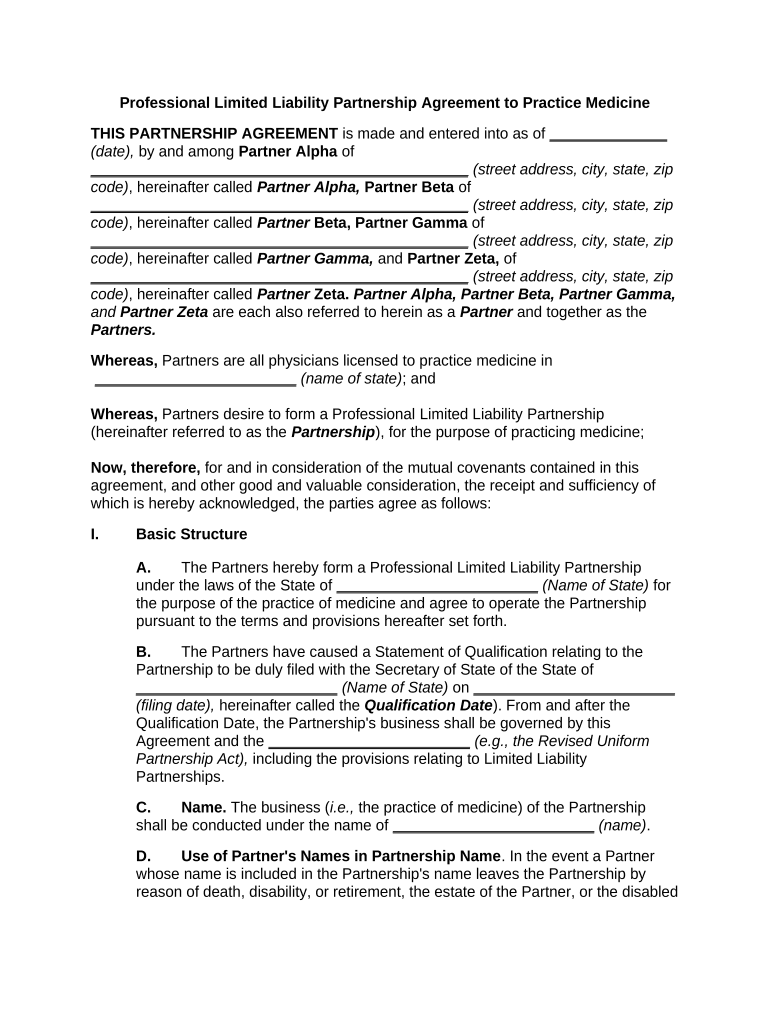

Professional Limited Liability Partnership Agreement to Practice Medicine

THIS PARTNERSHIP AGREEMENT is made and entered into as of ______________

(date), by and among Partner Alpha of

_____________________________________________ (street address, city, state, zip

code) , hereinafter called Partner Alpha, Partner Beta of

_____________________________________________ (street address, city, state, zip

code) , hereinafter called Partner Beta, Partner Gamma of

_____________________________________________ (street address, city, state, zip

code) , hereinafter called Partner Gamma, and Partner Zeta, of

_____________________________________________ (street address, city, state, zip

code) , hereinafter called Partner Zeta. Partner Alpha, Partner Beta, Partner Gamma,

and Partner Zeta are each also referred to herein as a Partner and together as the

Partners.

Whereas, Partners are all physicians licensed to practice medicine in

________________________ (name of state) ; and

Whereas, Partners desire to form a Professional Limited Liability Partnership

(hereinafter referred to as the Partnership ), for the purpose of practicing medicine;

Now, therefore, for and in consideration of the mutual covenants contained in this

agreement, and other good and valuable consideration, the receipt and sufficiency of

which is hereby acknowledged, the parties agree as follows:

I. Basic Structure

A. The Partners hereby form a Professional Limited Liability Partnership

under the laws of the State of ________________________ (Name of State) for

the purpose of the practice of medicine and agree to operate the Partnership

pursuant to the terms and provisions hereafter set forth.

B. The Partners have caused a Statement of Qualification relating to the

Partnership to be duly filed with the Secretary of State of the State of

________________________ (Name of State) on ________________________

(filing date), hereinafter called the Qualification Date ). From and after the

Qualification Date, the Partnership's business shall be governed by this

Agreement and the ________________________ (e.g., the Revised Uniform

Partnership Act), including the provisions relating to Limited Liability

Partnerships.

C. Name. The business ( i.e., the practice of medicine) of the Partnership

shall be conducted under the name of ________________________ (name) .

D. Use of Partner's Names in Partnership Name . In the event a Partner

whose name is included in the Partnership's name leaves the Partnership by

reason of death, disability, or retirement, the estate of the Partner, or the disabled

or retiring Partner, hereby expressly authorizes and consents to the continued

use of such Partner's name, at the option of the Partnership.

E. If a Partner whose name is included in the Partnership's name withdraws

or is expelled from the Partnership for any reason other than death, disability or

retirement, the Partnership may continue to use such Partner's name in the

Partnership's name unless and until the former Partner requests in writing that

his name be removed from the Partnership's name; then his name shall be

deleted from the Partnership name within sixty (60) days from the date of such

request.

F. Place of Business. The principal office and place of business of the

Partnership shall be located at ______________________________________

(street address, city, state, zip code) , or such other place as the Partners may

from time to time designate.

G. Term. The Partnership shall commence on ________________________

(date) , and shall be perpetual ______________________________________ [or

shall continue for (number) years], unless earlier terminated in the following

manner:

1. Pursuant to this Agreement;

2. By applicable ____________________ (Name of State) law; or

3. By death, insanity, bankruptcy, retirement, withdrawal, resignation,

expulsion, or disability of all of the then Partners.

H. Liability. No Partner shall incur any liability for any mistakes or errors in

judgment made in good faith and in the exercise of due care in connection with

the Partnership business, and no Partner shall be deemed to have violated any

of the provisions of this Agreement for any such mistakes or errors in judgment.

II. Management.

A. Managing Partner. The Managing Partner shall be __________________

(name).

B. Rights, Powers and Restrictions of Payments. No Partner without the

consent of all the other Partners shall:

1. Do any act in contravention of this Agreement.

2. Do any act which would make it impossible to carry on the ordinary

business of the Partnership.

3. Confess judgment against the Partnership.

4. Possess rights in specific Partnership property.

C. Powers. The Managing Partner shall have the authority to exercise the

powers reasonably necessary in order to pursue the Partnership's purpose,

provided, however, that the consent of all of the Partners shall be necessary for

any decision in contravention of the express desires of any other Partner or

involving $ __________________ or more:

D. Extent of Services . The Managing Partner shall devote his time,

attention, and energies to the business of the Partnership, and shall not during

the term of this Agreement be engaged in any other business activity, whether or

not such business activity is pursued for gain, profit, or other pecuniary

advantage, without first obtaining the prior written consent of the Partners; but

this shall not be construed as preventing the Managing Partner from investing,

when such investment will not interfere with the Managing Partner’s full time

employment by the Partnership.

E. Vacancies. Managing Partner vacancies shall be filled by a vote of the

Partners at a special meeting for such purpose.

F. Dissenting Vote . A Partner who is either present at a meeting of the

Partners at which action on any matter is taken, or who is absent but has notice

of such action by certified mail, shall be presumed to have assented to the action

taken unless his dissent shall be entered in the minutes of the meeting or unless

he shall file his written dissent to such action with the person action as the

secretary of the meeting before the adjournment thereof or shall forward such

dissent by certified mail to the other Partners immediately after the adjournment

of the meeting or within __________________ (number) days after written

notification of such action by certified mail. The objection shall be deemed made

when mailed by certified mail. Such right to dissent shall not apply to a Partner

who voted in favor of such action.

G. Unanimous Consent Required to Admit Partners. There shall be no

right to admit additional Partners, except by unanimous consent of all of the

Partners.

H. Removal of Managing Partner

1. The Managing Partner may be removed by the Partners, but only if:

_____________________________________________ (set forth

circumstances; e.g., loses license to practice medicine).

2. A __________________ ( number) day notice must be given to the

Managing Partner spelling out to the Managing Partner those acts which

have caused such removal. The moving Partner shall, in writing, submit to

all of the Partners the basis upon which he seeks removal of the

Managing Partner and the name of another person as the proposed

successor Managing Partner of the Partnership. If, within ____________

(number) days after the submission of the allegation and the proposal of

substitution to all of the Partners, the Partners owning an aggregate of at

least __________________ (number) percent of the total capital income

approve such removal and proposed Partner substitution in writing, the

person so proposed shall be admitted as the Managing Partner.

III. Meetings of Partners

A. The Partners may hold meetings, both regular and special, either within or

without the State of __________________ (Name of State). Regular meetings of

the Partners may be held without notice at such time and at such place as shall

from time to time be determined by the Managing Partner.

B. Annual Meetings of Partners. Annual meetings of Partners, if actually

held, shall be held on such date and time as shall be designated from time to

time by the Partners and stated in the notice of the meeting, at which they shall

transact such other business as may properly be brought before the meeting.

Written notice of the annual meeting stating the place, date and hour of the

meeting shall be given to each Partner entitled to vote at such meeting not less

than __________________ (number) nor more than __________________

(number) days before the date of the meeting.

C. Special Meetings. Special meetings of Partners, for any purpose or

purposes, may be held by waiver of notice and consent or may be called by a

Managing Partner and shall be called by a Managing Partner at the request in

writing of a Partner owning not less than __________________ (number)

percent of the entire capital or profit interest of the Partnership. Such request

shall state the purpose or purposes of the proposed meeting. Written notice of a

special meeting stating the place, date and hour of the meeting and the purpose

or purposes for which the meeting is called, shall be given not less than

__________________ (number) nor more than __________________ (number)

days before the date of the meeting, to each Partner entitled to vote at such

meeting.

D. Voting. Unless specifically provided herein to the contrary, w henever the

vote of Partners at a meeting thereof is required or permitted to be taken for or in

connection with any action, a majority shall control and the meeting and the vote

of the Partners may be dispensed with if the written consent to each such action

from Partners having not less than the minimum percentage of the vote for such

action.

E. At all meetings of the Partners, a majority of the Partners shall constitute a

quorum for the transaction of business and the act of a majority of the Partners

present at any meeting at which there is a quorum shall be the act of the

Partners. If a quorum shall not be present at any meeting the Partners present

thereat may adjourn the meeting from time to time, without notice other than

announcement at the meeting, until a quorum shall be present.

F. Any action required or permitted to be taken at any meeting of the

Partners thereof may be taken without a meeting, if all the Partners consent in

writing.

G. Partners may participate in a meeting by means of telephone conference

or similar communications equipment..

IV. Capitalization

A. Definitions

1. For purposes of this document capital shall be defined as property

owned by the Partnership other than property of a kind which would be

includable in the inventory of the Partnership in its ordinary course of

business in accordance with generally accepted accounting principles .

The gain on such property and the losses, deductions, amortization and

depreciation associated with such property shall be added to or subtracted

from the Partners' capital accounts.

2. All other operating profits or losses of the Partnership shall be (if

income) deemed to be income of the Partners according to their share of

profits and losses. If losses, these shall be deducted from the Partners

capital accounts according to their share of profits and losses.

Undistributed profits shall be added to the relevant Partners' capital

accounts. Amounts distributed in excess of current profits shall be

deducted from the relevant Partners' capital accounts.

3. Upon dissolution, any Partner having a negative capital account

balance shall be required to make up such balance.

B. Initial Contributions of Partners. Each Partner has contributed to the

initial capital of the Partnership property in the amount and form indicated on

Exhibit A attached hereto and made a part hereof. Capital contributions to the

Partnership shall not bear interest. An individual capital account shall be

maintained for each Partner.

C. Additional Capital Contribution. If at any time during the existence of

the Partnership it becomes necessary to increase the capital with which the said

Partnership is doing business, then upon the majority vote of the Partner: each

Party to this Agreement shall contribute to the capital of this Partnership, within

__________________ (number) days notice of written request for the same, an

amount according to his then Percentage Share of Capital as called for by the

Managing Partner.

D. Rights of the Partners upon the Default of a Partner . Upon the refusal

of any Partner to make a capital contribution as required in Section IV-C:

1. The Managing Partner shall notify, in writing, the remaining

Partners of any default no later than __________________ (number) days

following the date upon which the defaulted Partner's payment was

originally due.

2. Any Partner, other than the defaulted Partner may, within

__________________ (number) days thereafter, purchase the

Partnership interest of the defaulted Partner by notifying the Partners and

by making payment:

(i) To the defaulted Partner, an amount equal to

__________________ (number) percent of such defaulted

Partner's then capital, less the expenses incurred in the sale; and

(ii) To the Partnership, the amount of the capital contribution

required upon which the defaulting Partner defaulted.

3. Should more than one Partner notify the Managing Partner of an

intention to purchase the Partnership interest of the defaulting

Partner, then each such Partner desiring to purchase the defaulted

Partner's interest may purchase that portion according to such

purchasing Partner's then percentage share of capital. The purchase

shall be made in accordance with the provisions if Subsection

D-2 above.

E. Percentage Share of Capital . The Percentage Share of Capital of each

Partner shall be (unless otherwise modified by the terms of this Agreement) as

follows:

Initial Percentage

________________________ ________________________

(Partner Alpha) (Share of Capital)

________________________ ________________________

(Partner Beta) (Share of Capital)

________________________ ________________________

(Partner Gamma) (Share of Capital)

________________________ ________________________

(Partner Zeta) (Share of Capital)

F. Partner's Share of Profits and Losses. The individual Partners shall

share in the profits and losses of the Partnership according to their then

Percentage Share of Capital. Notwithstanding the foregoing, the Managing

Partner shall receive an additional $ __________________ for his services as

Managing Partner.

G. Adjustments. Nothing herein to the contrary withstanding, the rules of

Internal Revenue Code § 704(b) shall be followed in determining capital and the

Partners' capital accounts.

H. Interest. No interest shall be paid on any contribution to the capital of the

Partnership.

I. Return of Capital Contributions . No Partner shall have the right to

demand the return of his capital contributions except as herein provided.

J. Rights of Priority. Except as herein provided, the individual Partners

shall have no right to any priority over each other as to the return of capital

contributions.

K. Distributions

1. Distributions to the Partners of net operating profits of the

Partnership, as hereinafter defined, shall be made at least monthly . Such

distributions shall be made to the Partners simultaneously.

2. For the purpose of this Agreement, net operating profit for any

accounting period shall mean the gross receipts of the Partnership

for such period, less the sum of all cash expenses of operation of the

Partnership, and such sums may be necessary to establish a

reserve for operating expenses.

V. Assignment of Partnership Interest

A. No Right to Assign Right to Profits and Losses. Except as herein

provided, the Partnership interest shall not be assigned.

B. Transfers. The Partners shall not sell, assign, pledge or otherwise

transfer or encumber in any manner or by any means whatever, and share in all

or any part of the interests of the Partnership now owned or hereafter acquired

by them without having first obtained the consent of or offered it to the other

Partners and to the Partnership in accordance with the terms and conditions of

this Agreement.

C. Offer to Purchase Partnership Interest

1. In the event that any Partner is in receipt of a bona fide offer to

purchase his interest, and shall desire to sell, assign, transfer or otherwise

dispose of his interest without the prior written consent of the other

Partners, he shall serve notice to such effect upon the other Partners and

the Partnership by registered or certified mail, return receipt requested,

and said notice shall indicate the name and address of the person desiring

to purchase the same and the price and terms of payment upon which

said sale is proposed. Said notice shall also imply an offer to sell such

interest first to the Partnership and then, if the Partnership does not

exercise its option, to the other Partners upon the same payment terms as

the proposed sale. The Partnership and then, if the Partnership does not

exercise its option, the other Partners shall each have two weeks in which

to exercise the option to purchase.

2. The purchase of such interest shall be in accordance with Section

V-I.

D. Partner Desires To Sell

1. In the event that any Partner, not in receipt of a bona fide offer,

shall desire to dispose of his interest, dissolve, make an assignment for

the benefit of creditors or be adjudicated bankrupt, he shall, at least

__________________ (number) days prior to the date he is to dispose of

his interest, serve notice upon the other Partners and upon the

Partnership by registered or certified mail, return receipt requested, said

notice containing an offer to sell such interest first to the Partnership and

then, if the Partnership does not exercise its option, to the other Partners

upon the following terms and conditions. The Partnership and then, if the

Partnership does not exercise its option, the other Partners shall each

have two weeks in which to exercise the option to purchase.

2. The purchase price of the interest of a Partner shall be as set forth

in Section V-I of this Agreement.

3. The purchase of such interest shall be in accordance with Section

V-I .

E. Disability

1. If any Partner is, by reason of illness, injury or disability, unable to

carry on his normal duties in the conduct of the Partnership business then

such inactive Partner shall be deemed permanently disabled. Such

disability shall be deemed to have occurred when the Partner is unable to

effectively carry on his normal duties during any __________________

(number) months during any __________________ (number) consecutive

period. A permanently disabled Partner shall be deemed to have offered

his interest first to the Partnership and then, if the Partnership does not

exercise its option, to the other Partners upon the following terms and

conditions. The Partnership and then, if the Partnership does not exercise

its option, the other Partners shall each have two weeks in which to

exercise the option to purchase.

2. The purchase price paid for such interest shall be as set forth in

Section V-I .

3. The purchase of such interest shall be in accordance with Section

V-I .

F. Death

1. Upon the death of any Partner, the entire interest of such deceased

Partner shall be sold to the Partnership.

2. The purchase price paid for such interest shall be as set forth in

Section V-I .

3. The purchase of such interest shall be in accordance with Section

V-I .

4. Inasmuch as the Partnership has arranged to provide funds needed

to acquire the interest of any of the Partners through life insurance policies

on their respective lives, it is hereby agreed that the Partnership shall

secure life insurance at its own expense, on the lives of the

Partners and in amounts set forth in Exhibit B attached hereto.

G. Termination of Employment before Normal Retirement

1. If any Partner's employment with the Partnership voluntarily or

involuntarily is terminated before age __________________ (number),

then such event shall constitute an implied offer to sell his interest first to

the Partnership and then, if the Partnership does not exercise its option, to

the other Partners upon the following terms and conditions. The

Partnership and then, if the Partnership does not exercise its option, the

other Partners shall each have two weeks in which to exercise the option

to purchase.

2. The purchase price paid for such interest shall be as set forth in

Section V-I .

3. The purchase of such interest shall be in accordance with Section

V-I .

H. Termination of Employment after Certain Age.

1. If any Partner voluntarily or involuntarily terminates employment

with the Partnership after age __________________ (number) such event

shall constitute an implied offer to sell his interest first to the Partnership

and then, if the Partnership does not exercise its option, to the other

Partners upon the following terms and conditions. The Partnership and

then, if the Partnership does not exercise its option, the other Partners

shall each have two weeks in which to exercise the option to purchase.

2. The purchase price paid for such interest shall be as set forth in

Section V-I .

3. The purchase of such interest shall be in accordance with Section

V-I.

I. Purchase Price. The purchase price paid for an interest pursuant to the

terms of this Agreement shall be calculated as follows:

1. The Partner's Partnership Value shall be determined by calculating

the adjusted capital contribution rendered by the Partner which has not yet

been repaid to the Partner;

2. After calculating the adjusted capital contribution which has not yet

been re-paid to the Partner, the figure shall be supplemented by the

portion of the Partnership's profits, if any, earned through the date of

disposition of the interest;

3. The purchase price shall be paid in cash or by cashier's check. The

purchase of the Partnership interest will take place at a closing, held at

__________________ (time) on the __________________ (number) day

after the date on which the option to purchase is exercised at the

Partnership's primary place of business, or at any other place to which the

parties agree.

