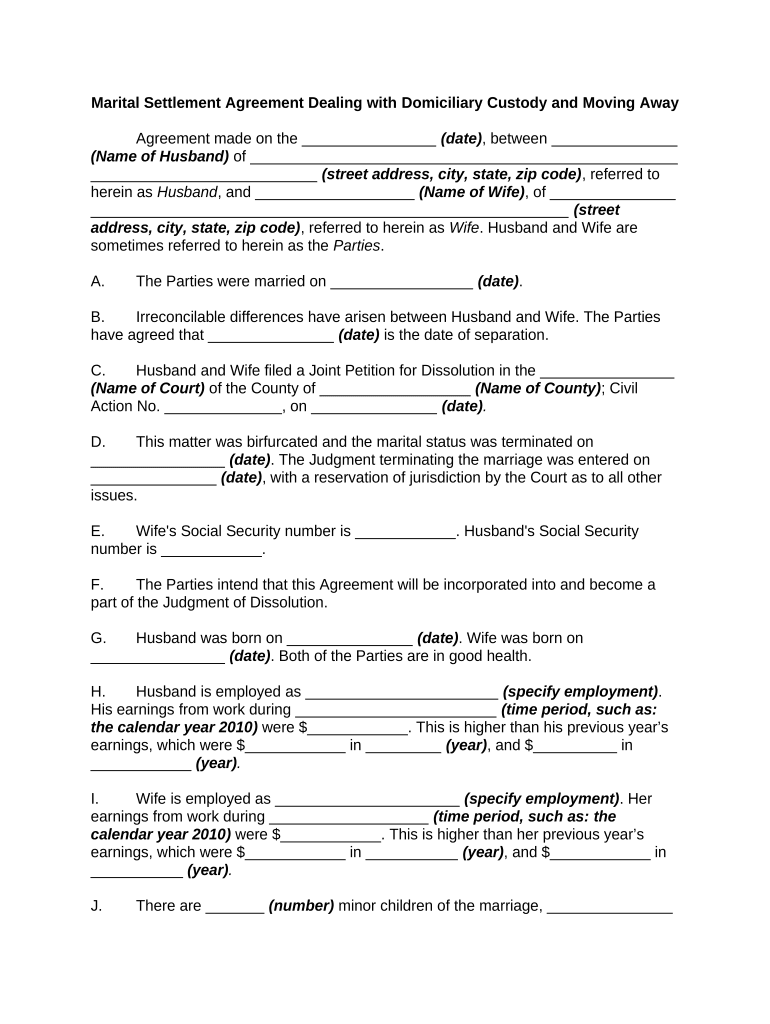

Marital Settlement Agreement Dealing with Domiciliary Custody and Moving Away

Agreement made on the ________________ (date) , between _______________

(Name of Husband) of ___________________________________________________

___________________________ (street address, city, state, zip code) , referred to

herein as Husband , and ___________________ (Name of Wife) , of _______________

_________________________________________________________ (street

address, city, state, zip code) , referred to herein as Wife . Husband and Wife are

sometimes referred to herein as the Parties .

A. The Parties were married on _________________ (date) .

B. Irreconcilable differences have arisen between Husband and Wife. The Parties

have agreed that _______________ (date) is the date of separation.

C. Husband and Wife filed a Joint Petition for Dissolution in the ________________

(Name of Court) of the County of __________________ (Name of County) ; Civil

Action No. ______________, on _______________ (date) .

D. This matter was birfurcated and the marital status was terminated on

________________ (date) . The Judgment terminating the marriage was entered on

_______________ (date) , with a reservation of jurisdiction by the Court as to all other

issues.

E. Wife's Social Security number is ____________. Husband's Social Security

number is ____________.

F. The Parties intend that this Agreement will be incorporated into and become a

part of the Judgment of Dissolution.

G. Husband was born on _______________ (date) . Wife was born on

________________ (date) . Both of the Parties are in good health.

H. Husband is employed as _______________________ (specify employment) .

His earnings from work during ________________________ (time period, such as:

the calendar year 2010 ) were $____________. This is higher than his previous year’s

earnings, which were $____________ in _________ (year) , and $__________ in

____________ (year) .

I. Wife is employed as ______________________ (specify employment) . Her

earnings from work during ___________________ (time period, such as: the

calendar year 2010 ) were $____________. This is higher than her previous year’s

earnings, which were $____________ in ___________ (year) , and $____________ in

___________ (year) .

J. There are _______ (number) minor children of the marriage, _______________

(name of child) , born ______________ (date) , and __________________ (name of

child) , born __________________ (date) .

K. Wife has been represented throughout these proceedings by _______________

(name of wife's attorney) . Husband has been represented throughout these

proceedings by _____________________ (name of husband's attorney) .

1. Purpose of Agreement

The purposes of this Agreement are:

A. Final Settlement. To make a final and complete settlement of all property

rights and obligations between the Parties;

B. Support. To resolve, finally, the support rights and obligations between

the Parties; and

C. Claims. To relinquish any and all past, present, or future claims that each

may have against the property or estate of the other, or of his or her executors,

administrators, representatives, successors, and assigns, except as otherwise

provided herein.

2. Effective Date. This Agreement will be effective as of the date of its execution by

the last of the Parties to sign as indicated on the signature page of that party.

3. Child Support

A. Amount and Duration of Child Support. Husband will pay to Wife as

and for child support for the minor children named above the sum of

$____________ per month commencing ________________ (date) , and

continuing until each child reaches age 18 unless still a full-time high school

student living with Husband or Wife in which case support will terminate upon

attaining the age of 19 or graduation from high school, whichever is earlier, or

upon death, marriage, or other emancipation, whichever first occurs.

B. Schedule and Method of Payment. One-half of the child support will be

paid on the first day of each month and one-half on the 15 th

day of each month.

C. Husband will mail or deliver the child support to Wife at the address set

forth above and Wife will keep Husband informed of her address.

D. Termination of Support for One Child. At such time as child support

terminates for _________________ (name of oldest child) , child support will be

reduced to $____________ per month.

E. Support Factors. The amount of child support is based upon the

following factors:

1. $____________ for housing and utilities allowance;

2. $____________for vacation and travel allowance

3. $____________for clothing and gift allowance

4. $____________for entertainment allowance

5. $____________for ____________________________ (specify

other categories)

6. The breakdown of child support per child is $____________ per

month for ________________ (name of child) , and $____________ per

month for _________________ (name of child) .

F. Health Insurance. Husband will maintain health insurance coverage

available through his employment for the minor children for the duration of his

obligation to pay child support or for so long as each child qualifies for coverage

as his dependent. Husband will provide Wife with all forms necessary for

submission of claims to the insurer.

G. Health Care Expenses. Husband will pay ______% and Wife will pay

______% of any insurance deductible or uninsured portion of expenses for health

care.

H. Health care expenses include, but are not limited to, the following:

________________________________________________________________

________________________________________________________________

(specify, such as: medical treatment, optometric treatment, dental

treatment, orthodontic treatment, psychotherapeutic treatment, educational

therapy, occupational therapy, and audio/speech therapy ) .

I. Extracurricular Activities. Husband will contribute ______% of the cost

of extracurricular activities of the children and Wife will pay ______%. Neither

party will unreasonably withhold his or her consent to an extracurricular activity

reasonably within the scope of a child's interests, abilities, or requests.

1. Extracurricular activities include all activities that are not a part of

the school curriculum.

2. The cost of extracurricular activities includes expenses reasonably

associated with the activities, including transportation, clothing, dues, and

equipment.

J. Childcare Expenses. Husband will pay to Wife ______% of all childcare

expenses incurred for purposes of work. The payments will be made on a

monthly basis at the same time as the child support is paid.

K. Educational Expenses. Husband will pay ______% and Wife will pay

______%) of the school expenses for the children ) . "School expenses" include,

but are not limited to, the following: tuition, field trip fees, books, supplies,

yearbooks, uniforms, tutoring, appropriate computer equipment, including a

printer and educational software, and lunches at school.

L. Post-High School Expenses. The Parties agree that Husband will pay

______% of the cost of 4 years of post-high school education so long as the child

is enrolled on a full-time basis up to a total cost that is equivalent to the cost of

four years at an in-state public college or university. "Full-time" means the

minimum number of units required by the institution for full-time enrollment.

1. These expenses include room and board, tuition, books and

supplies, round-trip travel between school and home twice each year, and

an allowance of $___________.

2. The selection of the institution will be a collaborative effort of the

Child, Wife, and Husband.

