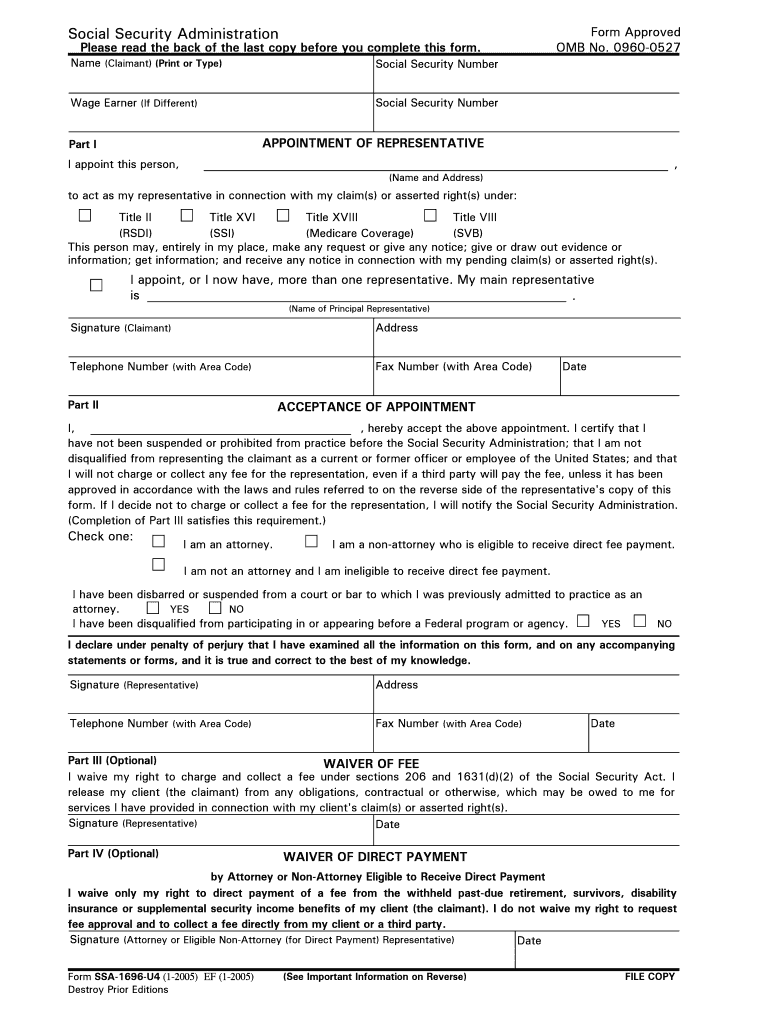

Social Security Administration

Please read the back of the last copy before you complete this form. Form Approved

OMB No. 0960-0527

Name (Claimant) (Print or Type)

Social Security Number

Wage Earner (If Different) Social Security Number

Part I APPOINTMENT OF REPRESENTATIVE

I appoint this person, ,

(Name and Address)

to act as my representative in connection with my claim(s) or asserted right(s) under:

Title II Title XVI Title XVIII Title VIII

(RSDI) (SSI) (Medicare Coverage) (SVB)

This person may, entirely in my place, make any request or give any notice; give or draw out evidence or

information; get information; and receive any notice in connection with my pending claim(s) or asserted right(s).

I appoint, or I now have, more than one representative. My main representative is .

(Name of Principal Representative)

Signature (Claimant) Address

Telephone Number (with Area Code) Fax Number (with Area Code) Date

Part II ACCEPTANCE OF APPOINTMENT

I, , hereby accept the above appointment. I certify that I

have not been suspended or prohibited from practice before the Social Security Administration; that I am not

disqualified from representing the claimant as a current or former officer or employee of the United States; and that

I will not charge or collect any fee for the representation, even if a third party will pay the fee, unless it has been

approved in accordance with the laws and rules referred to on the reverse side of the representative's copy of this

form. If I decide not to charge or collect a fee for the representation, I will notify the Social Security Administration.

(Completion of Part III satisfies this requirement.) Check one: I am an attorney. I am a non-attorney who is eligible to receive direct fee payment.

I am not an attorney and I am ineligible to receive direct fee payment.

I have been disbarred or suspended from a court or bar to which I was previously admitted to practice as an

attorney. YES NO

I have been disqualified from participating in or appearing before a Federal program or agency. YES NO

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying

statements or forms, and it is true and correct to the best of my knowledge.

Signature (Representative) Address

Telephone Number (with Area Code) Fax Number (with Area Code) Date

Part III (Optional) WAIVER OF FEE

I waive my right to charge and collect a fee under sections 206 and 1631(d)(2) of the Social Security Act. I

release my client (the claimant) from any obligations, contractual or otherwise, which may be owed to me for

services I have provided in connection with my client's claim(s) or asserted right(s).

Signature (Representative)

Date

Part IV (Optional) WAIVER OF DIRECT PAYMENT

by Attorney or Non-Attorney Eligible to Receive Direct Payment

I waive only my right to direct payment of a fee from the withheld past-due retirement, survivors, disability

insurance or supplemental security income benefits of my client (the claimant). I do not waive my right to request

fee approval and to collect a fee directly from my client or a third party. Signature (Attorney or Eligible Non-Attorney (for Direct Payment) Representative)

Date

Form SSA-1696-U4 (1-2005) EF (1-2005) (See Important Information on Reverse)

FILE COPY

Destroy Prior Editions

INFORMATION FOR CLAIMANTS

What a Representative May Do What Your Representative(s) May Charge,

continued

We will work directly with your appointed representative unless

he or she asks us to work directly with you. Your representative may: o

get information from your claim(s) file;

o give us evidence or information to support your claim;

o come with you, or for you, to any interview,

conference, or hearing you have with us;

o request a reconsideration, hearing, or Appeals Council

review; and

o

help you and your witnesses prepare for a hearing and

question any witnesses.

Also, your representative will receive a copy of the

decision(s) we make on your claim(s). We will rely on your

representative to tell you about the status of your claim(s), but you

still may call or visit us for information.

You and your representative(s) are responsible for giving Social

Security accurate information. It is wrong to willingly furnish

false information. Doing so may result in criminal prosecution.

We usually continue to work with your representative until

(1) you tell us that he or she no longer represents you; or

(2) your representative tells us that he or she is withdrawing or

indicates that his or her services have ended (for example, by

filing a fee petition or not pursuing an appeal). We do not

continue to work with someone who is suspended or disqualified

from representing claimants.

What Your Representative(s) May Charge

Each representative you appoint can ask for a fee. To charge you

a fee for services, your representative must get our approval.

(Even when someone else will pay the fee for you, for example,

an insurance company, your representative usually must get our

approval.) One way is to file a fee petition. The other way is to

file a fee agreement with us. In either case, your representative

cannot charge you more than the fee amount we approve. If he or

she does, promptly report this to your Social Security office. o Filing

a Fee Petition

Your representative may ask for approval of a fee by giving us a

fee petition when his or her work on your claim(s) is complete.

This written request describes in detail the amount of time he or

she spent on each service provided you. The request also gives

the amount of the fee the representative wants to charge for these

services. Your representative must give you a copy of the fee

petition and each attachment. If you disagree with the information

shown in the fee petition, contact your Social Security office.

Please do this within 20 days of receiving your copy of the petition.

We will review the petition and consider the reasonable value of

the services provided. Then we will tell you in writing the

amount of the fee we approve. o

Filing A Fee Agreement

If you and your representative have a written fee agreement,

one of you must give it to us before we decide your claim(s).

We usually will approve the agreement if you both signed it;

the fee you agreed on is no more than 25 percent of past-due

benefits, or $5,300 (or a higher amount we set and

announced in the Federal Register), whichever is less; we

approve your claim(s); and your claim results in past-due

benefits. We will tell you in writing the amount of the fee

your representative can charge based on the agreement.

If we do not approve the fee agreement, we will tell you and your

representative in writing. Then your representative must file a fee petition

to charge and collect a fee.

After we tell you the amount of the fee your representative can charge, you

or your representative can ask us to look at it again if either or both of you

disagree with the amount. (If we approved a fee agreement, the person who

decided your claim(s) also may ask us to lower the amount.) Someone who

did not decide the amount of the fee the first time will review and finally

decide the amount of the fee.

How Much You Pay

You never owe more than the fee we approve, except for: o any fee a Federal court allows for your representative's

services before it; and

o

out-of-pocket expenses your representative incurs or

expects to incur, for example, the cost of getting your

doctor's or hospital's records. Our approval is not

needed for such expenses.

Your representative may accept money in advance as long as

he or she holds it in a trust or escrow account. If an attorney

or a non-attorney who is eligible to receive direct fee payment

represents you, and if your retirement, survivors, disability

insurance, and/or supplemental security income claim(s)

results in past-due benefits, we usually withhold 25 percent of

your past-due benefits to pay toward the fee for you.

You must pay your representative directly:

o the rest of the fee you owe

- if the amount of the fee is more than any amount(s)

your representative held for you in a trust or escrow account and we withheld and paid your

representative for you.

o all of the fee you owe

- if we did not withhold past-due benefits, for example, because

your representative waived direct payment, or you discharged the

representative, or the representative withdrew from representing

you before we issued a favorable decision; or if we withheld, but

later paid you the money because your representative did not either

ask for our approval until after 60 days of the date of your notice

of award or tell us on time that he or she planned to ask for a fee.

Form SSA-1696-U4 (1-2005) EF (1-2005)

Social Security Administration

Please read the back of the last copy before you complete this form. Form Approved

OMB No. 0960-0527

Name (Claimant) (Print or Type)

Social Security Number

Wage Earner (If Different) Social Security Number

Part I APPOINTMENT OF REPRESENTATIVE

I appoint this person, ,

(Name and Address)

to act as my representative in connection with my claim(s) or asserted right(s) under:

Title II Title XVI Title XVIII Title VIII

(RSDI) (SSI) (Medicare Coverage) (SVB)

This person may, entirely in my place, make any request or give any notice; give or draw out evidence or

information; get information; and receive any notice in connection with my pending claim(s) or asserted right(s).

I appoint, or I now have, more than one representative. My main representative is .

(Name of Principal Representative)

Signature (Claimant) Address

Telephone Number (with Area Code) Fax Number (with Area Code) Date

Part II ACCEPTANCE OF APPOINTMENT

I, , hereby accept the above appointment. I certify that I

have not been suspended or prohibited from practice before the Social Security Administration; that I am not

disqualified from representing the claimant as a current or former officer or employee of the United States; and that

I will not charge or collect any fee for the representation, even if a third party will pay the fee, unless it has been

approved in accordance with the laws and rules referred to on the reverse side of the representative's copy of this

form. If I decide not to charge or collect a fee for the representation, I will notify the Social Security Administration.

(Completion of Part III satisfies this requirement.) Check one: I am an attorney. I am a non-attorney who is eligible to receive direct fee payment.

I am not an attorney and I am ineligible to receive direct fee payment.

I have been disbarred or suspended from a court or bar to which I was previously admitted to practice as an

attorney. YES NO

I have been disqualified from participating in or appearing before a Federal program or agency. YES NO

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying

statements or forms, and it is true and correct to the best of my knowledge.

Signature (Representative) Address

Telephone Number (with Area Code) Fax Number (with Area Code) Date

Part III (Optional) WAIVER OF FEE

I waive my right to charge and collect a fee under sections 206 and 1631(d)(2) of the Social Security Act. I

release my client (the claimant) from any obligations, contractual or otherwise, which may be owed to me for

services I have provided in connection with my client's claim(s) or asserted right(s).

Signature (Representative)

Date

Part IV (Optional) WAIVER OF DIRECT PAYMENT

by Attorney or Non-Attorney Eligible to Receive Direct Payment

I waive only my right to direct payment of a fee from the withheld past-due retirement, survivors, disability

insurance or supplemental security income benefits of my client (the claimant). I do not waive my right to request

fee approval and to collect a fee directly from my client or a third party. Signature (Attorney or Eligible Non-Attorney (for Direct Payment) Representative)

Date

Form SSA-1696-U4 (1-2005) EF (1-2005) (See Important Information on Reverse)

CLAIMANT'S COPY

Destroy Prior Editions

INFORMATION FOR CLAIMANTS

What a Representative May Do What Your Representative(s) May Charge,

continued

We will work directly with your appointed representative unless

he or she asks us to work directly with you. Your representative may: o

get information from your claim(s) file;

o give us evidence or information to support your claim;

o come with you, or for you, to any interview,

conference, or hearing you have with us;

o request a reconsideration, hearing, or Appeals Council

review; and

o

help you and your witnesses prepare for a hearing and

question any witnesses.

Also, your representative will receive a copy of the

decision(s) we make on your claim(s). We will rely on your

representative to tell you about the status of your claim(s), but you

still may call or visit us for information.

You and your representative(s) are responsible for giving Social

Security accurate information. It is wrong to willingly furnish

false information. Doing so may result in criminal prosecution.

We usually continue to work with your representative until

(1) you tell us that he or she no longer represents you; or

(2) your representative tells us that he or she is withdrawing or

indicates that his or her services have ended (for example, by

filing a fee petition or not pursuing an appeal). We do not

continue to work with someone who is suspended or disqualified

from representing claimants.

What Your Representative(s) May Charge

Each representative you appoint can ask for a fee. To charge you

a fee for services, your representative must get our approval.

(Even when someone else will pay the fee for you, for example,

an insurance company, your representative usually must get our

approval.) One way is to file a fee petition. The other way is to

file a fee agreement with us. In either case, your representative

cannot charge you more than the fee amount we approve. If he or

she does, promptly report this to your Social Security office. o Filing

a Fee Petition

Your representative may ask for approval of a fee by giving us a

fee petition when his or her work on your claim(s) is complete.

This written request describes in detail the amount of time he or

she spent on each service provided you. The request also gives

the amount of the fee the representative wants to charge for these

services. Your representative must give you a copy of the fee

petition and each attachment. If you disagree with the information

shown in the fee petition, contact your Social Security office.

Please do this within 20 days of receiving your copy of the petition.

We will review the petition and consider the reasonable value of

the services provided. Then we will tell you in writing the

amount of the fee we approve. o

Filing A Fee Agreement

If you and your representative have a written fee agreement,

one of you must give it to us before we decide your claim(s).

We usually will approve the agreement if you both signed it;

the fee you agreed on is no more than 25 percent of past-due

benefits, or $5,300 (or a higher amount we set and

announced in the Federal Register), whichever is less; we

approve your claim(s); and your claim results in past-due

benefits. We will tell you in writing the amount of the fee

your representative can charge based on the agreement.

If we do not approve the fee agreement, we will tell you and your

representative in writing. Then your representative must file a fee petition

to charge and collect a fee.

After we tell you the amount of the fee your representative can charge, you

or your representative can ask us to look at it again if either or both of you

disagree with the amount. (If we approved a fee agreement, the person who

decided your claim(s) also may ask us to lower the amount.) Someone who

did not decide the amount of the fee the first time will review and finally

decide the amount of the fee.

How Much You Pay

You never owe more than the fee we approve, except for: o any fee a Federal court allows for your representative's

services before it; and

o

out-of-pocket expenses your representative incurs or

expects to incur, for example, the cost of getting your

doctor's or hospital's records. Our approval is not

needed for such expenses.

Your representative may accept money in advance as long as

he or she holds it in a trust or escrow account. If an attorney

or a non-attorney who is eligible to receive direct fee payment

represents you, and if your retirement, survivors, disability

insurance, and/or supplemental security income claim(s)

results in past-due benefits, we usually withhold 25 percent of

your past-due benefits to pay toward the fee for you.

You must pay your representative directly:

o the rest of the fee you owe

- if the amount of the fee is more than any amount(s)

your representative held for you in a trust or escrow account and we withheld and paid your

representative for you.

o all of the fee you owe

- if we did not withhold past-due benefits, for example, because

your representative waived direct payment, or you discharged the

representative, or the representative withdrew from representing

you before we issued a favorable decision; or if we withheld, but

later paid you the money because your representative did not either

ask for our approval until after 60 days of the date of your notice

of award or tell us on time that he or she planned to ask for a fee.

Form SSA-1696-U4 (1-2005) EF (1-2005)

Social Security Administration

Please read the back of the last copy before you complete this form. Form Approved

OMB No. 0960-0527

Name (Claimant) (Print or Type)

Social Security Number

Wage Earner (If Different) Social Security Number

Part I APPOINTMENT OF REPRESENTATIVE

I appoint this person, ,

(Name and Address)

to act as my representative in connection with my claim(s) or asserted right(s) under:

Title II Title XVI Title XVIII Title VIII

(RSDI) (SSI) (Medicare Coverage) (SVB)

This person may, entirely in my place, make any request or give any notice; give or draw out evidence or

information; get information; and receive any notice in connection with my pending claim(s) or asserted right(s).

I appoint, or I now have, more than one representative. My main representative is .

(Name of Principal Representative)

Signature (Claimant) Address

Telephone Number (with Area Code) Fax Number (with Area Code) Date

Part II ACCEPTANCE OF APPOINTMENT

I, , hereby accept the above appointment. I certify that I

have not been suspended or prohibited from practice before the Social Security Administration; that I am not

disqualified from representing the claimant as a current or former officer or employee of the United States; and that

I will not charge or collect any fee for the representation, even if a third party will pay the fee, unless it has been

approved in accordance with the laws and rules referred to on the reverse side of the representative's copy of this

form. If I decide not to charge or collect a fee for the representation, I will notify the Social Security Administration.

(Completion of Part III satisfies this requirement.) Check one: I am an attorney. I am a non-attorney who is eligible to receive direct fee payment.

I am not an attorney and I am ineligible to receive direct fee payment.

I have been disbarred or suspended from a court or bar to which I was previously admitted to practice as an

attorney. YES NO

I have been disqualified from participating in or appearing before a Federal program or agency. YES NO

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying

statements or forms, and it is true and correct to the best of my knowledge.

Signature (Representative) Address

Telephone Number (with Area Code) Fax Number (with Area Code) Date

Part III (Optional) WAIVER OF FEE

I waive my right to charge and collect a fee under sections 206 and 1631(d)(2) of the Social Security Act. I

release my client (the claimant) from any obligations, contractual or otherwise, which may be owed to me for

services I have provided in connection with my client's claim(s) or asserted right(s).

Signature (Representative)

Date

Part IV (Optional) WAIVER OF DIRECT PAYMENT

by Attorney or Non-Attorney Eligible to Receive Direct Payment

I waive only my right to direct payment of a fee from the withheld past-due retirement, survivors, disability

insurance or supplemental security income benefits of my client (the claimant). I do not waive my right to request

fee approval and to collect a fee directly from my client or a third party. Signature (Attorney or Eligible Non-Attorney (for Direct Payment) Representative)

Date

Form SSA-1696-U4 (1-2005) EF (1-2005) (See Important Information on Reverse)

REPRESENTATIVE COPY

Destroy Prior Editions

INFORMATION FOR REPRESENTATIVES

Fees for Representation

An attorney or other person who wants to charge or

collect a fee for providing services in connection with a

claim before the Social Security Administration must first

obtain our approval of the fee for representation. The only

exceptions are if the fee is for services provided: o

when a nonprofit organization or government

agency will pay the fee and any expenses from

government funds and the claimant incurs no

liability, directly or indirectly, for the cost(s);

o

in an official capacity such as legal guardian,

committee, or similar court-appointed office and

the court has approved the fee in question; or

o in representing the claimant before a court of

law. A representative who has provided

services in a claim before both the Social

Security Administration and a court of law may

seek a fee from either or both, but neither tribunal has the authority to set a fee for the other.

Obtaining Approval of a Fee

To charge a fee for services, you must use one of two,

mutually exclusive fee approval processes. You must file

either a fee petition or a fee agreement with us. In either

case, you cannot charge more than the fee amount we approve. o Fee Petition Process

You may ask for approval of a fee by giving us a fee

petition when you have completed your services to the

claimant. This written request must describe in detail

the amount of time you spent on each service provided and the

amount of the fee you are requesting.

You must give the claimant a copy of the fee petition

and each attachment. The claimant may disagree with

the information shown by contacting a Social Security

office within 20 days of receiving his or her copy of

the fee petition. We will consider the reasonable value

of the services provided, and send you notice of the

amount of the fee you can charge. o Fee

Agreement Process

If you and the claimant have a written fee agreement, either

of you must give it to us before we decide the claim(s). We

usually will approve the agreement if you both signed it; the

fee you agreed on is no more than 25 percent of past-due

benefits, or $5,300 (or a higher amount we set and announce

in the Federal Register), whichever is less; we approve the

claim(s); and the claim results in past-due benefits. We will

send you a copy of the notice we send the claimant telling

him or her the amount of the fee you can charge based on the agreement.

If we do not approve the fee agreement, we will tell you in

writing. We also will tell you and the claimant that you must file a

fee petition if you wish to charge and collect a fee.

After we tell you the amount of the fee you can charge, you

or the claimant may ask us in writing to review the

approved fee. (If we approved a fee agreement, the person

who decided the claim(s) also may ask us to lower the

amount.) Someone who did not decide the amount of the fee

the first time will review and finally decide the amount of the fee.

Form SSA-1696-U4 (1-2005) EF (1-2005) Collecting a Fee

You may accept money in advance, as long as you hold it

in a trust or escrow account. The claimant never owes you more than

the fee we approve, except for: o

any fee a Federal court allows for your services

before it; and

o out-of-pocket expenses you incur or expect to

incur, for example, the cost of getting evidence. Our approval is not needed for such expenses.

If you are not an attorney and you are ineligible to receive direct

payment , you must collect the approved fee from the claimant. If you are

interested in becoming eligible to receive direct payment, you can find

information on the procedures for becoming eligible for direct payment

on our "Representing Claimants" website: http://www.ssa.gov/representation/ .

If you are an attorney or a non-attorney whom SSA has found eligible to

receive direct payment , we usually withhold 25 percent of any past-due

benefits that result from a favorably decided retirement, survivors,

disability insurance, or supplemental security income claim. Once we

approve a fee, we pay you all or part of the fee from the funds withheld.

We will also charge you the assessment required by section 206(d) and

1631(d)(2)(C) of the Social Security Act. You cannot charge or collect

this expense from the claimant. You must collect from the claimant: o the rest he or she owes

- if the amount of the fee is more than the

amount of money we withheld and paid you for

the claimant, and any amount you held for

the claimant in a trust or escrow account.

o all of the fee he or she owes

- if we did not withhold past-due benefits, for example,

because there are no past-due benefits, or the claimant

discharged you, or you withdrew from representing the

claimant; or - if we withheld, but later paid the money to the claimant

because you did not either ask for our approval until after 60

days of the date of the notice of award or tell us on time that

you planned to ask for a fee.

Conflict of Interest and Penalties

For improper acts, you can be suspended or disqualified

from representing anyone before the Social Security

Administration. You also can face criminal prosecution.

Improper acts include: o If you are or were an officer or employee of the

United States, providing services as a representative

in certain claims against and other matters affecting

the Federal government. o Knowingly and willingly furnishing false information.

o Charging or collecting an unauthorized fee or too

much for services provided in any claim, including

services before a court that made a favorable decision. References

o 18 U.S.C. §§ 203, 205, and 207; and 42 U.S.C. §§

406(a), 1320a-6, and 1383(d)(2) o 20 CFR §§ 404.1700 et. seq. and 416.1500 et. seq.

o Social Security Rulings 88-10c, 85-3, 83-27, and 82-39

Social Security Administration

Please read the back of the last copy before you complete this form. Form Approved

OMB No. 0960-0527

Name (Claimant) (Print or Type)

Social Security Number

Wage Earner (If Different) Social Security Number

Part I APPOINTMENT OF REPRESENTATIVE

I appoint this person, ,

(Name and Address)

to act as my representative in connection with my claim(s) or asserted right(s) under:

Title II Title XVI Title XVIII Title VIII

(RSDI) (SSI) (Medicare Coverage) (SVB)

This person may, entirely in my place, make any request or give any notice; give or draw out evidence or

information; get information; and receive any notice in connection with my pending claim(s) or asserted right(s).

I appoint, or I now have, more than one representative. My main representative is .

(Name of Principal Representative)

Signature (Claimant) Address

Telephone Number (with Area Code) Fax Number (with Area Code) Date

Part II ACCEPTANCE OF APPOINTMENT

I, , hereby accept the above appointment. I certify that I

have not been suspended or prohibited from practice before the Social Security Administration; that I am not

disqualified from representing the claimant as a current or former officer or employee of the United States; and that

I will not charge or collect any fee for the representation, even if a third party will pay the fee, unless it has been

approved in accordance with the laws and rules referred to on the reverse side of the representative's copy of this

form. If I decide not to charge or collect a fee for the representation, I will notify the Social Security Administration.

(Completion of Part III satisfies this requirement.) Check one: I am an attorney. I am a non-attorney who is eligible to receive direct fee payment.

I am not an attorney and I am ineligible to receive direct fee payment.

I have been disbarred or suspended from a court or bar to which I was previously admitted to practice as an

attorney. YES NO

I have been disqualified from participating in or appearing before a Federal program or agency. YES NO

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying

statements or forms, and it is true and correct to the best of my knowledge.

Signature (Representative) Address

Telephone Number (with Area Code) Fax Number (with Area Code) Date

Part III (Optional) WAIVER OF FEE

I waive my right to charge and collect a fee under sections 206 and 1631(d)(2) of the Social Security Act. I

release my client (the claimant) from any obligations, contractual or otherwise, which may be owed to me for

services I have provided in connection with my client's claim(s) or asserted right(s).

Signature (Representative)

Date

Part IV (Optional) WAIVER OF DIRECT PAYMENT

by Attorney or Non-Attorney Eligible to Receive Direct Payment

I waive only my right to direct payment of a fee from the withheld past-due retirement, survivors, disability

insurance or supplemental security income benefits of my client (the claimant). I do not waive my right to request

fee approval and to collect a fee directly from my client or a third party. Signature (Attorney or Eligible Non-Attorney (for Direct Payment) Representative)

Date

Form SSA-1696-U4 (1-2005) EF (1-2005) (See Important Information on Reverse)

OHA COPY

Destroy Prior Editions

COMPLETING THIS FORM TO APPOINT A REPRESENTATIVE

Choosing to Be Represented

You can choose to have a representative help you when you

do business with Social Security. We will work with your

representative, just as we would with you. It is important that

you select a qualified person because, once appointed, your

representative may act for you in most Social Security

matters. We give more information, and examples of what a

representative may do, on the back of the "Claimant's Copy"

of this form. Paperwork and Privacy Act Notice

The Social Security Administration (SSA) will recognize

someone else as your representative if you sign a written

notice appointing that person and, if he or she is not an

attorney, that person signs the notice agreeing to be your

representative. (You can read more about this in our

regulations: 20 CFR §§ 404.1707 and 416.1507.) Giving the

information this form requests is voluntary. Without it

though, we may not work with the person you choose to represent you. How to Complete This Form

Please print or type. At the top, show your full name and

your Social Security number. If your claim is based on

another person's work and earnings, also show the ''wage

earner's'' name and Social Security number. If you appoint

more than one person, you may want to complete a form for

each of them.

Part I Appointment of Representative

Give the name and address of the person(s) you are

appointing. You may appoint an attorney or any other

qualified person to represent you. You also may appoint

more than one person, but see ''What Your Representative(s)

May Charge'' on the back of the ''Claimant's Copy'' of this form. You can appoint one or more persons in a firm,

corporation, or other organization as your representative(s), but you may not appoint a law firm, legal aid group,

corporation, or organization itself.

Check the block(s) showing the program(s) under which

you have a claim. You may check more than one block. Check: o Title Il (RSDI), if your claim concerns retirement,

survivors, or disability insurance benefits.

o

Title XVI (SSI), if your claim concerns

supplemental security income.

o

Title XVIII (Medicare Coverage), if your claim

concerns entitlement to Medicare or enrollment in

the Supplementary Medical Insurance (SMI) plan.

If you will have more than one representative, check the

block and give the name of the person you want to be the main representative. How To Complete This Form, continued

Sign your name, but print or type your address, your area

code and telephone number, and the date. Part II Acceptance of Appointment

Each person you appoint (named in part I) completes this

part, preferably in all cases. If the person is not an

attorney, he or she must give his or her name, state that

he or she accepts the appointment, and sign the form. Part III (Optional) Waiver of Fee

Your representative may complete this part if he or she

will not charge any fee for the services provided in this

claim. If you appoint a second representative or

co-counsel who also will not charge a fee, he or she also

should sign this part or give us a separate, written waiver statement. Part IV (Optional) Waiver of Direct Payment by an

Attorney or a Non-Attorney Eligible to Receive Direct Payment

Your representative may complete this part if he or she is an

attorney or a non-attorney who does not want direct

payment of all or part of the approved fee from past-due

retirement, survivors, disability insurance, or supplemental security income benefits withheld. Paperwork Reduction Act Statement - This information

collection meets the requirements of 44 U.S.C. § 3507, as

amended by Section 2 of the Paperwork Reduction Act of

1995 . You do not need to answer these questions unless we

display a valid Office of Management and Budget control

number. We estimate that it will take about 10 minutes to

read the instructions, gather the facts, and answer the questions. SEND THE COMPLETED FORM TO

YOUR LOCAL SOCIAL SECURITY OFFICE. The

office is listed under U. S. Government agencies in your

telephone directory or you may call Social Security at 1-800-772-1213. You may send comments on our time

estimate above to: SSA, 1338 Annex Building, Baltimore,

MD 21235-6401. Send only

comments relating to our

time estimate to this address, not the completed form. References o 18 U.S.C. §§ 203, 205, and 207; and 42 U.S.C. §§

406(a), 1320a-6, and 1383(d)(2) o 20 CFR §§ 404.1700 et. seq. and 416.1500 et. seq.

o Social Security Rulings 88-10c, 85-3, 83-27, and

82-39

Form SSA-1696-U4 (1-2005) EF (1-2005)