DISCLOSURES AND NOTICES§24.757

September 1992 24-363

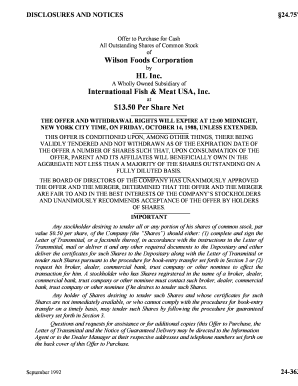

Offer to Purchase for Cash

All Outstanding Shares of Common Stock of

Wilson Foods Corporation by

HL Inc.

A Wholly Owned Subsidiary of

International Fish & Meat USA, Inc. at

$13.50 Per Share Net

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 12:00 MIDNIGHT,

NEW YORK CITY TIME, ON FRIDAY, OCTOBER 14, 1988, UNLESS EXTENDED.

THIS OFFER IS CONDITIONED UPON, AMONG OTHER THINGS, THERE BEING

VALIDLY TENDERED AND NOT WITHDRAWN AS OF THE EXPIRATION DATE OF

THE OFFER A NUMBER OF SHARES SUCH THAT, UPON CONSUMMATION OF THE

OFFER, PARENT AND ITS AFFILIATES WILL BENEFICIALLY OWN IN THE

AGGREGATE NOT LESS THAN A MAJORITY OF THE SHARES OUTSTANDING ON A

FULLY DILUTED BASIS.

THE BOARD OF DIRECTORS OF THE COMPANY HAS UNANIMOUSLY APPROVED

THE OFFER AND THE MERGER, DETERMINED THAT THE OFFER AND THE MERGER ARE FAIR TO AND IN THE BEST INTERESTS OF THE COMPANY’S STOCKHOLDERS

AND UNANIMOUSLY RECOMMENDS ACCEPTANCE OF THE OFFER BY HOLDERS OF SHARES.

IMPORTANT

Any stockholder desiring to tender all or any portion of his shares of common stock, par

value $0.50 per share, of the Company (the “Shares”) should either: (1) complete and sign the

Letter of Transmittal, or a facsimile thereof, in accordance with the instructions in t he Letter of

Transmittal, mail or deliver it and any other required documents to the Depositary and eithe r

deliver the certificates for such Shares to the Depositary along with the Letter of Transmittal or

tender such Shares pursuant to the procedure for book-entry transfer set forth in Section 3 or (2)

request his broker, dealer, commercial bank, trust company or other nominee to effect the

transaction for him. A stockholder who has Shares regirstered in the name of a broker, dealer,

commercial bank, trust company or other nominee must contact such broker, dealer, commercial

bank, trust company or other nominee if he desires to tender such Shares.

Any holder of Shares desiring to tender such Shares and whose certificates for such

Shares are not immediately available, or who cannot comply with the procedures for book-entry

transfer on a timely basis, may tender such Shares by following the procedure for guaranteed

delivery set forth in Section 3.

Questions and requests for assistance or for additional copies (this Offer to Purchase, the

Letter of Transmittal and the Notice of Guaranteed Delivery may be directed to the Information

Agent or to the Dealer Manager at their respective addresses and telephone numbers set forth on

the back cover of this Offer to Purchase.

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-364© 1992 Jefren Publishing Company, Inc.

The Dealer Manager for the Offer is:

The First Boston Corporation

September 16, 1988

DISCLOSURES AND NOTICES§24.757

September 1992 24-365

To the Holders of Common Stock of

Wilson Foods Corporation:

HL Inc., a Delaware corporation (the “Purchaser”) and a wholly owned subsidiary of

International Fish & Meat USA, Inc., a Delaware corporation (“Parent”), hereby offers to

purchase all of the outstanding shares of common stock, par value $0.50 per share (the “Shares” ),

of Wilson Foods Corporation, a Delaware corporation (the “Company”), at $13.50 per Share, net

to the seller in cash, upon the terms and subject to the conditions set forth in thi s Offer to

Purchase and in the related Letter of Transmittal (which together constitute the “Offer”).

Tendering stockholders will not be obligated to pay brokerage commissions or, except as set

forth in Instruction 6 of the Letter of Transmittal, transfer taxes on the purchase of Shares by the

Purchaser pursuant to the Offer. The Purchaser will pay all charges and expenses of The First

Boston Corporation (“First Boston” or the “Dealer Manager”), Morgan Shareholder Services

Trust Company (the “Depositary”) and Morrow & Co., Inc. (the “Information Agent”) in

connection with the Offer.

The Offer is conditioned upon, among other things, there being validly tendered and

not withdrawn as of the Expiration Date of the Offer a number of Shares (the “Minimum

Number of Shares”) such that, upon consummation of the Offer, Parent and its affiliates

will beneficially own in the aggregate not less than a majority of the Shares outstanding on

a fully diluted basis (the “Minimum Condition”).

The Board of Directors of the Company has unanimously approved the Offer and

the Merger, determined that the Offer and the Merger are fair to and in the best intere sts

of the Company’s stockholders and unanimously recommends acceptance of the Offer by

holders of Shares.

The Company has informed the Purchaser that as of September 6, 1988, there were

10,225,845 Shares issued and outstanding, 656,950 Shares reserved for issuance upon the

exercise of employee stock options and 260,000 Shares reserved for issuance upon the exercise

of warrants to purchase Shares. According to the Company, between September 6, 1988, and

September 10, 1988, no more than 25,000 additional Shares were issued. The Purchaser and its

affiliates currently do not own any Shares. Accordingly, assuming the issuance of the Shares

reserved for issuance pursuant to the employee stock options and the warrants, the Minimum

Number of Shares would be 5,583,898.

On September 10, 1988, the Purchaser, Soparind Meat Packing Corporation, a Delaware

corporation (“Soparind”) of which the Purchaser is an indirect wholly owned subsidiary, and the

Company entered into an Agreement and Plan of Merger (the “Merger Agreement”), which,

subject to the terms and conditions thereof, provides that the Company and the Purchaser will be

merged (the “Merger”). On September 15, 1988, with the consent of the Company, Soparind

assigned its rights under the Merger Agreement to Parent. See Section 12. The Merger

Agreement provides that the Offer will be the first step in Parent’s proposed acquisiti on of the

entire equity interest in the Company. In the Merger, each outstanding Share (other than Sha res

held by the Company, Soparind, Parent, the Purchaser, or any other subsidiary of Parent or

Shares that are subject to dissenters’ rights) will be converted into the right to recei ve $13.50 in

cash, without interest. The Merger is subject to a number of conditions, including approval by

the stockholders of the Company if such approval is required by applicable law. See Section 12.

On September 10, 1988, the Purchaser and the Company also entered into an option

agreement (the “Fischer Option Agreement”), pursuant to which the Company granted the

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-366© 1992 Jefren Publishing Company, Inc.

Purchaser the option (the “Fischer Option”) to purchase all of the issued and outstanding share s

of capital stock of Fischer Packing Company, a Kentucky corporation (“Fischer”), at an

aggregate purchase price of $35,000,000. The Fischer Option is exercisable by the Purchaser at

any time prior to the Option Expiration Date, as hereinafter defined, if (i)any enti ty other than the

Purchaser or any of its affiliates shall have acquired beneficial ownership of twenty-five (25%)

percent or more of the outstanding Shares, (ii) any person shall have consummated or entered

into an agreement with respect to any merger or consolidation with, or other business

combination involving the acquisition of, or sale of substantially all of the

DISCLOSURES AND NOTICES§24.757

September 1992 24-367

assets of, the Company, which, in the case of any agreement, shall not have been terminated or

publicly withdrawn at the time of exercise of the Fischer Option or (iii) the Merger Agre ement

shall be terminated in accordance with its terms under circumstances where the Purchaser would

be entitled to be reimbursed for its expenses pursuant to the Merger Agreement. Under certa in

circumstances, the Company may elect to terminate the option by paying $2,000,000 to t he

Purchaser, and under certain circumstances the Purchaser may elect to terminate t he Fischer

Option in exchange for a $2,000,000 payment from the Company. See Section 12.

On July 27, 1988, Doskocil Acquisition Corp., a Delaware corporation and wholly owned

subsidiary of Doskocil Companies Incorporated (“Doskocil”), commenced a tender offer to

purchase all the outstanding Shares, including the associated preferred stock purchase rights (t he

“Rights”) issued pursuant to the Rights Agreement, dated as of April 19, 1988, as amended (the

“Rights Agreement”), between the Company and MTrust Corp, N.A., as Rights agent (the

“Rights Agent”), at $12.50 per Share and Right (the “Doskocil Tender Offer”). On August 8,

1988, the Board of Directors of the Company by unanimous vote determined that the Doskocil

Tender Offer was financially inadequate and not in the best interest of the Company or i ts

stockholders and recommended that the stockholders reject the Doskocil Tender Offer and not

tender their Shares pursuant thereto. On September 1, 1988, Doskocil Acquisition Corp.

amended the Doskocil Tender Offer to decrease the cash tender price to $12.25 per Share a nd

Right (the “Amended Doskocil Tender Offer”). See Section 11.

In order to be assured of participation in the Offer and to receive the $13.50 per Share

offered hereby, stockholders who have tendered Shares pursuant to the Amended Doskocil

Tender Offer must withdraw their Shares from the Amended Doskocil Tender Offer and tender

their Shares to the Purchaser. Enclosed with this Offer to Purchase is a notice of withdra wal that

may be used to withdraw Shares tendered to Doskocil. Stockholders who desire assistance in

withdrawing Shares so tendered may contact the Information Agent at the address and tel ephone

numbers set forth on the back cover of this Offer to Purchase.

According to the Company’s Registration Statement on Form 8-A dated April 29, 1988,

relating to the Rights Agreement, the Company declared a dividend distribution on April 19,

1988, of one Right for each outstanding Share to stockholders of record on April 29, 1988.

Under the terms of the Rights Agreement, the Rights become exercisable on the tent h day (which

period may be extended by the Board of Directors of the Company) following the earlier to occur

of (i) the date the Company shall become aware of, or the date of a public announcem ent of, a

person acquiring beneficial ownership of 20% or more of the outstanding Shares (the “Stock

Acquisition Date”) or (ii) the date of the commencement of, or the announcement of a n intent to

commence, a tender or exchange offer for 25% or more of the Shares. According to the Rights

Agreement, if, once the Rights become exercisable, the acquiring person engages in cert ain types

of transactions with the Company, including a merger or transfer of assets, and certain self-

dealing transactions, or any person shall become the Beneficial Owner of 25% or more of the

Shares (other than pursuant to certain excluded transactions), then the holder of each Ri ght will

have the right to purchase Shares at one-half the then current market price. In additi on, the

Rights Agreement provides that following an acquisition of the Company (whether by an

acquisition of Shares or assets), holders of Rights will be permitted to purchase additiona l shares

in the new entity at half price. At any time until the earlier of (i) ten days following the Stock

Acquisition Date (subject to extension by the Board of Directors) or (ii) April 19, 1998, the

Company may redeem the Rights in whole, but not in part, at a price of $.01 per Right; provided,

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-368© 1992 Jefren Publishing Company, Inc.

that the vote of a majority of Continuing Directors is required if the Company authorize s

redemption at or after the time a person becomes the Beneficial Owner of 20% or more of the

Shares. Terms which are capitalized in the preceding sentence not otherwise defined he rein have

the meanings ascribed to them in the Rights Agreement.

Pursuant to the terms of the Merger Agreement, prior to the purchase of Shares under the

Offer, the Company will not, except in certain circumstances and as provided below, redeem the

Rights or

DISCLOSURES AND NOTICES§24.757

September 1992 24-369

otherwise amend the Rights Agreement to provide that the Rights shall not become exercisable

or that the Rights Agreement shall not otherwise apply to any acquisition of Shares, business

combination or self-dealing transaction. The Merger Agreement provides that prior to the

purchase of Shares under the Offer, unless previously redeemed, the Company, after consultation

with Parent, shall (i) redeem the Rights or (ii) amend the Rights Agreement in order that Rights

not be exercisable as a result of the Offer and the Merger or (iii) otherwise take such action with

respect to the Rights as shall be mutually agreed upon by Parent and the Company. For furt her

information with respect to the Rights and the circumstances under which the Company may

redeem the Rights or amend the Rights Agreement with respect to any acquisit ion of Shares

other than pursuant to the Offer, see Section 12.

Under Article Fourteenth of the Company’s Restated Certificate of Incorporation

(“Article Fourteenth”), any merger or consolidation of the Company with or into the Purchaser,

or the sale or lease of all or any substantial part of the assets of the Company to the Purchaser, or

any sale or lease to the Company or any subsidiary thereof in exchange for securities of the

Company of any assets (except assets having an aggregate fair market value of less t han $5

million) of the Purchaser would, if the Purchaser beneficially owns, directly or indirectly, more

than thirty (30%) percent of the oustanding Shares entitled to vote in the election of directors of

the Company, require the affirmative vote or consent of ninety-five percent (95%) of the

outstanding Shares entitled to vote thereon, unless certain “fair price” and other requi rements of

Article Fourteenth are met.

Under the terms of the Merger Agreement, prior to the purchase of Shares pursuant to the

Offer, the Company’s Board of Directors shall not recommend the deletion of Article Fourteent h

or the amendment of Article Fourteenth to make it inapplicable to any other tra nsaction, except

with respect to a tender or exchange offer meeting the standards described in Sect ion 12 hereof,

and shall unanimously recommend to stockholders of the Company either the deletion of Artic le

Fourteenth or the amendment of Article Fourteenth making it inapplicable to the consummation

of the transactions contemplated by the Merger Agreement. See Section 12.

Article III, Section l(b) of the Company’s By-laws provides for a classified Board of

Directors, consisting of three approximately equal classes, each serving for a term of three years,

with their elections staggered so that the term of only one class expires at eac h annual meeting of

stockholders. Article III, Section l(a) of the Company’s By-laws provides that the number of

directors from time to time may be altered (but in no case to less than thre e) by resolution

adopted by a majority of the entire Board of Directors, or at the annual meeting of st ockholders

by the affirmative approval of the holders of sixty-six and two-thirds percent (662/3%) of the

Company’s oustanding stock entitled to vote. The Company currently has six directors. Artic le

III, Section 2 of the Company’s By-laws provides that vacancies and newly created directorshi ps

resulting from any increase in the authorized number of directors may be filled by a m ajority of

directors. The provisions of Section I of Article III of the Bylaws may be amended only by the

affirmative vote of the holders of two-thirds of the Shares. All other provisions of the By-laws

may be amended by the affirmative vote of a majority of the Shares present in person or by

proxy at a meeting at which there is a quorum. Absent an amendment of this provision, at least

two annual meetings could be required for the Purchaser to elect new directors comprising a

majority of the Board of Directors. Pursuant to the terms of the Merger Agreement, if the

Purchaser becomes beneficial owner of at least a majority of the Shares outstanding on a fully

diluted basis, the Purchaser will be entitled to designate representation on the Board of Directors

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-370© 1992 Jefren Publishing Company, Inc.

proportional to its ownership of Shares, subject to certain restrictions. See Section 12.

1. Terms of the Offer. Upon the terms and subject to the conditions of the Offer

(including, if the Offer is extended or amended, the terms and conditions of any extensi on or

amendment), the Purchaser will accept for payment and pay for all Shares which are va lidly

tendered on or prior to the Expiration Date (as hereinafter defined) and not theretofore

withdrawn in accordance with the procedures set forth in Section 4. The term “Expirat ion Date”

means 12:00 midnight, New York City time, on Friday, October 14, 1988, unless and until the

Purchaser, in its sole discretion, shall have

DISCLOSURES AND NOTICES§24.757

September 1992 24-371

extended the period of time during which the Offer is open, in which event the term “Expiration

Date” shall refer to the latest time and date at which the Offer, as so extended by the Purchaser,

shall expire.

The Offer is conditioned upon, among other things, the satisfaction of the Minimum

Condition. Subject to the limitations set forth in the Merger Agreement, the Purchaser expressly

reserves the right (but shall not be obligated), in its sole discretion, at any tim e or from time to

time, and regardless of whether or not any of the events set forth in Section 14 shall have

occurred or shall have been determined by the Purchaser to have occurred, (i) to extend the

period of time during which the Offer is open by giving oral or written notice of such extension

to the Depositary, and (ii) to amend the Offer by giving oral or written notice of suc h amendment

to the Depositary. The rights reserved by the Purchaser in this paragraph are in addition to the

Purchaser’s rights to terminate the Offer pursuant to Section 14. Pursuant to the Merger

Agreement, the Purchaser has agreed that, without the prior written consent of the Company, it

will not amend or waive the Minimum Condition, reduce the maximum number of Shares to be

purchased pursuant to the Offer, reduce the price to be paid pursuant to the Offer or amend any

other material term of the Offer in a manner adverse to the holders of Shares. Any ext ension,

amendment or termination of the Offer will be followed as promptly as practicable by publ ic

announcement thereof. Without limiting the manner in which the Purchaser may choose to make

any public announcement, subject to the Purchaser’s obligations under Rule 14d-4(c) under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”) (relating to the Purcha ser’s

obligation to disseminate public announcements concerning material amendments to t he Offer to

Purchase) if such rule is applicable, the Purchaser presently intends to make public

announcements by issuing a release to the Dow Jones News Service.

If the Purchaser extends the Offer, or if the Purchaser (whether before or after its

acceptance for payment of Shares) is delayed in its payment for Shares or is unable to pay for

Shares pursuant to the Offer for any reason, then, without prejudice to the Purchaser’s rights

under the Offer, the Depositary may retain tendered Shares on behalf of the Purchaser, and such

Shares may not be withdrawn except to the extent tendering stockholders are entitled to

withdrawal rights as described in Section 4. However, the ability of the Purchaser to delay the

payment for Shares that the Purchaser has accepted for payment is limited by Rule 14e -1 under

the Exchange Act, which requires. that a bidder pay the consideration offered or return the

securities deposited by or on behalf of holders of securities promptly after the termination or

withdrawal of the Offer.

If the Purchaser makes a material change in the terms of the Offer or the information

concerning the Offer or waives a material condition of the Offer (including a waiver of t he

Minimum Condition), the Purchaser will disseminate additional tender offer materials and extend

the Offer to the extent required by Rules 14d-4(c) and 14d-6(d) under the Exchange Act. The

Securities and Exchange Commission (the “Commission”) has taken the position that t he

minimum period during which an offer must remain open following material changes in the

terms of the offer or information concerning the offer, other than a change in price or a change of

more than two percent in percentage of securities sought, will depend upon the facts and

circumstances, including the relative materiality of the terms or information. Wi th respect to a

change in price or a change in percentage of securities sought, a minimum ten business da y

period is generally required to allow for adequate dissemination to stockholders and investor

response. In addition, the Merger Agreement provides that the Purchaser shall not waive or

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-372© 1992 Jefren Publishing Company, Inc.

amend the Minimum Condition without the Company’s consent. As used in this Offer to

Purchase, “business day” means any day other than a Saturday, Sunday or Federal holiday and

consists of the time period from 12:01 a.m. through Midnight, New York City time.

The Company has provided the Purchaser with the Company’s stockholder list and

security position listings for the purpose of disseminating the Offer to holders of Shares. This

Offer to Purchase and the related Letter of Transmittal will be mailed by t he Purchaser to record

holders of Shares and will be furnished by the Purchaser to brokers, dealers, commercial banks,

trust companies and similar persons whose names, or the names of whose nominees, appear on

the stockholder list or, if applicable,

DISCLOSURES AND NOTICES§24.757

September 1992 24-373

who are listed as participants in a clearing agency’s security position listing, for subsequent

transmittal to beneficial owners of Shares.

