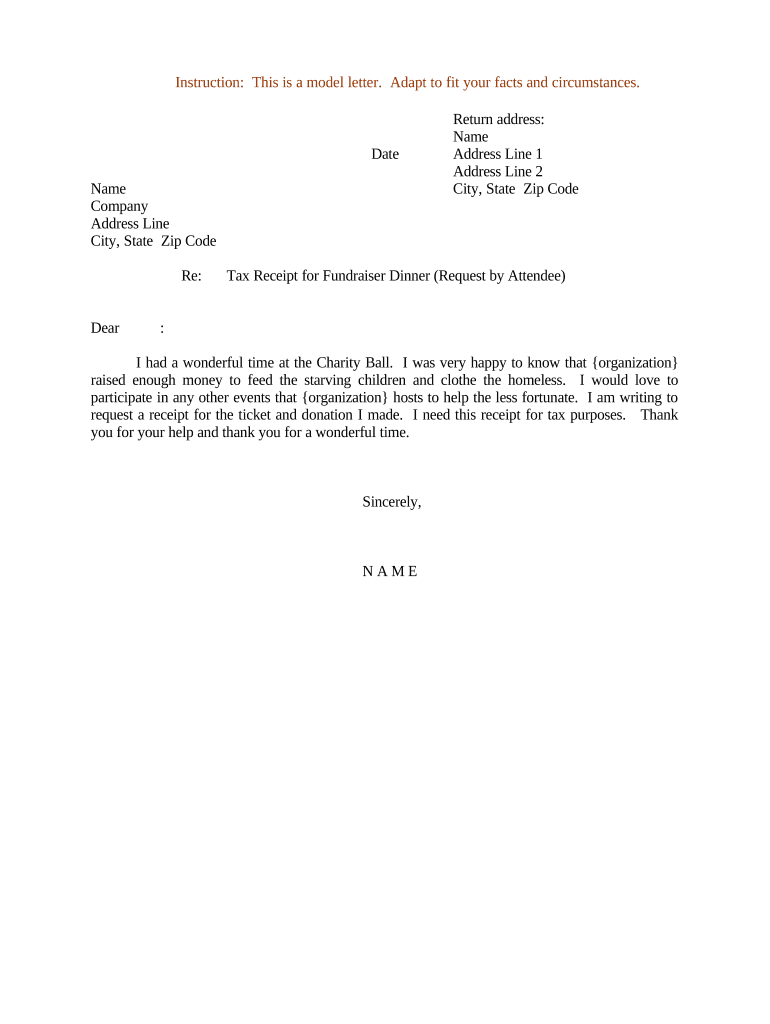

Fill and Sign the Tax Receipt Form

Useful tips for finalizing your ‘Tax Receipt Form’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for both individuals and companies. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the robust capabilities included in this intuitive and affordable platform to transform your document management strategy. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow simplifies the process with just a few clicks.

Adhere to this detailed guide:

- Access your account or initiate a free trial with our service.

- Hit +Create to bring in a file from your device, cloud storage, or our template collection.

- Open your ‘Tax Receipt Form’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for other participants (if necessary).

- Continue with the Send Invite options to solicit eSignatures from others.

- Download, print your copy, or transform it into a reusable template.

Don’t fret if you need to work with others on your Tax Receipt Form or send it for notarization—our solution provides everything you require to accomplish such tasks. Register for an account with airSlate SignNow today and enhance your document management experience!

FAQs

-

What is a Tax Receipt Form and why do I need it?

A Tax Receipt Form is a document that provides proof of payment for goods or services received, which is essential for tax deduction purposes. Using airSlate SignNow, you can easily create and manage Tax Receipt Forms, ensuring you have accurate records for your finances. This form helps streamline your accounting processes and can save you time during tax season.

-

How can airSlate SignNow help me with my Tax Receipt Form?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign your Tax Receipt Form in just a few clicks. You can customize the form to meet your specific needs, making it easy to capture all necessary information. Additionally, the platform keeps your documents secure and organized, enhancing your workflow.

-

Is there a cost associated with using the Tax Receipt Form feature in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the Tax Receipt Form feature. Depending on your business needs, you can choose a plan that fits your budget while providing the essential tools for document management and eSigning. Visit our pricing page for detailed information on the best plan for your requirements.

-

Can I integrate airSlate SignNow with other software for managing Tax Receipt Forms?

Absolutely! airSlate SignNow provides seamless integrations with popular software applications, allowing you to sync your Tax Receipt Forms with tools you already use. This integration capability enhances your productivity by streamlining your workflow and ensuring all your documents are connected across platforms.

-

What are the benefits of using airSlate SignNow for my Tax Receipt Form?

Using airSlate SignNow for your Tax Receipt Form offers numerous benefits, including time-saving automation, easy document tracking, and enhanced security. Our platform ensures that your forms are completed accurately and stored securely, reducing the risk of lost documentation. Plus, you can access your forms from anywhere, making it convenient for busy professionals.

-

How secure is my Tax Receipt Form information in airSlate SignNow?

Security is a top priority at airSlate SignNow. Your Tax Receipt Form and all associated data are protected with industry-standard encryption and secure cloud storage. We comply with strict regulations to ensure your sensitive information remains confidential and safe from unauthorized access.

-

Can I customize my Tax Receipt Form in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your Tax Receipt Form to match your branding and specific requirements. You can modify fields, add your logo, and include any necessary disclaimers to ensure the form meets your business needs. This level of customization helps you present a professional image to your clients.

The best way to complete and sign your tax receipt form

Find out other tax receipt form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles