Fill and Sign the Wage Ampamp Tax Statement Form W 2 What is it Do You Need Itwages W2ftbcagov Franchise Tax Board Homepageabout Form 4852

Practical advice for preparing your ‘Wage Ampamp Tax Statement Form W 2 What Is It Do You Need Itwages W2ftbcagov Franchise Tax Board Homepageabout Form 4852’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and organizations. Bid farewell to the monotonous process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the powerful features included in this user-friendly and budget-friendly platform and transform your document management approach. Whether you need to sign forms or collect eSignatures, airSlate SignNow takes care of everything seamlessly, needing just a few clicks.

Follow this step-by-step guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Wage Ampamp Tax Statement Form W 2 What Is It Do You Need Itwages W2ftbcagov Franchise Tax Board Homepageabout Form 4852’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for other parties (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you have to collaborate with your teammates on your Wage Ampamp Tax Statement Form W 2 What Is It Do You Need Itwages W2ftbcagov Franchise Tax Board Homepageabout Form 4852 or send it for notarization—our platform has everything you need to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is the Wage & Tax Statement Form W-2?

The Wage & Tax Statement Form W-2 is a tax document that employers must provide to their employees every year. It reports an employee's annual wages and the amount of taxes withheld from their paycheck. Understanding 'Wage & Tax Statement Form W-2: What Is It? Do You Need It?' is essential for accurate tax filing.

-

Do I need the Wage & Tax Statement Form W-2?

Yes, if you are employed, you need the Wage & Tax Statement Form W-2 to prepare your tax returns. It contains crucial information about your earnings and tax contributions for the year. Therefore, knowing 'Wage & Tax Statement Form W-2: What Is It? Do You Need It?' can help you ensure compliance with tax regulations.

-

How can I obtain my Wage & Tax Statement Form W-2?

You can obtain your Wage & Tax Statement Form W-2 from your employer, who is required to provide it by January 31st each year. If you haven't received it, you can request it directly from your HR department or payroll administrator. This form is vital for understanding 'Wage & Tax Statement Form W-2: What Is It? Do You Need It?'

-

What should I do if my W-2 form is incorrect?

If your Wage & Tax Statement Form W-2 contains errors, you should immediately contact your employer to request a corrected form. It's important to resolve discrepancies as they can affect your tax obligations. Remember, understanding 'Wage & Tax Statement Form W-2: What Is It? Do You Need It?' helps in identifying issues early.

-

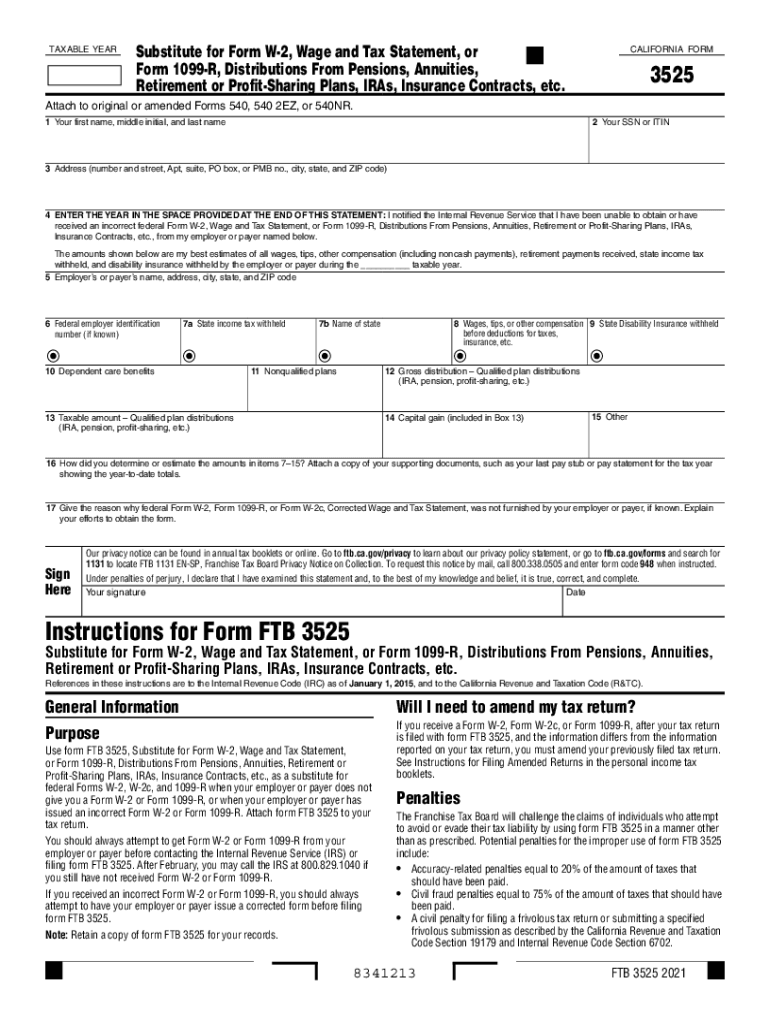

What is Form 4852 and when do I need it?

Form 4852 is a substitute for Form W-2 that you can use if your employer fails to provide you with a Wage & Tax Statement Form W-2. It's essential to file this form to ensure your tax returns are accurate if the W-2 is missing. Familiarizing yourself with 'Wage & Tax Statement Form W-2: What Is It? Do You Need It?' can help clarify when to use Form 4852.

-

Can I eSign my Wage & Tax Statement Form W-2?

Yes, you can eSign your Wage & Tax Statement Form W-2 using airSlate SignNow's secure platform. This feature simplifies the process of signing and sending your documents electronically, making tax season more convenient. Knowing 'Wage & Tax Statement Form W-2: What Is It? Do You Need It?' enhances your understanding of document management.

-

What features does airSlate SignNow offer for handling W-2 forms?

airSlate SignNow offers features like electronic signatures, document templates, and cloud storage to manage your Wage & Tax Statement Form W-2 efficiently. These tools streamline the process, ensuring you can focus on more important tasks during tax season. Understanding 'Wage & Tax Statement Form W-2: What Is It? Do You Need It?' will enhance your experience with these features.

Find out other wage ampamp tax statement form w 2 what is it do you need itwages w2ftbcagov franchise tax board homepageabout form 4852

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles