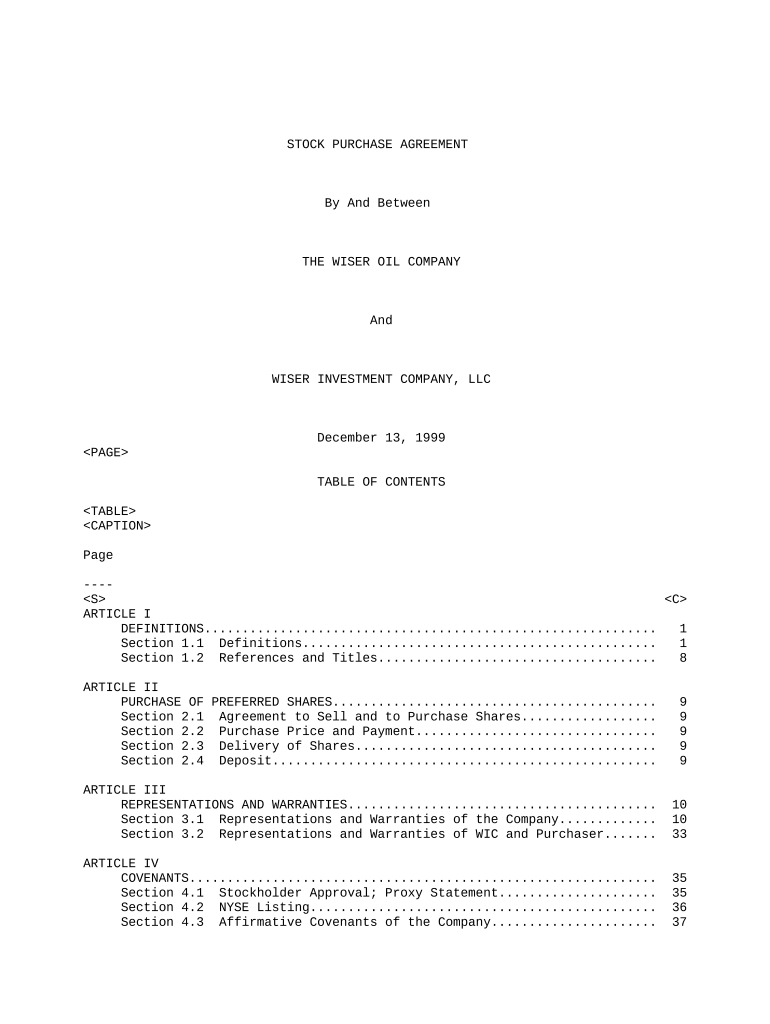

STOCK PURCHASE AGREEMENT

By And Between

THE WISER OIL COMPANY

And

WISER INVESTMENT COMPANY, LLC

December 13, 1999

TABLE OF CONTENTS

Page

----

ARTICLE I

DEFINITIONS............................................................ 1

Section 1.1 Definitions............................................... 1

Section 1.2 References and Titles..................................... 8

ARTICLE II

PURCHASE OF PREFERRED SHARES........................................... 9

Section 2.1 Agreement to Sell and to Purchase Shares.................. 9

Section 2.2 Purchase Price and Payment................................ 9

Section 2.3 Delivery of Shares........................................ 9

Section 2.4 Deposit................................................... 9

ARTICLE III

REPRESENTATIONS AND WARRANTIES......................................... 10

Section 3.1 Representations and Warranties of the Company............. 10

Section 3.2 Representations and Warranties of WIC and Purchaser....... 33

ARTICLE IV

COVENANTS.............................................................. 35

Section 4.1 Stockholder Approval; Proxy Statement..................... 35

Section 4.2 NYSE Listing.............................................. 36

Section 4.3 Affirmative Covenants of the Company...................... 37

Section 4.4 Negative Covenants of the Company......................... 37

Section 4.5 Reasonable Best Efforts; Financing........................ 40

Section 4.6 Other Transaction Documents............................... 40

Section 4.7 HSR Act Notification...................................... 41

Section 4.8 Notification of Certain Matters........................... 41

Section 4.9 No Solicitation by Company................................ 41

Section 4.10 Access; Confidentiality................................... 43

Section 4.11 Transfer Restrictions..................................... 43

ARTICLE V

CONDITIONS PRECEDENT TO CLOSING......................................... 45

Section 5.1 Conditions Precedent to Each Party's Obligation........... 45

Section 5.2 Conditions Precedent to Obligations of WIC and Purchaser.. 45

Section 5.3 Conditions Precedent to Obligation of Company............. 47

ARTICLE VI

CLOSING................................................................ 47

Section 6.1 Closing................................................... 47

-i-

Section 6.2 Actions to Occur at the Closing........................... 48

ARTICLE VII

TERMINATION............................................................ 49

Section 7.1 Termination............................................... 49

Section 7.2 Effect of Termination..................................... 50

ARTICLE VIII

INDEMNIFICATION........................................................ 51

Section 8.1 Indemnification of WIC and Purchaser...................... 51

Section 8.2 Indemnification of Company................................ 51

Section 8.3 Defense of Third-Party Claims............................. 51

Section 8.4 Direct Claims............................................. 52

Section 8.5 No Punitive Damages....................................... 52

Section 8.6 Exclusivity............................................... 52

ARTICLE IX

MISCELLANEOUS.......................................................... 53

Section 9.1 Survival of Provisions.................................... 53

Section 9.2 No Waiver; Modification in Writing........................ 54

Section 9.3 Specific Performance...................................... 54

Section 9.4 Severability.............................................. 54

Section 9.5 Fees and Expenses......................................... 55

Section 9.6 Parties in Interest....................................... 55

Section 9.7 Notices................................................... 55

Section 9.8 Counterparts.............................................. 56

Section 9.9 Entire Agreement.......................................... 56

Section 9.10 Governing Law............................................ 56

Section 9.11 Public Announcements..................................... 57

Section 9.12 Assignment............................................... 57

Section 9.13 Independent Determination................................ 58

Exhibits:

Exhibit A - Form of Agreement and Irrevocable Proxy

Exhibit B - Form of Certificate of Designation

Exhibit C - Form of Employment Agreement

Exhibit D - Form of Management Agreement

Exhibit E - Form of Restated Certificate

Exhibit F - Form of Stockholder Agreement

Exhibit G - Form of Opinion of Thompson & Knight L.L.P.

Exhibit H - Form of Opinion of Andrews & Kurth L.L.P.

-ii-

STOCK PURCHASE AGREEMENT

STOCK PURCHASE AGREEMENT, dated as of December 13, 1999, by and between The

Wiser Oil Company, a Delaware corporation (the "Company"), and Wiser Investment

Company, LLC, a Delaware limited liability company ("WIC").

In consideration of the mutual covenants and agreements set forth herein

and for good and valuable consideration, the receipt of which is hereby

acknowledged, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS

SECTION 1.1 Definitions. As used in this Agreement, and unless the

context requires a different meaning, the following terms have the meanings

indicated:

"Affiliate" means, with respect to any Person, any other Person directly,

or indirectly through one or more intermediaries, controlling, controlled by or

under common control with such Person. For purposes of this definition and this

Agreement, the term "control" (and correlative terms) means the power, whether

by contract, equity ownership or otherwise, to direct the policies or management

of a Person.

"Agreement" means this Stock Purchase Agreement, as the same may be

amended, supplemented or modified from time to time in accordance with the terms

hereof.

"Agreement and Irrevocable Proxy" means an agreement in the form attached

as Exhibit A hereto.

---------

"Alternative Transaction" has the meaning set forth in Section 4.9(d).

"Alternative Transaction Proposal" has the meaning set forth in Section

4.9(a).

"Approval" means any approval, authorization, grant of authority, consent,

order, qualification, permit, license, variance, exemption, franchise,

concession, certificate, filing or registration, or any waiver of the foregoing,

or any notice, statement or other communication, required to be obtained from,

filed with or delivered to any Governmental Entity or other Person.

"Benefit Arrangement" has the meaning set forth in Section 3.1(s)(i)(B).

"Board" means the Board of Directors of the Company.

"Business Day" means any day except Saturday, Sunday and any day which

shall be a legal holiday or a day on which banking institutions in Dallas, Texas

generally are authorized or required by Law to close.

"Bylaws" means the By-Laws of the Company as amended to the date of this

Agreement.

"Certificate of Cancellation" means a certificate, in form and substance

reasonably satisfactory to WIC and Purchaser, effecting the cancellation of the

Company's Series A Preferred Stock, in accordance with Section 151(g) of the

Delaware General Corporation Law.

"Certificate of Designation" means the Certificate of Designations for the

Series C Preferred Stock, in the form attached as Exhibit B hereto.

---------

"Certificate of Incorporation" means the Restated Certificate of

Incorporation of the Company as amended to the date of this Agreement and as

filed with the Secretary of State of Delaware.

"Closing" has the meaning set forth in Section 6.1.

"Closing Date" has the meaning set forth in Section 6.1.

"Code" means the Internal Revenue Code of 1986, as amended, and the rules

and regulations thereunder as in effect on the date hereof.

"Commitment Letter" has the meaning set forth in Section 4.5(b).

"Common Stock" means the Company's common stock, the par value of which is

$3.00 per share on the date hereof but will be changed to $.01 per share on the

Closing Date pursuant to the Restated Certificate.

"Company" has the meaning set forth in the introductory paragraph hereof.

"Company Agents" has the meaning set forth in Section 4.9(a).

"Company Disclosure Schedule" means the disclosure schedule dated as of the

date of this Agreement, which refers to the Sections of this Agreement that it

qualifies, and which has been delivered by the Company to WIC on the date of

this Agreement.

"Company Indemnified Costs" means any and all damages, losses (including

diminution in value), claims, liabilities, demands, charges, suits, penalties,

costs and expenses (including court costs and reasonable legal fees and expenses

incurred in investigating and preparing for any litigation or proceeding) that

any of the Company Indemnified Parties incurs and that arise out of (i) any

breach by WIC or Purchaser of any of its representations or warranties under

this Agreement or any other Transaction Document or (ii) any breach by WIC or

Purchaser of any of its covenants or agreements under this Agreement or any

other Transaction Document.

-2-

"Company Indemnified Parties" means the Company, its Subsidiaries and each

officer, director, employee, stockholder and Affiliate of the Company or its

Subsidiaries (other than WIC, Purchaser and Persons who are also officers,

directors, managers, employees, stockholders or Affiliates of WIC or Purchaser).

"Company Options" has the meaning set forth in Section 3.1(c)(iii).

"Company SEC Documents" has the meaning set forth in Section 3.1(i).

"Contracts" means all agreements, contracts or other binding commitments,

arrangements or plans, written or oral (including any amendments and other

modifications thereto), to which the Company or any of its Subsidiaries is a

party or is otherwise bound.

"Conversion Shares" means the shares of Common Stock issuable upon

conversion of the Preferred Shares in accordance with the terms of the

Certificate of Designation.

"Credit Facility" has the meaning set forth in Section 3.1(m).

"Cure Period" has the meaning set forth in Section 7.1(b)(i).

"Debt", without duplication, means (a) all indebtedness (including the

principal amount thereof or, if applicable, the accreted amount thereof and the

amount of accrued and unpaid interest thereon) of the Company and its

Subsidiaries, whether or not represented by bonds, debentures, notes or other

securities, for the repayment of money borrowed, (b) all deferred indebtedness

of the Company and its Subsidiaries for the payment of the purchase price of

property or assets purchased, (c) all obligations of the Company and its

Subsidiaries to pay rent or other payment amounts under a lease of real or

personal property which is required to be classified as a capital lease or a

liability on the face of a balance sheet prepared in accordance with GAAP, (d)

any outstanding reimbursement obligation of the Company or its Subsidiaries with

respect to letters of credit, bankers' acceptances or similar facilities issued

for the account of the Company or its Subsidiaries, (e) any payment obligation

of the Company or its Subsidiaries under any interest rate swap agreement,

forward rate agreement, interest rate cap or collar agreement or other financial

agreement or arrangement entered into for the purpose of limiting or managing

interest rate risks, (f) all indebtedness for borrowed money secured by any Lien

existing on property owned by the Company or its Subsidiaries, whether or not

indebtedness secured thereby shall have been assumed, (g) all guaranties,

endorsements, assumptions and other contingent obligations of the Company or its

Subsidiaries in respect of, or to purchase or to otherwise acquire, indebtedness

for borrowed money of others, (h) all other short-term and long-term liabilities

of the Company or its Subsidiaries of any nature, other than accounts payable

and accrued liabilities incurred in the ordinary course of business, and (i) all

premiums, penalties and change of control payments required to be paid or

offered in respect of any of the foregoing as a result of the consummation of

the transactions contemplated by the Transaction Documents regardless if any of

such are actually paid.

-3-

"Deposit" has the meaning set forth in Section 2.4(a).

"Dividend Shares" means the shares of Common Stock issuable in payment of

dividends payable on the Preferred Shares in accordance with the terms of the

Certificate of Designation.

"Employment Agreement" means the Employment Agreement to be entered into by

and between the Company and George K. Hickox, Jr. at the Closing, in the form

attached as Exhibit C hereto.

---------

"Environmental Laws" has the meaning set forth in Section 3.1(w)(A).

"ERISA" means the Employee Retirement Income Security Act of 1974, as

amended.

"Escrow Agreement" has the meaning set forth in Section 2.4(a).

"Exchange Act" means the Securities Exchange Act of 1934, as amended, and

the rules and regulations of the SEC promulgated thereunder.

"Financing" has the meaning set forth in Section 4.5(b).

"Financing Commitment Date" has the meaning set forth in Section 4.5(b).

"GAAP" has the meaning set forth in Section 3.1(i).

"Governmental Entity" means any agency, bureau, commission, court,

authority, department, official, political subdivision, tribunal or other

instrumentality of any government, whether (i) regulatory, administrative or

otherwise, (ii) federal, state or local or (iii) domestic or foreign.

"Hazardous Materials" has the meaning set forth in Section 3.1(w)(B).

"Hedge" and "Hedging" have the respective meanings set forth in Section

3.1(ii).

"HSR Act" means the Hart-Scott-Rodino Antitrust Improvements Act of 1976,

as amended.

"Indemnified Parties" means the Purchaser Indemnified Parties or the

Company Indemnified Parties, as the case may be.

"Indemnifying Party" has the meaning set forth in Section 8.3.

"Indenture" means the Indenture between the Company and Texas Commerce

Bank, N.A., as trustee, dated as of May 21, 1997, for the Company's 9 1/2%

Senior Subordinated Notes due 2007.

"Intangible Property" has the meaning set forth in Section 3.1(v).

-4-

"IRS" means the Internal Revenue Service.

"knowledge" (and corresponding derivative expressions) mean the actual

knowledge of the executive officers, directors or senior managers of the

Company, WIC or Purchaser, as the case may be, after reasonable inquiry.

"Law" means any constitutional provision, statute or other law, ordinance,

rule, regulation or interpretation of any thereof and any Order of any

Governmental Entity (including Environmental Laws).

"Lien" means, with respect to any asset, any mortgage, lien, pledge,

encumbrance, charge or security interest of any kind in or on such asset or the

revenues or income thereon or therefrom.

"Litigation" has the meaning set forth in Section 3.1(o).

"Management Agreement" means the Management Agreement to be entered into by

and between the Company and WIC at the Closing, in the form attached as Exhibit

-------

D hereto.

- -

"Material Adverse Effect" means any effect, change, event or occurrence

that is materially adverse to the business, operations, properties, condition

(financial or otherwise), results of operations, assets, liabilities or

prospects of the Company and its Subsidiaries taken as a whole, other than as a

result of (i) changes in oil or gas prices or (ii) general conditions in the

Company's industry (or changes in such conditions) not relating solely to the

Company or a Subsidiary in any specific manner.

"Material Contracts" has the meaning set forth in Section 3.1(p)(i).

"NYSE" means the New York Stock Exchange.

"Oil and Gas Properties" has the meaning set forth in Section 3.1(k).

"Order" means any decree, injunction, judgment, order, ruling, assessment

or writ.

"Person" means an individual or a corporation, partnership, trust,

incorporated or unincorporated association, limited liability company, joint

venture, joint stock company, Governmental Entity or other entity of any kind.

"Plan" has the meaning set forth in Section 3.1(s)(i)(A).

"Preferred Share Issuance" means the issuance of the Preferred Shares to

Purchaser at the Closing.

-5-

"Preferred Shares" means the shares of Series C Preferred Stock to be

purchased by Purchaser at the Closing pursuant to Section 2.1.

"Proxy Statement" has the meaning set forth in Section 3.1(d)(iii).

"Purchase Price" has the meaning set forth in Section 2.2(a).

"Purchaser" means WIC; provided, however, that if a permitted assignment or

assignments occur pursuant to Section 9.12(b) or 9.12(c), "Purchaser" shall mean

and include each assignee to whom such an assignment has been made (and shall

continue to mean and include WIC unless WIC has assigned all of its rights,

interests and obligations as Purchaser hereunder in accordance with the

provisions of Section 9.12).

"Purchaser Designees" has the meaning given to it in the Stockholder

Agreement.

"Purchaser Indemnified Costs" means any and all damages, losses (including

diminution in value), claims, liabilities, demands, charges, suits, penalties,

costs and expenses (including court costs and reasonable legal fees and expenses

incurred in investigating and preparing for any litigation or proceeding) that

any of the Purchaser Indemnified Parties incurs and that arise out of (i) any

breach by the Company of any of its representations or warranties under this

Agreement or any other Transaction Document or (ii) any breach by the Company of

any of its covenants or agreements under this Agreement or any other Transaction

Document.

"Purchaser Indemnified Parties" means WIC, Purchaser and each officer,

director, manager, employee, stockholder and Affiliate (other than the Company

and its Subsidiaries) of WIC and Purchaser.

"Release" has the meaning set forth in Section 3.1(w)(C).

"Remedial Action" has the meaning set forth in Section 3.1(w)(D).

"Requisite Votes" has the meaning set forth in Section 3.1(g).

"Reserve Reports" means the reserve information prepared by the Company's

independent petroleum engineers estimating the proved reserves attributable to

the Oil and Gas Properties as of December 31, 1998 and described in (i) the

Appraisal Report as of December 31, 1998 on Certain Properties Owned by The

Wiser Oil Company, prepared by DeGolyer and MacNaughton, and (ii) the Reserve

Appraisal and Economic Evaluation for The Wiser Oil Company Canada Ltd. dated as

of January 1, 1999, prepared by Gilbert Laustsen Jung Associates.

"Restated Bylaws" has the meaning set forth in Section 4.6.

-6-

"Restated Certificate" means the Restated Certificate of Incorporation of

the Company to be submitted to the stockholders of the Company for their

approval at the Stockholders' Meeting, in the form attached as Exhibit E hereto.

---------

"Rights Agreement" means the Rights Agreement dated as of October 25, 1993,

between the Company and ChaseMellon Shareholder Services, L.L.C., as successor

rights agent, as amended.

"SEC" means the Securities and Exchange Commission.

"Securities Act" means the Securities Act of 1933, as amended, and the

rules and regulations of the SEC promulgated thereunder.

"Series C Preferred Stock" means the Company's Series C Cumulative

Convertible Preferred Stock, par value $10.00 per share, which shall have the

terms set forth in the Certificate of Designation.

"Stockholder Agreement" means the Stockholder Agreement to be entered into

by and between the Company, WIC and Purchaser at the Closing, in the form

attached as Exhibit F hereto.

---------

"Stockholders' Meeting" has the meaning set forth in Section 4.1(a).

"Stock Plans" means the Company's 1991 Stock Incentive Plan, 1991 Non-

Employee Directors' Stock Option Plan, Equity Compensation Plan for Non-Employee

Directors and 1997 Share Appreciation Rights Plan, all as amended.

"Subsidiary" means (i) a corporation, a majority of whose stock with voting

power to elect directors is at the date of determination thereof, directly or

indirectly, owned by the Company, by a Subsidiary or by the Company and another

Subsidiary or (ii) any other Person (other than a corporation) in which the

Company, a Subsidiary or the Company and a Subsidiary, directly or indirectly,

at the date of determination thereof have a majority ownership interest.

"Superior Proposal" has the meaning set forth in Section 4.9(a).

"Tax" has the meaning set forth in Section 3.1(r).

"Tax Return" has the meaning set forth in Section 3.1(r).

"Third Party" has the meaning set forth in Section 4.9(d).

"third-party action" has the meaning set forth in Section 8.3.

"Transaction Documents" means this Agreement, the Certificate of

Designation, the Employment Agreement, the Escrow Agreement, the Management

Agreement, the Stockholder

-7-

Agreement, the Warrant Agreement, the Warrant Purchase Agreement and, for

purposes of Article III only, the Restated Certificate.

"Transfer" has the meaning set forth in Section 4.11.

"Underlying Common Shares" means the Conversion Shares, the Dividend Shares

and the Warrant Shares.

"Warrant Agreement" means the Warrant Agreement to be entered into by and

between the Company and WIC at the Closing, in the form attached as Exhibit A to

---------

the Warrant Purchase Agreement.

"Warrant Issuance" means the issuance of the Warrants to WIC pursuant to

the Warrant Agreement.

"Warrant Purchase Agreement" means the Warrant Purchase Agreement dated of

even date herewith between the Company and WIC, pursuant to which at the Closing

WIC will purchase the Warrants from the Company and both parties will enter into

the Warrant Agreement.

"Warrants" means the warrants issued pursuant to the terms of the Warrant

Agreement.

"Warrant Shares" means the shares of Common Stock issuable upon exercise of

the Warrants in accordance with the terms of the Warrant Agreement.

"WIC" has the meaning set forth in the introductory paragraph hereof.

SECTION 1.2 References and Titles. All references in this Agreement to

Exhibits, Schedules, Articles, Sections, subsections and other subdivisions

refer to the corresponding Exhibits, Schedules, Articles, Sections, subsections

and other subdivisions of this Agreement unless expressly provided otherwise.

Titles appearing at the beginning of any Articles, Sections, subsections or

other subdivisions of this Agreement are for convenience only, do not constitute

any part of such Articles, Sections, subsections or other subdivisions, and

shall be disregarded in construing the language contained therein. The words

"this Agreement," "herein," "hereby," "hereunder," and "hereof" and words of

similar import, refer to this Agreement as a whole and not to any particular

subdivision unless expressly so limited. The words "this Section," "this

subsection," and words of similar import, refer only to the Sections or

subsections hereof in which such words occur. The word "including" (in its

various forms) means "including without limitation." Pronouns in masculine,

feminine or neuter genders shall be construed to state and include any other

gender, and words, terms and titles (including terms defined herein) in the

singular form shall be construed to include the plural and vice versa, unless

the context otherwise expressly requires. Unless the context otherwise

requires, all defined terms contained herein shall include the singular and

plural and the conjunctive and disjunctive forms of such defined terms.

-8-

ARTICLE II

PURCHASE OF PREFERRED SHARES

SECTION 2.1 Agreement to Sell and to Purchase Shares. Subject to the

terms and conditions herein set forth, the Company will issue and sell to

Purchaser, and Purchaser will purchase from the Company, at the Closing, a total

of 1,000,000 Preferred Shares.

SECTION 2.2 Purchase Price and Payment.

(a) The purchase price payable for the Preferred Shares shall be $25.00

per Preferred Share, or $25,000,000 in the aggregate (the "Purchase Price").

(b) Payment of the Purchase Price for the Preferred Shares shall be made

by or on behalf of Purchaser by wire transfer of immediately available funds to

an account of the Company (the number for which account shall have been

furnished to Purchaser at least two Business Days prior to the Closing Date),

provided that the Deposit shall be deemed a credit to the Purchase Price as

provided in Section 2.4(b)(i).

SECTION 2.3 Delivery of Shares. Delivery of the Preferred Shares shall be

made at the Closing by delivery to Purchaser, against payment of the Purchase

Price therefor as provided herein, of a share certificate (or share certificates

in such denominations as Purchaser may reasonably request not later than three

Business Days prior to the Closing Date) representing the total number of

Preferred Shares.

SECTION 2.4 Deposit.

(a) WIC has deposited in escrow the amount of $500,000 (the "Deposit")

under an Escrow Agreement dated December 9, 1999 between the Company, WIC and

Bank One, Texas, N.A., as escrow agent (the "Escrow Agreement").

(b) The Deposit shall be held by Bank One, Texas, N.A. in escrow under the

Escrow Agreement and shall be disbursed only in accordance with the following

terms and conditions:

(i) If the purchase of the Preferred Shares contemplated hereby is

consummated in accordance with the terms hereof, then concurrently with the

Closing the Deposit shall be disbursed to the Company and applied to the

Purchase Price to be paid by Purchaser for the Preferred Shares at the

Closing.

(ii) If this Agreement is terminated by the Company pursuant to

Section 7.1(f) or is terminated by any party pursuant to Section 7.1(e)

(and provided that the Company is not then in material breach of any of its

obligations hereunder), the Deposit shall be disbursed to the Company

within three Business Days following such termination, to be retained by

the

-9-

Company as liquidated damages. The retention by the Company of the Deposit

shall be the sole remedy available to the Company in any such case.

(iii) If this Agreement is terminated pursuant to Article VII and the

Company is not entitled to a disbursement of the Deposit pursuant to

Section 2.4(b)(ii), WIC shall be entitled to a return of the Deposit within

three Business Days following such termination.

ARTICLE III

REPRESENTATIONS AND

WARRANTIES

SECTION 3.1 Representations and Warranties of the Company. The Company

represents and warrants to WIC and Purchaser as follows:

(a) Organization, Standing and Power. Each of the Company and its

Subsidiaries is a corporation or other entity duly organized, validly existing

and in good standing under the laws of the jurisdiction in which it is

incorporated or organized and has the requisite corporate or other such entity

power and authority to carry on its business as now being conducted. Each of

the Company and its Subsidiaries is duly qualified or licensed to do business

and is in good standing in each jurisdiction in which the nature of its business

or the ownership or leasing of its properties makes such qualification or

licensing necessary, other than in such jurisdictions where the failure to be so

qualified or licensed or to be in good standing, individually or in the

aggregate, has not had and could not reasonably be expected to have a Material

Adverse Effect. The Company has delivered to WIC prior to the execution of this

Agreement complete and correct copies of the Company's Certificate of

Incorporation and Bylaws, as in effect on the date of this Agreement, and has

made available to WIC the certificate of incorporation and bylaws (or comparable

organizational documents) of each of its Subsidiaries, in each case as in effect

on the date of this Agreement.

(b) Subsidiaries. Schedule 3.1(b)(i) of the Company Disclosure Schedule

sets forth a true and complete list, as of the date hereof, of each Subsidiary

of the Company, together with the jurisdiction of incorporation or organization

and the percentage of each Subsidiary's outstanding capital stock (or other

voting or equity securities or interests, as applicable) owned by the Company or

another Subsidiary of the Company. Except as set forth in Schedule 3.1(b)(ii)

of the Company Disclosure Schedule, all the outstanding shares of capital stock

(or other voting or equity securities or interests, as applicable) of each

Subsidiary of the Company have been validly issued and (with respect to

corporate Subsidiaries) are fully paid and nonassessable and are owned directly

or indirectly by the Company, free and clear of all Liens. Except for the

capital stock (or other voting or equity securities or interests, as applicable)

of its Subsidiaries and except as set forth in Schedule 3.1(b)(iii) of the

Company Disclosure Schedule, as of the date hereof, the Company does not own,

directly or indirectly, any capital stock (or other voting or equity securities

or interests, as applicable) of any corporation, limited liability company,

partnership, joint venture or other entity.

-10-

(c) Capital Structure.

(i) The authorized capital stock of the Company consists of

20,000,000 shares of Common Stock (which will be increased on the Closing

Date to 30,000,000 shares of Common Stock, par value $.01 per share,

pursuant to the Restated Certificate) and 300,000 shares of preferred

stock, par value $10.00 per share (which will be increased on the Closing

Date to 1,300,000 shares of preferred stock pursuant to the Restated

Certificate), which shares of preferred stock may be divided into and

issued in one or more series upon the creation thereof by the Board. As of

the date hereof, 8,951,965 shares of Common Stock are issued and

outstanding (including the associated preferred stock purchase rights

issued pursuant to the Rights Agreement) and 176,204 shares of Common Stock

are held by the Company in its treasury. No shares of Common Stock are

held by any of the Company's Subsidiaries. An aggregate of (A) 10,000

shares of preferred stock of the Company have been designated as the Series

A Preferred Stock as of the date hereof (which will be cancelled on the

Closing Date pursuant to the Certificate of Cancellation) and (B) 20,000

shares of preferred stock of the Company have been designated as the Series

B Preferred Stock and reserved for issuance pursuant to the Rights

Agreement, but none of such shares of preferred stock has been issued and

there is no commitment, arrangement or understanding to issue any such

shares.

(ii) There are no bonds, debentures, notes or other indebtedness

issued or outstanding having the right to vote on any matters on which

holders of capital stock of the Company may vote, including without

limitation the approval of the Preferred Share Issuance, the Warrant

Issuance and the Restated Certificate, and there is no commitment,

arrangement or understanding to issue any of such bonds, debentures, notes

or other indebtedness.

(iii) Except as contemplated in the Transaction Documents or as set

forth in Schedule 3.1(c)(iii) of the Company Disclosure Schedule and except

for the preferred stock purchase rights issued pursuant to the Rights

Agreement, there are no outstanding warrants, stock options, stock

appreciation rights or other rights to receive any capital stock of the

Company granted by the Company under the Stock Plans or otherwise.

Schedule 3.1(c)(iii) of the Company Disclosure Schedule sets forth a

complete and correct list, as of the date hereof, of the number, class and

series of shares subject to all such outstanding warrants, options, stock

appreciation rights or other rights to receive any capital stock of the

Company (collectively, "Company Options"), and the current exercise,

conversion or base prices thereof. Except for the Stock Plans and the

Company Options and except as set forth above in this Section 3.1(c), as of

the date hereof, there are no outstanding securities, options, warrants,

calls, rights, commitments, agreements, arrangements or undertakings of any

kind to which the Company or any of its Subsidiaries is a party or by which

any of them is bound obligating the Company or any of its Subsidiaries

under any circumstances to issue, deliver or sell, or cause to be issued,

delivered or sold, additional shares of capital stock (or other voting or

equity securities or interests, as applicable) of the Company or of any of

its

-11-

Subsidiaries or obligating the Company or any of its Subsidiaries to issue,

grant, extend or enter into any such security, option, warrant, call,

right, commitment, agreement, arrangement or undertaking. Except as set

forth in Schedule 3.1(c)(iii) of the Company Disclosure Schedule, there are

no outstanding contractual obligations of the Company or any of its

Subsidiaries to repurchase, redeem or otherwise acquire any shares of

capital stock (or other voting or equity securities or interests, as

applicable) of the Company or any of its Subsidiaries under any

circumstances.

(iv) All outstanding shares of capital stock (or other voting or

equity securities or interests, as applicable) of the Company and its

Subsidiaries are, and all shares which may be issued under the Company

Options will be when issued, duly authorized, validly issued, fully paid

and nonassessable and not subject to preemptive or similar rights.

(v) Except as contemplated in the Transaction Documents or as set

forth in the Stock Plans or in Schedule 3.1(c)(v) of the Company Disclosure

Schedule, there are not as of the date hereof and there will not be at the

time of the Closing any stockholder agreements, voting agreements or

trusts, proxies or other agreements or contractual obligations to which the

Company or any Subsidiary is a party or bound with respect to the voting or

disposition of any shares of the capital stock (or other voting or equity

securities or interests, as applicable) of the Company or any of its

Subsidiaries and, to the Company's knowledge, as of the date hereof, there

are no other stockholder agreements, voting agreements or trusts, proxies

or other agreements or contractual obligations among the stockholders of

the Company with respect to the voting or disposition of any shares of the

capital stock (or other voting or equity securities or interests, as

applicable) of the Company or any of its Subsidiaries.

(d) Authority; No Violations; Approvals.

(i) The Board has approved this Agreement, the other Transaction

Documents and the transactions contemplated hereby and thereby, has

declared this Agreement, the other Transaction Documents and the

transactions contemplated hereby and thereby to be in the best interests of

the stockholders of the Company and has recommended to the Company's

stockholders approval of the Preferred Share Issuance, the Warrant Issuance

and the Restated Certificate, in each case by unanimous vote of the Board

members present at the meeting of the Board at which such actions were

taken. The Company has all requisite corporate power and authority to

enter into this Agreement and the other Transaction Documents and, subject

to receipt of the approval referred to in the next following sentence, to

consummate the transactions contemplated hereby and thereby. The execution

and delivery of this Agreement and the other Transaction Documents and the

consummation of the transactions contemplated hereby and thereby have been

duly authorized by all necessary corporate action on the part of the

Company, other than the approval of the Preferred Share Issuance, the

Warrant Issuance and the Restated Certificate by the Requisite Votes of the

stockholders of the Company as provided in Section 4.1. This Agreement has

been, and at the Closing the

-12-

other Transaction Documents will be, duly executed and delivered by the

Company and, assuming this Agreement and the other Transaction Documents

constitute the valid, binding and enforceable obligations of the other

parties thereto, constitute valid and binding obligations of the Company

enforceable in accordance with their respective terms, subject, as to

enforceability, to bankruptcy, insolvency, reorganization, moratorium and

other laws of general applicability relating to or affecting creditors'

rights and to general principles of equity (regardless of whether such

enforceability is considered in a proceeding in equity or at law).

(ii) Except as set forth in Schedule 3.1(d)(ii) of the Company

Disclosure Schedule, the execution and delivery of this Agreement and the

other Transaction Documents does not, and the consummation of the

transactions contemplated hereby and thereby and compliance with the

provisions hereof and thereof will not, conflict with, or result in any

violation of or default (with or without notice or lapse of time, or both)

under, or give rise to a right of termination, cancellation or acceleration

of any material obligation or to the loss of a material benefit under, or

give rise to a right of purchase or "put" right under, or result in the

creation of any Lien upon any of the properties or assets of the Company or

any of its Subsidiaries under, any provision of (A) the Certificate of

Incorporation or Bylaws of the Company or any provision of the comparable

charter or organizational documents of any of its Subsidiaries, (B) the

Indenture, (C) any other loan or credit agreement, note, bond, mortgage,

indenture, lease or agreement to which the Company or any of its

Subsidiaries is a party or is otherwise bound or any existing Approval

applicable to the Company or any of its Subsidiaries, or (D) assuming the

Approvals referred to in Section 3.1(d)(iii) are duly and timely obtained

or made, any Law applicable to the Company or any of its Subsidiaries or

any of their respective properties or assets, other than, in the case of

clause (C) or (D), any such conflicts, violations, defaults, rights,

losses, Liens or Laws that, individually or in the aggregate, have not and

could not reasonably be expected to (x) have a Material Adverse Effect, (y)

impair the ability of the Company to perform its obligations under any of

the Transaction Documents in any material respect or (z) delay in any

material respect or prevent the consummation of any of the transactions

contemplated by any of the Transaction Documents.

(iii) No Approval of or from any Governmental Entity is required by

or with respect to the Company or any of its Subsidiaries in connection

with the execution and delivery of this Agreement or any other Transaction

Document by the Company or the consummation by the Company of the

transactions contemplated hereby or thereby, except for: (A) the filing of

a notification report by the Company under the HSR Act and the expiration

or termination of the applicable waiting period with respect thereto; (B)

the filing of the Restated Certificate, the Certificate of Designation and

the Certificate of Cancellation with the Secretary of State of Delaware in

accordance with Section 103 of the Delaware General Corporation Law; (C)

the filing with the SEC of (1) a proxy statement in preliminary and

definitive form relating to the Stockholders' Meeting to be held in

connection with the approval of the Preferred Share Issuance, the Warrant

Issuance and the Restated Certificate

-13-

(the "Proxy Statement") and (2) such reports under Section 13(a) of the

Exchange Act and such other compliance with the Exchange Act as may be

required in connection with this Agreement, the other Transaction Documents

and the transactions contemplated hereby and thereby; (D) such Approvals as

are required under the Securities Act in connection with the registration

rights granted to WIC and Purchaser under the Stockholder Agreement; (E)

such Approvals as may be required by any applicable state securities or

"blue sky" laws; (F) such Approvals as may be required by any foreign

securities, corporate or other Laws; and (G) any such Approvals the failure

of which to be made or obtained has not and could not reasonably be

expected to (1) impair the ability of the Company to perform its

obligations under any of the Transaction Documents in any material respect

or (2) delay in any material respect or prevent the consummation of any of

the transactions contemplated by any of the Transaction Documents.

(iv) The Company has received the executed, irrevocable resignation

of each of Andrew J. Shoup, Jr., Howard Hamilton and John W. Cushing III,

from the Board (and, in the case of Mr. Shoup, from the offices of

President and Chief Executive Officer), in each case effective immediately

following the Closing on the Closing Date.

(e) Status of Preferred Shares, Conversion Shares and Dividend Shares.

(i) Subject to receipt of the approval of the Preferred Share

Issuance and the Restated Certificate by the Company's stockholders as

contemplated by Section 4.1, the issuance and sale of the Preferred Shares

have been duly authorized by all necessary corporate action on the part of

the Company (other than the filing of the Restated Certificate and the

Certificate of Designation with the Secretary of State of Delaware), and

the Preferred Shares, when delivered to Purchaser at the Closing against

payment of the Purchase Price therefor as provided herein, will be validly

issued, fully paid and nonassessable, and the issuance and sale of the

Preferred Shares are not and will not be subject to preemptive rights of

any stockholder of the Company.

(ii) Subject to receipt of the approval of the Preferred Share

Issuance and the Restated Certificate by the Company's stockholders as

contemplated by Section 4.1, the reservation and issuance of the Conversion

Shares and the Dividend Shares have been duly authorized by all necessary

corporate action on the part of the Company (other than the filing of the

Restated Certificate and the Certificate of Designation with the Secretary

of State of Delaware), and the Conversion Shares, when issued upon

conversion of the Preferred Shares in accordance with the terms of the

Certificate of Designation, and the Dividend Shares, when issued in payment

of dividends payable on the Preferred Shares in accordance with the terms

of the Certificate of Designation, will be validly issued, fully paid and

nonassessable, and the issuance of the Conversion Shares and the Dividend

Shares are not and will not be subject to preemptive rights of any

stockholder of the Company.

-14-

(f) Status of Warrants and Warrant Shares.

(i) Subject to receipt of the approval of the Warrant Issuance by

the Company's stockholders as contemplated by Section 4.1, the issuance and

sale of the Warrants have been duly authorized by all necessary corporate

action on the part of the Company, and the Warrants, when issued, sold and

delivered as provided in the Warrant Purchase Agreement and the Warrant

Agreement, will be validly issued and will constitute valid and binding

obligations of the Company enforceable in accordance with the terms of the

Warrant Agreement, subject, as to enforceability, to bankruptcy,

insolvency, reorganization, moratorium and other laws of general

applicability relating to or affecting creditors' rights and to general

principles of equity (regardless of whether such enforceability is

considered in a proceeding in equity or at law).

(ii) Subject to receipt of the approval of the Warrant Issuance by

the Company's stockholders as contemplated by Section 4.1, the reservation,

issuance and sale of the Warrant Shares have been duly authorized by all

necessary corporate action on the part of the Company, and the Warrant

Shares, when issued and delivered upon exercise of the Warrants in

accordance with the provisions of the Warrant Agreement, will be validly

issued, fully paid and nonassessable, and the issuance and sale of the

Warrant Shares are not and will not be subject to preemptive rights of any

stockholder of the Company.

(g) Requisite Votes. Pursuant to Section 4.1, the Company will seek, at

the Stockholders' Meeting, the approval of (i) each of the Preferred Share

Issuance and the Warrant Issuance by the affirmative vote of (A) a majority of

the total votes cast on the proposal by the holders of Common Stock, in

accordance with Paragraph 312.07 of the NYSE Listed Company Manual, and (B) a

majority of the shares of Common Stock present in person or represented by proxy

at the Stockholders' Meeting and entitled to vote thereon, in accordance with

Section 216 of the Delaware General Corporation Law, and (ii) the Restated

Certificate by the affirmative vote of the holders of a majority of the issued

and outstanding shares of Common Stock entitled to vote thereon (the "Requisite

Votes"). There are no approvals of the Transaction Documents and the

transactions contemplated thereby that are required of the holders of any class

or series of capital stock of the Company under the requirements of the NYSE or

any Law other than the Requisite Votes.

(h) Certain Anti-Takeover Provisions; Amendment to Rights Agreement.

(i) The Board has duly approved each of WIC and Purchaser, and of

WIC and Purchaser as a "group" (as such term is used in Rule 13d-5 of the

rules and regulations promulgated under the Exchange Act), becoming an

"interested stockholder" within the meaning of Section 203 of the Delaware

General Corporation Law by reason of the acquisition by WIC and Purchaser

of the Preferred Shares, the Conversion Shares, the Dividend Shares, the

Warrants and the Warrant Shares, and such approval is sufficient to render

inapplicable to the transactions contemplated by the Transaction Documents

the restrictions contained in such Section 203.

-15-

(ii) The Board has taken all necessary action to amend the Rights

Agreement so that none of the execution and delivery of this Agreement and

the other Transaction Documents and the consummation of the transactions

contemplated hereby and thereby (including, without limitation, the receipt

of Conversion Shares or Dividend Shares in respect of the Preferred Shares

or the receipt of Warrant Shares upon the exercise of the Warrants) will

upon the lapse of any waiting period cause (A) any of WIC, Purchaser or any

"group" consisting of WIC or Purchaser to constitute an "Acquiring Person"

(as defined in the Rights Agreement), (B) the preferred stock purchase

rights issued pursuant to the Rights Agreement to become exercisable under

the Rights Agreement or (C) the distribution of "Rights Certificates" (as

defined in the Rights Agreement).

(iii) The Board has taken, or will take, all necessary action to

approve the appointment of the Purchaser Designees to the Board so that

such appointment will not contribute to or result in a "Change of Control"

as defined in the Indenture.

(i) SEC Documents. The Company has made available to WIC a true and

complete copy of each report, schedule, registration statement and definitive

proxy statement filed by the Company with the SEC since December 31, 1997 and

prior to or on the date of this Agreement (the "Company SEC Documents"), which

are all the documents (other than preliminary materials) that the Company was

required to file with the SEC between December 31, 1997 and the date of this

Agreement. As of their respective dates, the Company SEC Documents complied in

all material respects with the requirements of the Securities Act or the

Exchange Act, as the case may be, and the rules and regulations of the SEC

thereunder applicable to such Company SEC Documents, and none of the Company SEC

Documents contained any untrue statement of a material fact or omitted to state

a material fact required to be stated therein or necessary to make the

statements therein, in light of the circumstances under which they were made,

not misleading. The financial statements of the Company included in the Company

SEC Documents complied as to form in all material respects with the published

rules and regulations of the SEC with respect thereto, were prepared in

accordance with United States generally accepted accounting principles ("GAAP")

applied on a consistent basis during the periods involved (except as may be

indicated in the notes thereto or, in the case of the unaudited statements, as

permitted by Rule 10-01 of Regulation S-X of the SEC) and fairly present in all

material respects and in accordance with applicable requirements of GAAP

(subject, in the case of the unaudited statements, to normal, recurring

adjustments, none of which is material) the consolidated financial position of

the Company and its consolidated Subsidiaries as of their respective dates and

the consolidated results of operations and the consolidated cash flows of the

Company and its consolidated Subsidiaries for the periods presented therein.

(j) Information Supplied. None of the information included or

incorporated by reference in the Proxy Statement will, at the date mailed to

stockholders of the Company or at the time of the Stockholders' Meeting or as of

the Closing, contain any statement which, at the time and in the light of the

circumstances under which it is made, is false or misleading with respect to any

material fact or omit to state any material fact necessary in order to make the

statements therein not

-16-

false or misleading. The Proxy Statement will comply as to form in all material

respects with the provisions of the Exchange Act. The representations and

warranties contained in this Section 3.1(j) shall not apply to statements or

omissions in the Proxy Statement based upon information furnished in writing to

the Company by WIC or Purchaser expressly for use therein.

(k) Absence of Certain Changes or Events. Except as set forth in Schedule

3.1(k) of the Company Disclosure Schedule or as disclosed in, or reflected in

the financial statements included in, the Company SEC Documents, or except as

contemplated by this Agreement, since December 31, 1998 the Company and its

Subsidiaries have conducted their business only in the ordinary course

consistent with past practice, and there has not occurred: (i) any event that

would have been prohibited by Section 4.4 if the terms of such Section had been

in effect as of and after December 31, 1998; (ii) any material casualties

affecting the Company or any of its Subsidiaries or any material loss, damage or

destruction to any of their respective properties or assets, including the Oil

and Gas Properties; or (iii) any event, circumstance or fact that has or could

reasonably be expected to (x) have a Material Adverse Effect, (y) impair the

ability of the Company to perform its obligations under any of the Transaction

Documents in any material respect or (z) delay in any material respect or

prevent the consummation of any of the transactions contemplated by any of the

Transaction Documents.

(l) No Undisclosed Material Liabilities. Except as disclosed in the

Company SEC Documents, there are no material liabilities or obligations of the

Company or any of its Subsidiaries of any kind whatsoever, whether accrued,

contingent, absolute, determined, determinable or otherwise, required by GAAP to

be recognized or disclosed on a consolidated balance sheet of the Company and

its consolidated Subsidiaries or in the notes thereto, other than: (i)

liabilities adequately provided for on the balance sheet of the Company dated as

of September 30, 1999 (including the notes thereto) contained in the Company's

Quarterly Report on Form 10-Q for the three months ended September 30, 1999;

(ii) liabilities incurred in the ordinary course of business consistent with

past practice since September 30, 1999; and (iii) liabilities arising under the

Transaction Documents.

(m) No Default. Neither the Company nor any of its Subsidiaries is in

default or violation (and no event has occurred which, with notice or the lapse

of time or both, would constitute a default or violation) of any term, condition

or provision of (i) the Certificate of Incorporation or Bylaws of the Company or

the comparable charter or organizational documents of any of its Subsidiaries,

(ii) any loan or credit agreement, note, bond, mortgage, indenture, lease,

instrument, permit, concession, franchise, license or any other contract,

agreement, arrangement or understanding to which the Company or any of its

Subsidiaries is a party or by which the Company or any of its Subsidiaries or

any of their respective properties or assets is bound, or (iii) any Law

applicable to the Company or any of its Subsidiaries, except in the case of

clauses (ii) and (iii), for violations or defaults that, individually or in the

aggregate, have not and could not reasonably be expected to (x) have a Material

Adverse Effect, (y) impair the ability of the Company to perform its obligations

under any of the Transaction Documents in any material respect or (z) delay in

any material respect or prevent the consummation of any of the transactions

contemplated by any of the Transaction Documents. The

-17-

Company (i) is not in breach of or default under any financial covenant under

the Restated Credit Agreement dated May 10, 1999, among the Company, Bank One,

Texas, N.A., as agent, and the other parties thereto (the "Credit Facility") and

(ii) does not have any reason to believe that it will be in breach of or default

under any financial covenant under the Credit Facility as of the next date on

which the Company is required to be in compliance with any such financial

covenant (other than any breaches or defaults which the Company reasonably

believes will be waived by the lenders under the Credit Facility).

(n) Compliance with Applicable Laws. The Company and each of its

Subsidiaries has in effect all Approvals of all Governmental Entities necessary

for the lawful conduct of their respective businesses, and there has occurred no

default or violation (and no event has occurred which, with notice or the lapse

of time or both, would constitute a default or violation) under any such

Approval, except for failures to obtain, or for defaults or violations under,

Approvals which failures, defaults or violations, individually or in the

aggregate, have not and could not reasonably be expected to (i) have a Material

Adverse Effect, (ii) impair the ability of the Company to perform its

obligations under any of the Transaction Documents in any material respect or

(iii) delay in any material respect or prevent the consummation of any of the

transactions contemplated by any of the Transaction Documents. Except as

disclosed in the Company SEC Documents, the businesses of the Company and its

Subsidiaries are in compliance with all applicable Laws, except for possible

noncompliance which, individually or in the aggregate, has not had and could not

reasonably be expected to have any effect referred to in clause (i), (ii) or

(iii) above. No investigation or review by any Governmental Entity with respect

to the Company, any of its Subsidiaries, the transactions contemplated by this

Agreement and the other Transaction Documents, is pending or, to the knowledge

of the Company, threatened, nor has any Governmental Entity indicated to the

Company or any of its Subsidiaries any intention to conduct the same, other than

those the outcome of which, individually or in the aggregate, has not had and

could not reasonably be expected to have any effect referred to in clause (i),

(ii) or (iii) above.

(o) Litigation. Except as disclosed in the Company SEC Documents or set

forth in Schedule 3.1(o) of the Company Disclosure Schedule, there is no suit,

action, proceeding or claim, at law or in equity, pending before any

Governmental Entity, or, to the knowledge of the Company, threatened, against

the Company or any of its Subsidiaries ("Litigation"), and neither the Company

nor any of its Subsidiaries is a party to any Litigation, and the Company and

its Subsidiaries have no knowledge of any facts that are likely to give rise to

any Litigation, that, individually or in the aggregate, has or could reasonably

be expected to (i) have a Material Adverse Effect, (ii) impair the ability of

the Company to perform its obligations under any of the Transaction Documents in

any material respect or (iii) delay in any material respect or prevent the

consummation of any of the transactions contemplated by any of the Transaction

Documents, nor is there any Order of any Governmental Entity or arbitrator

outstanding against the Company or any of its Subsidiaries which, individually

or in the aggregate, has had or could reasonably be expected to have any effect

referred to in clause (i), (ii) or (iii) above.

-18-

(p) Certain Agreements.

(i) Except as set forth in Schedule 3.1(p)(i) of the Company

Disclosure Schedule or as included as an exhibit to the Company's Annual

Report on Form 10-K for the year ended December 31, 1998 or Quarterly

Reports on Form 10-Q for the quarters ended March 31, 1999, June 30, 1999

and September 30, 1999, respectively, there are no (A) employment or

consulting Contracts (unless such employment or consulting Contracts are

terminable without liability or penalty on 30 days or less notice), (B)

Contracts under which the Company or any of its Subsidiaries remains

obligated to provide goods or services having a value, or to make payments

aggregating (for Debt or otherwise), in excess of $500,000 per year with

respect to any one Contract, (C) other Contracts that are material to the

Company and its Subsidiaries, taken as a whole, and (D) Contracts with

Affiliates, in any such case, to which the Company or any Subsidiary is a

party or to which the Company or any Subsidiary or their respective assets

are bound (such Contracts included as exhibits to such Company SEC

Documents or disclosed or required to be disclosed in Schedule 3.1(p)(i),

collectively the "Material Contracts"). Each Material Contract is a valid

and binding obligation of the Company or one of its Subsidiaries and, to

the knowledge of the Company, of each party thereto other than the Company

or its respective Subsidiary and is in full force and effect.

(ii) The Company or the relevant Subsidiary and, to the knowledge of

the Company, each other party to the Material Contracts, has performed in

all material respects the obligations required to be performed by it under

the Material Contracts and is not (with or without lapse of time or the

giving of notice, or both) in breach or default thereunder in any material

respect.

(iii) Schedule 3.1(p)(iii) of the Company Disclosure Schedule

identifies, as to each Material Contract, (A) whether the consent of the

other party thereto is required, (B) whether notice must be provided to any

party thereto (and the length of such notice) and (C) whether any payments

are required (and the amount of such payments), in each case in order for

such Material Contract to continue in full force and effect upon the

consummation of the transactions contemplated by the Transaction Documents,

and (D) whether such Material Contract can be canceled by the other party

without liability to such other party due to the consummation of the

transactions contemplated by the Transaction Documents.

(iv) A complete copy of each written Material Contract has been made

available to WIC prior to the date of this Agreement. Schedule 3.1(p)(iv)

sets forth a written description of each oral Material Contract.

(v) The Company has made available to WIC (A) true and correct

copies of all loan or credit agreements, notes, bonds, mortgages,

indentures and other agreements and instruments pursuant to which any Debt

of the Company or any of its Subsidiaries is

-19-

outstanding or may be incurred and (B) accurate information regarding the

respective principal amounts currently outstanding thereunder.

(q) Title.

(i) Except as disclosed in the Company SEC Documents or set forth

in Schedule 3.1(q)(i) of the Company Disclosure Schedule, the Company and

its Subsidiaries have good and indefeasible title to all leasehold and

other interests in oil, gas and other mineral properties owned by the

Company or its Subsidiaries (the "Oil and Gas Properties"), which are

necessary for the Company or its Subsidiaries to receive from the wells or

units to be located on the Oil and Gas Properties, except as has not had

and could not reasonably be expected to have, individually or in the

aggregate, a Material Adverse Effect, a percentage of the oil, gas and

other hydrocarbons produced from such well or unit equal to not less than

the percentage set forth as the "Net Revenue Interest" in those portions of

the Reserve Reports attributable thereto, without reduction, suspension, or

termination throughout the