Fill and Sign the Preferred Risk Policy Fema Form

Useful Advice on Getting Your ‘Preferred Risk Policy Fema’ Ready Online

Are you fed up with the inconvenience of managing documents? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Take advantage of the powerful features offered by this user-friendly and affordable service and transform your method of document management. Whether you need to sign forms or collect electronic signatures, airSlate SignNow takes care of it all seamlessly, with just a few clicks.

Follow these comprehensive steps:

- Sign in to your account or register for a free trial of our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Preferred Risk Policy Fema’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite options to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to work with your teammates on your Preferred Risk Policy Fema or send it for notarization—our solution is equipped with everything necessary to accomplish these tasks. Create an account with airSlate SignNow today and take your document management to a new height!

FAQs

-

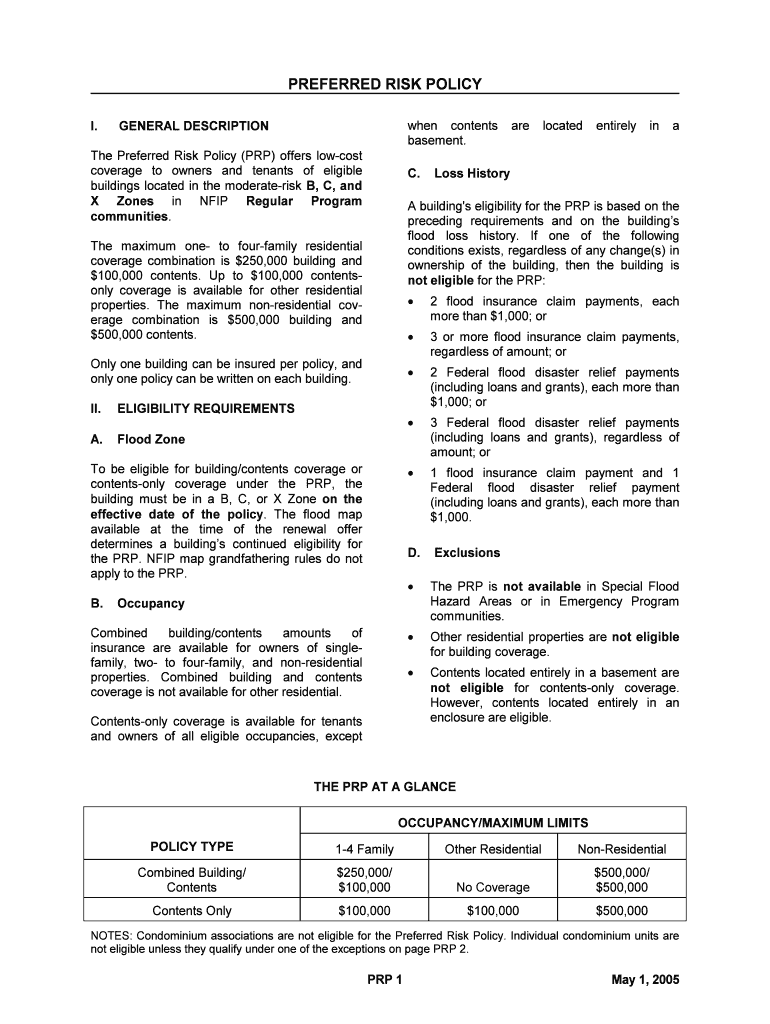

What is the PREFERRED RISK POLICY Fema and who can benefit from it?

The PREFERRED RISK POLICY Fema is a specialized insurance policy designed for properties in flood-prone areas. It offers affordable coverage options for homeowners and renters, making it an ideal choice for those at risk of flooding. By understanding this policy, you can ensure your property is adequately protected against flood damage.

-

How does the PREFERRED RISK POLICY Fema differ from standard flood insurance?

Unlike standard flood insurance, the PREFERRED RISK POLICY Fema is tailored specifically for low-risk flood zones, offering lower premiums and simplified coverage. This policy is designed to encourage property owners to obtain flood insurance without the high costs associated with traditional options. It's a smart choice for many homeowners looking to safeguard their investments.

-

What are the key benefits of choosing the PREFERRED RISK POLICY Fema?

The PREFERRED RISK POLICY Fema provides several advantages, including lower premiums, a straightforward application process, and comprehensive coverage for flood-related damages. Additionally, it helps protect your home and belongings, ensuring peace of mind in the event of a flood. This policy is a cost-effective way to secure your financial future.

-

How do I apply for the PREFERRED RISK POLICY Fema?

Applying for the PREFERRED RISK POLICY Fema is a simple process that can often be completed online. You will need to provide basic information about your property and its location to determine eligibility. Once your application is submitted, you can receive quotes and finalize your coverage quickly.

-

What types of properties are eligible for the PREFERRED RISK POLICY Fema?

The PREFERRED RISK POLICY Fema is available for various types of residential properties, including single-family homes, condos, and apartments. Properties located in designated low-to-moderate flood risk zones are generally eligible for this policy. It's important to check with your insurance agent to confirm your property's eligibility.

-

Can I integrate the PREFERRED RISK POLICY Fema with other insurance policies?

Yes, the PREFERRED RISK POLICY Fema can often be combined with other insurance policies, such as homeowners or renters insurance, to create a comprehensive protection plan. This integration can help streamline your coverage and potentially lead to discounts on your overall insurance costs. Consult with your insurance provider for detailed options.

-

What is the cost of the PREFERRED RISK POLICY Fema?

The cost of the PREFERRED RISK POLICY Fema varies depending on several factors, including the property's location, type, and the amount of coverage selected. However, it is typically more affordable than standard flood insurance policies, making it a budget-friendly option for many homeowners. Obtaining quotes from multiple providers can help you find the best deal.

Related searches to preferred risk policy fema form

Find out other preferred risk policy fema form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles