Fill and Sign the Revocable Trust Property Record Form

Useful suggestions for preparing your ‘The Revocable Trust Property Record’ online

Are you fed up with the complications of handling paperwork? Look no further than airSlate SignNow, the leading eSignature platform for both individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and approve paperwork online. Utilize the powerful features embedded within this intuitive and cost-effective platform to transform your approach to document management. Whether you need to authorize forms or collect signatures, airSlate SignNow manages it all effortlessly, with only a few clicks.

Follow these comprehensive steps:

- Access your account or register for a complimentary trial with our service.

- Click +Create to add a file from your device, cloud storage, or our template library.

- Open your ‘The Revocable Trust Property Record’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

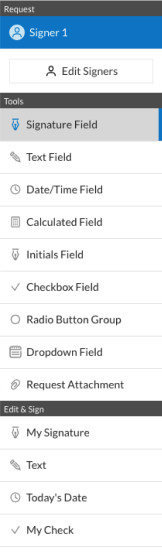

- Insert and designate fillable fields for others (if necessary).

- Continue with the Send Invite options to request eSignatures from additional parties.

- Download, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to work with others on your The Revocable Trust Property Record or send it for notarization—our platform provides all the resources necessary to accomplish those tasks. Create an account with airSlate SignNow today and take your document management to new levels!

FAQs

-

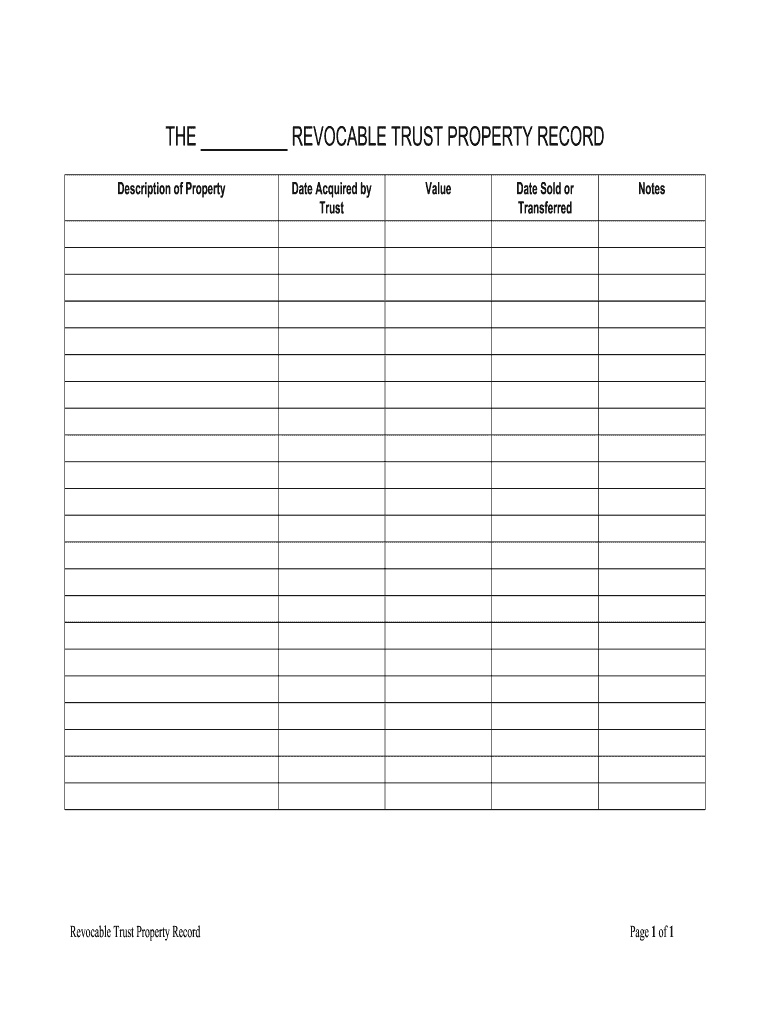

What is THE REVOCABLE TRUST PROPERTY RECORD?

THE REVOCABLE TRUST PROPERTY RECORD is a legal document that outlines the assets held in a revocable trust. It provides clarity on ownership and management of the property during the grantor's lifetime and after their passing. Understanding this record is essential for effective estate planning.

-

How can airSlate SignNow help with managing THE REVOCABLE TRUST PROPERTY RECORD?

airSlate SignNow offers a streamlined platform for creating, signing, and managing THE REVOCABLE TRUST PROPERTY RECORD. With our easy-to-use interface, you can ensure that all necessary documents are securely signed and stored. This simplifies the process of managing your trust assets.

-

What are the benefits of using airSlate SignNow for THE REVOCABLE TRUST PROPERTY RECORD?

Using airSlate SignNow for THE REVOCABLE TRUST PROPERTY RECORD provides several benefits, including enhanced security, ease of access, and cost-effectiveness. Our platform allows you to manage documents from anywhere, ensuring that your trust records are always up-to-date and accessible. This can save you time and reduce stress in managing your estate.

-

Is there a cost associated with using airSlate SignNow for THE REVOCABLE TRUST PROPERTY RECORD?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs, including those related to THE REVOCABLE TRUST PROPERTY RECORD. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment in document management. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for managing THE REVOCABLE TRUST PROPERTY RECORD?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your ability to manage THE REVOCABLE TRUST PROPERTY RECORD. Whether you use CRM systems, cloud storage, or other document management solutions, our integrations ensure a smooth workflow and better organization of your trust documents.

-

How secure is my data when using airSlate SignNow for THE REVOCABLE TRUST PROPERTY RECORD?

Security is a top priority at airSlate SignNow. When managing THE REVOCABLE TRUST PROPERTY RECORD, your data is protected with advanced encryption and secure storage solutions. We comply with industry standards to ensure that your sensitive information remains confidential and secure.

-

Can I access THE REVOCABLE TRUST PROPERTY RECORD from multiple devices?

Yes, airSlate SignNow allows you to access THE REVOCABLE TRUST PROPERTY RECORD from any device with internet connectivity. This flexibility ensures that you can manage your trust documents on-the-go, whether you are using a computer, tablet, or smartphone. Stay organized and in control of your estate planning anytime, anywhere.

The best way to complete and sign your the revocable trust property record form

Get more for the revocable trust property record form

Find out other the revocable trust property record form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles