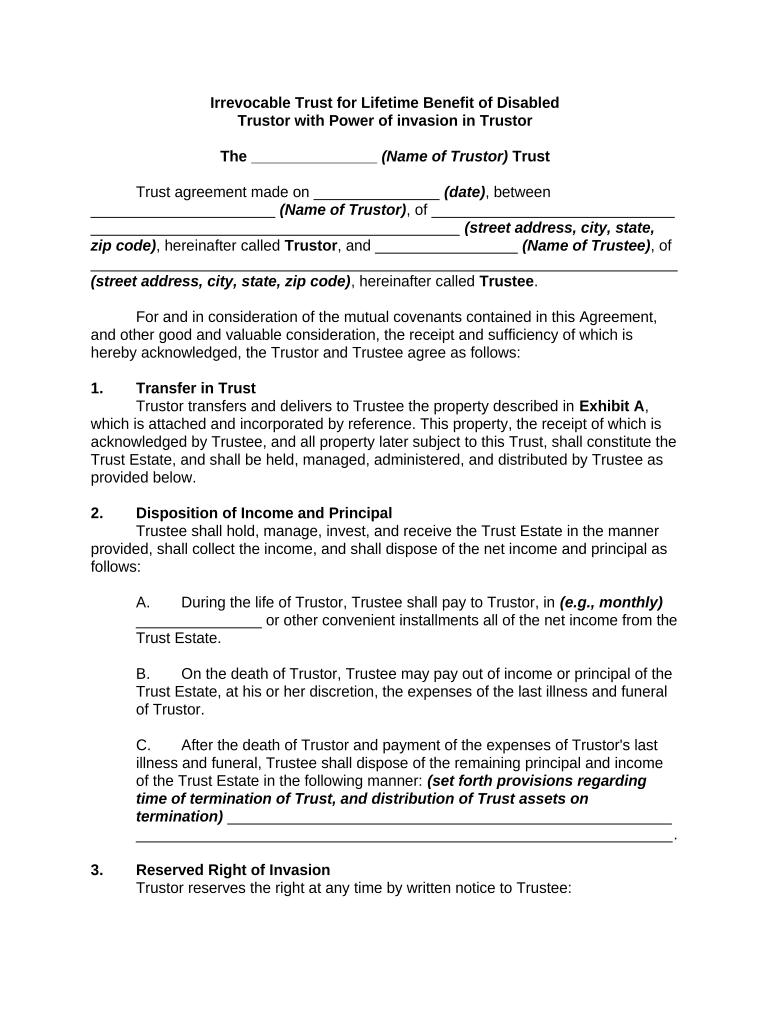

Irrevocable Trust for Lifetime Benefit of Disabled

Trustor with Power of invasion in Trustor

The _______________ (Name of Trustor) Trust

Trust agreement made on _______________ (date) , between

______________________ (Name of Trustor) , of _____________________________

____________________________________________ (street address, city, state,

zip code) , hereinafter called Trustor , and _________________ (Name of Trustee) , of

______________________________________________________________________

(street address, city, state, zip code) , hereinafter called Trustee .

For and in consideration of the mutual covenants contained in this Agreement,

and other good and valuable consideration, the receipt and sufficiency of which is

hereby acknowledged, the Trustor and Trustee agree as follows:

1. Transfer in Trust

Trustor transfers and delivers to Trustee the property described in Exhibit A ,

which is attached and incorporated by reference. This property, the receipt of which is

acknowledged by Trustee, and all property later subject to this Trust, shall constitute the

Trust Estate, and shall be held, managed, administered, and distributed by Trustee as

provided below.

2. Disposition of Income and Principal

Trustee shall hold, manage, invest, and receive the Trust Estate in the manner

provided, shall collect the income, and shall dispose of the net income and principal as

follows:

A. During the life of Trustor, Trustee shall pay to Trustor, in (e.g., monthly)

_______________ or other convenient installments all of the net income from the

Trust Estate.

B. On the death of Trustor, Trustee may pay out of income or principal of the

Trust Estate, at his or her discretion, the expenses of the last illness and funeral

of Trustor.

C. After the death of Trustor and payment of the expenses of Trustor's last

illness and funeral, Trustee shall dispose of the remaining principal and income

of the Trust Estate in the following manner: (set forth provisions regarding

time of termination of Trust, and distribution of Trust assets on

termination) _____________________________________________________

________________________________________________________________ .

3. Reserved Right of Invasion

Trustor reserves the right at any time by written notice to Trustee:

A. To withdraw from the principal of the Trust within each and any calendar

year cash or property not in excess of the sum or value of $____________,

provided that no such withdrawal shall diminish the value of the principal then

remaining below the total sum of $____________.

B. On Trustee's consent, to withdraw from the principal of the Trust within

each and any calendar year, in addition to withdrawals made under Paragraph A

of this Section, funds or property not in excess of the sum or value of

$____________, provided that no withdrawal requiring Trustee's consent shall

diminish the value of the principal then remaining below the total sum of

$____________.

C. Either or both of the powers that Trustor retains under this Section are to

be exercised only at Trustor's personal discretion, and not as powers to be

exercised by any other person, under any process of law for Trustor's benefit, or

for the benefit of Trustor's creditors by any other person or any court.

4. Additions to Trust

Trustor, and any other person, shall have the right at any time to add property

acceptable to Trustee to this Trust. Such property, when received and accepted by

Trustee, shall become part of the Trust Estate.

5. Irrevocability of Trust

This Trust shall be irrevocable and shall not be altered, amended, revoked, or

terminated by Trustor or any other person.

6. Powers of Trustee

In the administration of this Trust, Trustee shall have the following powers, in

addition to but not in limitation of Trustee's common law and statutory powers, such

powers to be exercised in a fiduciary capacity in accordance with the general standards

of Trust administration imposed on Trustees:

A. To receive and retain the initial Trust corpus and all other property which

may subsequently transfer to Trustee either during Trustor's lifetime, by will or

other testamentary disposition, or which any other person may subsequently

transfer to Trustee.

B. To sell, exchange, give options on, partition, or otherwise dispose of any

property which Trustee may hold from time to time, at public or private sale, or

otherwise for cash or other consideration or on credit, and on any terms and for

any consideration as Trustee deems advisable; and to transfer and convey the

property free of all Trust.

C. To invest and reinvest in any property, real or personal, including, but not

limited to, securities of domestic and foreign corporations and investment trusts,

bonds, preferred stocks, common stocks, option contracts, mortgages and

mortgage participations, even though the investment by reason of its character,

amount, proportion to the total Trust Estate, or otherwise would not be

considered appropriate for a fiduciary apart from this provision, and even though

the investment causes a greater proportion of the total Trust to be invested in

investments of one type or of one company than would be considered

appropriate for a fiduciary apart from this provision. The investment may be on a

cash or margin basis, and Trustee, for such purpose, may maintain and operate

cash or margin accounts with brokers, and may deliver and pledge securities

held or purchased by Trustee with the brokers both as security for loans and

advances made to Trustee and to insure the ability of Trustee to deliver stock

against short options. In addition, Trustee may purchase life insurance with Trust

assets only, even though it is non-income-producing. Trustee is authorized to

invest in any common fund, legal or discretionary, which may be operated by or

under the control of a corporate Trustee.

D. To make loans, secured or unsecured, in amounts, on terms, at rates of

interest, and to persons, Trusts, corporations or other parties, and to extend or

renew any existing indebtedness, as Trustee deems advisable.

E. To improve real Estate, including the power to demolish buildings in whole

or in part and to erect new buildings; to lease (including leasing for oil, gas, and

minerals) real Estate on any terms as Trustee deems advisable, including the

power to give leases for periods that extend beyond the duration of any Trust; to

foreclose, extend, assign, partially release, and discharge mortgages.

F. To collect, pay, contest, compromise, or abandon, on any terms and

evidence as Trustee deems advisable, any claims, including taxes, either in favor

of or against Trust property of Trustee; to abandon or surrender any property.

G. To employ brokers, banks, custodians, investment counsel, attorneys,

accountants, and other agents, and to delegate to them any duties, rights, and

powers of Trustee (including the right to vote shares of stock held by Trustee) for

any periods as Trustee deems advisable.

H. To hold and register securities in the name of a nominee with or without

the addition of words indicating the securities are held in a fiduciary capacity; to

hold and register securities in a securities depository or in any other form

convenient for Trustee.

I. To participate in any voting Trust, merger, reorganization, consolidation, or

liquidation affecting Trust property and, in this connection, to deposit any Trust

property with or under the discretion of any protective committee and to

exchange any Trust property for other property.

J. To exercise any stock or other kind of option.

K. To keep Trust property in Oregon, or elsewhere, or with a depository or

custodian.

L. To distribute the Trust Estate in cash or in kind, or partly in cash and partly

in kind, as Trustee deems is advisable, to sell such property as Trustee shall

deem advisable for the purpose of making division or distribution, and for

purposes of distribution, to value the assets reasonably and in good faith as of

the date of distribution. The valuation shall be conclusive on all beneficiaries.

Trustee shall not be required to distribute a proportionate amount of each asset

to each beneficiary but may instead make non-pro-rata distributions. In making a

distribution, Trustee may, but shall not be required to, take account of the income

tax basis in relation to market value of assets distributed. Distribution may be

made directly to the beneficiary, to a legally-appointed guardian, or where

permitted by law, to a custodian under any Uniform Transfers (or Gifts) to Minors

Act, including a custodian selected by Trustee.

M. To deposit monies to be paid to a beneficiary who is a minor in any

demand savings bank or savings and loan account maintained in the sole name

of the minor and to accept and deposit a receipt as a full acquittance.

N. To accept the receipt of a minor as a full acquittance.

O. To borrow from anyone (including Trustee or any affiliate) in the name of

the Trust, to execute promissory notes and to secure obligations by mortgage or

pledge of Trust property, provided that Trustee shall not be personally liable and

that any such loan shall be payable out of Trust income or assets only.

P. To hold, manage, invest, and account for any separate Trust in one or

more consolidated funds, in whole or in part, as Trustee deems advisable. As to

each consolidated fund, the division into the various shares comprising the fund

need be made only on Trustee's books of account, in which each separate Trust

shall be allocated its proportionate share of the expenses. No such holding shall

defer any distribution.

Q. To carry, at the expense of the Trust, insurance of the kinds and in

amounts as Trustee deems advisable to protect the Trust Estate and Trustee

personally against any hazard or liability.

Trustee shall not be required to diversify assets and is authorized to receive and

retain in the Trust any one or more securities or other property, whether or not the

security or other property shall constitute a larger share of the Trust than would be

appropriate for a fiduciary to receive and retain apart from this provision.

With respect to all payments of income and principal from this Trust to a minor, or

any other person, including any Trustor, under legal disability or to a person, including

any Trustor, not adjudged incompetent but who, by reason of illness or mental or

physical disability, is, in the opinion of Trustee, unable to properly administer such

amounts, Trustee may retain all or part of such income or principal and distribute all or

part of the income or principal for the suitable support, care, and maintenance of the

person: (1) directly to the person; (2) to the legally appointed guardian of the person; (3)

to a custodian under any Uniform Transfers (or Gifts) to Minors Act where permitted by

law; (4) to some person or persons having the care of the person for his or her suitable

support, maintenance, welfare, and education; or (5) by direct application of such

amounts for the suitable support, maintenance, welfare, and education of the person, as

Trustee deems advisable.

Trustee shall have the power to select a tax year and make, or refrain from

making, all other decisions and elections permitted under any applicable income,

Estate, or inheritance tax law, including the imposition of a lien on Trust assets to

secure tax payments, without regard to the effect, if any, on any beneficiary of this Trust

and, if any such decision or election shall be made, to apportion or refrain from

apportioning among the respective interests of the beneficiaries of this Trust, all in a

manner as Trustee shall deem appropriate. If Trustee is responsible for preparing and

filing a federal Estate tax return in Trustor's Estate and determines there is uncertainty

as to the inclusion of a particular item of property in Trustor's gross Estate for federal

Estate tax purposes, then the property may, in the discretion of Trustee, be excluded

from Trustor's gross Estate in Trustor's federal Estate tax return. Similarly, if Trustee is

responsible for preparing and filing a federal Estate tax return in Trustor's Estate, then

the decision of Trustee as to the valuation date for federal Estate tax purposes shall be

conclusive on all concerned.

Trustor leaves to the discretion of Trustee the retention, continuance, sale,

liquidation, or other disposition of any business or business interest, partnership,

corporate, or otherwise, which may become an asset of this Trust. Trustee may take all

steps Trustee deems necessary or advisable in connection with any business or

business interest and shall be exempt from any liability for any loss for its acts or

decision in good faith. Trustee is authorized to lend money to or borrow money for the

business or business interests or to or for any corporation representing the same and to

vote the shares of stock in any such corporation as Trustee may in good faith determine

to be reasonable.

Trustee shall have the discretion to elect the time and manner of payment of all

benefits payable to Trustee after Trustor's death from a qualified retirement plan or any

other source described in Section 2039 of the United States Internal Revenue Code of

1986, as amended, or any corresponding section of any future United States law.

During Trustor's lifetime Trustee is authorized to purchase and retain as an asset of this

Trust, or to receive from Trustor or any other person(s), United States Treasury Bonds

which may be redeemed at par for the payment of federal Estate tax which is expected

to be imposed on Trustor's Estate. Trustee is authorized to borrow funds for the purpose

of purchasing such bonds, and is authorized to secure any such borrowing by a pledge

of the bonds so purchased, or pledge of any other Trust assets, or by any other security

arrangement which Trustee determines to be feasible. The discretion granted in this

paragraph shall be freely exercised at any time or from time to time, when information is

received making it appear that such a tax will likely be imposed, that the bonds are

available to be acquired, and the circumstances are such that the acquisition of the

bonds and the proximity of their use would make their acquisition a reasonable

investment under the circumstances prevailing at the time of their acquisition.

7. Accounting

Trustee shall (e.g., each year) _______________ render an account of its

administration of the Trust to Trustor during Trustor's lifetime. Written approval of the

person so entitled to an accounting shall, as to all matters and transactions stated in the

account or shown by it, be final and binding on all persons, regardless of whether in

being, who are then or may later become interested in, or entitled to share in, either the

income or the principal of the Trust. However, nothing contained in this Section shall be

deemed to give such person acting in conjunction with Trustee the power to alter,

amend, revoke, or terminate this Trust.

8. Allocation of Principal and Income

Trustee shall have the power to determine whether any receipt is income or

principal, or partly income and partly principal. Trustee shall also have the power to

determine whether any expense, charge, or loss is to offset any item of income or

principal, or partly income and partly principal.

9. Compensation of Trustee

Trustee shall be entitled to reasonable compensation from time to time for

Trustee's ordinary services rendered under this Agreement, for any extraordinary

services performed by Trustee, and for all services in connection with the termination of

the Trust, either in whole or in part.

10. Successor Trustees

In the event Trustee shall die, resign, or become incapacitated during the term of

this Trust, _____________________ (Name of Successor Trustee) of ____________

_____________________________________ (street address, city, state, zip code) ,

shall be the Successor Trustee. The Successor Trustee shall be required to designate

his or her own Successor as Trustee when and if necessary. Every Successor Trustee

shall have the same duties and powers as are assumed and conferred in this

Agreement on Trustee, including the duty to appoint a Successor Trustee.

11. Trustee’s Bond

No bond shall be required of Trustee or of any Successor Trustee. If a bond is

required by law, no surety shall be required on the bond.

12. Governing Law

This Agreement shall be governed by the laws of Oregon.

Trustor and Trustee have executed this agreement at (designate place of

execution) _______________________________ the day and year first above written.

________________________ _______________________________

(Printed Name of Trustor) (Printed Name of Trustee)

________________________ ________________________________

(Signature of Trustor) (Signature of Trustee)

Attach Exhibit

State of Oregon

County of ______________

This instrument was acknowledged before me on _________________ (date) by

____________________ (Name of Trustor ) .

______________________________

(Printed Name of Notary Public)

______________________________

(Signature of Notary Public)

My Commission Expires:

___________________ Seal

State of Oregon

County of ______________

This instrument was acknowledged before me on ___________________ (date)

by _____________________ (Name of Trustee ) , individually and as Trustee of The

__________________ (Name of Trustor) Trust.

______________________________

(Printed Name of Notary Public)

______________________________

(Signature of Notary Public)

My Commission Expires:

___________________ Seal