684, Casualties and Thefts. You may also have to include the loss on Form 4797, Sales of Business Property,

if you are otherwise required to file that form. To figure

your deduction, add all casualty or theft losses from this

type of property included on Form 4684, lines 32 and 38b,

or Form 4797, line 18a. For more information on casualty

and theft losses, see Publication 547, Casualties, Disasters, and Thefts.

Clerical help and office rent in caring for investments.

Clerical Help and Office Rent

Depreciation on home computers used for investments.

You can deduct office expenses, such as rent and clerical

help, that you have in connection with your investments

and collecting the taxable income on them.

Excess deductions (including administrative expenses) allowed a beneficiary on termination of an estate

or trust.

Fees to collect interest and dividends.

Hobby expenses, but generally not more than hobby

income.

Indirect miscellaneous deductions from pass-through

entities.

Investment fees and expenses.

Legal fees related to producing or collecting taxable

income or getting tax advice.

Loss on deposits in an insolvent or bankrupt financial

institution.

Loss on traditional IRAs or Roth IRAs, when all

amounts have been distributed to you.

Repayments of income.

Repayments of social security benefits.

Safe deposit box rental, except for storing jewelry and

other personal effects.

Service charges on dividend reinvestment plans.

Tax advice fees.

Trustee's fees for your IRA, if separately billed and

paid.

If the expenses you pay produce income that is only partially taxable, see TaxExempt Income Expenses, later, under Nondeductible Expenses.

Appraisal Fees

You can deduct appraisal fees if you pay them to figure a

casualty loss or the fair market value of donated property.

Publication 529 (2013)

Credit or Debit Card Convenience Fees

You can deduct the convenience fee charged by the card

processor for paying your income tax (including estimated

tax payments) by credit or debit card. The fees are deductible on the return for the year in which you paid them. For

example, fees charged to payments made in 2013 can be

claimed on the 2013 tax return.

Depreciation on Home Computer

You can deduct depreciation on your home computer if

you use it to produce income (for example, to manage

your investments that produce taxable income). You generally must depreciate the computer using the straight line

method over the Alternative Depreciation System (ADS)

recovery period. But if you work as an employee and also

use the computer in that work, see Depreciation on Com

puters under Unreimbursed Employee Expenses, earlier.

For more information on depreciation, see Publication

946.

Excess Deductions of an Estate

If an estate's total deductions in its last tax year are more

than its gross income for that year, the beneficiaries succeeding to the estate's property can deduct the excess.

Do not include deductions for the estate's personal exemption and charitable contributions when figuring the estate's total deductions. The beneficiaries can claim the deduction only for the tax year in which, or with which, the

estate terminates, whether the year of termination is a normal year or a short tax year. For more information, see

Termination of Estate in Publication 559, Survivors, Executors, and Administrators.

Page 9

�Fees To Collect Interest and Dividends

You can deduct fees you pay to a broker, bank, trustee, or

similar agent to collect your taxable bond interest or dividends on shares of stock. But you cannot deduct a fee

you pay to a broker to buy investment property, such as

stocks or bonds. You must add the fee to the cost of the

property.

You cannot deduct the fee you pay to a broker to sell

securities. You can use the fee only to figure gain or loss

from the sale. See the instructions for Schedule D (Form

1040) for information on how to report the fee.

Hobby Expenses

You can generally deduct hobby expenses, but only up to

the amount of hobby income. A hobby is not a business

because it is not carried on to make a profit. See

NotforProfit Activities in chapter 1 of Publication 535.

Indirect Deductions of Pass-Through

Entities

Pass-through entities include partnerships, S corporations, and mutual funds that are not publicly offered. Deductions of pass-through entities are passed through to

the partners or shareholders. The partners or shareholders can deduct their share of passed-through deductions

for investment expenses as miscellaneous itemized deductions subject to the 2% limit.

Example. You are a member of an investment club

that is formed solely to invest in securities. The club is

treated as a partnership. The partnership's income is

solely from taxable dividends, interest, and gains from

sales of securities. In this case, you can deduct your

share of the partnership's operating expenses as miscellaneous itemized deductions subject to the 2% limit. However, if the investment club partnership has investments

that also produce nontaxable income, you cannot deduct

your share of the partnership's expenses that produce the

nontaxable income.

Publicly offered mutual funds. Publicly offered mutual

funds do not pass deductions for investment expenses

through to shareholders. A mutual fund is “publicly offered” if it is:

Continuously offered pursuant to a public offering,

Regularly traded on an established securities market,

or

Held by or for at least 500 persons at all times during

the tax year.

A publicly offered mutual fund will send you a Form

1099-DIV, Dividends and Distributions, or a substitute

form, showing the net amount of dividend income (gross

dividends minus investment expenses). This net figure is

the amount you report on your return as income. You cannot further deduct investment expenses related to publicly

Page 10

offered mutual funds because they are already included

as part of the net income amount.

Information returns. You should receive information returns from pass-through entities.

Partnerships and S corporations. These entities issue Schedule K-1, which lists the items and amounts you

must report, and identifies the tax return schedules and

lines to use.

Nonpublicly offered mutual funds. These funds will

send you a Form 1099-DIV, or a substitute form, showing

your share of gross income and investment expenses.

You can claim the expenses only as a miscellaneous

itemized deduction subject to the 2% limit.

Investment Fees and Expenses

You can deduct investment fees, custodial fees, trust administration fees, and other expenses you paid for managing your investments that produce taxable income.

Legal Expenses

You can usually deduct legal expenses that you incur in

attempting to produce or collect taxable income or that

you pay in connection with the determination, collection,

or refund of any tax.

You can also deduct legal expenses that are:

Related to either doing or keeping your job, such as

those you paid to defend yourself against criminal

charges arising out of your trade or business,

For tax advice related to a divorce if the bill specifies

how much is for tax advice and it is determined in a

reasonable way, or

To collect taxable alimony.

You can deduct expenses of resolving tax issues relating to profit or loss from business (Schedule C or C-EZ),

rentals or royalties (Schedule E), or farm income and expenses (Schedule F) on the appropriate schedule. You

deduct expenses of resolving nonbusiness tax issues on

Schedule A (Form 1040 or Form 1040NR). See Tax Prep

aration Fees, earlier.

Unlawful discrimination claims. You may be able to

deduct, as an adjustment to income on Form 1040,

line 36, or Form 1040NR, line 35, rather than as a miscellaneous itemized deduction, attorney fees and court costs

for actions settled or decided after October 22, 2004, involving a claim of unlawful discrimination, a claim against

the U.S. Government, or a claim made under section

1862(b)(3)(A) of the Social Security Act. However, the

amount you can deduct on Form 1040, line 36, or Form

1040NR, line 35, is limited to the amount of the judgment

or settlement you are including in income for the tax year.

See Publication 525 for more information.

Publication 529 (2013)

�Loss on Deposits

A loss on deposits can occur when a bank, credit union, or

other financial institution becomes insolvent or bankrupt. If

you can reasonably estimate the amount of your loss on

money you have on deposit in a financial institution that

becomes insolvent or bankrupt, you can generally choose

to deduct it in the current year even though its exact

amount has not been finally determined. If elected, the

casualty loss is subject to certain deduction limitations.

The election is made on Form 4684. Once you make this

choice, you cannot change it without IRS approval.

If none of the deposit is federally insured, you can deduct the loss in either of the following ways.

As an ordinary loss (as a miscellaneous itemized deduction subject to the 2% limit). Write the name of the

financial institution and “Insolvent Financial Institution”

beside the amount on Schedule A (Form 1040),

line 23, or Schedule A (Form 1040NR), line 9. This deduction is limited to $20,000 ($10,000 if you are married filing separately) for each financial institution, reduced by any expected state insurance proceeds.

As a casualty loss. Report it on Form 4684 first and

then on Schedule A (Form 1040). See Publication 547

for details.

As a nonbusiness bad debt. Report it on Schedule D

(Form 1040).

If any part of the deposit is federally insured, you can

deduct the loss only as a casualty loss.

Exception. You cannot make this choice if you are a

1%-or-more-owner or an officer of the financial institution,

or are related to such owner or officer. For a definition of

“related,” see Deposit in Insolvent or Bankrupt Financial

Institution in chapter 4 of Publication 550.

Actual loss different from estimated loss. If you make

this choice and your actual loss is less than your estimated loss, you must include the excess in income. See Re

coveries in Publication 525. If your actual loss is more

than your estimated loss, treat the excess loss as explained under Choice not made, next.