J. Substitution of Additional Partners . Notwithstanding anything to the

contrary the assignee (including, but without limitation, any transferee or

purchaser) of the whole or any part of the Partnership interest shall not he

substituted as a Partner without prior written consent of the Managing Partner. In

no event shall the consent of the Managing Partner be given unless such

assignee, as a condition precedent to such consent has:

1. Accepted and assumed in a form satisfactory to the Managing

Partner, all and provisions of this Agreement;

2. Executed such other documents or instruments as may be required

in order to effectuate its admission as a Partner; provided an opinion or

counsel in form and substance satisfactory to counsel for the

Partnership, that neither the offering nor the assignment of the

Partnership interest violates any provision of any federal or state

securities law and executed a statement that he is acquiring his interest in the

Partnership for his own account for investment, and not with a view to

sale or distribution thereof;

3. Executed such other documents or instruments as the Managing

Partner may reasonably require in order to effectuate the admission

of assignee as a Partner;

4. Be licensed to practice medicine in the state of _______________

(name of state); and

5. Paid such reasonable expenses, which expenses are estimated to

be __________________ (amount) , as may be incurred in connection with

such admission as a Partner.

K. Death, Dissolution, Withdrawal of a Partner. The death, expulsion,

dissolution, withdrawal, assignment for the benefit of creditors, retirement,

adjudication or bankruptcy or legal incapacity of a Partner shall not dissolve or

terminate the Partnership. Upon any such event the financial interest of such

Partner and all rights and obligations under this Agreement shall descend to and

vest in the heirs, legatees or legal representatives of such Partner; however,

such heirs, legatees or legal representatives may be bought out in accordance

with the provisions of this Agreement.

L. Sale of More Than 50% in Any 12-Month Period. No assignment of any

Partnership interest shall be effective if such assignment would result in there

having occurred within a 12-month period a sale or exchange of 50% or more of

the total interest in the Partnership capital and profits.

VI. Liquidation of Partnership and of Partner's Interests

A. Dissolution . In the event that the Partnership shall hereafter be dissolved

for any reason whatsoever, a full and general account of its assets, liabilities and

transactions shall at once be taken. Such assets may be sold and turned into

cash as soon as possible and all debts and other amounts due the Partnership

collected. The proceeds thereof shall thereupon be applied as follows:

1. To discharge the debts and liabilities of the Partnership and the

expenses of liquidation.

2. To pay each Partner or his legal representative any unpaid salary,

drawing account, interest or profits to which he shall then be

entitled and in addition, to repay to any Partner his capital contributions

in excess of his original capital contribution.

3. To divide the surplus, if any, amount the Partners or their

representatives as follows:

(i) First (to the extent of each Partner's then capital account) in

proportion to their then capital accounts;

(ii) Then according to each Partner's then Percentage Share of

Capital (or Income) .

B. Liquidations

1. Upon liquidation of the Partnership (or any Partner's interest in the

Partnership), liquidating distributions are required in all cases to be made

in accordance with the positive capital account balances of the Partners,

as determined after taking into account all capital account adjustments for

the Partnership taxable year during which such liquidation occurs by the

later of the end of such taxable year or __________________ (number)

days after the date of such liquidation.

2. If such Partner has deficit balance in his capital account following

the liquidation of his interest in the Partnership, as determined after

taking into account all capital account adjustments for the Partnership

taxable year during which such liquidation occurs, he is

unconditionally obligated to restore the amount of such deficit balance to

the Partnership by the end such year. Such amount shall, upon liquidation

of the Partnership, be paid to creditors of the Partnership or

distributed to other Partners in accordance with their positive capital

account balances.

C. Right to Demand Property. No Partner shall have the right to demand

and receive property in kind for his distribution.

VII. Limitations. P artners shall not endorse, guarantee, or act as surety on any

obligation, contract any indebtedness, or transfer any interest that may obligate the

Partnership for the indebtedness or may not give a third party an interest in the

Partnership, without the prior written permission of Partners representing a majority

interest in the Partnership. Partners shall not engage in any business or professional

activity relating to the practice of medicine outside of the Partnership except an activity

requiring the Partner's capital investment only.

IX. Patients and Medical Records. Partners shall continue to treat and care for all

patients who consulted them prior to the formation of the Partnership. All new patients

shall be given an initial opportunity to select the doctor under whose care they desire to

be placed. If the patient has no preference, the patient shall be assigned to a Partner,

with new patients distributed equally among Partners. Once an election or assignment

has been made as to a patient's doctor, the patient shall remain under that doctor's care

until the patient elects to terminate the relationship. The medical records shall be the

property of the Partnership, and the records shall be centrally filed. Partners shall be

responsible for the maintenance of the medical records of their patients. On dissolution

of the Partnership, Partners may retain the records of those patients that they cared for

or are presently treating, unless the patients elect otherwise. On withdrawal of a

Partner, the records shall be handled as specified in Section X.

X. Expulsion. A Partner shall be expelled from the Partnership if the Partner shall

(i) be expelled from a professional organization or have the Partner's license to practice

medicine revoked; (ii) resign from a professional organization under threat of expulsion;

or (iii) be convicted of a felony for a crime involving moral turpitude. ______________

(Number) days' prior written notice shall be required of any intent to expel a Partner,

and the notice shall contain a statement of the reason for expulsion. The expulsion shall

become operative at the expiration of the notice period unless the Partner to be

expelled has filed an appeal which has not been finally determined at the time.

XI. Retirement or Death. A Partner may retire from the Partnership after attaining

age __________________ (age) , on giving __________________ (number) months'

prior written notice of an intention to do so. On either retirement or death, the

Partnership shall pay to the retired Partner or to the decedent Partner's estate: _______

% of the Partner's average annual earnings for the last __________________

(number) years for a period of __________________ (number) months; _______ % for

a period of __________________ (number) months, and _______ % for a period

of __________________ (number) months. Additionally, the Partner or the estate shall

be entitled to the Partner's share of the profits for the last active fiscal year or part of

that fiscal year.

XII. New Partners. New Partners may be admitted to the Partnership only on a vote

of Partners representing _______ % of the Partnership interests. The Partnership

interests and capital accounts of existing Partners shall be adjusted proportionately to

provide a new Partner with an interest in the Partnership, once the new Partner's

contribution to capital is received. All new Partners must acknowledge their concurrence

in being bound by this Agreement.

XIII. Insurance. The Partnership shall obtain and maintain a policy of malpractice

insurance providing for $ __________________ in benefits for any one occurrence, and

$ __________________ total liability for any one practicing physician. The policy shall

insure against any accidental or negligent acts of the physicians, but shall not insure

against deliberate or reckless conduct.

XIV. Vacations and Leave. Each Partner shall be entitled to __________________

(number) weeks of vacation and __________________ (number) weeks of sick leave

during each calendar year. Partners shall not carry over any unused vacation time,

except with the express consent of the remaining Partners representing _______ % of

the Partnership interest. Each Partner shall receive __________________

(number) days per year to attend medical meetings, seminars, and courses necessary

to maintain skills and knowledge in the practice of medicine. A Partner who takes time

off in excess of the above provisions may do so without compensation, and that

Partner's share of the annual net profits shall be reduced by _______ % for each week

of additional time off used. The Partner's lost profits shall be divided proportionately

among the remaining Partners.

XV. Miscellaneous Provisions.

A. Year, Books, Statements

1. The Partnership's fiscal year shall commence on January 1st of

each year and shall end on the 31st day of December each year.

Full and accurate books of account shall be kept at such place as the

Managing Partner may from time to time designate, showing the

condition of the business and finances of the Partnership; and each

Partner shall have access to such books of account and shall be entitled

to examine them at any time during ordinary business hours. At the end of

each year, the Managing Partner shall cause the Partnership's

accountant to prepare a balance sheet setting forth the financial

position of the Partnership as of the end of that year and a statement of

operations (income and expenses) for that year. A copy of the balance

sheet and statement of operations shall be delivered to each Partner

as soon as it is available.

2. Each Partner shall be deemed to have waived all objections to any

transaction or other facts about the operation of the Partnership disclosed

in such balance sheet and/or statement of operations unless he shall have

notified the Managing Partner in writing of his objectives within

__________________ (number) days of the date on which such

statement is mailed.

3. The Partnership books shall be kept on the __________________

(cash or accrual) basis and in accordance with generally accepted

accounting principles consistent with those employed for determining its

income for Federal income tax purposes.

B . Protection of Confidential Information. No Partner, while a Partner of

the Partnership, shall directly or indirectly disclose to any other person, firm or

corporation the business secrets, confidential business information, or the names

or addresses of any of the patients of the Partnership or its successors or use

such items to the detriment of the Partnership or any successor entity.

C. Additional Instruments . This Agreement shall be binding upon the

parties hereto and upon their heirs, executors, administrators, successors or

assigns, and the parties hereto agree for themselves and their heirs, executors,

administrators, successors and assigns to execute any and all instruments in

writing which are or may become necessary or proper to carry out the purpose

and intent of this Agreement.

D. Amendments. This Agreement may be altered at any time by the decision

of Partners holding not less than two-thirds (2/3) of the then capital of the

Partnership confirmed by an instrument in writing, which instrument the Partners

hereby agree to execute.

E. Banking. The Partnership shall maintain a bank account or bank accounts

in the Partnership's name in a national or state bank in the State of

__________________ (Name of State). Checks and drafts shall be drawn on the

Partnership's bank account for Partnership purposes only.

F. Severability. The invalidity of any portion of this Agreement will not and

shall not be deemed to affect the validity of any other provision. If any provision

of this Agreement is held to be invalid, the parties agree that the remaining

provisions shall be deemed to be in full force and effect as if they had been

executed by both parties subsequent to the expungement of the invalid provision.

G. No Waiver. The failure of either party to this Agreement to insist upon the

performance of any of the terms and conditions of this Agreement, or the waiver

of any breach of any of the terms and conditions of this Agreement, shall not be

construed as subsequently waiving any such terms and conditions, but the same

shall continue and remain in full force and effect as if no such forbearance or

waiver had occurred.

H. Governing Law. This Agreement shall be governed by, construed, and

enforced in accordance with the laws of the State of __________________

(name of state).

I. Notices. Unless provided herein to the contrary, any notice provided for or

concerning this Agreement shall be in writing and shall be deemed sufficiently

given when sent by certified or registered mail if sent to the respective address of

each party as set forth at the beginning of this Agreement.

J. Mandatory Arbitration . Any dispute under this Agreement shall be

required to be resolved by binding arbitration of the parties hereto. If the parties

cannot agree on an arbitrator, each party shall select one arbitrator and both

arbitrators shall then select a third. The third arbitrator so selected shall arbitrate

said dispute. The arbitration shall be governed by the rules of the American

Arbitration Association then in force and effect.

K. Entire Agreement . This Agreement shall constitute the entire agreement

between the parties and any prior understanding or representation of any kind

preceding the date of this Agreement shall not be binding upon either party

except to the extent incorporated in this Agreement.

L. Modification of Agreement. Any modification of this Agreement or

additional obligation assumed by either party in connection with this Agreement

shall be binding only if placed in writing and signed by each party or an

authorized representative of each party.

M. Counterparts. This Agreement may be executed in any number of

counterparts, each of which shall be deemed to be an original, but all of which

together shall constitute but one and the same instrument.

N. Gender. Words used herein regardless of the gender specifically used,

shall be deemed and construed to any other gender, masculine, feminine or

neuter, as the context requires.

O. Compliance with Laws. In performing under this Agreement, all

applicable governmental laws, regulations, orders, and other rules of duly-

constituted authority will be followed and complied with in all respects by both

parties.

WITNESS our signatures as of the day and date first above stated.

__________________________

General Partner Alpha

__________________________

General Partner Beta

__________________________

General Partner Gamma

__________________________

General Partner Zeta