2. Acceptance for Payment and Payment. Upon the terms and subject to the

conditions of the Offer (including, if the Offer is extended or amended, the terms and condit ions

of any extension or amendment), the Purchaser will purchase, by accepting for payment, and wil l

pay for, all Shares validly tendered prior to the Expiration Date (and not properly withdrawn in

accordance with Section 4) as soon as practicable after the later to occur of (a) the Expiration

Date and (b) the expiration or termination of the waiting period under the Hart-Scott-R odino

Antitrust Improvements Act of 1976, as amended (the “HSR Act”) applicable to tile Purc haser’s

acquisition of Shares pursuant to the Offer. See Sections 14 and 15. Any determination

concerning the satisfaction of such terms and conditions shall be within the sole discre tion of the

Purchaser. See Section 14.

In all cases, payment for Shares purchased pursuant to the Offer will be made only after

timely receipt by the Depositary of certificates for such Shares or timely confi rmation of a book-

entry transfer (a “Book-Entry Confirmation”) of such Shares into the Depositary’s account at

The Depository Trust Company, the Midwest Securities Trust Company or the Philadelphia

Depository Trust Company (collectively, the “Book-Entry Transfer Facilities”) pursuant to the

procedures set forth in Section 3, a properly completed and duly executed Letter of T ransmittal

(or facsimile thereof) and any other documents required by the Letter of Transmittal.

For purposes of the Offer, the Purchaser will be deemed to have accepted for payment

(and thereby purchased) Shares tendered to the Purchaser and not withdrawn, if, as and when the

Purchaser gives oral or written notice to the Depositary of tile Purchaser’s acceptance of such

Shares for payment pursuant to the Offer. In all cases, payment for Shares purchased pursuant to

the Offer will be made by deposit of the purchase price with the Depositary, which wil l act as

agent for tendering stockholders for the purpose of receiving payment from the Purchaser and

transmitting payment to tendering stockholders. Under no circumstances will interest on the

purchase price of Shares be paid by the Purchaser by reason of any delay in making payment.

If any tendered Shares are not purchased pursuant to the Offer for any reason, or if

certificates submitted represent more Shares than are tendered, certificates for Sha res not

purchased or tendered will be returned, without expense to the tendering stockholder (or, in the

case of Shares tendered by book-entry transfer into the Depositary’s account at a Book-Entry

Transfer Facility pursuant to the procedures set forth in Section 3, such Shares will be credited to

an account maintained at such Book-Entry Transfer Facility), as promptly as practi cable after the

expiration or termination of the Offer.

The Purchaser reserves the right to transfer or assign, in whole at any time or in part from

time to time, to Soparind or to one or more affiliates of Soparind, the right to purchase all or any

portion of the Shares tendered pursuant to the Offer, but any such transfer or assignment will not

relieve the Purchaser of its obligations under the Offer or prejudice the rights of tenderi ng

stockholders to receive payment for Shares validly tendered and accepted for payment pursuant

to the Offer. On September 15, 1988 Soparind, with the Company’s consent, assigned its rights

and obligations under the Merger Agreement to Parent. See Section 12.

3. Procedures for Tendering Shares. For Shares to be validly tendered pursuant to the

Offer, a properly completed and duly executed Letter of Transmittal (or facsimile thereof), with

any required signature guarantees and any other required documents, must be received by the

Depositary at one of its addresses set forth on the back cover of this Offer to Purchase on or prior

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-374© 1992 Jefren Publishing Company, Inc.

to the Expiration Date. In addition, either (i) the certificates for Sharcs must be re ceived by the

Depositary along with the Letter of Transmittal, or Shares must be tendered pursuant to the

procedures for book-entry transfer described below and a Book-Entry Confirmation must be

received by the Depositary, in each case prior to the Expiration Date, or (it) the t endering

stockholder must comply with the guaranteed delivery procedures described below.

DISCLOSURES AND NOTICES§24.757

September 1992 24-375

The Depositary will make a request for the establishment of an account with respect to

the Shares at each Book-Entry Transfer Facility for purposes of the Offer within two business

days after the date of this Offer to Purchase, and any financial institution that is a participant in

any of the Book-Entry Transfer Facilities’ systems may make book-entry delivery of Shares by

causing a Book-Entry Transfer Facility to transfer such Shares into the Depositary’s account at a

Book-Entry Transfer Facility in accordance with such Book-Entry Transfer Facility’s procedures

for transfer. Although delivery of Shares, if available, may be effected through book-entry

transfer at a Book-Entry Transfer Facility, the Letter of Transmittal or facsimil e thereof, with any

required signature guarantees and any other required documents, must, in any case, be

transmitted to and received by the Depositary at one of its addresses set forth on the back cover

of this Offer to Purchase prior to the Expiration Date or the guaranteed delivery procedures

described below must be complied with. Delivery of documents to a Book-Entry Transfer

Facility in accordance with the Book-Entry Transfer Facility’s procedures does not constit ute

delivery to the Depositary.

Signatures on all Letters of Transmittal must be guaranteed by a member firm of a

registered national securities exchange, a member of the National Association of Securities

Dealers, Inc. (“NASD”) or a commercial bank or trust company having an office or

correspondent in the United States (each of the foregoing being referred to as an “Eligibl e

Institution”), unless the Shares tendered thereby are tendered (i) by a registered holder of Sha res

who has not completed either the box entitled “Special Delivery Instructions” or the box entitled

“Special Payment Instructions” on the Letter of Transmittal, or (ii) for the account of an Eligible

Institution. See Instruction 1 of the Letter of Transmittal. If the certificates a re registered in the

name of a person other than the signer of the Letter of Transmittal or if payment is to be made or

certificates for unpurchased Shares are to be issued to a person other than the registered holder,

then the tendered certificates must be endorsed or accompanied by appropriate stock powe rs, in

either case signed exactly as the name or names of the registered owner or owners appe ar on the

certificates, with the signatures on the certificates or stock powers guaranteed a s described

above. See Instruction 5 of the Letter of Transmittal.

The method of delivery of the Shares, the Letter of Transmittal and any other

required documents is at the option and risk of the tendering stockholder. If delivery is by

mail, registered mail with return receipt requested, properly insured, is recommended.

If a stockholder desires to tender Shares pursuant to the Offer and such stockholder’s

certificates for Shares are not immediately available or time will not pe rmit all required

documents to reach the Depositary on or prior to the Expiration Date, or the procedure for book-

entry transfer cannot be completed on a timely basis, such Shares may nevertheless be tendered

if all the following conditions are satisfied:

(i) the tender is made by or through an Eligible Institution;

(ii) a properly completed and duly executed Notice of Guaranteed Delivery,

substantially in the form provided by the Purchaser herewith, is received by the

Depositary as provided below on or prior to the Expiration Date; and

(iii) the certificates for all tendered Shares, in proper form for transfer (or a Book-

Entry Confirmation), together with a properly completed and duly executed Letter of

Transmittal (or facsimile thereof) and any other documents required by the Letter of

Transmittal, are received by the Depositary within five New York Stock Exchange, Inc.

(“NYSE”) trading days after the date of execution of the Notice of Guaranteed Delivery.

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-376© 1992 Jefren Publishing Company, Inc.

The Notice of Guaranteed Delivery may be delivered by hand or transmitted by telegra m,

telex, facsimile transmission or mail to the Depositary and must include a guarant ee by an

Eligible Institution in the form set forth in the Notice of Guaranteed Delivery.

Notwithstanding any other provision hereof, payment for Shares purchased pursuant to

the Offer will in all cases be made only after timely receipt by the Deposita ry of certificates for

such Shares (or a

DISCLOSURES AND NOTICES§24.757

September 1992 24-377

Book-Entry Confirmation), a properly completed and duly executed Letter of Transmittal (or

facsimile thereof) and any other documents required by the Letter of Transmittal.

Unless an exemption applies under the applicable law and regulations, the

Depositary will be required to withhold, and will withhold, 20% of the gross proceeds

otherwise payable to a stockholder or other payee pursuant to the Offer unless the

stockholder or other payee provides his tax identification number (social security number

or employer identification number) and certifies that such number is correct. Each

tendering stockholder (and, if applicable, each other payee) should complete and sign the

main signature form and the Substitute Form W-9 included as part of the Letter of

Transmittal, so as to provide the information and certification necessary to avoid backup

withholding, unless an applicable exemption exists and is proved in a manner satisfactory

to the Purchaser and the Depositary.

By executing a Letter of Transmittal as set forth above, a tendering stockholder

irrevocably appoints designees of the Purchaser as the stockholder’s attorneys-in-fact and

proxies, in the manner set forth in the Letter of Transmittal, each with full powe r of substitution,

to the full extent of the stockholder’s rights with respect to the Shares tendered by the

stockholder and accepted for payment by the Purchaser (and any and all other Shares or other

securities issued or issuable in respect of such Shares on or after September 10, 1988). All such

proxies shall be considered coupled with an interest in the tendered Shares. This appointm ent

will be effective when, and only to extent that, the Purchaser accepts Shares for payment . Upon

acceptance for payment, all prior proxies given by the stockholder with respect to the Shares or

other securities will, without further action, be revoked, and no subsequent proxies may be give n.

The designees of the Purchaser will, with respect to the Shares and other securities, be

empowered to exercise all voting and other rights of such stockholder as they in their sole

discretion may deem proper at any annual, special or adjourned meeting of the Compa ny’s

stockholders, by written consent or otherwise. The Purchaser reserves the right to require that, in

order for Shares to be deemed validly tendered immediately upon the Purchaser’s accepta nce for

payment of such Shares, the Purchaser must be able to exercise full voting rights with respe ct to

such Shares.

All questions as to the validity, form, eligibility (including time of receipt) and

acceptance for payment of any tendered Shares pursuant to any of the procedures described

above will be determined in the sole discretion of the Purchaser, whose determination wi ll be

final and binding. The Purchaser reserves the absolute right to reject any or all tenders

determined by it not to be in proper form or if the acceptance for payment of, or payment for

which may, in the opinion of the Purchaser’s counsel, be unlawful. The Purchaser also reserves

the absolute right to waive any of the conditions of the Offer (other than as provided by the

Merger Agreement) or any defect or irregularity in any tender with respect to Share s of any

particular stockholder, and the Purchaser’s interpretation of the terms and conditions of the Offer

(including the Letter of Transmittal and the instructions thereto) will be final and binding. None

of the Purchaser, Parent, the Dealer Manager, the Depositary, the Information Agent or any other

person will be under any duty to give notification of any defects or irregularities in t enders or

will incur any liability for failure to give any such notification.

The tender of Shares to the Purchaser pursuant to any of the procedures described above

will constitute a binding agreement between the tendering stockholder and the Purchaser upon

the terms and subject to the conditions of the Offer, including the tendering stockholder’s

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-378© 1992 Jefren Publishing Company, Inc.

representation that (i) such stockholder owns the Shares being tendered within the meaning of

Rule 10b-4 under the Exchange Act, and (ii) the tender of such Shares complies with Rule 10b-4.

4. Withdrawal Rights. Except as otherwise provided herein, tenders of Shares made

pursuant to the Offer are irrevocable, except that Shares tendered pursuant to the Offer may be

withdrawn at any time prior to the Expiration Date and, unless theretofore accepted for payment

by the Purchaser pursuant to the Offer, may also be withdrawn at any time after Novembe r 14,

1988.

For withdrawal to be effective, a written, telegraphic, telex or facsimile transmi ssion

notice of withdrawal must be timely received by the Depositary at one of its addresse s set forth

on the back

DISCLOSURES AND NOTICES§24.757

September 1992 24-379

cover of this Offer to Purchase. Any such notice of withdrawal must specify the name of the

person who tendered the Shares to be withdrawn, the number of such Shares to be withdrawn

and the name of the registered holder, if different from that of the person who tendered such

Shares. If certificates for Shares have been delivered or otherwise identified to the De positary,

then, prior to the release of such certificates, the serial numbers of the particula r certificates

evidencing the Shares to be withdrawn and a signed notice of withdrawal with signatures

guaranteed by an Eligible Institution, except in the case of Shares tendered for the a ccount of an

Eligible Institution, must also be furnished to the Depositary as described above. If Shares have

been tendered pursuant to the procedures for book-entry transfer as set forth in Section 3, any

notice of withdrawal must also specify the name and number of the account at the appropriate

Book-Entry Transfer Facility to be credited with the withdrawn Shares and otherwise comply

with such facility’s procedures. Any Shares withdrawn will be deemed to be not validly tende red

for purposes of the Offer. However, withdrawn Shares may be retendered by again following one

of the procedures described in Section 3 at any time prior to the Expiration Date.

All questions as to the form and validity (including time of receipt) of any notice of

withdrawal will be determined by the Purchaser in its sole discretion, whose determina tion will

be final and binding. None of the Purchaser, Parent, the Dealer Manager, the Depositary, the

Information Agent or any other person will be under any duty to give notification of any defec ts

or irregularities in any notice of withdrawal or incur any liability for failure t o give any such

notification.

5. Certain Tax Consequences. The receipt of cash for Shares pursuant to the Offer (or

the Merger) will be a taxable transaction for federal income tax purposes under the Int ernal

Revenue Code of 1986, as amended (the “Code”), and also may be a taxable transact ion under

applicable state, local and other tax laws. In general, a stockholder will recogniz e gain or loss

equal to the difference between · the tax basis for the Shares sold and the amount of cash

received in exchange therefor. Long-term capital gains recognized in 1988 are taxable at the

same rate as ordinary income.

The foregoing discussion may not apply to stockholders who acquired their Shares

pursuant to the exercise of employee stock options or other compensation arrangements with t he

Company or who are not citizens or residents of the United States or who are otherwise subje ct

to special tax treatment under the Code.

Holders of Shares should consult their tax advisors as to the federal income tax

consequences of the redemption of the Rights in their particular circumstances.

THE FEDERAL INCOME TAX DISCUSSION SET FORTH ABOVE IS

INCLUDED FOR GENERAL INFORMATION ONLY, AND EACH STOCKHOLDER IS

URGED TO CONSULT HIS OWN TAX ADVISOR WITH RESPECT TO THE

SPECIFIC TAX CONSEQUENCES OF THE OFFER AND THE MERGER,

INCLUDING THE EFFECTS OF APPLICABLE STATE, LOCAL OR OTHER TAX

LAWS.

6. Price Range of Shares; Dividends. The Shares are principally traded in the over-the-

counter market and are quoted through the NASD Automated Quotation System (“NASDAQ”)

National Market System under the symbol WILF. The following table sets forth, for the fisc al

quarters of the Company indicated, the high and low sale price per Share on the NASDAQ

National Market System all as reported in the Company’s 1987 Annual Report on Form 10-K as

to the fiscal year ended August 1, 1987 (the “1987 10-K”) and in published financial sources

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-380© 1992 Jefren Publishing Company, Inc.

(with respect to the periods thereafter):

DISCLOSURES AND NOTICES§24.757

September 1992 24-381

High Low

Fiscal Year Ended August 1, 1987:

First Quarter Quarter ..................................................................... 11 3

8 9

Second Quarter .............................................................................. 10 78 83 4

Third Quarter ................................................................................. 12 12 95 8

Fourth Quarter ............................................................................... 11 12 914

Fiscal Year Ended July 30, 1988:

First Quarter .................................................................................. 10 7 8 678

Second Quarter .............................................................................. 9 7

Third Quarter ................................................................................. 13 78 758

Fourth Quarter ............................................................................... 12 78 93 8

Fiscal Year Ending July 29, 1989 .............................................................

First Quarter (through 9/15/88) ..................................................... 13 38 12

On September 9, 1988, the last day of trading prior to the public announcement of the

execution of the Merger Agreement and the Purchaser’s intention to commence the Offer, the

reported closing sale price per share on NASDAQ was $121/8. On September 15, 1988, the last

full trading day prior to the commencement of the Offer, the reported closing sale pric e per Share

on NASDAQ was $13 1/4. Stockholders are urged to obtain a current market quotation for

the Shares.

According to the Company, no dividends on the Shares have been paid or declared by the

Company since 1981.

7. Effect of the Offer on the Market for the Shares; NASDAQ Quotation and

Exchange Act Registration. The purchase of Shares pursuant to the Offer will reduce the

number of Shares that might otherwise trade publicly and the number of holders of Shares and

could adversely affect the liquidity and market value of the remaining Shares held by the public.

Depending upon the number of Shares purchased pursuant to the Offer, the Shares may

no longer meet the requirements for continued inclusion in the NASDAQ National Market

System, which require that an issuer have at least 200,000 publicly held shares with a market

value of $2,000,000, and must have had a net income of $200,000 in the previous fiscal year or

in two of its last three fiscal years or net worth of at least $1,000,000. If these standards are not

met, quotations might continue to be published in the over-the-counter “additional list ” or in one

of the “local lists”, but if the number of holders of the Shares falls below 300, or if the number of

publicly held Shares falls below 100,000, or there is not at least one market maker for t he Shares,

NASD rules provide that the securities would no longer be “authorized” for NASDAQ reporting

and NASDAQ would cease to provide any quotations. Shares held directly or indirectly by an

officer or director of the Company or by any beneficial owner of more than 10% of the Shares

will ordinarily not be considered as being publicly held for this purpose. In the event the Sha res

were no longer eligible for NASDAQ quotation, quotations might still be available from other

sources. The extent of the public market for the Shares and the availability of such quot ations

would, however, depend upon the number of holders of such Shares remaining at such time, the

interest in maintaining a market in such Shares on the part of securities firms, the possible

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-382© 1992 Jefren Publishing Company, Inc.

termination of registration of such Shares under the Exchange Act, as described below, and othe r

factors.

The Shares are currently “margin securities” under the regulations of the Board of

Governors of the Federal Reserve System (the “Federal Reserve Board”) which has the effect ,

among other things, of allowing brokers to extend credit on the collateral of the Shares.

Depending upon factors similar to those described above regarding quotation, following the

Offer it is possible that the Shares would no longer constitute “margin securities” for t he purpose

of the margin regulations of the Federal Reserve Board and therefore could no longer be use d as

collateral for margin loans made by brokers. In

DISCLOSURES AND NOTICES§24.757

September 1992 24-383

addition, if registration of Shares under the Exchange Act were terminated, the Shares would no

longer constitute margin securities.

Registration of the Shares under the Exchange Act may be terminated upon application of

the Company to the Commission if the Shares are not listed on a national securiti es exchange and

there are fewer than 300 record holders of the Shares. Termination of registration of the Shares

under the Exchange Act would substantially reduce the information required to be furnished by

the Company to its stockholders and to the Commission and would make certain provisions of

the Exchange Act, such as the short-swing profit recovery provisions of Section 16(b), the

requirement of furnishing a proxy statement in connection with stockholders’ meetings pursuant

to Section 14(a), and the requirements of Rule 13e-3 under the Exchange Act with respect to

“going private” transactions no longer applicable to the Company. Furthermore, if the Purchase r

acquires a substantial number of Shares, the ability of “affiliates” of the Company and persons

holding “restricted securities” of the Company to dispose of such securities pursuant to R ule 144

under the Securities Act of 1933 (the “Securities Act”) may be impaired or elimina ted. If

registration of the Shares under the Exchange Act were terminated, the Shares would no longer

be eligible for NASDAQ reporting. It is the present intention of the Purchaser to seek to ca use

the Company to make an application for termination of registration of the Shares as soon as

possible following the Offer if the requirements for termination of registration are met.

8. Certain Information Concerning the Company. The Company is a Delaware

corporation with its principal executive offices located at 4545 Lincoln Boulevard, Okl ahoma

City, Oklahoma 73105. According to the 1987 10-K, the business of the Company is the

processing of fresh and frozen meat products made primarily from pork.

Set forth below is a summary of certain consolidated financial information with respect to

the Company, excerpted or derived from the information contained in the 1987 10-K and the

Company’s preliminary prospectus filed on July 11, 1988, with the Commission with respect to

Convertible Exchangeable Preferred Stock of the Company, par value $1.00 per share. More

comprehensive financial information is included in such reports and other documents fi led by the

Company with the Commission, and the following summary is qualified in its entirety by

reference to such reports and other documents and all of the financial information (incl uding any

related notes) contained therein. Such reports and other documents may be inspected and copies

may be obtained from the offices of the Commission in the manner set forth below.

Wilson Foods Corporation

Selected Consolidated Financial Data

(Dollars in thousands except per share data)

Fiscal Year Ended Thirty-nine Weeks Ended

August 1, 1987 August 2,1986 August 3, 1985 April 30,1999 May 2,1987

Income Statement Data:

Net sales .............................................. $1,347,570 $1,454,210 $1,533,155 $998,761 $1,001,649

Income (loss) before taxes and

extraordinary gains ........................... 6,095 (25,028) (16,978) 5,263 4,861

Net income (loss) 5,581 (23,514) (16,185) 4,900 4,536

Net income (loss) per share ofCommon Stock ............................... $.67 $(3.80) $(2.71) $.48 $.58

August 1, 1987 August 2,1986 April 30,988

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-384© 1992 Jefren Publishing Company, Inc.

Balance Sheet Data:

Total assets ............................................... $ 203,362 $ 220,165 $220.746

Working capital ...................................... 38,934 6,617 54,551

Long-term debt and capitalized

lease obligations, less current

portion .............................................. 45,406 45,449 68,432

Total long-term liabilities ..................... 64,140 72,789 82,807

Total stockholders’ equity..................... 70,802 36,746 76,326

DISCLOSURES AND NOTICES§24.757

September 1992 24-385

In the course of the due diligence investigation of the Company conducted by the

Purchaser and Soparind, the Company furnished to the Purchaser and Soparind certain non-

public information. The information was contained in a booklet (the “Smith Barney Bookl et”)

prepared by Smith Barney, Harris Upham & Co. Incorporated (“Smith Barney”), the Company’s

financial advisor. Such information included an overview of the Company’s recent history,

business strategy and prospects; a narrative review of the Company’s business segments; and a

discussion of the organization and management of the Company. In addition, the information

included certain historical and projected financial information for the Company as a whole and

for each of its business segments. No assumptions regarding the projected results of the

Company and its various segments were described in the Smith Barney Booklet.

Parent, the Purchaser and Soparind have been advised that the projected financial

information contained in the Smith Barney Booklet was not prepared with a view to public

disclosure or compliance with published guidelines of the Commission regarding

projections or forecasts, nor was such information prepared in accordance with generally

accepted accounting principles. The projected information has been included herein solely

to comply with rules adopted by the Commission pursuant to the Exchange Act and

because such information was furnished to the Purchaser in connection with the

Purchaser’s evaluation of the Company. Projections regarding future performance are

merely estimates and are inherently subject to significant economic and competitive

uncertainties beyond the Company’s control. Some of the assumptions upon which the

projected results of the Company were based inevitably will not materialize and

unanticipated events may occur. Therefore, the actual results achieved during the periods

for which projections are set forth will vary from those projections, and the variations

could well be material. Parent, the Purchaser and Soparind make no representation as to,

and accept no responsibility whatsoever for, the accuracy or reliability of the projected

financial information. In addition, Parent, the Purchaser and Soparind assume no

responsibility for any failure by the Company to disclose events that may have occurred

and may affect the significance or accuracy of any such information but that are unknown

to Parent, the Purchaser or Soparind. The Company has advised Parent, the Purchaser

and Soparind that actual results could be higher or lower than those projected and,

accordingly, the projections should not necessarily be relied upon. The Company has

further advised Parent, the Purchaser and Soparind that, although such results have not

been finalized, results for the fiscal year ended July 30, 1988, are likely to be slightly lowe r

than the projections indicate.

The projections which follow have been taken in their entirety from the Smith Ba rney

Booklet.

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-386© 1992 Jefren Publishing Company, Inc.

EXCERPTS FROM THE SMITH BARNEY BOOKLET FOR

WILSON FOODS CORPORATION

CONSOLIDATED FINANCIAL STATEMENTS

Balance Sheets

Fiscal Year Ending

1988 1989 1990 1991 1992

% of

Assets % of

Assets % of

Assets % of

Assets % of

Assets

Current Assets

Cash ................................................... $ 3.0 1.4% $ 3.0 1.3% $ 3.0 1.4% $ 3.0 1.3% $ 3.0 1.3%

Receivables........................................ 52.0 24.1% 63.2 27.1% 58.9 26.6% 62.7 27.3% 66.9 28.3%

Inventories ......................................... 58.1 26.9% 63.3 27.1% 54.5 24.6% 58.0 25.3% 61.1 25.9%

Other .................................................. 1.6 0.7% 1.4 0.6% 1.4 0.6% 1.4 0.6% 1.4 0.6%

Total Current Assets 114.7 53.1% 130.9 56.0% 117.7 53.2% 125.1 54.4% 132.4 56.1%

Property, Plant & Equipment ............... 151.8 70.3% 168.6 72.2% 182.6 82.6% 197.6 86.0% 213.6 90.5%

Less: Accumulated Deprectiation ..... (71.4) -33.1% (82.2) -35.2% (93.1) -42.1% (104.2) -45.3% (115.7) -49.0%

Net Property, Plant & Equipment ..... 80.4 37.2% 86.4 37.0% 89.5 40.5% 93.4 40.6% 97.9 41.5%

Notes Receivable ................................ 16.8 7.8% 12.4 5.3% 10.1 4.6% 7.6 3.3% 2.0 0.8%

Other Assets ........................................ 4.0 1.9% 3.9 1.7% 3.8 1.7% 3.7 1.6% 3.6 1.5%

Total Assets $ 215.9 100.0% $ 233.6 100.0% $ 221.1 100.0% $ 229.8 100.0% $ 235.9 100.0%

Current Liabilities

Payable to Bank .............................. $ 13.9 6.4% $ 20.3 8.7% ($ 8.9) -4.0% ($ 1.7) -0.7% ($ 16.0) -6.8%

Current Portion of Long-Term Debt 4.0 1.9% 4.6 2.0% 27.5 12.4% 4.4 1.9% 4.2 1.8%

Accounts Payable ........................... 20.7 9.6% 20.6 8.8% 20.4 9.2% 20.3 8.8% 20.4 8.6%

Accruals and Others ........................ 40.3 18.7% 37.3 16.0% 37.8 17.1% 38.7 16.8% 40.2 17.0%

