Sign Idaho Banking Agreement Safe

Contact Sales

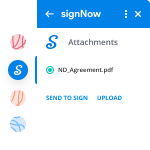

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Discover the easiest way to Sign Idaho Banking Agreement Safe with our powerful tools that go beyond eSignature. Sign documents and collect data, signatures, and payments from other parties from a single solution.

Robust integration and API capabilities

Enable the airSlate SignNow API and supercharge your workspace systems with eSignature tools. Streamline data routing and record updates with out-of-the-box integrations.

Advanced security and compliance

Set up your eSignature workflows while staying compliant with major eSignature, data protection, and eCommerce laws. Use airSlate SignNow to make every interaction with a document secure and compliant.

Various collaboration tools

Make communication and interaction within your team more transparent and effective. Accomplish more with minimal efforts on your side and add value to the business.

Enjoyable and stress-free signing experience

Delight your partners and employees with a straightforward way of signing documents. Make document approval flexible and precise.

Extensive support

Explore a range of video tutorials and guides on how to Sign Idaho Banking Agreement Safe. Get all the help you need from our dedicated support team.

Can i industry sign banking alabama medical history

Keep your eSignature workflows on track

Make the signing process more streamlined and uniform

Take control of every aspect of the document execution process. eSign, send out for signature, manage, route, and save your documents in a single secure solution.

Add and collect signatures from anywhere

Let your customers and your team stay connected even when offline. Access airSlate SignNow to Sign Idaho Banking Agreement Safe from any platform or device: your laptop, mobile phone, or tablet.

Ensure error-free results with reusable templates

Templatize frequently used documents to save time and reduce the risk of common errors when sending out copies for signing.

Stay compliant and secure when eSigning

Use airSlate SignNow to Sign Idaho Banking Agreement Safe and ensure the integrity and security of your data at every step of the document execution cycle.

Enjoy the ease of setup and onboarding process

Have your eSignature workflow up and running in minutes. Take advantage of numerous detailed guides and tutorials, or contact our dedicated support team to make the most out of the airSlate SignNow functionality.

Benefit from integrations and API for maximum efficiency

Integrate with a rich selection of productivity and data storage tools. Create a more encrypted and seamless signing experience with the airSlate SignNow API.

Collect signatures

24x

faster

Reduce costs by

$30

per document

Save up to

40h

per employee / month

Our user reviews speak for themselves

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

Trusted esignature solution— what our customers are saying

be ready to get more

Get legally-binding signatures now!

Related searches to Sign Idaho Banking Agreement Safe

Frequently asked questions

How do you make a document that has an electronic signature?

How do you make this information that was not in a digital format a computer-readable document for the user? "

"So the question is not only how can you get to an individual from an individual, but how can you get to an individual with a group of individuals. How do you get from one location and say let's go to this location and say let's go to that location. How do you get from, you know, some of the more traditional forms of information that you are used to seeing in a document or other forms. The ability to do that in a digital medium has been a huge challenge. I think we've done it, but there's some work that we have to do on the security side of that. And of course, there's the question of how do you protect it from being read by people that you're not intending to be able to actually read it? "

When asked to describe what he means by a "user-centric" approach to security, Bensley responds that "you're still in a situation where you are still talking about a lot of the security that is done by individuals, but we've done a very good job of making it a user-centric process. You're not going to be able to create a document or something on your own that you can give to an individual. You can't just open and copy over and then give it to somebody else. You still have to do the work of the document being created in the first place and the work of the document being delivered in a secure manner."

How to sign pdf file?

Download pdf file.

Use this link.

Print the pdf file and sign.

Can anyone download my signed pdf file for me ?

Not at your request. Please sign the pdf files using the link above.

Can I use my printer's ink to sign a pdf file and save it to my pc?

No. Printing ink does not have the same density as a laser printer.

If a pdf file is printed on black paper, will the text disappear?

Unfortunately there is a possibility of text being printed on the paper, which is invisible on the pdf file.

Is there any way to make the pdf file printable on different paper colors?

If you use a PDF Converter, you can use the color profile of the pdf file as a reference to find out the color of other printing paper. You can download the Adobe Color Profile and use it to colorize pdf file.

Can I print an original pdf file on black paper?

Not easily. PDF files are created as color images, so in order to be usable, PDF files need to be printed on a color printer.

Can I print an original pdf file on white paper?

If you print an entire pdf file on a color printer (or just a part of a pdf on a color printer) you will not see what the pdf file is actually showing. But you can still read the text on the front of most pdf files.

Can I use a digital camera to print an original pdf file?

Yes, but please note, if you use a digital camera in order to create and print a pdf file, you can only print the pdf on a non-colored printer.

Can I use a laser printer to print an original pdf file?...

How to send a document for electronic signature?

To send email, it's as easy as sending the message and hitting send. If it's for a paper letter, there's a separate program on a computer you can use for that.

How do I send an email that my computer can read?

Some of the more complex emails, like documents created by third-party software, require an intermediate tool to be run on your PC.

For this, you'll find some programs, such as Microsoft Office Word, Microsoft Access, and Adobe Reader, for a wide range of programs. And, for more complicated emails, you can use a program such as Microsoft Outlook Express or Apple Mail, to make the process easier.

If you're using a device like a Mac or PC, you can find apps that can do most of these types of work. But if you only have certain types of applications, there may be a separate program you can use instead.

Can I send an email on my BlackBerry?

In general, BlackBerry users can send email via email, and not through the BlackBerry Mail app. However, BlackBerry users are limited to sending emails to a select number of people or groups.

So, if you're an employee at a company that has access to email at work, you can send an email from your BlackBerry. If you're part of a group that has access to email at home, you can send an email using any other device at home or at work. However, it's better to have your organization's email software on all devices rather than using one or two devices.

I don't receive emails from other people, but I do read their social media pages. C...

Get more for Sign Idaho Banking Agreement Safe

- Electronic signature Iowa Real Estate Rental Application Online

- Electronic signature Iowa Real Estate Rental Application Computer

- Electronic signature New York Plumbing Agreement Online

- Electronic signature Iowa Real Estate Rental Application Mobile

- Electronic signature Indiana Real Estate Affidavit Of Heirship Now

- Electronic signature Iowa Real Estate Rental Application Now

- Electronic signature New York Plumbing Agreement Computer

- Electronic signature Iowa Real Estate Rental Application Later

Find out other Sign Idaho Banking Agreement Safe

- 134a pt chart form

- Alexander forbes withdrawal form

- Eea1 form 15810874

- Be 12 form

- Bennett mechanical comprehension test pdf download 29064730 form

- Unisa rpl application form pdf

- Smart value personal data change form pdf 30270358

- Eia executive instructions form

- End use certificate format

- Rti form pdf

- Editable biodata format in word

- Ncfrs enrollment form download

- Zvirahwe nedudziro yazvo form

- Sinumpaang salaysay sss death claim sample with answer form

- Head office cpd debit card bank of india co in form

- Ecd learnership online application form

- Online item number form

- Election form 14

- Social insurance number application service canada servicecanada gc form

- Alankit tpa hospital empanelment form