eSign Form Mobile

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Robust integration and API capabilities

Advanced security and compliance

Various collaboration tools

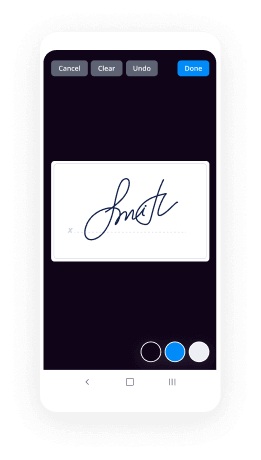

Enjoyable and stress-free signing experience

Extensive support

Keep your eSignature workflows on track

Our user reviews speak for themselves

Advantages of Utilizing an Electronic Signature Form with airSlate SignNow

In terms of optimizing your document signing workflow, employing an electronic signature form is crucial. airSlate SignNow provides a smooth platform that enables organizations to effectively dispatch and electronically sign documents. With its intuitive interface and comprehensive features, airSlate SignNow not only boosts efficiency but also offers an economical solution for your signing requirements.

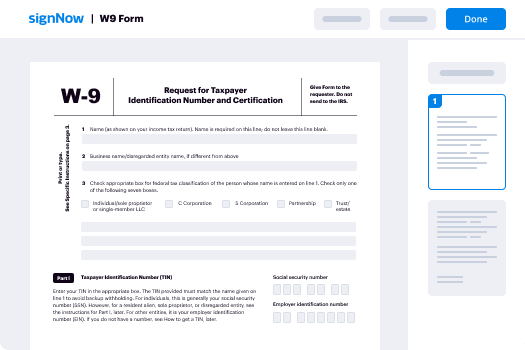

Procedure to set up an electronic signature form using airSlate SignNow

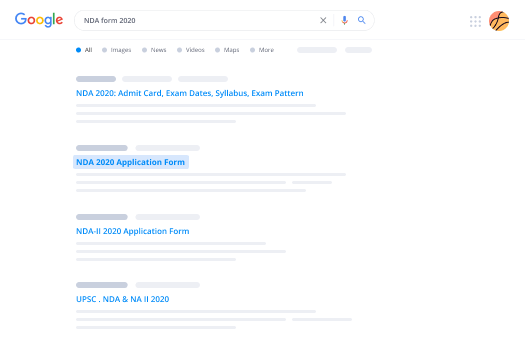

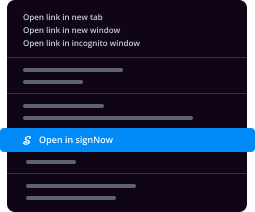

- Launch your internet browser and go to the airSlate SignNow webpage.

- Establish a free trial account or log into your current account.

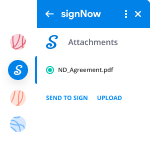

- Choose the document you intend to sign or forward for signatures and upload it.

- If you plan to utilize this document in the future, convert it into a reusable template.

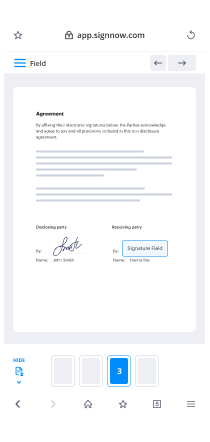

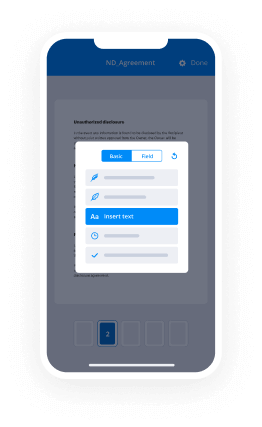

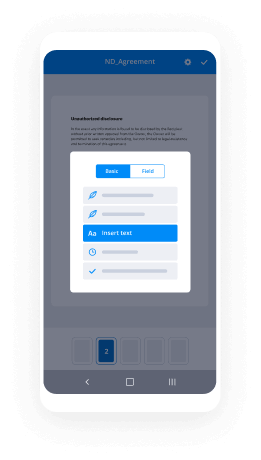

- Access your uploaded document to implement necessary modifications, such as incorporating fillable fields or adding specific details.

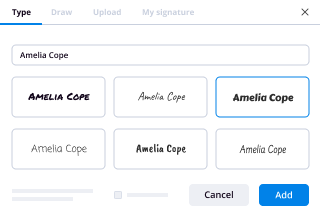

- Include your signature as well as the signature fields needed for your recipients.

- Click on the 'Continue' button to complete the setup and send your eSignature invitation.

To sum up, airSlate SignNow distinguishes itself as a remarkable platform for businesses aiming to simplify their document signing workflows. Its extensive features deliver considerable value, making it a perfect choice for small to mid-sized enterprises.

Eager to revolutionize your document process? Initiate your free trial with airSlate SignNow today and discover the advantages of utilizing an electronic signature form for your business!

How it works

Rate your experience

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

FAQs

-

What is an esign form and how does it work?

An esign form is a digital document that allows users to electronically sign and manage agreements online. With airSlate SignNow, you can create, send, and track esign forms effortlessly, ensuring a secure and legally binding signing process. This not only streamlines your workflow but also eliminates the need for physical paperwork.

-

How much does it cost to use airSlate SignNow for esign forms?

airSlate SignNow offers flexible pricing plans tailored to different business needs. You can start with a free trial to explore the features of esign forms before committing to a subscription. Our plans are designed to be cost-effective, making it easy for businesses of any size to utilize esign forms without breaking the bank.

-

What features are included with esign forms in airSlate SignNow?

When you use airSlate SignNow for esign forms, you gain access to a variety of features like document templates, customizable workflows, and real-time tracking. Additionally, our platform provides advanced security measures to protect your documents, ensuring that your esign forms are safe and compliant with legal standards.

-

Can I integrate airSlate SignNow with other applications for my esign forms?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft 365. This means you can easily manage your esign forms alongside your existing tools, improving efficiency and collaboration within your organization.

-

Is it legal to use esign forms for contracts and agreements?

Absolutely! Esign forms created with airSlate SignNow comply with electronic signature laws such as the ESIGN Act and UETA in the United States. This ensures that your electronically signed documents are legally binding, providing you with the same legal standing as traditional handwritten signatures.

-

How can I track the status of my esign forms?

With airSlate SignNow, you can easily track the status of your esign forms in real-time. The platform provides notifications and updates on when your documents are sent, viewed, and signed, allowing you to stay informed throughout the signing process.

-

Can I customize my esign forms for different use cases?

Yes, airSlate SignNow allows you to fully customize your esign forms to suit various business needs. You can add fields, branding elements, and specific instructions, ensuring that your forms are tailored to your audience and maintain a professional appearance.

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+ [ https://esign.wondershare.com/?utm_source=esign-forum&utm_medium=quora-Q1&utm_campaign=esign1.0 ]. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

-

How do I Register under GST in India?

GST registration process will be online through a portal maintained by Central Government of India. Govt. will also appoint GSPs (GST Suvidha Providers) to help businesses with the registration process.Based on the information provided by GSTn, registration process looks like this:The applicant, will need to submit his PAN, mobile number and email address in Part A of Form GST REG–01 on the GSTN portal or through Facilitation center (notified by board or commissioner).The PAN is verified on the GST Portal. Mobile number and E-mail address are verified with a one-time password (OTP). Once the verification is complete, applicant will receive an application reference number on the registered mobile number and via E-mail. An acknowledgement should be issued to the applicant in FORM GST REG-02 electronically.Applicant needs to fill Part- B of Form GST REG-01 and specify the application reference number. Then the form can be submitted after attaching required documents.If additional information is required, Form GST REG-03 will be issued. Applicant needs to respond in Form GST REG-04 with required information within 7 working days from the date of receipt of Form GST REG-03.If you have provided all required information via Form GST REG-01 or Form GST REG-04, the registration certificate in Form GST REG –06 for the principal place of business as well as for every additional place of business will be issued to the applicant. If the person has multiple business verticals within a state he can file a separate application for the registration in Form GST REG-01 for each business verticals.If the details submitted are not satisfactory, the registration application is rejected using Form GST REG-05.The applicant who is required to deduct TDS or collect TCS shall submit an application in Form GST REG – 07 for registration. If he is no longer liable to deduct or collect tax at source then the officer may cancel and communicate the cancel of registration.Documents required for GST registration:PAN card of the CompanyProof of constitution like partnership deed, Memorandum of Association (MOA) /Articles of Association (AOA), certificate of incorporation.Details and proof of place of business like rent agreement or electricity billCancelled cheque of your bank account showing name of account holder, MICR code, IFSC code and bank branch detailsAuthorized signatory like List of partners with their identity and address proof in case of partnership firm or List of directors with their identity and address proof in case of company.You can check this article on GST Registration Process In India. It covers 45 frequently asked questions on this topic.

-

Do pop-up newsletter sign ups actually work? Any stats?

Exit-intent popups work, there’s no doubt about that. In my experience of building email lists for my businesses over the last 12 years is that the only thing your visitor wants is information.They hate when you interrupt their quest for information on your website with an annoying popup. That’s why exit intent works. They are already done when you present a popup.Unfortunately, that’s the same reason they have low conversion rates.The best I got was around 5%.And I tried most of them, from Bounce Exchange that costs thousands of dollars per month to the free alternatives. None worked exceptionally well at collecting email leads. At least not as well as I expected.So I decided to build my own, and wrap email collection around a popular game The Wheel of Fortune. That way people are not annoyed and they like being amused, so they’ll give it a spin.I was taking advantage of a phenomenon called gambler’s high, which occurs even if a gambler loses, which I found fascinating.This proved INCREDIBLY efficient. People are not annoyed and it just works. My conversion rates on one of the websites with 7 digit monthly visits jumped from less than 4% to 17%.After that, a lot of my friends asked if they can use it, so after a while I decided to make it available to the public for FREE.You can now use my free exit intent popup: Wheel of PopupsHere’s how this exit popup looks like to your website visitors:It can be triggered after page load (you define the delay in seconds);Or after a visitor attempts to leave your website (by tracking mouse movements and scrolling behavior on mobile devices);It can also be restricted to be shown just for Mobile/Tablet or Desktop, or shown everywhere you need it;I also made it so you can brand it to your business or translate it to your language:Change colors of the wheel, text, background and buttons;Add your (small) logo on the wheel of fortune and large logo above the form on the right;Translate all text or simply change it to better fit your brand;It was important that you don’t give away too many coupon codes to visitors:Decide how big coupon codes you want to offer as a prize to visitors for spinning the wheel of fortune;Then define the probability of visitors to win a certain discount. For example, you can enter huge discount as one of the slices on the wheel, but if the probability is set to “0”, no one will ever get it, but it will serve as an added incentive for people to leave their email address;You can start using it right now and it’s completely FREE:Create a free account on Wheel of Popups;Configure the wheel to fit your brand (colors, logos, etc)Add coupon codes and probability for winnings;Enable it and it will show up on your website;Woohoo! That’s it.I hope you’ll appreciate my answer and give it a go. I am more than happy to help in any way possible.Thanks!

-

What are some useful SaaS (software as a service) tools for small businesses?

The logical route for most small businesses that are operating on tight budgets is to start with free SaaS software. There are many out there but you will find that they are limited in features and capabilities. You may want to have a mix of free tools and set aside a reasonable investment for paid solutions since there are lots of affordably priced, SMB-friendly SaaS software offerings in the market. Here’s a great resource on SaaS tools for small business you may want to check out.The following are my suggestions of software categories and the respective products that are most useful in y...

-

What is the process to do e-signature in GST?

