Fill and Sign the Hmrc Form 5003 En

Practical advice on finishing your ‘Hmrc Form 5003 En’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and small businesses. Bid farewell to the lengthy procedures of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and authorize paperwork online. Take advantage of the robust features available in this user-friendly and cost-effective platform, transforming your method of document management. Whether you need to authorize forms or gather digital signatures, airSlate SignNow manages it all seamlessly, needing only a few clicks.

Follow these step-by-step instructions:

- Log in to your account or register for a free trial with our platform.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Hmrc Form 5003 En’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Add and assign fillable fields for others (if needed).

- Proceed with the Send Invite options to request eSignatures from others.

- Download or print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Hmrc Form 5003 En or send it for notarization—our platform has everything you require to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

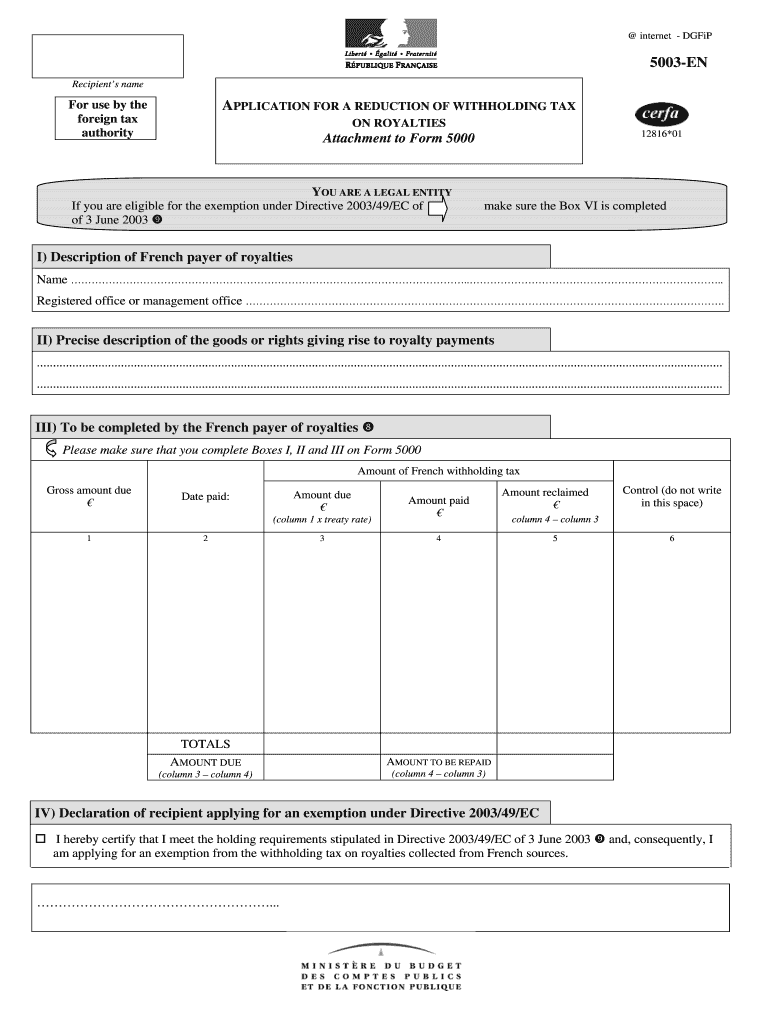

What is Tax Form 5003 and why do I need it?

Tax Form 5003 is a crucial document used for reporting specific financial information to the state. Businesses often need Tax Form 5003 to ensure compliance with local tax regulations. airSlate SignNow makes it easy to create, send, and eSign this form, streamlining your tax filing process.

-

How can airSlate SignNow help with Tax Form 5003?

airSlate SignNow simplifies the process of managing Tax Form 5003 by allowing you to easily fill out and eSign the document online. Our platform provides templates and tools that help you accurately complete the form and maintain compliance. Plus, you can track the status of your submissions effortlessly.

-

Is there a cost to use airSlate SignNow for Tax Form 5003?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. While there is a cost associated with using our platform for Tax Form 5003, the investment is often outweighed by the time and effort saved in managing your documents efficiently. We also provide a free trial so you can explore our features.

-

Can I integrate airSlate SignNow with other software for Tax Form 5003?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and business management software. This means you can effortlessly connect your existing tools to streamline the process of filling out and submitting Tax Form 5003.

-

What features does airSlate SignNow offer for Tax Form 5003?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and document tracking for Tax Form 5003. These tools are designed to enhance productivity and accuracy, allowing you to manage your tax documentation with ease.

-

How secure is my information when using airSlate SignNow for Tax Form 5003?

Security is a top priority at airSlate SignNow. When using our platform for Tax Form 5003, your data is protected with industry-leading encryption and compliance measures. You can confidently eSign and share documents knowing your sensitive information is safe.

-

What types of businesses can benefit from using airSlate SignNow for Tax Form 5003?

Any business that needs to file Tax Form 5003 can benefit from airSlate SignNow. Our platform is particularly advantageous for small to medium-sized businesses looking for an efficient, cost-effective solution to manage their tax documentation. Whether you’re in retail, services, or any other industry, our tools are designed to help.

Find out other hmrc form 5003 en

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles