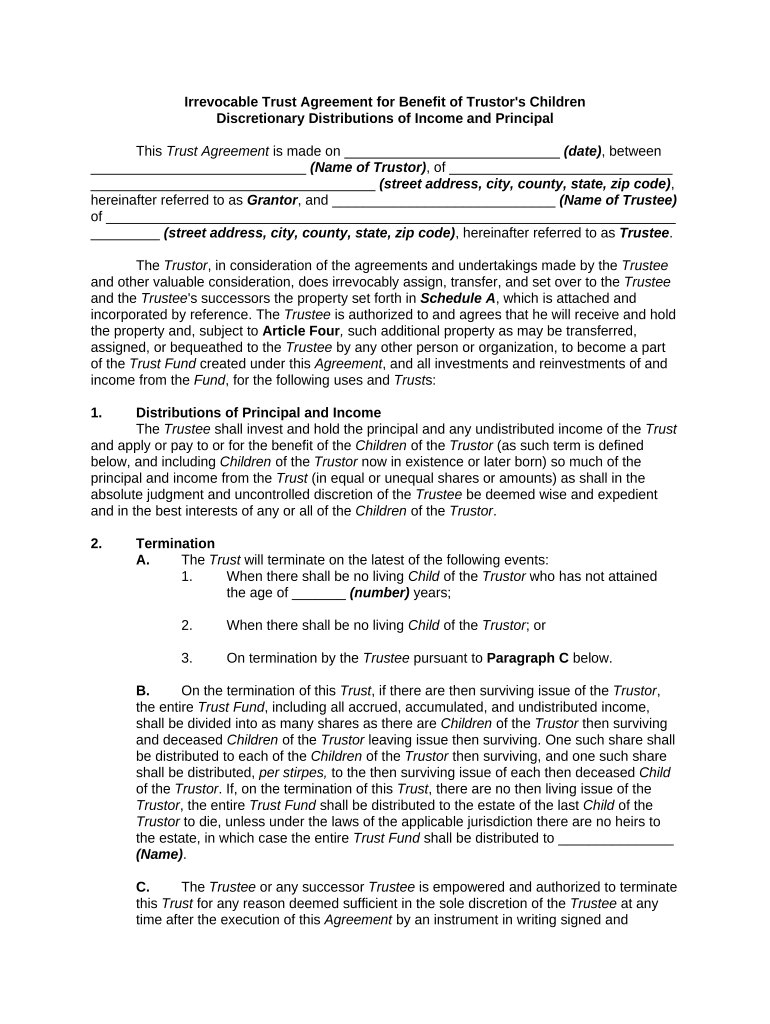

Irrevocable Trust Agreement for Benefit of Trustor's Children

Discretionary Distributions of Income and Principal

This Trust Agreement is made on ____________________________ ( date) , between

____________________________ (Name of Trustor) , of _____________________________

_____________________________________ (street address, city, county, state, zip code) ,

hereinafter referred to as Grantor , and _____________________________ (Name of Trustee)

of __________________________________________________________________________

_________ (street address, city, county, state, zip code) , hereinafter referred to as Trustee .

The Trustor , in consideration of the agreements and undertakings made by the Trustee

and other valuable consideration, does irrevocably assign, transfer, and set over to the Trustee

and the Trustee 's successors the property set forth in Schedule A , which is attached and

incorporated by reference. The Trustee is authorized to and agrees that he will receive and hold

the property and, subject to Article Four , such additional property as may be transferred,

assigned, or bequeathed to the Trustee by any other person or organization, to become a part

of the Trust Fund created under this Agreement , and all investments and reinvestments of and

income from the Fund , for the following uses and Trust s:

1. Distributions of Principal and Income

The Trustee shall invest and hold the principal and any undistributed income of the Trust

and apply or pay to or for the benefit of the Children of the Trustor (as such term is defined

below, and including Children of the Trustor now in existence or later born) so much of the

principal and income from the Trust (in equal or unequal shares or amounts) as shall in the

absolute judgment and uncontrolled discretion of the Trustee be deemed wise and expedient

and in the best interests of any or all of the Children of the Trustor .

2. Termination

A. The Trust will terminate on the latest of the following events:

1. When there shall be no living Child of the Trustor who has not attained

the age of _______ (number) years;

2. When there shall be no living Child of the Trustor ; or

3. On termination by the Trustee pursuant to Paragraph C below.

B. On the termination of this Trust , if there are then surviving issue of the Trustor ,

the entire Trust Fund , including all accrued, accumulated, and undistributed income,

shall be divided into as many shares as there are Children of the Trustor then surviving

and deceased Children of the Trustor leaving issue then surviving. One such share shall

be distributed to each of the Children of the Trustor then surviving, and one such share

shall be distributed, per stirpes, to the then surviving issue of each then deceased Child

of the Trustor . If, on the termination of this Trust , there are no then living issue of the

Trustor , the entire Trust Fund shall be distributed to the estate of the last Child of the

Trustor to die, unless under the laws of the applicable jurisdiction there are no heirs to

the estate, in which case the entire Trust Fund shall be distributed to _______________

(Name) .

C. The Trustee or any successor Trustee is empowered and authorized to terminate

this Trust for any reason deemed sufficient in the sole discretion of the Trustee at any

time after the execution of this Agreement by an instrument in writing signed and

acknowledged by the Trustee or a successor.

3. Payments for Minors

The Trustee shall have full power to make payments to or for a minor in any one or more

of the following ways:

A. To the name of the minor as by depositing cash or registering securities in his or

her name, whether or not the person is then able to exercise control over the property;

B. To any custodian under the Uniform Transfers (or Gifts) to Minors Act or similar

statutes, all without bond. The Trustee shall also have full power to make payments for a

beneficiary of this Trust , whether or not a minor, directly to any person or organization,

other than the Trustor or any other Trustor or the spouse of either of the foregoing, in

payment for the education, medical, or other expense of or incurred by the minor. No

payment or distribution shall be made by the Trustee which would have the effect of

satisfying any legal obligation of the Trustor or any other Trustor or the spouse of either

of the foregoing other than the legal obligation of any such person to support or maintain

the beneficiary to or on whose behalf the payment or distribution is made.

4. Additions to Trust

The Trustor , or any other person or organization, may at any time give, transfer or

bequeath to the Trust created by this instrument, either by inter vivos transfer or

testamentary disposition, additional money or property of any kind acceptable to the

Trustee . In that event, such additional property shall become a part of the Trust created

by this instrument and shall be divided, allocated, administered, and distributed as if it

originally had been a part of the Trust . The Trustee may assume any obligation

associated with any such property.

5. Irrevocability

This instrument constitutes an irrevocable gift in Trust of all property at any time held

this Agreement and any future gift, whether by the Trustor or any other person or

organization as Trustor , shall likewise be irrevocable. Any right, title, or reversionary

interest in the same, of any kind or description, which the Trustor or any other Trustor or

the spouse of either of the foregoing may have or subsequently acquire, by operation of

law or otherwise, is and shall, by the making of the gift to this Trust , be renounced,

relinquished, and divested forever, excepting, however, the possibility that the Trustor or

any other Trustor , or the spouse of either of them, might receive back from a beneficiary

an interest in the Trust by inheritance.

6. Trustee’s Discretion

In allotting or making any division of or payment or distribution from the Trust Fund or

any portion of it for any purpose under this Agreement , the Trustee shall not be required

to convert any property, real or personal, tangible or intangible, into money or to divide

or apportion each or any item of property, but may, in the sole discretion of the Trustee ,

allot all or any part (including an undivided interest) of any item of property, real or

personal, tangible or intangible, to any Fund or to any beneficiary provided for by this

instrument; or the Trustee may convert any property into any other form, it being the

Trustor 's intent and purpose to leave all such divisions and apportionments entirely to

the discretion of the Trustee with the direction merely that each Fund , share, portion, or

part at any time created or provided for in this Agreement shall be constituted so that the

same shall have the value, relative or absolute, designated by this instrument.

7. Powers of Trustee

Subject only to the provisions and limitations set forth in this Article 7 and elsewhere in

this instrument, the Trustee , in extension and not in limitation of the powers given them

by law or other provisions of this instrument, shall have the following powers with respect

to the Trust created in this Agreement and its property, in each case to be exercised

from time to time in their discretion and without order or license of any court:

A. To invest any money held under this Agreement and available for investment in

and to retain stocks, bonds, securities, and other property, real and personal, whether or

not of the kind authorized by the common law or by the laws of _________________

(state) , without liability for any decrease in the value of the same;

B. To invest and reinvest and retain the investment of the whole or any part of the

Trust or any and all of the proceeds from the disposition of any assets of the Trust Fund

in any single security or other asset, or any limited number of securities or other assets,

or any exchanged or merged or substituted or successor security or securities, or any

single type or limited number of types of securities or other assets, without liability for

any loss resulting from any lack of diversification, it being the intention to free and

absolve the Trustee s from any and all obligation or liability for any lack of diversification

of investments and assets held in the Trust Fund , or any loss resulting from the same,

regardless of whether they are exchanged or merged or successor or substitute

investments;

C. To sell, at public or private sale, exchange for like or unlike property, convey,

lease for longer or shorter terms than the Trust provided, and otherwise dispose of, any

and all property, real or personal, held under this Agreement for such price and on such

terms and credit as it may deem proper;

D. To change the situs of the Trust to any other location within or without the United

States of America;

E. To vote directly or by proxy at any election or stockholders' meeting any shares

of stock held under this Agreement ;

F. To exercise or dispose of or reject any purchase rights arising from or issued in

connection with any stock, securities, or other property held under this Agreement ;

G. To form or join in forming any corporation and to subscribe for or acquire stock in

any corporation in exchange for money or other property; to participate in any plan or

proceeding for protecting or enforcing any right, obligation, or interest arising from any

stock, bond, note, securities, or other property held under this Agreement , or for

reorganizing, consolidating, merging, or adjusting the finances of any corporation issuing

the same; to accept in lieu of the same any new property; to pay any assessment or

expense incident to such property; to join in any voting Trust Agreement ; and to do any

other act or thing which it may deem necessary or advisable in connection with the

same;

H. To employ servants, agents, custodians of securities, or other property and

attorneys-at-law or in-fact, and to obtain the advice of any bank , trust company,

investment counsel, or any other institution or individual and permit books of account to

be kept by any of the foregoing and pay for such services out of the property held under

this Agreement , charging the same to the Trust Fund ;

I. To collect, pay, abandon, contest, compromise, or submit to arbitration any claim

in favor of or against the Trust Fund or the Trustee s in their fiduciary capacity;

J. To lend or borrow money for such periods of time and on such terms and

conditions as the Trustee s may deem advisable for any purpose whatsoever; and the

Trustee s may mortgage and pledge such part or the whole of the Trust Fund as may be

required to secure any loan or loans undertaken by the Trustee pursuant to this

Agreement ;

K. To hold stocks and other assets and to open bank accounts for deposits of

money comprising a part of the Trust Fund in the name of the Trustee s or of their

nominee with or without mention of the Trust or the disclosure of any fiduciary

relationship, and to employ custodians of securities or other property and to permit any

such custodian to hold securities or other property in its own name or in the name of its

nominee, with or without mention of the Trust or the disclosure of any fiduciary

relationship;

L. To make distributions in cash or in kind, or partly in cash and partly in kind.

8. Limitations on Trustee’s Powers

Notwithstanding any powers conferred on the Trustee elsewhere in this Agreement , no

Trustee or successor Trustee under this Agreement or any other person shall have at

any time, or in any manner or capacity, either directly or indirectly, (a) the power to

exercise any power of administration over the Trust other than in a fiduciary capacity for

the benefit of the beneficiaries under this Agreement , or (b) the power to do any of the

following in respect to the Trust and Trust Fund created under this Agreement :

A. To re-vest title to any part of the Trust Fund in the Trustor or any other Trustor or

the spouse of either of the foregoing; to hold or accumulate any part of the income of the

Trust or Trust Fund for future distribution to the Trustor or any other Trustor or the

spouse of either of the foregoing; to distribute any part of the income of the Trust to the

Trustor or any other Trustor or the spouse of either of the foregoing; or to apply any part

of the income or principal to the payment of premiums on policies of insurance on the life

of the Trustor or any other Trustor or the spouse of either of the foregoing.

B. To enable any person to purchase, exchange, or otherwise deal with or dispose

of any part or all of the principal or income of the Trust for less than adequate and full

consideration in money or money's worth.

C. To enable the Trustor or any other Trustor or the spouse of either of the

foregoing, directly or indirectly, to borrow any part or all of the principal or income of the

Trust except with adequate interest and adequate security.

D. To exercise any power of administration over the Trust other than in a fiduciary

capacity for the benefit of the beneficiaries under this Agreement .

9. Governing Law

The construction, validity, and effect of this Agreement and the rights and duties of the

beneficiaries and Trustee under it shall at all times be governed exclusively by the laws

of __________________ ( state) (whether or not any change of situs has been effected).

10. Counterparts

This Agreement may be executed in any number of counterparts, any one of which shall

constitute the Agreement between the parties.

11. Construction

A. Unless the context requires otherwise, all words used in this instrument in the

singular number shall extend to and include the plural; all words used in the plural

number shall extend to and include the singular; and all words used in any gender shall

extend to and include all genders.

B. For all purposes under this instrument, the adoption of a minor who is not an

issue of the Trustor by a person or persons shall have the same effect except for

determining his or her age as if the minor were born to the person or persons on the

date of his or her adoption.

C. As used in this instrument, the term Children means first generation offspring of

the designated ancestor; the term issue means both Children of the designated ancestor

and lineal descendants indefinitely.

D. As used in this instrument, the term Trustee shall include all those holding that

office under this Agreement from time to time without regard to whether they were

initially appointed, successor, or additional Trustee s.

12. Trustees

A. __________________________ (Name of Trustee) of ____________________

______________________________________ (street address, city, state, zip code) ,

is appointed initial Trustee under this Agreement . In the event that such initially

appointed Trustee , for any reason, ceases to be a Trustee under this Agreement , that

person shall have the power, by written instrument executed at or prior to the date the

person ceases to be a Trustee , to appoint his successor as Trustee . In the event a

successor Trustee is not so appointed, then (e.g. Name of Bank) __________________

_____________________ of _______________________________________________

_______________________ (street address, city, state, zip code) , or any legal

successor to that (e.g., Bank) ________________________ , shall appoint the successor

Trustee .

B. Any individual or corporation at any time serving as Trustee under this

Agreement may resign as Trustee by delivering a written instrument to his or her or its

successor Trustee or, if no successor Trustee has or is to be appointed, to the (e.g.

Name of Bank) __________________________________ of _____________________

_______________________________________ (street address, city, state, zip code ,

or any legal successor to that Bank. Any such resignation shall be effective as of the

date of the completion of delivery of the instrument to such persons or as of such later

date as shall be specified in the instrument.

C. No Trustee to or from whom or to or from whose spouse or issue a payment or

distribution of property, income, or principal may be made or withheld under any of the

provisions of this instrument shall be permitted or required by the provisions of this

Agreement to vote on or participate in any action taken on the same.

D. All discretionary powers and duties vested in any Trustee under this Agreement

which is not a natural person may be exercised on its behalf, from time to time, by its

governing board, or by an appropriate committee, or by its principal officers or Trust

officers.

E. No bond or other security shall ever be required to be given or be filed by any

Trustee under this Agreement for the faithful execution of his or her or its duty under this

Agreement . If, notwithstanding the foregoing provision, a bond shall nevertheless be

required, no security shall be required on the bond.

F. No Trustee under this Agreement shall be liable except for willful malfeasance or

bad faith.

The parties have executed this Agreement on the day and year first above written.

______________________________________ ___________________________________

Name & Signature of Trustor Name & Signature of Trustee

( Acknowledgments before Notary Public)

(Attach Exhibit)