E- sign is a new facility provided for GST enrolment. It will enable the taxpayer to sign their GST enrolement application without using DSC. It is however mandatory for some taxpayers to sign GST enrolement applicating using DSC only.Electronically signing of enrolement application using DSC is mandatory for:CompaniesForeign companiesLi mited liability partnership (LLP)Foreign limited liability partnership (FLLP’s)Only the taxpayers other than mentioned above will be able to file their enrolment application without using DSC. If you are an individual , HUF and partnership then you can file the enrolment application without DSC. You can sign the enrolment application electronically using the E- sign. It will result in cost saving as you will not have pay for the DSC. It will be easier for you as other procedure like registering DSC will also not be required.What is E- sign? How does it work?E- sign stands for electronic signature. It is an online electronic signature service that allows an Aadhaar holder to digitally sign a document. If the taxpayer opts to electronically sign the enrolement application or any other document at the GST common portal using the e- sign services.Following steps will be required to use E- signThe GST common portal prompts the taxpayer to enter the Aadhaar number of the authorized signatory.After validating the Aadhar number , the GST common portal sends a request to UIDAI system to send an OTPUIDAI system sends an OTP to e- mail address and mobile number registered against Aadhar number.the GST system prompts the taxpayer to enter the OTP.The taxpayer enters the OTP and submits the Enrollment Application or the document. The E- signing process is completed.This facility is free of cost and easy to use.It is mandatory to file your application with digital sign. This sign can be via DSC or E-sign. You will not be able to file your enrolement application without signature.

-

I lost my PAN card and I want a new one with the old PAN number. How should I proceed?

There are adequate provisions in place to cover loss of PAN card, with an option to reprint a card provided by the government. So if you have lost your PAN card and aren’t sure as to what needs to be done next, here are a few simple steps which you need to follow to get a reprinted card.Log onto the official website of TIN-NSDL and navigate to the section on online application for PAN.Once here, choose the option “Reprint of PAN card.” This option can be chosen if your PAN Card was stolen, lost or misplaced.On clicking the aforementioned link, you will be directed to a different page, where you need to click on the “Online Application for changes/correction in PAN data” link.Clicking the aforementioned link will take you to a page which highlights the guidelines as to what needs to be done next. Post reading these guidelines one can choose the type of PAN they lost (individual, company, firm, HUF, etc.).They will now be required to fill up a lost pan card application form, providing details like their lost pan number, name, communication address, telephone number, email id, etc. Documents like photographs and ID proof need to be submitted along with the lost pan card application form, with an applicant expected to sign it before submission but if you have choosen Aaadhar based ekyc option there is no any physical document is required…The lost pan card application form can be submitted either online or posted to NSDL, along with necessary documents.Payment of approx Rs 110 (if the communication address is within the country) or Rs 989 (if the communication address is outside India) should be made, either though credit / debit card, net banking or demand draft.On successful payment an acknowledgment number will be generated which can be used for further correspondence.A duplicate PAN with the same pan card number will be delivered to the address in about two weeks.

-

What is needed to get a personal loan in India?

A personal loan is an unsecured advance offered by both banks and NBFCs to any eligible individual. Personal Loans for Salaried class include people working in private or government enterprises and does Salaried Doctors working in health institutions, CAs working in companies, employees of Public listed and Private limited companies , MNCs, SMEs and Government Sector employees including public sector undertakings. Each bank has separate minimum criteria for income, age, employment type, credit score, job status, etc. You will need to meet these criteria in order to qualify for a personal loan.Personal Loan Eligibility1. Minimum and Maximum AgeThe minimum age for getting a loan is 21 Years whereas the maximum is 60 Years.2. Net Monthly IncomeFor salaried individuals, timely and regular salary credit is important to get eligible for loan. Min. Rs. 20,0003. Employment TypeSalaried customers have more choices for personal loan banks. Interest rates are typically in the range of 10.99% to 33.00% per annumPersonal loans to self-employed professionals and businessmen are classified as Business Loan4. Minimum Work Experience2 years of total work experience. Some banks also give loans with 1 year of total experience. Tenure from the current company should not be less than 6 – 12 months5. CIBIL Score for Personal LoanThe CIBIL Score for a Personal Loan should be more than650 & more credit history. The more the Credit Score the more chance for getting a LoanDocumentation RequiredDuly-filled and signed application form2 passport-size photographsCheque – Processing feeProof of Identity – Voter ID/ Passport Copy/ Driving License / PAN Card (any one)Address – Passport Copy/ Utility Bill (Electricity, Water)/ Rental Agreement/ Ration Card (any one)Income (depending on type of employment) – Latest Salary Slips (3 months) / Bank Statements (3 – 6 months) / Passbook (3 – 6 months)/ Current Salary Certificate (any one)Tax paid – Latest Form 16/ Income Tax ReturnKYC Documents – Address Proof, proof of Date of Birth, Identity Proof.How Income determines your Eligibility?Monthly Income to get personal loan should be at least Rs. 25,000. However, some banks give loans to individuals with salary less than Rs. 25,000. Banks also follow different limit to calculate the ratio of fixed obligations to monthly income.Suppose, your income is Rs. 25,000, then bank calculates your eligibility such that fixed obligations do not exceed 50% of your income. However, if your income is more than Rs. 35,000 per month, then banks will allow higher fixed obligations to income ratio of 65%, which means that your fixed expenses (including rent and other EMIs) can be up to 65% of your income to be eligible for a loan from a bank. Higher the income, better are the chances to get high loan amount.How to improve your eligibility for personal loan?You can improve your eligibility for personal loan by doing following things:To increase your eligibility, pay off your running debts firstPay your EMIs or other obligations on time to improve credit history and to negotiate with banks in future to get high loan amountTransfer your existing loans to lower rate to reduce your existing EMI and to get new loan of higher amount.FundsTiger can arrange loans from all the banks we can help you to get all types of loans and also balance transfers on existing loans and can also help you to giving free credit consultation.

-

How do I transfer car ownership in Pune?

All RTO services are available online ( no need to catch Agent)Online Process:Before starting transfer process online, keep all the details of seller, buyer and vehicle details handy (like pan number, Aadhar number, address, engine number, chassis number, insurance details)1. Go to VAHAN 4.0 (Beta) , Select the state other than Delhi and add the vehicle registration number (i.e. MH1X99XX) and proceed.2. Go to Online Services >> Misc (Ownership transfer)3. Enter vehicle chassis number (last 5 digits) and mobile number to receive OTP4. After successful OTP verifcation it will navigate to ownership transfer form, fill all required details of seller, purchaser, and vehicle.5. Cross check the details and proceed further to payment page .6. Rs. 550/- is the fee for Car ownership transfer, it may differ for other type of vehicle7. Pay the fee online and it will generate Form 29, Form 30 and E-payment receipt (download all this forms, Form 29 requires two copies to be downloaded)8. Make signature of seller and buyer wherever mentioned on all of these forms.Considering vehicle belongs to same RTO, below documents are required_Signed Form 29, Form 30 and E-payment receiptId proof and Address proof of seller and buyer, if buyer does not have permanent address from Pune, he/she needs to provide registered rent agreement with police verification.Original RC document from sellerLatest PUC certificate from sellerPencil print of chassis(5 copies), you can find chassis number below driver seat.Insurance details copy from seller.One passport size photograph of buyer.Lastly visit RTO office along with all the mentioned documents and submit it.In next 4–7 days, your application of vehicle ownership transfer gets approved and transferred. (RTO will notify this through SMS).It will take 10 - 30 days for RC smart card to get delivered to your mentioned address.As RC smart card take time to get delivered, you can download your RC particulars online for Fee of 50Rs. (RC particulars is the document you can provide for insurance transfer and other vehicle related transactions also its valid document when you do not have the RC smart card)To downlaod RC particulars _1. Go to VAHAN 4.0 (Beta), Select the state other than Delhi and add the vehicle registration number (i.e. MH1X99XX) and proceed.2. Go to Online Services >> RC Particulars3. Enter vehicle chassis number (last 5 digits) and mobile number to receive OTP4. After successful OTP verification click on show details , it will show one form with restricted vehicle details.5. Below that form it will ask to pay Rs. 50/- 6. After successful online payment it will generate RC particular form which you can download and use it as valid RC document until you get RC smart card.(remember to download the RC particulars otherwise, next time also you need to pay Rs. 50/- to generate it again.)If you thought my answer was helpful, it would mean a lot to me if you could press the light blue upvote button below.

-

After applying for a PAN card online, how will I get the main plastic PAN card?

You can make an application for E-Pan card which will be sent to you by mail or you can also apply for a physical PAN card.The applicant is only required to fill and submit the online application form along with online payment of the respective processing fee.Steps to apply for PAN cardVisit the NSDL websiteSelect "New PAN- India Citizen (form 49A)” as your application type and fill your status (i.e individual or company or firm) under the head category.Fill in rest of the information asked such as name, and date of birth. Information marked with an asterisk sign has to be filled in mandatorily. It is mandatory to mention the email id in case of application for an E-PAN card.A token number will be generated and same will be sent to your email id (But the same must be noted ). Click on continue with your Application.A new page will appear on your screen. There will be three options asking you how you want to proceed with your application. To apply for E-PAN you must select No to the question “Whether Physical Pan is required?”. ( Please check Note)Enter your details such as Aadhaar number, parents name, etc. Aadhaar number is mandatory if you have choosed e sign and e KYC as an option.Once you have filled all the relevant data, click on 'Next'. A new page will appear asking you to fill in details of the type of income earned by you. In the same page you will be required to mention your communication details.After you have filled in the same you will be required to enter your AO code. The Ao code can be searched from the dialog box given below. As shown in the image you will be required to fill the details and then scroll down the list to check the AO on the basis of the description mentioned.After you have filled the same you will be asked for document that you will submit as proof.You will be required to give a declaration . Then you have to click submit.You will be ask to recheck your application and you will be asked to make payment .You can pay using your debit or credit cards, Net banking .Once you have made the payment, you will be required to undergo the Aadhaar authentication process. If your Aadhaar authentication process is successful,then a 15 digit unique acknowledgement number will be generated.You will receive E PAN on your email after your application is processed or the physical PAN will be sent to your addressNote-There is a paperless facility called e-KYC and e-sign where your Aadhaar details will be used. You don't have to upload images such as photo, signature or other supporting documents. Your Aadhaar photograph will appear in your PAN if you use the e-KYC and e-sign facility.There is a second method which is a standalone e-sign facility where you are required to upload your photograph, signature (in black ink) and specified supporting documents in a prescribed format.

Trusted esignature solution— what our customers are saying

Get legally-binding signatures now!

Frequently asked questions

How do i add an electronic signature to a word document?

How to use electronic signature paint?

What is my esign password for ssc?

Get more for eSign Form Mobile

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

Find out other eSign Form Mobile

- When you cannot send or receive fax messages as wanted form

- Adding your sender information to faxesfax own sharp

- 15 06a training memorandum illinois state board of education form

- Hereinafter referred to as employer and form

- Frequently asked questions about wills peoples law library form

- Client fee agreement form

- Re entering a fax number to confirm destination ricoh form

- Between tenant and landlord form

- Fillable online illinois subcontractors 60 day notice to owner form

- Full text of ampquotthe inheritance tax law of the state of form

- Affidavit for service by publication ccg n013illinois form

- First duly sworn on oath state form

- Concealed carry court strikes down illinois ban chicago form

- Effective july 1 2018 illinois supreme court rule 16 is adopted form

- Domestic relations division american society of clinical form

- Whereas stable is the owner and operator of a certain commercial stable located in form

- Invoices are payable upon receipt form

- Should this account upon default be collected by or through an attorney at law the undersigned agrees to pay reasonable form

- Termination date form

- Attorneys fees in addition to the principal indebtedness and interest thereon form