Can I Sign Idaho Banking Presentation

Contact Sales

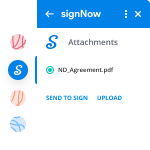

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Discover the easiest way to Sign Idaho Banking Presentation with our powerful tools that go beyond eSignature. Sign documents and collect data, signatures, and payments from other parties from a single solution.

Robust integration and API capabilities

Enable the airSlate SignNow API and supercharge your workspace systems with eSignature tools. Streamline data routing and record updates with out-of-the-box integrations.

Advanced security and compliance

Set up your eSignature workflows while staying compliant with major eSignature, data protection, and eCommerce laws. Use airSlate SignNow to make every interaction with a document secure and compliant.

Various collaboration tools

Make communication and interaction within your team more transparent and effective. Accomplish more with minimal efforts on your side and add value to the business.

Enjoyable and stress-free signing experience

Delight your partners and employees with a straightforward way of signing documents. Make document approval flexible and precise.

Extensive support

Explore a range of video tutorials and guides on how to Sign Idaho Banking Presentation. Get all the help you need from our dedicated support team.

Industry sign banking idaho form mobile

Keep your eSignature workflows on track

Make the signing process more streamlined and uniform

Take control of every aspect of the document execution process. eSign, send out for signature, manage, route, and save your documents in a single secure solution.

Add and collect signatures from anywhere

Let your customers and your team stay connected even when offline. Access airSlate SignNow to Sign Idaho Banking Presentation from any platform or device: your laptop, mobile phone, or tablet.

Ensure error-free results with reusable templates

Templatize frequently used documents to save time and reduce the risk of common errors when sending out copies for signing.

Stay compliant and secure when eSigning

Use airSlate SignNow to Sign Idaho Banking Presentation and ensure the integrity and security of your data at every step of the document execution cycle.

Enjoy the ease of setup and onboarding process

Have your eSignature workflow up and running in minutes. Take advantage of numerous detailed guides and tutorials, or contact our dedicated support team to make the most out of the airSlate SignNow functionality.

Benefit from integrations and API for maximum efficiency

Integrate with a rich selection of productivity and data storage tools. Create a more encrypted and seamless signing experience with the airSlate SignNow API.

Collect signatures

24x

faster

Reduce costs by

$30

per document

Save up to

40h

per employee / month

Our user reviews speak for themselves

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

Trusted esignature solution— what our customers are saying

be ready to get more

Get legally-binding signatures now!

Related searches to Can I Sign Idaho Banking Presentation

Frequently asked questions

How do i add an electronic signature to a word document?

When a client enters information (such as a password) into the online form on , the information is encrypted so the client cannot see it. An authorized representative for the client, called a "Doe Representative," must enter the information into the "Signature" field to complete the signature.

How to sign pdf on window?

- by nate

Submission information:

Posted:

Category: All

Theme: All

Species: Unspecified / Any

Gender: Any

Favorites: 0

Comments: 0

Views: 1191

Image Specifications:

Resolution: 765x904

Keywords:

furry little girl dog little girl

How to esign in pecos?

A. Yes, you can! You only need to get your hands on a good font, and a bit of basic knowlegde on how to use typography to draw it.

Q. How can I add some color to pecos?

A. Just like you can add colors to a web page, you can do the same thing to your pecos and have it look as much fun as you like. I recommend using a very bright color like red or neon green for them. This adds to the fun of the game and makes sure your pecos never feel dull.

Q. What do I put in my pecos?

A. Anything you like. Some people even make pecos with a little cartoon character on them.

You can find an example here.

Q. How do I make a pecos with a little bit of color on it?

Q. What's a "taco" and a "pop"? Why are there two different things in this game called a "pop"?

A. A "taco" is a type of burrito, and a "pop" is a type of candy.

You can find examples here.

Q. I'm having trouble making a "tea" on my pecos. Why are teas different from each other?

A. A tea is basically a cup of tea and is very different from a cup of coffee. You can even add your teas in a different color.

I suggest you take a look at this example of a teacup.

Q. I'm having a little trouble making a "bouquet". Why do they have to be different from each other?

A. A bouquet is basically a flower arrangement. You can put it in a different color to make it seem more interesting.

I suggest you take a look at this example of a bouquet.

Q. How do I make my pecos look like the letter "M"?

A. The most important part of...

Get more for Can I Sign Idaho Banking Presentation

- How Can I Sign Louisiana Car Dealer Credit Memo

- Help Me With Sign Louisiana Car Dealer Lease Agreement Form

- Can I Sign Louisiana Car Dealer Medical History

- Can I Sign Louisiana Car Dealer Credit Memo

- Sign Louisiana Car Dealer Permission Slip Online

- Sign Louisiana Car Dealer Permission Slip Computer

- How Can I Sign Louisiana Car Dealer Lease Agreement Form

- Sign Louisiana Car Dealer Permission Slip Mobile

Find out other Can I Sign Idaho Banking Presentation

- Wwwirsgovpubirs pdfrecords keeping business and irs tax forms

- Wwwirsgovpubirs prior2020 publication 536 irs tax forms

- Wwwirsgovstatisticssoi tax stats statisticsstatistics of incomeinternal revenue service irs tax forms

- P547pdf publication 547 contents casualties disasters form

- Wwwuslegalformscomform library202890superannuation standard choice form us legal forms

- Wwwsignnowcomfill and sign pdf form80120general information ampampampampamp instructions fill out and

- Dea compliance form penn veterinary supply

- Fillable online elderaffairs state fl g connie stephanie form

- A c a m s form

- Sexual consent form free fillable forms

- Pdf infinite algebra 1 solving equations practice form

- Wwwfillioform 202general informationfillable form 202general information certificate of

- Commuting form 21 22docx

- Commonwealth financial counselling community grants form

- Iowa athletic pre participation physical examination physical examination form

- Wwwuslegalformscomform library354784download the state of texas application for employment

- Wwwtdcjtexasgovdivisionshrtdcj employee performance log

- List of available free file fillable formsinternal

- Publication 557 rev february 2021 tax exempt status for your organization form

- Mc 03 answer civil form