Corporate Center forms

Browse over 85,000 state-specific fillable forms for all your business and personal needs. Customize legal forms using advanced airSlate SignNow tools.

Showing results for:

Oh dear! We couldn’tfind anything :(

Please try and refine your search for something like “sign”,“create”, or “request” or check the menu items on the left.

be ready to get more

Get legally-binding signatures now!

What steps do I need to take to create an LLC?

The steps and rules for creating an LLC are defined by your state. Before starting up your business, make sure to contact the state’s business office representatives. Generally, the process of setting up an LLC includes the following stages: choosing a business name, filing Articles of Organization (certificate of formation) with the state, creating an Operating Agreement, obtaining the needed permissions, and opening a bank account.

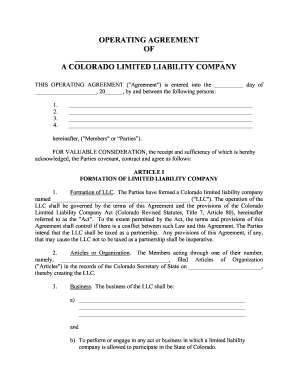

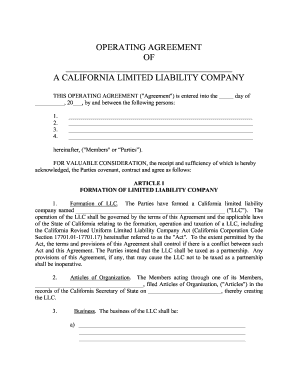

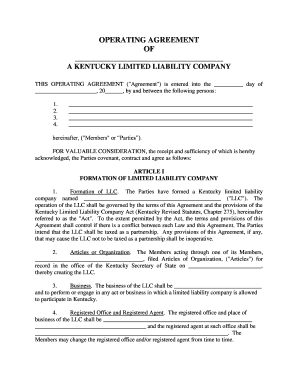

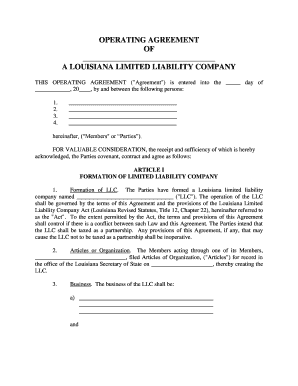

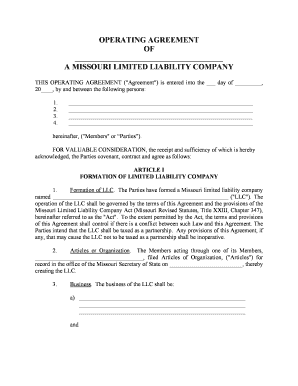

What is an LLC Operating Agreement?

An LLC's Operating Agreement is an official document that spells out the responsibilities and rights of the company’s members and defines how they will be managed and handled. Simply put, it describes what your business is about, and how decisions are made. It has many provisions and formalities that need to be kept for the company to run smoothly. It might be anything from the Corporation meeting requirements or the clause about profit share and its distribution among LLC members. You can find the sample template for drafting an operating agreement with airSlate SignNow. By using the airSlate SignNow document editor, you can easily fill out, edit, and certify the document with a legally-binding signature, and send it to other members to be filled and signed. In addition to that, every single change made to a document in airSlate SignNow, along with exact timestamps and the order of actions is recorded by the built-in Audit Trail feature. It provides all LLC members with increased visibility over document execution and makes the audit preparation process more streamlined in the long run. Before completing the document with airSlate SignNow, consider all airSlate SignNow agreements are sample operating agreements and should be modified to meet your needs.

Do I need to create a Single Member LLC Operating Agreement if I’m the sole owner of the company?

The answer to this question is manifold. Two primary documents are required for setting up an LLC: Articles of Organization and Operating Agreement. They’re regulated by the state they’re registered with. Following common logic, if you might think that a Single Member LLC Operating Agreement isn’t needed for an LLC with a single member, you’re right. Generally speaking, creating one isn’t mandatory and you can run your business efficiently without drafting this type of document. However, you need to double-check your state’s laws because in some states, it’s required. In addition to that, you can use this agreement as a legal tool to protect yourself from liability and have established patterns and rules for implementing different strategic decisions. For example, you can lay out a set of actions in the document if you decide to include another member in your LLC. With all that said, it won’t hurt to get this document to shield your business from any legal disputes. In any case, you’re always better off with an attorney that will help you set your business on the right track from the start.

How can I go about adding a member to an LLC?

Adding a new member to your LLC involves a relatively simple procedure. However, you need to be well aware of the laws and legal frameworks of the state in which your business operates. First and foremost, you need to think about what the person you’re going to introduce as a new owner can bring to the table. For example, depending on the nature of the business you own, you might want to run a basic background check. At the same time, it’s essential to consider all the legal and financial implications of a new person joining the board. For instance, if you run the company alone (as a sole proprietor), adding a new member will increase the tax rate and will require you to submit different tax forms. Also, you need to review the operating agreement and make changes to it if necessary. You’ll also be required to discuss and arrange the financial side of the contract and define the profit percentage a new member will be getting. No matter what your case is when you’re adding a member to an LLC, everything you need to know should be provisioned in your operating agreement. However, it’s highly advisable to get professional help from a legal expert when expanding your member board.

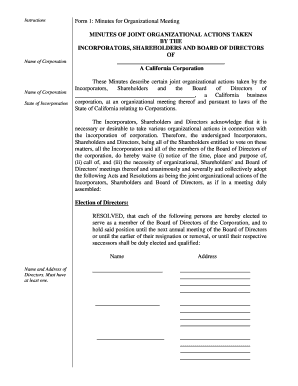

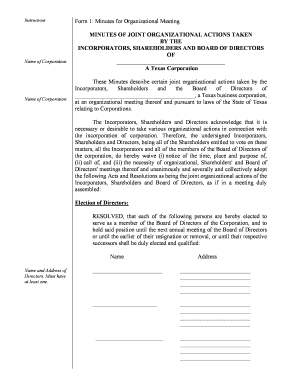

What does an LLC need to keep vital records?

The essence of any LLC lies in its ability to protect a company’s owners from being personally responsible for the company’s liabilities. As long as all the rules for all required formal procedures are in place and maintained, the company doesn’t run any risk of being involved in legal issues. These rules include but are not limited to the proper keeping of vital records. You can find the list of the required forms in the airSlate SignNow library of documents, such as the Blank Resolution form for Directors (required to document the major decisions made by the board of directors) or By-Laws, that need to be added to the company record. When keeping it, make sure to only use state-specific documents and packages. This way, you’ll have a better chance of getting through an audit more smoothly.