Total Current Liabilities 78.9 36.5% 82.8 35.4% 76.8 34.7% 61.7 26.8% 48.8 20.7%

Long-Term Debt 47.2 21.9% 51.2 21.9% 28.4 12.8% 27.8 12.1% 26.1 11.1%

Other Non-Current Liabilities 11.2 5.2% 8.6 3.7% 8.1% 3.7% 7.6 3.3% 7.1 3.0%

Stockholders’ Equity 78.6 36.4% 91.0 39.0% 107.8 48.7% 132.7 57.8% 153.9 65.2%

Total Liabilities & Stockholders’ Equity

$ 215.9 100.0% $ 233.6 100.0% $ 221.1 100.0% $ 229.8 100.0% $ 235.9 100.0%

DISCLOSURES AND NOTICES§24.757

September 1992 24-387

EXCERPTS FROM THE SMITH BARNEY BOOKLET FOR

WILSON FOODS CORPORATION

CONSOLIDATED FINANCIAL STATEMENTS

Income Statements

Fiscal Year Ending

1988 1989 1990 1991 1992

% ofNet

Sales

% of

Net Sales % of

Net Sales % of

Net Sales % of

Net Sales

Net Sales ...................... $

1,309.7 100.0% $ 1,434.9 100.0% $ 1,457.4 100.0% $ 1,531.1 100.0% $ 1,601.1 100.0%

Cost & Expenses Cost of Sales ...................... 1,194.7 91.2% 1,308.8 91.2% 1,324.3 90.9% 1,387.2 90.6% 1,449.8 90.6%

Depr. & Amortization 9.4 0.7% 10.8 0.8% 10.9 0.7% 11.1 0.7% 11.5 0.7%

Selling, Gen. &

Admin..................... 93.6 7.1% 97.2 6.8% 100.3 6.9% 103.3 6.7% 106.4 6.6%

Interest Expense (Income) ................. 4.4 0.3% 4.7 0.3% 3.7 0.3% 2.4 0.2% 2.1 0.1%

Unusual Items 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0 0.0%

Other Income Net 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0 0.0%

Income (Loss) before Taxes &

Extraordinary

Items .......................... 7.6 0.6% 13.4 0.9% 18.2 1.2% 27.1 1.8% 31.3 2.0%

Income Taxes (Credits) ..................... 0.6 0.0% 1.0 0.1% 1.4 0.1% 2.1 0.1% 10.1 0.6%

Income (Loss) before Extiaordinary

Items .......................... 7.0 0.5% 12.4 0.9% 16.8 1.1% 25.0 1.6% 21.2 1.3%

Extraordinary Items 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0 0.0%

Net Income (Loss) ....... $ 7.0 0.5% $ 12.4 0.9% $ 16.8 1.1% $ 25.0 1.6% $ 21.2 1.3%

Wghtd avg shares outstanding ................. 10,200,000 10,210,000 10,220,000 10,230,000 10,240,00 0

Per Share of Common Stock:

Income (Loss) before xtraordinary

Items ....................... $

0.69 $ 1.21 $ 1.64 2.44 $ 2.07

Extraordinary Items ....................... 0.00 0.00 0.00 0.00 0.00

Net Income(Loss) ........ $

0.69 $ 1.21 $ 1.64 $ 2.44 $ 2.07

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-388© 1992 Jefren Publishing Company, Inc.

EXCERPTS FROM THE SMITH BARNEY BOOKLET FOR

WILSON FOODS CORPORATION

CONSOLIDATED FINANCIAL STATEMENTS Sources and Uses of Funds

Fiscal Year Ending

1988 1989 1990 1991 1992

SOURCES

Income before Extraordinary Items ......... $ 7,000 $ 12,400 $ 16,751 $24,976 $21,173

Depreciation and Amortization ................ 9,400 10,800 10,900 11,100 11,500

Federal Income Tax (Credits) .................. 0 0 0 0 0

Other ........................................................ 0 0 0 0 0

Total Provided by Operations ............ 16,400 23,200 27,651 36,076 32,673

Change in Working Capital ..................... 3,100 0 7,200 0 0

Extraordinary Items ................................. 0 0 0 0 0

Issuance of Common Stock ..................... 30 30 30 30 30

Issuance of Debt....................................... 8,789 1,366 390 0 0

Sale of PP&E .......................................... 0 0 0 0 0

Other ........................................................ 0 4,504 0 25,109 5,081

Total Sources of Funds ...................... $28,319 $29,100 $35,271 $61,215 $37,784

USES

Additions to PP&E .................................. $15,500 $16,800 $14,000 $15,000 $16,000

Change in Working Capital ..................... 0 12,300 0 22,500 20,200

Decreases in Debt .................................... 0 0 0 23,715 1,584

Other ........................................................ 12,819 0 21,271 0 0

Total Uses of Funds ........................... $28,319 $29,100 $35,271 $61,215 $37,784

The Company is subject to the informational filing requirements of the Exchange Act and

is required to file reports and other information with the Commission relating to its business,

financial condition and other matters. Information as of particular dates concerning the

Company’s directors and officers, their remuneration, options granted to them, the principal

holders of the Company’s securities and any material interest of such persons in transactions

with the Company is required to be described in proxy statements distributed to the Compa ny’s

stockholders and filed with the Commission. These reports, proxy statements and other

information should be available for inspection at the Commission’s office at 450 Fifth St reet,

N.W., Washington, D.C. 20549, and also should be available for inspection and copying at the

regional offices of the Commission located in the Everett McKinley Dirksen Building, 219 South

Dearborn Street, Chicago, Illinois 60604, and the Jacob K. Javits Federal Building, 26 Federa l

Plaza, New York, New York 10278. Copies of the material may also be obtained by mail, upon

payment of the Commission’s customary fees, from the Commission’s principal office at 450

Fifth Street, N.W., Washington, D.C. 20549.

9. Certain Information Concerning the Purchaser, Parent and Soparind. The

Purchaser was incorporated in Delaware on September 8, 1988 for the purpose of acquiring the

Company and to date has engaged in no activities other than those incident to the organization of

the Purchaser and the making of the Offer. The Purchaser is a wholly owned subsidiary of

DISCLOSURES AND NOTICES§24.757

September 1992 24-389

Parent. The principal executive offices of the Purchaser are located at 1190 Rout??,

Mountainside, New Jersey 07092. Parent was incorporated in Delaware on September 14, 1988. Parent is a wholly-owned

subsidiary of Soparind. Under the terms of an assignment and assumption agreement dated

September 15, 1988

§24.757 PROXY STATEMENTS: STRATEGY & FORMS

24-390© 1992 Jefren Publishing Company, Inc.

(“Assignment and Assumption Agreement”), Soparind (i) assigned all of its right, title and

interest in and to all of the issued and outstanding shares of capital stock of Fiel d Packing

Company, a Kentucky corporation (“Field”), Sunnyland of America Inc., a Georgia corporation

(“Sunnyland”), Soparind Energy Corporation, a Georgia c