Choice not made. If you do not make this choice (or if

you have an excess actual loss after choosing to deduct

your estimated loss), treat your loss (or excess loss) as a

nonbusiness bad debt (deductible as a short-term capital

loss) in the year its amount is finally determined. See Non

business Bad Debts in chapter 4 of Publication 550.

Loss on IRA

If you have a loss on your traditional IRA (or Roth IRA) investment, you can deduct the loss as a miscellaneous

itemized deduction subject to the 2% limit, but only when

all the amounts in all your traditional IRA (or Roth IRA) accounts have been distributed to you and the total distributions are less than your unrecovered basis. For more information, see Publication 590, Individual Retirement

Arrangements (IRAs).

Repayments of Income

If you had to repay an amount that you included in income

in an earlier year, you may be able to deduct the amount

you repaid. If the amount you had to repay was ordinary

income of $3,000 or less, the deduction is subject to the

2% limit. If it was more than $3,000, see Repayments Un

der Claim of Right under Deductions Not Subject to the

2% Limit, later.

Repayments of Social Security Benefits

If the total of the amounts in box 5 (net benefits for 2013)

of all your Forms SSA-1099, Social Security Benefit Statement, and Forms RRB-1099, Payments By the Railroad

Retirement Board, is a negative figure (a figure in parentheses), you may be able to take a miscellaneous itemized deduction subject to the 2% limit. The amount you

can deduct is the part of the negative figure that represents an amount you included in gross income in an earlier year.

The amount in box 5 of Form SSA-1099 or RRB-1099

is the net amount of your benefits for the year. It will be a

negative figure if the amount of benefits you repaid in

2013 (box 4) is more than the gross amount of benefits

paid to you in 2013 (box 3).

If the deduction is more than $3,000, you will

have to use a special computation to figure your

CAUTION

tax. See Publication 915, Social Security and

Equivalent Railroad Retirement Benefits, for additional in

formation.

!

Safe Deposit Box Rent

You can deduct safe deposit box rent if you use the box to

store taxable income-producing stocks, bonds, or investment-related papers and documents. You cannot deduct

the rent if you use the box only for jewelry, other personal

items, or tax-exempt securities.

Service Charges on Dividend

Reinvestment Plans

You can deduct service charges you pay as a subscriber

in a dividend reinvestment plan. These service charges include payments for:

Holding shares acquired through a plan,

Collecting and reinvesting cash dividends, and

Keeping individual records and providing detailed

statements of accounts.

Publication 529 (2013)

Page 11

�Trustee's Administrative Fees for IRA

Trustee's administrative fees that are billed separately and

paid by you in connection with your IRA are deductible (if

they are ordinary and necessary) as a miscellaneous

itemized deduction subject to the 2% limit.

Deductions Not Subject

to the 2% Limit

You can deduct the items listed below as miscellaneous

itemized deductions. They are not subject to the 2% limit.

Report these items on Schedule A (Form 1040), line 28,

or Schedule A (Form 1040NR), line 14.

List of Deductions

Amortizable premium on taxable bonds.

Casualty and theft losses from income-producing

property.

Federal estate tax on income in respect of a decedent.

Gambling losses up to the amount of gambling winnings.

Impairment-related work expenses of persons with

disabilities.

Loss from other activities from Schedule K-1 (Form

1065-B), box 2.

Losses from Ponzi-type investment schemes.

Repayments of more than $3,000 under a claim of

right.

Unrecovered investment in an annuity.

Amortizable Premium on Taxable Bonds

In general, if the amount you pay for a bond is greater than

its stated principal amount, the excess is bond premium.

You can elect to amortize the premium on taxable bonds.

The amortization of the premium is generally an offset to

interest income on the bond rather than a separate deduction item.

Pre-1998 election to amortize bond premium. Generally, if you first elected to amortize bond premium before

1998, the above treatment of the premium does not apply

to bonds you acquired before 1988.

Bonds acquired after October 22, 1986, and before

1988. The amortization of the premium on these bonds is

investment interest expense subject to the investment interest limit, unless you chose to treat it as an offset to interest income on the bond.

Bonds acquired before October 23, 1986. The amortization of the premium on these bonds is a miscellaneous itemized deduction not subject to the 2% limit.

Page 12

Deduction for excess premium. On certain bonds

(such as bonds that pay a variable rate of interest or that

provide for an interest-free period), the amount of bond

premium allocable to a period may exceed the amount of

stated interest allocable to the period. If this occurs, treat

the excess as a miscellaneous itemized deduction that is

not subject to the 2% limit. However, the amount deductible is limited to the amount by which your total interest inclusions on the bond in prior periods exceed the total

amount you treated as a bond premium deduction on the

bond in prior periods. If any of the excess bond premium

cannot be deducted because of the limit, this amount is

carried forward to the next period and is treated as bond

premium allocable to that period.

Pre-1998 choice to amortize bond premium.

If you made the choice to amortize the premium

CAUTION

on taxable bonds before 1998, you can deduct

the bond premium amortization that is more than your in

terest income only for bonds acquired during 1998 and

later years.

!

More information. For more information on bond premium, see Bond Premium Amortization in chapter 3 of

Publication 550.

Casualty and Theft Losses of

Income-Producing Property

You can deduct a casualty or theft loss as a miscellaneous itemized deduction not subject to the 2% limit if the

damaged or stolen property was income-producing property (property held for investment, such as stocks, notes,

bonds, gold, silver, vacant lots, and works of art). First report the loss in Section B of Form 4684. You may also

have to include the loss on Form 4797, Sales of Business

Property, if you are otherwise required to file that form. To

figure your deduction, add all casualty or theft losses from

this type of property included on Form 4684, lines 32 and

38b, or Form 4797, line 18a. For more information on

casualty and theft losses, see Publication 547.

Federal Estate Tax on Income in Respect of

a Decedent

You can deduct the federal estate tax attributable to income in respect of a decedent that you as a beneficiary

include in your gross income. Income in respect of the decedent is gross income that the decedent would have received had death not occurred and that was not properly

includible in the decedent's final income tax return. See

Publication 559 for information about figuring the amount

of this deduction.

Gambling Losses Up to the Amount of

Gambling Winnings

You must report the full amount of your gambling winnings

for the year on Form 1040, line 21. You deduct your gambling losses for the year on Schedule A (Form 1040),

line 28. You cannot deduct gambling losses that are more

Publication 529 (2013)

�than your winnings. Generally, nonresident aliens cannot

deduct gambling losses on Schedule A (Form 1040NR).

You cannot reduce your gambling winnings by

your gambling losses and report the difference.

CAUTION

You must report the full amount of your winnings

as income and claim your losses (up to the amount of win

nings) as an itemized deduction. Therefore, your records

should show your winnings separately from your losses.

!

RECORDS

Diary of winnings and losses. You must keep

an accurate diary or similar record of your losses

and winnings.

Your diary should contain at least the following information.

The date and type of your specific wager or wagering

activity.

The name and address or location of the gambling establishment.

The names of other persons present with you at the

gambling establishment.

The amount(s) you won or lost.

Proof of winnings and losses. In addition to your diary,

you should also have other documentation. You can generally prove your winnings and losses through Form

W-2G, Certain Gambling Winnings, Form 5754, Statement by Person(s) Receiving Gambling Winnings, wagering tickets, canceled checks, substitute checks, credit records, bank withdrawals, and statements of actual

winnings or payment slips provided to you by the gambling establishment.

For specific wagering transactions, you can use the following items to support your winnings and losses.

These recordkeeping suggestions are intended

as general guidelines to help you establish your

CAUTION

winnings and losses. They are not allinclusive.

Your tax liability depends on your particular facts and cir

cumstances.

!

Keno. Copies of the keno tickets you purchased that

were validated by the gambling establishment, copies of

your casino credit records, and copies of your casino

check cashing records.

Slot machines. A record of the machine number and

all winnings by date and time the machine was played.

Table games (twenty-one (blackjack), craps,

poker, baccarat, roulette, wheel of fortune, etc.). The

number of the table at which you were playing. Casino

credit card data indicating whether the credit was issued

in the pit or at the cashier's cage.

Bingo. A record of the number of games played, cost

of tickets purchased, and amounts collected on winning

tickets. Supplemental records include any receipts from

the casino, parlor, etc.