M. Dependency Claim. Husband will be entitled to claim the children as

dependents on his income tax returns.

N. The Parties acknowledge and agree to the following:

1. They are fully informed of their rights concerning child support.

2. The order is being agreed to without coercion or duress.

3. The agreement is in the best interests of the children involved.

4. The needs of the children will be adequately met by the stipulated

amount.

O. Life Insurance. Husband will maintain the children as beneficiaries on a

policy of life insurance with a minimum death benefit of $__________. Husband

is restrained and enjoined from changing the beneficiary designation on the life

insurance for the duration of his obligation to pay child support to the younger

child.

1. Husband will produce the insurance policy for the other party within

30 days of the effective date of this Agreement.

2. As of the date that Husband's obligation to pay child support

terminates for each child, the death benefit may be reduced by

$____________ per child for whom child support is no longer payable.

3. Exchange of Information. Each year that there is an obligation to

pay child support, the Parties will exchange their respective federal and

state income tax returns, together with all W-2 forms, 1099 forms, 1098

forms, and K-1 returns within two weeks of the filing of the returns with the

tax authorities.

4. Joint Legal Custody and Timeshare

A. The Parties will share joint legal custody of the minor children. All

decisions pertaining to the health, education, and welfare of the children will be

jointly made. These include, but are not limited to, decisions regarding

professional treatment, teaching or tutoring, routine and elective healthcare,

religious worship or practice, cosmetic body alterations such as piercing, schools,

extracurricular activities, and summer camps.

B. Wife will have physical custody of the minor children.

C. Timeshare. The timeshare of the Parties with the children will be as

follows:

1. Husband will be with the children (describe schedule) .

2. Holiday timeshare will be as follows: _________________

___________________________________________________________

________________________________ (describe holiday timeshare) .

3. Vacation timeshare will be as follows:

i. The schedule for vacation timeshare will be as follows:

_____________________________________________________

_____________________________________________________

___________________ (describe vacation timeshare schedule) .

ii. Neither party may leave the state of ______ or continental

United States with the children without prior written consent of the

other party or court order.

iii. The timeshare for each child's birthday will be as follows:

_____________________________________________________

_____________________________________________________

_______________________ (describe birthday schedule) .

D. Notice Regarding Modification. If either party needs to modify the

timeshare, he or she will give the other party reasonable notice of at least three

days.

E. Travel or Other Absence. If Wife is going to be away from the family

residence without the children, she is to give Husband the right to have the

children during the absence.

F. Move Away. Neither party may move away with the minor children to a

distance in excess of _____ (number) miles without the prior written consent of

the other parent or court order.

1. If Wife intends to move away in excess of _____ (number) miles

and wishes to take the children along, she must give Husband not less

than ______ (number) days' notice.

2. If there is a dispute regarding one party's desire to move away with

the children, in any adversary hearing to adjudicate the requested move

away, the burden of proof will be upon the parent wishing to move away

with the children. That burden of proof will depend upon the age of the

youngest child that would be moved away. If the youngest child is _____

(age) or less, the burden of proof is to demonstrate by clear and

convincing evidence that the detriment to the parent/child relationship of

__________________________ ( the children or the youngest child or

all of the children ) with the parent who is not moving, is outweighed by

the necessity of the move away. If the youngest child is older than ______

(age) , the burden of proof is to show, by a preponderance of evidence,

that the detriment to the parent/child relationship of __________________

_________________ ( the children or the youngest child or all of the

children ) with the parent who is not moving is outweighed by the

necessity of the move away.

G. Mediation. In the event there is a dispute regarding the children, the

Parties will cooperate in meeting with a mutually agreed upon co-parenting

mediator prior to filing any application before the _______________________

(name family court) Court. The Parties will equally share the cost of the

mediation.

1. If either party feels that there is a problem regarding the children

that he or she would like to discuss with a therapist or mediator, the other

party will cooperate with the concerned party and meet with a therapist or

mediator whether or not the Parties disagree about the existence of a

problem. The Parties will equally share the cost of the consultation or

consultations.

2. Nothing in this section is intended to prevent the Parties from

seeking the Court's intervention if either party believes, in good faith, that

the either of the children are in danger of any kind.

H. Substance Use/Abuse. Husband and Wife will refrain from consuming

any nonprescription drugs or alcohol 24 hours before commencement of or at

any time during their time with the minor children. If either party suspects, in good

faith, that the other party has been taking nonprescription drugs or drinking

alcohol within 24 hours of commencement of timeshare, he or she may

unilaterally deny access to the minor children for the scheduled timeshare.

I. Access to Records . Both of the Parties will cooperate to ensure that

each of them will have access to all of the minor children's medical, dental, and

school records, in conformity with _____________ (name of state) law. Wife will

instruct _____________________ (name of school) to mail a duplicate copy of

all correspondence from the school to Husband, who will also contact the school

and request a duplicate copy of all correspondence.

5. Spousal Support

A. Amount and Duration of Spousal Support. Husband will pay to Wife the

sum of $____________ per month as spousal support, commencing

__________________ (date) and continuing until either party's death, or Wife's

remarriage, whichever first occurs.

1. The amount of spousal support is based upon the following factors:

i) The timeshare for the children is ______________________

_____________________________________________________

_______________________ (describe timeshare arrangement) .

ii) Husband is a salaried employee of ___________________

(name of employer) earning $____________ per ____________

_________________________ (time period) .

2. A ________________________ (support program) calculation

showing the factors used to determine support is attached to this

Agreement as Exhibit A .

B. Tax Treatment . All support payments under the terms of this Agreement

are deductible to Husband and taxable as income to Wife on their respective

income tax returns.

C. Method of Payment. All support payments will be made to Wife by

delivery or mailing to _______________________________________________

____________________________ (Wife’s address) . Wife will advise Husband

if there is a change of address.

D. Termination of Jurisdiction. The Court's jurisdiction to award spousal

support will terminate upon Wife's Death, Husband's death, Wife's remarriage, or

_____________________ (date) , whichever first occurs (the Termination Date ).

In no event will Husband be obligated to pay spousal support to Wife beyond the

Termination Date. Upon execution of this Agreement, the Court is divested of

jurisdiction to hear an application for spousal support that would require

payments of support after the Termination Date.

E. Amount and Duration of Support Non-modifiable. The amount and

duration of spousal support payable under this Agreement is non-modifiable.

Upon execution of this Agreement, the Court is divested of jurisdiction to

entertain any application that would change the amount of support paid or the

Termination Date of support payments. The Court cannot make any order for

support before the Termination Date that would extend payments beyond the

Termination Date.

F. Attorney Fees as Additional Spousal Support. Husband will pay as

additional deductible spousal support the sum of $____________ on behalf of

Wife to the law office of _______________________ (name of payee spouse's

attorney) , in discharge of Wife’s attorney fees and costs.

G. Life Insurance. Husband will maintain a policy of life insurance with a

benefit of $____________ assigned to Wife as beneficiary until ____________

_______________________________________ ( support payments terminate

or the Court's jurisdiction over spousal support terminates ) . Husband will

produce proof of the life insurance to Wife upon demand by Wife. Failure to

maintain the insurance will create a right in Wife to make a claim against the

estate of Husband in the same amount as the life insurance benefit set forth this

Section of this Agreement.

H. Health Insurance. Wife is currently covered under Husband's medical

insurance maintained through his employment. Husband will continue to provide

medical insurance for Wife until the effective date of the Parties' marriage

dissolution. Commencing upon the effective date of the Parties' dissolution, Wife

will be responsible for paying her own medical insurance and all unreimbursed

medical costs.

6. Assets and Obligations

A. Assets and Obligations Listed. The Parties declare that the property

listed on Exhibits B and C, attached to and made a part of this Agreement,

constitutes all of the marital assets and obligations of the Parties.

B. No Other Obligations. At the time of the signing of this Agreement, the

only known obligations are those listed on Exhibits B and C .

C. Assets and Obligations to Husband. The Parties agree that Husband

will be awarded as his share of the assets and obligations those items set forth

on Exhibit B , attached to and incorporated in this Agreement by this reference.

D. Assets and Obligations to Wife. The Parties agree that Wife will be

awarded as her share of the marital assets and obligations those items set forth

on Exhibit C , attached to and incorporated in this Agreement by this reference.

E. Unknown Obligations. Any latent debt, claim, or obligation (including the

cost of defending against same) not provided for in this Agreement and unknown

by the Parties at the time of the preparation of this Agreement, will be deemed a

joint expense so long as the debt, claim, or obligation arose from the conduct of

both Parties (or from the conduct of one party where both Parties benefited from

that conduct) occurring during the marriage, but prior to the effective date of this

Agreement. If, however, such latent claim, debt, or obligation arose from the

conduct of just one party and the other party did not benefit from it, then any such

claim, debt, or obligation will be the sole responsibility of that party who did

benefit from such latent claim, debt, or obligation.

F. Credit Card Accounts. Within 30 days of the signing of this Agreement,

each party will remove the other from any credit cards or other accounts upon

which the other's name appears, for any credit accounts that have remained

under his or her control during the period of separation. Each of the Parties will

be solely responsible and forever hold the other harmless from any debts

incurred on any credit card or other accounts maintained by him or her since

separation, and from any professional fees incurred to defend any creditors'

actions to collect from the party who did not maintain that account since

separation.

G. Sale of Residence. The residence located at ______________________

____________________________________________ (street address, city,

state, zip code) , will be listed for sale on or before _____________________

(date) . The Parties will mutually agree on a listing agent whose listing contract

will be in increments of ______ (number) months. The property will be listed for

sale at a price according to the opinion and advice of the individual selected by

the Parties to be the listing agent. The Parties will equally share the cost of

preparing the property for sale by performance of that maintenance

recommended by the listing agent.

1. Wife will occupy the residence pending its sale. She will be liable

for maintaining the property in a condition to maximize its potential sale

and will vacate the property at all times reasonably necessary for its

showing to the public. Wife will cooperate in providing opportunities for

private viewings of the property by interested individuals who are

represented by brokers or agents.

2. The Parties will act reasonably and promptly in responding to offers

on the property and neither party will unreasonably withhold consent to

terms so as to jeopardize a sale.

3. The Court retains jurisdiction to oversee and supervise all

transactions associated with implementation of all of the provisions of this

Section G and its subparts, including the ultimate vacating of the

residence by the close of escrow.

4. The Court may substitute its judgment in the place of the judgment

of one of the Parties with respect to whether particular terms are

reasonable, including the choice of listing agent, the agent's term of listing,

the terms of sale, the sales price, and the escrow instructions, in the event

the Court determines that either party is acting unreasonably.

5. The Parties are advised that the Court may order a third party to

sign any documents reasonably necessary to implement the terms of this

Section G and its subparts, including but not limited to listing documents,

counteroffers, escrow instructions, and conveyance instruments, in the

place of either party found to be unreasonable or acting in a manner likely

to jeopardize a potential sale on appropriate terms, as determined by the

Court.

6. Proceeds from the sale of said Residence shall be divided between

the Parties as follows: each Party will have confirmed to him or her one-

half the property and each shall receive one-half the cost basis, one-half

of any capital gains deferred into the purchase of this Residence, and one-

half the capital gains attributable to this property.

7. Each party shall report on his or her separate income tax returns for

________ (year of sale) the sale of one-half the residence. Each party

shall hold the other harmless from and fully indemnify the other against

any liability for capital gains tax attributable to the other's one-half interest.

7. Separate Property

A. Exhibits. Exhibits D and E contain the separate property being confirmed

to each of the Parties.

B. Wife's Separate Property. Wife will have confirmed to her as her sole

and separate property and obligations those assets and obligations set forth at

Exhibit D, attached to and incorporated in this Agreement. All such assets are

taken together with any insurance and subject to any encumbrances attached to

or taxes flowing from those assets.

C. Husband's Separate Property. Husband will have confirmed to him as

his sole and separate property and obligations those assets and obligations set

forth at Exhibit E attached to and incorporated in this Agreement. All such assets

are taken together with any insurance and subject to any encumbrances

attached to or taxes flowing from those assets.

8. Warranties, Covenants, and Releases

A. Disclosure of Assets. The Parties warrant to each other that neither

party owns any property of any kind, other than the property listed in this

Agreement, including the Exhibits. The Parties acknowledge that each of them

has conscientiously endeavored to fulfill the duty of full disclosure.

B. After-Discovered Property. The Parties agree that any property or

property interests discovered after the effective date of this Agreement will be

divided equally between the Parties.

C. Valuation of Assets. Each party warrants to the other that the warrantor

has not given any false or misleading information and has not withheld any

information to which he or she has access, to the exclusion of the other,

concerning the existence of or value of any marital assets and/or separate

property. In the event it is determined that false or misleading information was

given or that information was withheld, the portion or portions of this Agreement

that was or were affected by the breach will be voidable, at the warrantee's

option, and the Parties will conduct themselves as though those issues were

reserved for later determination. This Section is not intended to impair the

availability, in a court of competent jurisdiction, of any other remedy arising from

the undisclosed or misleading information.

D. Unauthorized Gifts. Each party warrants to the other that the warrantor

has not made, without the warrantee's knowledge and consent, any gift or

disposition of property with a value in excess of $__________. If it later appears

that the warrantor has made a disposition of property contrary to this warranty,

the warrantor will pay the warrantee one half the fair market value of that

property. This Section and its subsections will not impair the availability, in a

court of competent jurisdiction, of any other remedy arising from the undisclosed

disposition.

E. Indemnity Against Assumed and Additional Liabilities. Each party

warrants to the other that neither has incurred any debt or obligation for which

the other can be held liable or an obligation that could be enforced at any time

against an asset held, or to be received under this Agreement, by the other party,

except as set forth in this Agreement.

F. Survival of Warranties. The Parties intend that the warranties,

covenants, and releases contained in this Article 8 will survive the merger of this

Agreement into a Judgment of Dissolution of Marriage and each party consents

and agrees that the Court in the pending action for dissolution of marriage will

retain continuing jurisdiction to resolve any claims relating to the warranties,

covenants, and releases contained in this Article 8 .

9. Waiver of Inheritance Rights

A. Mutual Waiver of Inheritance Rights. Each party waives and renounces

any and all rights to inherit the estate of the other at the other's death, or to

receive any property of the other under a will executed before the effective date

of this Agreement or to claim any (a) family allowance, (b) probate homestead,

(c) rights or claims of dower, curtesy, or any statutory substitute now or hereafter

provided under the laws of any state in which the Parties may die domiciled or in

which they may own real property, or to act as executor or other personal

representative under a will of the other executed before the effective date of this

Agreement, or to act as administrator, or as administrator with the will annexed,

of the other's estate under any circumstances.

10. Taxes

A. Joint Tax Return. The joint tax return for ________ (year) will be

prepared by _____________________ (name of tax preparer) . Each of the

Parties will cooperate to provide _____________________ (name of tax

preparer) with all information necessary for preparation of the tax returns in a

timely fashion. Each of the Parties understands that ____________________

(name of tax preparer) does not have a confidential relationship with the other

party in connection with the preparation of this tax return and that each of the

Parties will have full and complete access to any and all information provided to

the tax preparer by the other.

1. The Parties will split the tax liability on this joint return as follows:

Husband will pay ______%, and will hold Wife free and harmless from and

fully indemnify her against any liability for that amount. Wife will pay will

pay ______%, and will hold Husband free and harmless from and fully

indemnify him against any liability for that amount.

2. The Parties understand that each is jointly and severally liable for

the entire tax liability to any taxing authority if a joint return is filed,

regardless of the allocation of liability between the Parties pursuant to

agreement or court order. Each party agrees to hold the other party

harmless from and fully indemnify the other party against that portion of

the liability the indemnifying party is obligated to pay under this Agreement

or any court order. Payment of each party's share of any taxes is to be

timely. If one party fails to make the payment agreed to or ordered in a

timely way, enforcement of collection may occur against the other party.

Any party who agrees to make payment or who is ordered to do so, will

act promptly and completely to indemnify the other party against any

liability or costs caused by the obligated party's failure to timely pay. The

costs for professional fees for any professional hired by the non-obligated

party to deal with the taxing authority will be included in the

indemnification under this Paragraph 10 .

3. The Parties understand that, by filing a joint return, each is legally

precluded from amending the return for______________ (year for which

joint return filed) to a separate return at any time after the joint return is

filed.

4. The Parties understand that spousal support payments made by

one party to the other are not deductible on a joint return filed by the

Parties.

B. Audit of Joint Tax Returns. The Parties have filed joint federal and state

income tax returns ending with the tax year, __________ (year) . The Parties

intend to file joint tax returns for ____________ (year) . With respect to these

returns, they agree as follows:

1. If either party receives any tax deficiency notice for any joint tax

return, he or she will immediately forward a copy of the notice to the other.

Each party agrees to cooperate fully with the other and to execute or

furnish any documents reasonably requested by the other, and to furnish

information and testimony with respect to any tax liability asserted by

taxing authorities for any joint returns filed by the Parties.

2. Subject to Section 3 below, the Court reserves jurisdiction to

allocate between the Parties (1) the costs of any professional hired to

defend any joint return before any taxing authority, and (2) any taxes,

penalties, or interest assessed by any taxing authority or the proceeds of

any refund provided by any taxing authority.

3. Neither party waives his or her right to seek status as an Innocent

Spouse under Internal Revenue Code section 6015 (26 USCA § 6015). If

either is found to be an Innocent Spouse, the Court retains jurisdiction to

equitably allocate the assessed deficiency, together with any interest or

penalties on it, unequally between the Parties up to the assignment of one

hundred percent (100%) to one party and zero percent (0%) to the other.

C. Separate Tax Returns. Each of the Parties will file separate tax returns

for ___________ (year) reporting only the income earned by each during that

year and all income, gains, interest, deductions, expenses, and losses

associated with any asset confirmed to him or her under the terms of this

Agreement. Each will hold the other free and harmless from and fully indemnify

the other against any taxes associated with any asset confirmed to him or her

under the terms of this Agreement.

D. Conformity of Tax Returns. In the event deductible/taxable spousal

support was paid during a given calendar year, the Parties will do the following:

On or before February 15 of the following year, the Parties will provide each

other with the amount each intends to put on his or her income tax return for

deductible support payments or taxable support received.

1. If the amount each provides the other is different, the Parties will

meet and confer to resolve the difference, with the goal of setting forth the

exact same amount on their respective income tax returns.

2. If the Parties cannot resolve the difference between themselves,

they will mutually agree on a mediator and will immediately attend

mediation for the purpose of resolving the dispute. The mediator may be

anyone the Parties mutually agree could be helpful in facilitating a

resolution of the dispute. The cost of the mediator will be split equally

between the Parties.

3. The Court reserves jurisdiction to enforce the terms of this Section

D and its subparts, including (1) the power to adjudicate the support

amount to be set forth on the Parties' income tax returns so that the

amounts on the returns are in conformity, and (2) allocation of attorney

fees and costs associated with the implementation of this Section D and

its subparts.

11. Bankruptcy

A. Husband's Acknowledgment. Husband acknowledges that the debts

and liabilities assigned to him pursuant to this Agreement, including his obligation

of indemnification to Wife, are assumed by him as part of an overall bargain with

Wife that the Parties agree and believe is an equitable and fair division of their

assets and liabilities.

B. Wife's Acknowledgment. Wife acknowledges that the debts and liabilities

assigned to her pursuant to this Agreement, including her obligation of

indemnification to Husband, are assumed by her as part of an overall bargain

with Husband that the Parties agree and believe is an equitable and fair division

of their assets and liabilities.

12. General Provisions

A. Entire Agreement; Settlement and Release. The Parties intend this

Agreement to be a final and complete settlement of all of their rights and

obligations arising out of the marriage and acknowledge that it contains the entire

agreement on the matters it covers and it supersedes any previous Agreement

between the Parties. Except as otherwise provided in this Agreement, each party

releases the other from any and all debts, obligations, and liabilities owing to the

other, whether incurred before or after the effective date of this Agreement. Each

party releases and discharges the other from any right to claim any interest in the

property of the other, except as provided in this Agreement. Each party releases

the other from any claims of reimbursement because of the conduct of either

party during the marriage or with respect to any asset during the pendente lite

period up to the date upon which this Agreement is last executed.

B. Execution of Other Documents. Each party agrees that he or she will,

upon request, execute, acknowledge, and deliver to the other party or to the

other party's executor or representative any and all documents, deeds, contracts,

releases, bills of sale, promissory notes, or other instruments necessary to

effectuate the terms of this Agreement. Either party who fails to comply with this

paragraph will reimburse the other for any expenses, including attorney fees and

court costs, that, as a result of this failure, become reasonably necessary for

carrying out this Agreement.

C. Mutual Release from Interspousal Obligations. Except as otherwise

provided in this Agreement, each party hereby releases the other from all

interspousal obligations, whether incurred before or after the effective date, and

all claims to the property of the other. This release extends to all claims based on

rights that have accrued before the marriage. The Parties have considered and

provided for such claims in this Agreement.

D. Amendment. The provisions of this Agreement may only be waived,

altered, amended, modified, revoked, or terminated, in whole or in part, in a

subsequent written agreement specifically referring to this Agreement and signed

by both the Parties. However, those provisions of this Agreement that are

specifically modifiable may be modified either by the written consent of both

Parties or by an order of a court of competent jurisdiction. Each party waives the

right to claim, contend, or assert in the future that this Agreement was modified,

canceled, superseded, or changed by oral agreement, course of conduct, or

estoppel.

E. Binding Effect. This Agreement will inure to the benefit of and be binding

on the Parties and their heirs, personal representatives, assigns, and other

successors in interest of each party.

F. Effect of Reconciliation. Any reconciliation between the Parties will not

cancel, terminate, or modify the force or effect of any provision of this Agreement

dealing with the present assets or obligations of either or both Parties.

G. Severability. This is an integrated agreement entered into by the Parties

because of the overall settlement. Therefore, if any term, provision, or condition

of this Agreement is altered or held by a court of proper jurisdiction to be invalid,

void, or unenforceable, and should enforcement of the remaining provisions then

result in a substantial injustice to one party, the Parties request and agree that

the Court retain the jurisdiction to modify the remainder of the Agreement to the

extent necessary to cure the injustice. Otherwise, the remaining provisions will

remain in full force and effect and will in no way be affected, impaired, or

invalidated.

H. Governing Law. This Agreement will be construed in accordance with,

and governed by the laws of the State of __________________ (name of state) ,

except that this Agreement will not be construed in favor of or against either

party, but in a manner that is fair to both Parties.

I. Continuing Jurisdiction. The Parties agree that the Court will have

continuing jurisdiction to enforce the executory provisions of this Agreement and

to divide any subsequently discovered or undisclosed property and to resolve

any claims relating to the warranties, covenants, and releases contained in this

Agreement. The Parties agree that the warranties, covenants, and releases will

survive the merger of this Agreement into the Judgment of Dissolution and may

be enforceable independently of the judgment by a breach of warranty action.

J. Incorporation into Judgment. This Agreement will be submitted to the

Court in the Parties' dissolution action and be incorporated into the judgment of

dissolution. The Parties by the terms of said judgment will be ordered to comply

with the terms of this Agreement. However, the Parties intend and agree that the

terms of this Agreement will bind them regardless of its incorporation into any

judgment of dissolution of marriage. This Agreement does not depend upon

approval of the Court for it to be binding upon the Parties.

K. Agreement Voluntary and Clearly Understood. In affixing their

signatures to this Agreement, each of the Parties is acknowledging that he or she

has read the Agreement and discussed it with his or her attorneys, that each

understands all of its terms, and agrees to be bound by its provisions. The

Parties have not entered into the terms of this settlement under duress or

coercion, but upon due reflection.

WITNESS our signatures as of the day and date first above stated.

________________________ _________________________

(P rinted Name of Husband) (P rinted Name of Wife)

________________________ _________________________

(Signature of Husband) (Signature of Wife)

Attorney’s Certification for Husband

The undersigned, ___________________ (name of attorney) , certifies that he is

an attorney at law duly licensed to practice and admitted to practice in the State of

_________________ (name of state) ; that he has been employed by ______________

(name of husband) , a party to the foregoing Agreement, and has explained to him the

meaning and legal effect of it, and that ________________ (name of husband) has

acknowledged his full and complete understanding of the Agreement and its legal

consequences, and has freely and voluntarily executed the Agreement.

WITNESS my signature as of the day and date first above stated.

__________________________

(Printed Name of Attorney)

__________________________

(Signature of Attorney)

Attorney’s Certification for Wife

The undersigned, __________________ (name of attorney) , certifies that he is

an attorney at law duly licensed to practice and admitted to practice in the

______________ (name of state) ; that he has been employed by _________________

(name of wife) , a party to the foregoing Agreement, and has explained to her the

meaning and legal effect of it, and that _________________ (name of wife) has

acknowledged her full and complete understanding of the Agreement and its legal

consequences, and has freely and voluntarily executed the Agreement.

WITNESS my signature as of the day and date first above stated.

__________________________

(Printed Name of Attorney)

__________________________

(Signature of Attorney)