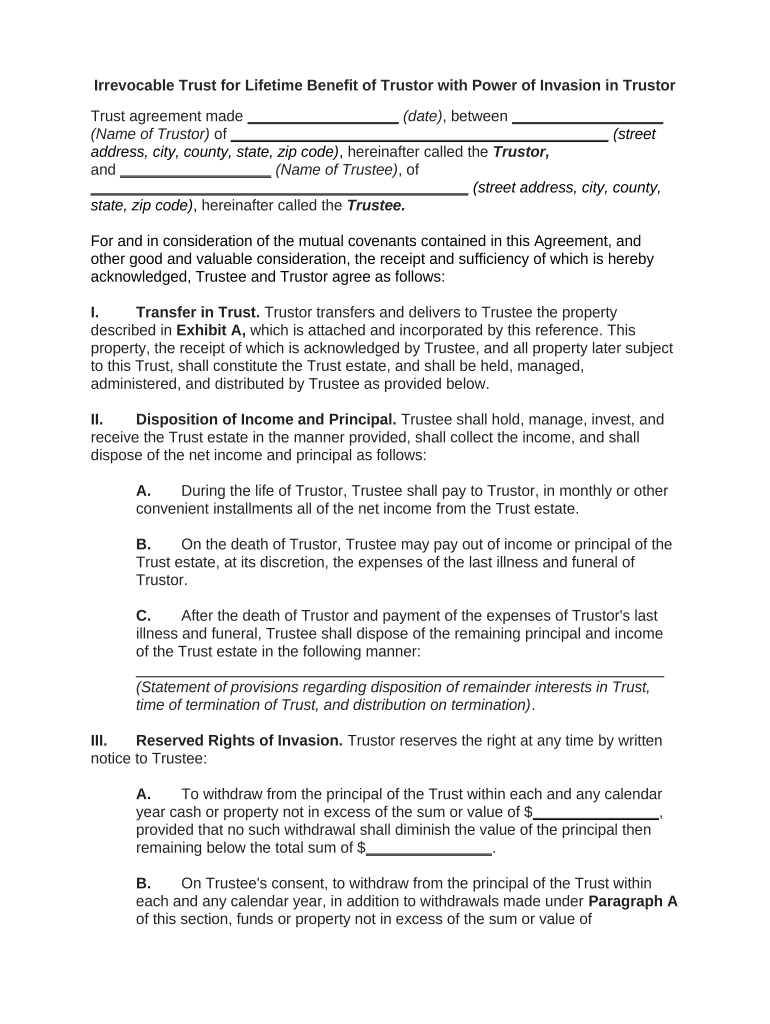

Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Trust agreement made __________________ (date) , between __________________

(Name of Trustor) of _____________________________________________ (street

address, city, county, state, zip code) , hereinafter called the Trustor,

and __________________ (Name of Trustee) , of

_____________________________________________ (street address, city, county,

state, zip code) , hereinafter called the Trustee .

For and in consideration of the mutual covenants contained in this Agreement, and

other good and valuable consideration, the receipt and sufficiency of which is hereby

acknowledged, Trustee and Trustor agree as follows:

I. Transfer in Trust. Trustor transfers and delivers to Trustee the property

described in Exhibit A, which is attached and incorporated by this reference. This

property, the receipt of which is acknowledged by Trustee, and all property later subject

to this Trust, shall constitute the Trust estate, and shall be held, managed,

administered, and distributed by Trustee as provided below.

II. Disposition of Income and Principal. Trustee shall hold, manage, invest, and

receive the Trust estate in the manner provided, shall collect the income, and shall

dispose of the net income and principal as follows:

A. During the life of Trustor, Trustee shall pay to Trustor, in monthly or other

convenient installments all of the net income from the Trust estate.

B. On the death of Trustor, Trustee may pay out of income or principal of the

Trust estate, at its discretion, the expenses of the last illness and funeral of

Trustor.

C. After the death of Trustor and payment of the expenses of Trustor's last

illness and funeral, Trustee shall dispose of the remaining principal and income

of the Trust estate in the following manner:

_______________________________________________________________

(Statement of provisions regarding disposition of remainder interests in Trust,

time of termination of Trust, and distribution on termination) .

III. Reserved Rights of Invasion. Trustor reserves the right at any time by written

notice to Trustee:

A. To withdraw from the principal of the Trust within each and any calendar

year cash or property not in excess of the sum or value of $ _______________ ,

provided that no such withdrawal shall diminish the value of the principal then

remaining below the total sum of $ _______________ .

B. On Trustee's consent, to withdraw from the principal of the Trust within

each and any calendar year, in addition to withdrawals made under Paragraph A

of this section, funds or property not in excess of the sum or value of

$ _______________ , provided that no withdrawal requiring Trustee's consent

shall diminish the value of the principal then remaining below the total sum of

$ _______________ .

C. Either or both of the powers that Trustor retains under this Section are to

be exercised only at Trustor's personal discretion, and not as powers to be

exercised by any other person, under any process of law for Trustor's benefit, or

for the benefit of Trustor's creditors by any other person or any court.

IV. Additions to Trust. Trustor, and any other person, shall have the right at any

time to add property acceptable to Trustee to this Trust. Such property, when received

and accepted by Trustee, shall become part of the Trust estate.

V. Irrevocability of Trust. This Trust shall be irrevocable and shall not be altered,

amended, revoked, or terminated by Trustor or any other person.

VI. Powers of Trustee. In the administration of this Trust, Trustee shall have the

following powers, in addition to but not in limitation of Trustee's common law and

statutory powers, such powers to be exercised in a fiduciary capacity in accordance with

the general standards of trust administration imposed on Trustees:

A. To receive and retain the initial Trust corpus and all other property which

may subsequently transfer to Trustee either during Trustor's lifetime, by will or

other testamentary disposition, or which any other person may subsequently

transfer to Trustee. Trustee shall receive all such property as part of the Trust

even though it may not be a legal investment for Trustee and even though the

property by reason of its character may not be an appropriate Trust investment

apart from this provision. Trustee is authorized to retain its own stock or other

securities or stock or securities of any affiliate or holding company which owns

Trustee.

B. To sell, exchange, give options on, partition, or otherwise dispose of any

property which Trustee may hold from time to time, at public or private sale, or

otherwise for cash or other consideration or on credit, and on any terms and for

any consideration as Trustee deems advisable; and to transfer and convey the

property free of all Trust.

C. To invest and reinvest in any property, real or personal, including, but not

limited to, securities of domestic and foreign corporations and investment Trusts,

bonds, preferred stocks, common stocks, option contracts, short sales,

mortgages and mortgage participations, even though the investment by reason of

its character, amount, proportion to the total Trust estate, or otherwise would not

be considered appropriate for a fiduciary apart from this provision, and even

though the investment causes a greater proportion of the total Trust to be

invested in investments of one type or of one company than would be considered

appropriate for a fiduciary apart from this provision. The investment may be on a

cash or margin basis, and Trustee, for such purpose, may maintain and operate

cash or margin accounts with brokers, and may deliver and pledge securities

held or purchased by Trustee with the brokers both as security for loans and

advances made to Trustee and to insure the ability of Trustee to deliver stock

against short options. In addition, Trustee may purchase life insurance with Trust

assets only, even though it is non-income-producing. Trustee is authorized to

invest in any common fund, legal or discretionary, which may be operated by or

under the control of a corporate Trustee.

D. To make loans, secured or unsecured, in amounts, on terms, at rates of

interest, and to persons, Trusts, corporations or other parties, and to extend or

renew any existing indebtedness, as Trustee deems advisable.

E. To improve real estate, including the power to demolish buildings in whole

or in part and to erect new buildings; to lease (including leasing for oil, gas, and

minerals) real estate on any terms as Trustee deems advisable, including the

power to give leases for periods that extend beyond the duration of any Trust; to

foreclose, extend, assign, partially release, and discharge mortgages.

F. To collect, pay, contest, compromise, or abandon, on any terms and

evidence as Trustee deems advisable, any claims, including taxes, either in favor

of or against Trust property of Trustee; to abandon or surrender any property.

G. To employ brokers, banks, custodians, investment counsel, attorneys,

accountants, and other agents, and to delegate to them any duties, rights, and

powers of Trustee (including the right to vote shares of stock held by Trustee) for

any periods as Trustee deems advisable.

H. To hold and register securities in the name of a nominee with or without

the addition of words indicating the securities are held in a fiduciary capacity; to

hold and register securities in a securities depository or in any other form

convenient for Trustee.

I. To participate in any voting trust, merger, reorganization, consolidation, or

liquidation affecting Trust property and, in this connection, to deposit any Trust

property with or under the discretion of any protective committee and to

exchange any Trust property for other property.

J. To exercise any stock or other kind of option.

K. To keep Trust property in ________________________ (name of state) ,

or elsewhere, or with a depository or custodian.

L. To distribute the Trust estate in cash or in kind, or partly in cash and partly

in kind, as Trustee deems is advisable, to sell such property as Trustee shall

deem advisable for the purpose of making division or distribution, and for

purposes of distribution, to value the assets reasonably and in good faith as of

the date of distribution. The valuation shall be conclusive on all beneficiaries.

Trustee shall not be required to distribute a proportionate amount of each asset

to each beneficiary but may instead make non-pro rata distributions. In making a

distribution, Trustee may, but shall not be required to, take account of the

income-tax basis in relation to market value of assets distributed. Distribution

may be made directly to the beneficiary, to a legally appointed guardian, or

where permitted by law, to a custodian under any Uniform Transfers to Minors

Act, including a custodian selected by Trustee.

M. To deposit monies to be paid to a beneficiary who is a minor in any

demand savings bank or savings and loan account maintained in the sole name

of the minor and to accept and deposit a receipt as a full acquittance.

N. To accept the receipt of a minor as a full acquittance.

O. To borrow from anyone (including Trustee or any affiliate) in the name of

the Trust, to execute promissory notes and to secure obligations by mortgage or

pledge of Trust property, provided that Trustee shall not be personally liable and

that any such loan shall be payable out of Trust income or assets only.

P. To hold, manage, invest, and account for any separate Trust in one or

more consolidated funds, in whole or in part, as Trustee deems advisable. As to

each consolidated fund, the division into the various shares comprising the fund

need be made only on Trustee's books of account, in which each separate Trust

shall be allocated its proportionate share of the expenses. No such holding shall

defer any distribution.

Q. To carry, at the expense of the Trust, insurance of the kinds and in

amounts as Trustee deems advisable to protect the Trust estate and Trustee

personally against any hazard or liability.

Trustee shall not be required to diversify assets and is authorized to receive and retain

in the Trust any one or more securities or other property, whether or not the security or

other property shall constitute a larger share of the Trust than would be appropriate for

a fiduciary to receive and retain apart from this provision. With respect to all payments

of income and principal from this Trust to a minor, or any other person, including any

Trustor, under legal disability or to a person, including any Trustor, not adjudged

incompetent but who, by reason of illness or mental or physical disability, is, in the

opinion of Trustee, unable to properly administer such amounts, Trustee may retain all

or part of such income or principal and distribute all or part of the income or principal for

the suitable support, care, and maintenance of the person: (1) directly to the person; (2)

to the legally appointed guardian of the person; (3) to a custodian under any Uniform

Transfers to Minors Act where permitted by law; (4) to some person or persons having

the care of the person for his or her suitable support, maintenance, welfare, and

education; or (5) by direct application of such amounts for the suitable support,

maintenance, welfare, and education of the person, as Trustee deems advisable.

Trustee shall have the power to select a tax year and make, or refrain from making, all

other decisions and elections permitted under any applicable income, estate, or

inheritance tax law, including the imposition of a lien on Trust assets to secure tax

payments, without regard to the effect, if any, on any beneficiary of this Trust and, if any

such decision or election shall be made, to apportion or refrain from apportioning among

the respective interests of the beneficiaries of this Trust, all in a manner as Trustee shall

deem appropriate. If Trustee is responsible for preparing and filing a federal estate tax

return in Trustor's estate and determines there is uncertainty as to the inclusion of a

particular item of property in Trustor's gross estate for federal estate tax purposes, then

the property may, in the discretion of Trustee, be excluded from Trustor's gross estate in

Trustor's federal estate tax return. Similarly, if Trustee is responsible for preparing and

filing a federal estate tax return in Trustor's estate, then the decision of Trustee as to the

valuation date for federal estate tax purposes shall be conclusive on all concerned.

Trustor leaves to the discretion of Trustee the retention, continuance, sale, liquidation,

or other disposition of any business or business interest, partnership, corporate, or

otherwise, which may become an asset of this Trust. Trustee may take all steps Trustee

deems necessary or advisable in connection with any business or business interest and

shall be exempt from any liability for any loss for its acts or decision in good faith.

Trustee or any affiliate is authorized to lend money to or borrow money for the business

or business interests or to or for any corporation representing the same and to vote the

shares of stock in any such corporation as Trustee may in good faith determine to be

reasonable. Trustee shall have the discretion to elect the time and manner of payment

of all benefits payable to Trustee after Trustor's death from a qualified retirement plan or

any other source described in Section 2039 of the United States Internal Revenue

Code of 1986 , as amended, or any corresponding section of any future United States

law. During Trustor's lifetime Trustee is authorized to purchase and retain as an asset of

this Trust, or to receive from Trustor or any other person(s), United States Treasury

Bonds which may be redeemed at par for the payment of federal estate tax which is

expected to be imposed on Trustor's estate. Trustee is authorized to borrow funds for

the purpose of purchasing such bonds, and is authorized to secure any such borrowing

by a pledge of the bonds so purchased, or pledge of any other Trust assets, or by any

other security arrangement which Trustee determines to be feasible. The discretion

granted in this paragraph shall be freely exercised at any time or from time to time,

when information is received making it appear that such a tax will likely be imposed, that

the bonds are available to be acquired, and the circumstances are such that the

acquisition of the bonds and the proximity of their use would make their acquisition a

reasonable investment under the circumstances prevailing at the time of their

acquisition.

VII. Limitation on Powers. _________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

(Statement of provisions regarding general limitations on Trustee's powers so as to

exclude Trustor's retention of any taxable powers) .

VIII. Accounting. Trustee annually shall render an account of its administration of the

Trust to Trustor during Trustor's lifetime and subsequently to _____________________

(name of beneficiary) . Written approval of the person so entitled to an accounting shall,

as to all matters and transactions stated in the account or shown by it, be final and

binding on all persons, regardless of whether in being, who are then or may later

become interested in, or entitled to share in, either the income or the principal of the

Trust. However, nothing contained in this Section shall be deemed to give such person

acting in conjunction with Trustee the power to alter, amend, revoke, or terminate this

Trust.

IX. Death Taxes. Should any executor, administrator, or other person acting in a

fiduciary capacity pay death taxes levied or assessed under the provisions of any

federal or state inheritance, succession, or estate tax laws now existing or later enacted,

and should any or all of the Trust property be required under such provisions to be

included in the gross estate of Trustor, Trustee shall reimburse the executor,

administrator, or other person acting in a fiduciary capacity for that proportionate part of

the death taxes paid by reason of the inclusion of the Trust property in Trustor's gross

estate.

X. Allocation of Principal and Income. Trustee shall have the power to determine

whether any receipt is income or principal, or partly income and partly principal. Trustee

shall also have the power to determine whether any expense, charge, or loss is to offset

any item of income or principal, or partly income and partly principal.

XI. Compensation of Trustee. Trustee shall be entitled to reasonable

compensation from time to time for Trustee's ordinary services rendered under this

Agreement, for any extraordinary services performed by Trustee, and for all services in

connection with the termination of the Trust, either in whole or in part.

XII. Successor Trustees. If Trustee shall die, resign, or become incapacitated

during the term of this Trust, ________________________ (name of successor

Trustee) , of _____________________________________________ (address of

successor Trustee) , shall be the successor Trustee. The successor Trustee shall be

required to designate his or her own successor as Trustee when and if necessary.

Every successor Trustee shall have the same duties and powers as are assumed and

conferred in this agreement on Trustee, including the duty to appoint a successor

Trustee.

XIII. Trustee’s Bond. No bond shall be required of Trustee or of any successor

Trustee. If a bond is required by law, no surety shall be required on the bond.

XIV. Governing Law. This Agreement shall be governed by the laws of

________________________ (name of state) .

WITNESS our signatures as of the day and date first above stated.

_____________________________

(Signature of Trustor)

________________________

(Printed Name of Trustor)

_____________________________

(Signature of Trustee)

________________________

(Printed Name of Trustee)

(Acknowledgments) (Attachment of schedule)