Racing (horse, harness, dog, etc.). A record of the

races, amounts of wagers, amounts collected on winning

Publication 529 (2013)

tickets, and amounts lost on losing tickets. Supplemental

records include unredeemed tickets and payment records

from the racetrack.

Lotteries. A record of ticket purchases, dates, winnings, and losses. Supplemental records include unredeemed tickets, payment slips, and winnings statements.

Impairment-Related Work Expenses

If you have a physical or mental disability that limits your

being employed, or substantially limits one or more of your

major life activities, such as performing manual tasks,

walking, speaking, breathing, learning, and working, you

can deduct your impairment-related work expenses.

Impairment-related work expenses are ordinary and

necessary business expenses for attendant care services

at your place of work and other expenses in connection

with your place of work that are necessary for you to be

able to work.

Example. You are blind. You must use a reader to do

your work. You use the reader both during your regular

working hours at your place of work and outside your regular working hours away from your place of work. The

reader's services are only for your work. You can deduct

your expenses for the reader as impairment-related work

expenses.

Self-employed. If you are self-employed, enter your impairment-related work expenses on the appropriate form

(Schedule C, C-EZ, E, or F) used to report your business

income and expenses.

See Impairmentrelated work expenses., later under

How To Report.

Loss From Other Activities From

Schedule K-1 (Form 1065-B), Box 2

If the amount reported in Schedule K-1 (Form 1065-B),

box 2, is a loss, report it on Schedule A (Form 1040),

line 28, or Schedule A (Form 1040NR), line 14 (only if effectively connected with a U.S. trade or business). It is not

subject to the passive activity limitations.

Officials Paid on a Fee Basis

If you are a fee-basis official, you can claim your expenses

in performing services in that job as an adjustment to income rather than as a miscellaneous itemized deduction.

See Publication 463 for more information.

Performing Artists

If you are a qualified performing artist, you can deduct

your employee business expenses as an adjustment to income rather than as a miscellaneous itemized deduction.

If you are an employee, complete Form 2106 or Form

2106-EZ. See Publication 463 for more information.

Page 13

�Losses From Ponzi-type Investment

Schemes

Health spa expenses.

These losses are deductible as theft losses of income-producing property on your tax return for the year

the loss was discovered. You figure the deductible loss in

Section B of Form 4684. However, if you qualify to use

Revenue Procedure 2009-20 (as modified by Revenue

Procedure 2011-58) and you choose to follow the procedures in the guidance, complete Section C of Form 4684

before completing Section B. Section C of Form 4684 replaces Appendix A in Revenue Procedure 2009-20. You

do not need to complete Appendix A. See the Form 4684

instructions and Publication 547, Casualties, Disasters,

and Thefts, for more information.

Home repairs, insurance, and rent.

Repayments Under Claim of Right

If you had to repay more than $3,000 that you included in

your income in an earlier year because at the time you

thought you had an unrestricted right to it, you may be

able to deduct the amount you repaid, or take a credit

against your tax. See Repayments in Publication 525 for

more information.

Unrecovered Investment in Annuity

A retiree who contributed to the cost of an annuity can exclude from income a part of each payment received as a

tax-free return of the retiree's investment. If the retiree

dies before the entire investment is recovered tax free,

any unrecovered investment can be deducted on the retiree's final income tax return. See Publication 575, Pension

and Annuity Income, for more information about the tax

treatment of pensions and annuities.

Nondeductible Expenses

You cannot deduct the following expenses.

List of Nondeductible Expenses

Hobby losses—but see Hobby Expenses, earlier.

Home security system.

Illegal bribes and kickbacks—see Bribes and kick

backs in chapter 11 of Publication 535.

Investment-related seminars.

Life insurance premiums paid by the insured.

Lobbying expenses.

Losses from the sale of your home, furniture, personal

car, etc.

Lost or misplaced cash or property.

Lunches with co-workers.

Meals while working late.

Medical expenses as business expenses other than

medical examinations required by your employer.

Personal disability insurance premiums.

Personal legal expenses.

Personal, living, or family expenses.

Political contributions.

Professional accreditation fees.

Professional reputation, expenses to improve.

Relief fund contributions.

Residential telephone line.

Stockholders' meeting, expenses of attending.

Tax-exempt income, expenses of earning or collecting.

Adoption expenses.

The value of wages never received or lost vacation

time.

Broker's commissions.

Travel expenses for another individual.

Burial or funeral expenses, including the cost of a

cemetery lot.

Voluntary unemployment benefit fund contributions.

Campaign expenses.

Wristwatches.

Capital expenses.

Adoption Expenses

Check-writing fees.

You cannot deduct the expenses of adopting a child but

you may be able to take a credit for those expenses. For

details, see Form 8839, Qualified Adoption Expenses.

Club dues.

Commuting expenses.

Fees and licenses, such as car licenses, marriage licenses, and dog tags.

Fines and penalties, such as parking tickets.

Page 14

Commissions

Commissions paid on the purchase of securities are not

deductible, either as business or nonbusiness expenses.

Instead, these fees must be added to the taxpayer's cost

Publication 529 (2013)

�of the securities. Commissions paid on the sale are deductible as business expenses only by dealers.

Campaign Expenses

You cannot deduct campaign expenses of a candidate for

any office, even if the candidate is running for reelection to

the office. These include qualification and registration fees

for primary elections.

Legal fees. You cannot deduct legal fees paid to defend

charges that arise from participation in a political campaign.

Capital Expenses

Fines or Penalties

You cannot deduct fines or penalties you pay to a governmental unit for violating a law. This includes an amount

paid in settlement of your actual or potential liability for a

fine or penalty (civil or criminal). Fines or penalties include

parking tickets, tax penalties, and penalties deducted

from teachers' paychecks after an illegal strike.

Health Spa Expenses

You cannot deduct health spa expenses, even if there is a

job requirement to stay in excellent physical condition,

such as might be required of a law enforcement officer.

Home Security System

You cannot currently deduct amounts paid to buy property

that has a useful life substantially beyond the tax year or

amounts paid to increase the value or prolong the life of

property. If you use such property in your work, you may

be able to take a depreciation deduction. See Publication

946. If the property is a car used in your work, also see

Publication 463.

You cannot deduct the cost of a home security system as

a miscellaneous deduction. However, you may be able to

claim a deduction for a home security system as a business expense if you have a home office. See Home Office

under Unreimbursed Employee Expenses, earlier, and

Publication 587.

Check-Writing Fees on Personal Account

Investment-Related Seminars

If you have a personal checking account, you cannot deduct fees charged by the bank for the privilege of writing

checks, even if the account pays interest.

You cannot deduct any expenses for attending a convention, seminar, or similar meeting for investment purposes.

Club Dues

Generally, you cannot deduct the cost of membership in

any club organized for business, pleasure, recreation, or

other social purpose. This includes business, social, athletic, luncheon, sporting, airline, hotel, golf, and country

clubs.

You cannot deduct dues paid to an organization if one

of its main purposes is to:

Conduct entertainment activities for members or their

guests, or

Provide members or their guests with access to entertainment facilities.

Dues paid to airline, hotel, and luncheon clubs are not

deductible.

Commuting Expenses

You cannot deduct commuting expenses (the cost of

transportation between your home and your main or regular place of work). If you haul tools, instruments, or other

items in your car to and from work, you can deduct only

the additional cost of hauling the items, such as the rent

on a trailer to carry the items.

Life Insurance Premiums

You cannot deduct premiums you pay on your life insurance. You may be able to deduct, as alimony, premiums

you pay on life insurance policies assigned to your former

spouse. See Publication 504, Divorced or Separated Individuals, for information on alimony.

Lobbying Expenses

You generally cannot deduct amounts paid or incurred for

lobbying expenses. These include expenses to:

1. Influence legislation,

2. Participate, or intervene, in any political campaign for,

or against, any candidate for public office,

3. Attempt to influence the general public, or segments

of the public, about elections, legislative matters, or

referendums, or

4. Communicate directly with covered executive branch

officials in any attempt to influence the official actions

or positions of those officials.

Lobbying expenses also include any amounts paid or

incurred for research, preparation, planning, or coordination of any of these activities.

Covered executive branch official. A covered executive branch official, for the purpose of (4) above, is any of

the following officials.

The President.

Publication 529 (2013)

Page 15

�The Vice President.

Any officer or employee of the White House Office of

the Executive Office of the President, and the two

most senior level officers of each of the other agencies in the Executive Office.

Any individual serving in a position in Level I of t