Sign Credit Memo

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Top-notch form management with airSlate SignNow

Get access to a rich form collection

Create reusable templates

Collect signatures via secure links

Keep paperwork protected

Enhance collaboration

eSign via API integrations

Your complete how-to guide - credit memo

At present, you probably won't find an organization that doesn't use modern technologies to atomize workflow. An electronic signing is no longer the future, but the present. Modern businesses using their turnover simply don't want to stop on-line software that provide advanced document processing automation tools, including Sign Credit Memo function.

How you can manage Sign Credit Memo airSlate SignNow feature:

-

When you enter our web site, Login or create your account if you don't have one, it will require you a few seconds.

-

Upload the appropriate record or select one from your catalogue folders: Documents, Archive, Templates.

-

Due to the cloud-based storage compatibility, you may quickly import the appropriate doc from favored clouds with practically any device.

-

You'll discover your data document opened within the advanced PDF Editor where you can include modifications before you decide to move forward.

-

Type textual content, insert graphics, add annotations or fillable areas to be accomplished further.

-

Use My Signature button for self-signing or add Signature Fields to deliver the sign request to one or multiple users.

-

Use the DONE button when completed to continue with Sign Credit Memo function.

airSlate SignNow web-based platform is necessary to boost the effectiveness and productivity of all operational processes. Sign Credit Memo is one of the features that will help. Utilizing the web-based software these days is actually a necessity, not a competitive advantage. Try it out now!

How it works

Rate your experience

What is the best credit monitoring services

The best credit monitoring services provide individuals with tools to track their credit scores, receive alerts for any changes, and monitor their credit reports for inaccuracies or fraudulent activity. These services typically include features such as real-time alerts, identity theft protection, and access to credit report summaries. Users can benefit from understanding their credit status, which is crucial for making informed financial decisions.

How to use the best credit monitoring services

To effectively use the best credit monitoring services, users should start by signing up for a service that meets their needs. After registration, individuals can link their financial accounts to monitor transactions and changes in credit scores. Regularly reviewing alerts and reports is essential for catching any discrepancies early. Utilizing the educational resources provided by these services can also enhance users' understanding of credit management.

Steps to complete the best credit monitoring services

Completing the setup for the best credit monitoring services involves several straightforward steps:

- Choose a credit monitoring service that fits your requirements.

- Provide personal information, such as your name, address, and Social Security number, to create an account.

- Verify your identity through the service's security protocols.

- Link your financial accounts for comprehensive monitoring.

- Review your credit report and set up alerts for any significant changes.

Security & Compliance Guidelines

When using credit monitoring services, security and compliance are paramount. Users should ensure that the service employs robust encryption methods to protect personal data. Additionally, it is important to verify that the service complies with regulations such as the Fair Credit Reporting Act (FCRA). Regularly updating passwords and enabling two-factor authentication can further enhance account security.

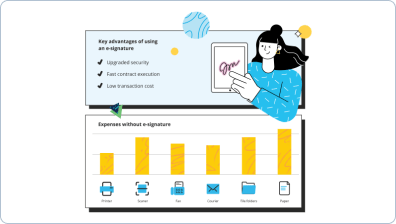

Digital vs. Paper-Based Signing

Digital signing offers numerous advantages over traditional paper-based methods, especially in the context of credit monitoring services. Digital signatures are faster, allowing for immediate processing of documents. They also reduce the risk of lost paperwork and provide a secure way to store signed documents electronically. This method is more environmentally friendly and facilitates easier sharing and collaboration among users.

Eligibility and Access to best credit monitoring services

Eligibility for the best credit monitoring services typically requires users to be at least eighteen years old and possess a valid Social Security number. Most services are accessible to U.S. residents, but some may have specific requirements based on state regulations. Users should review the terms and conditions of their chosen service to ensure compliance with any eligibility criteria.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

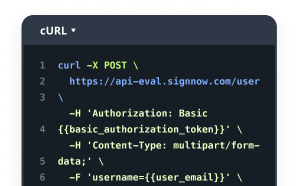

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What are the best credit monitoring services available?

The best credit monitoring services offer comprehensive features such as real-time alerts, credit score tracking, and identity theft protection. These services help you stay informed about changes to your credit report and provide tools to improve your credit health. It's essential to compare different options to find the best fit for your needs.

-

How much do the best credit monitoring services cost?

Pricing for the best credit monitoring services can vary widely, typically ranging from $10 to $30 per month. Some services offer free trials or basic plans with limited features. It's important to evaluate what each service includes to ensure you get the best value for your investment.

-

What features should I look for in the best credit monitoring services?

When searching for the best credit monitoring services, look for features like daily credit report updates, identity theft insurance, and credit score simulations. Additional features such as dark web monitoring and financial account alerts can also enhance your protection. Prioritizing these features will help you choose a service that meets your needs.

-

Are the best credit monitoring services worth the investment?

Yes, the best credit monitoring services are worth the investment for anyone concerned about their credit health and identity security. They provide peace of mind by alerting you to potential fraud and helping you manage your credit score effectively. Investing in these services can save you from costly mistakes and identity theft.

-

Can I integrate the best credit monitoring services with other financial tools?

Many of the best credit monitoring services offer integrations with popular financial tools and apps. This allows you to manage your finances and credit in one place, making it easier to track your progress. Check the service's website for a list of compatible integrations to enhance your financial management.

-

How do the best credit monitoring services protect my personal information?

The best credit monitoring services use advanced encryption and security protocols to protect your personal information. They also monitor your credit report for suspicious activity and provide identity theft protection services. This multi-layered approach ensures that your data remains secure while you monitor your credit.

-

What benefits do I gain from using the best credit monitoring services?

Using the best credit monitoring services provides numerous benefits, including improved credit score awareness, timely alerts for changes in your credit report, and identity theft protection. These services empower you to take proactive steps in managing your credit health. Overall, they contribute to better financial decision-making.

Credit memo

Trusted eSignature solution - credit memo

Join over 28 million airSlate SignNow users

Get more for credit memo

- Find All You Need to Know: how to add signature to PDF ...

- Start Your eSignature Journey: how to change signature ...

- Enjoy Streamlined eSignature Workflows: how to change ...

- Start Your eSignature Journey: how to create a free ...

- Enjoy Streamlined eSignature Workflows: how to create a ...

- Start Your eSignature Journey: how to create an ...

- Start Your eSignature Journey: how to create an ...

- Try Seamless eSignatures: how to create an electronic ...

The ins and outs of eSignature