Employment (payroll) taxes

Employers must deposit and report employment taxes. At the end of the year, they must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee. Use Form W-3, Transmittal of Wage and Tax Statements to transmit Forms W-2 to the Social Security Administration. In this section, you can also find annual and quarterly federal tax returns for agricultural and household employees.

940 forms

Employer’s Annual Federal Unemployment (FUTA) Tax Return

Learn more

941 forms

Employer’s Quarterly Federal Tax Return

Learn more

943 form

Employer's Annual Federal Tax Return for Agricultural Employees

Learn more

944 forms

Employer’s Annual Federal Tax Return

Learn more

945 forms

Annual Return of Withheld Federal Income Tax

Learn more

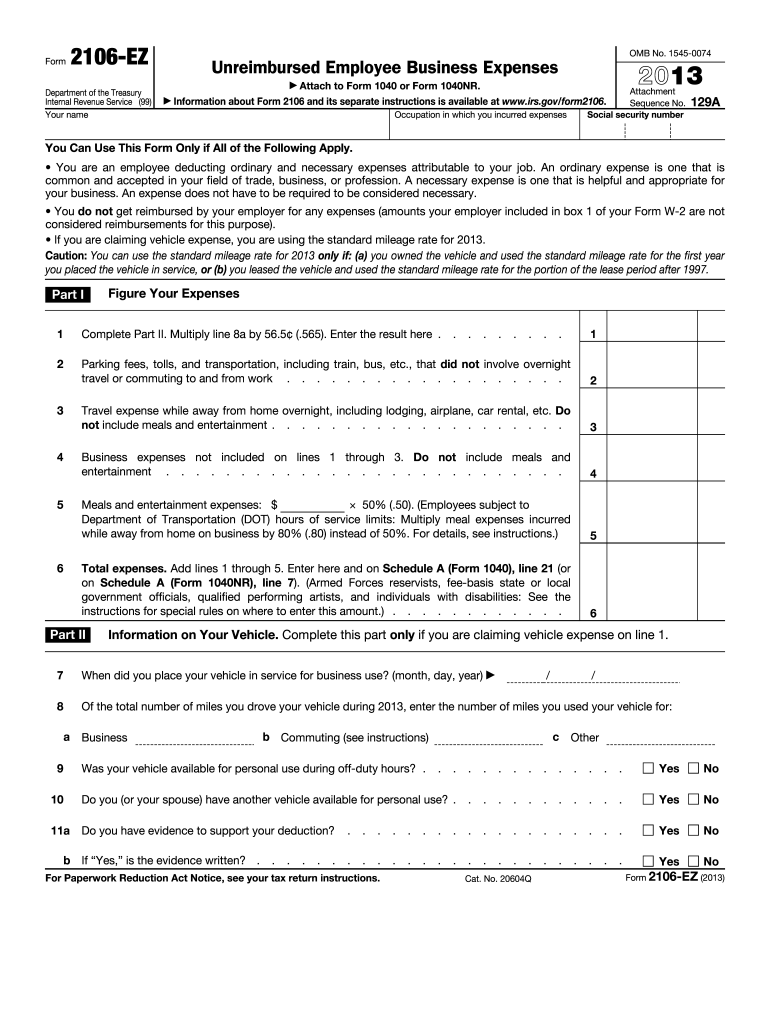

2106-EZ form

Unreimbursed Employee Business Expenses

Learn more

SS-4 forms

Application for Employer Identification Number

Learn more

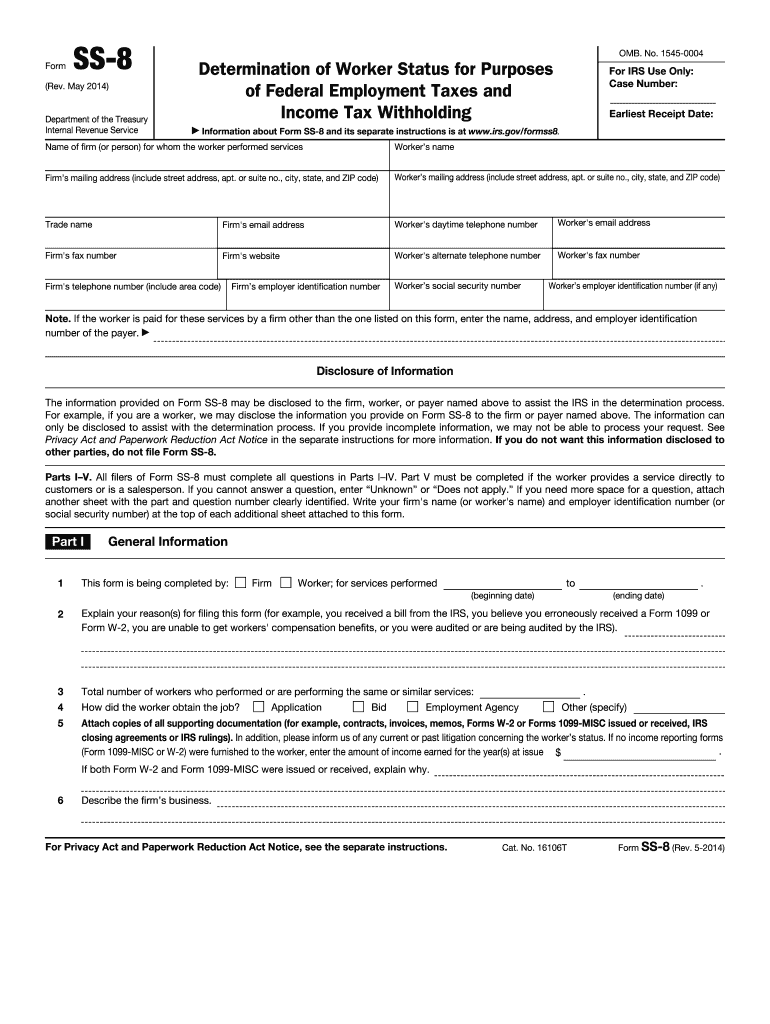

SS-8 form

Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

Learn more

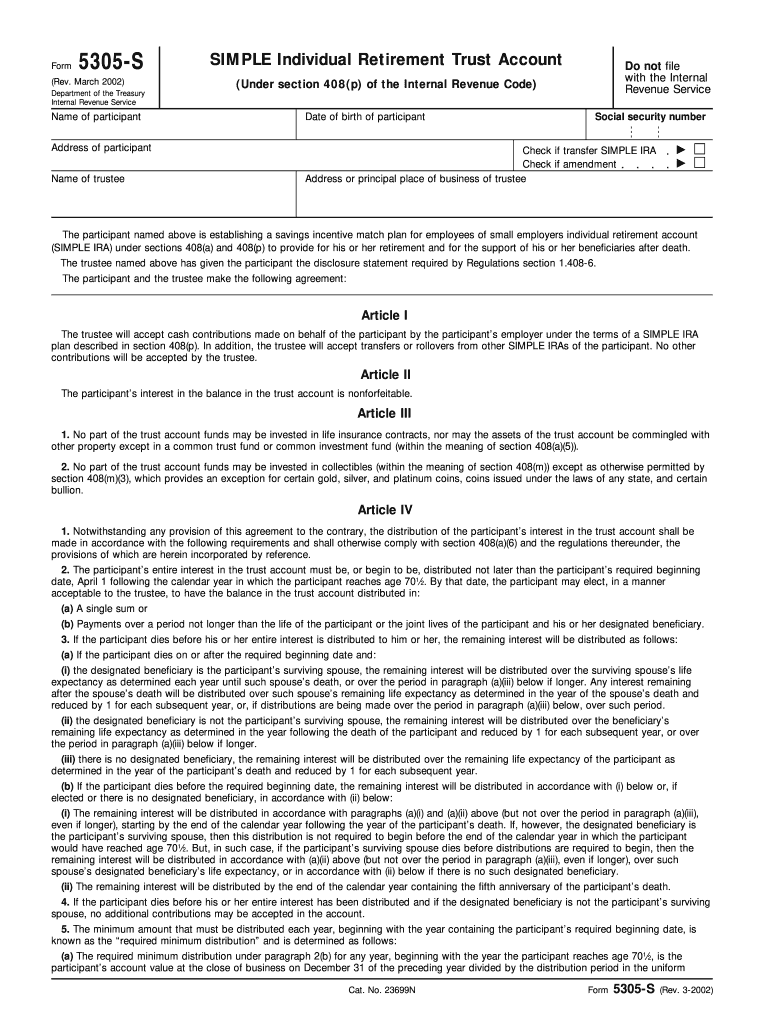

5305-S form

Simple Individual Retirement Trust Account

Learn more

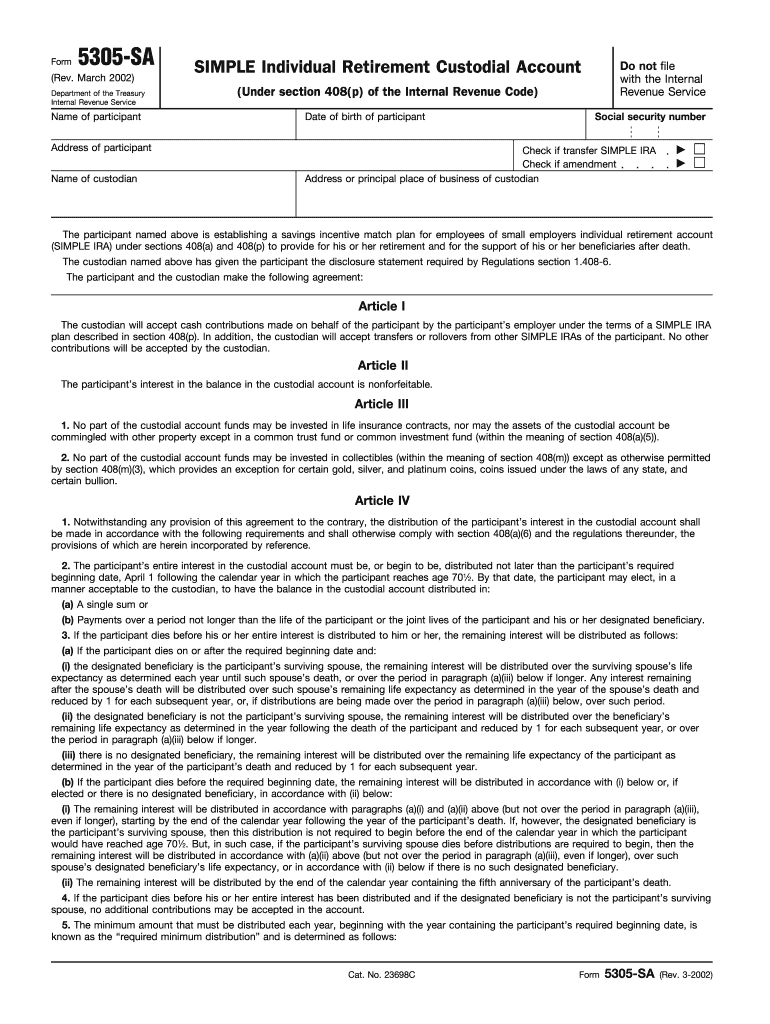

5305-SA form

Simple Individual Retirement Custodial Account

Learn more

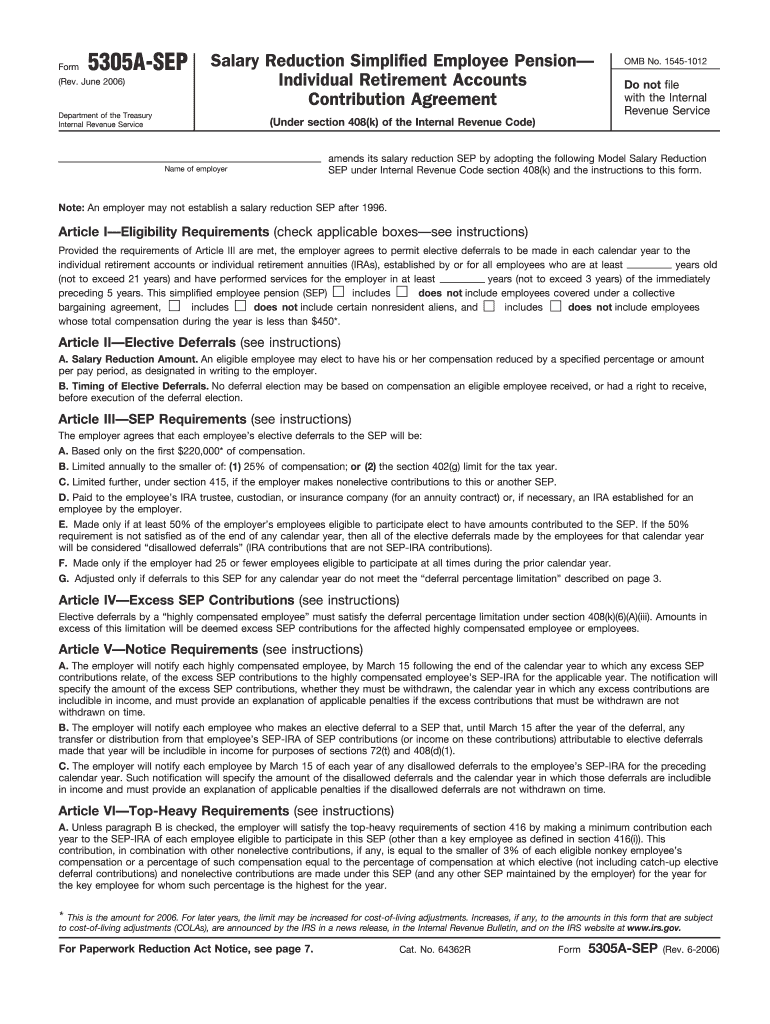

5305A-SEP form

Salary Reduction Simplified Employee Pension— Individual Retirement Accounts Contribution Agreement.

Learn more

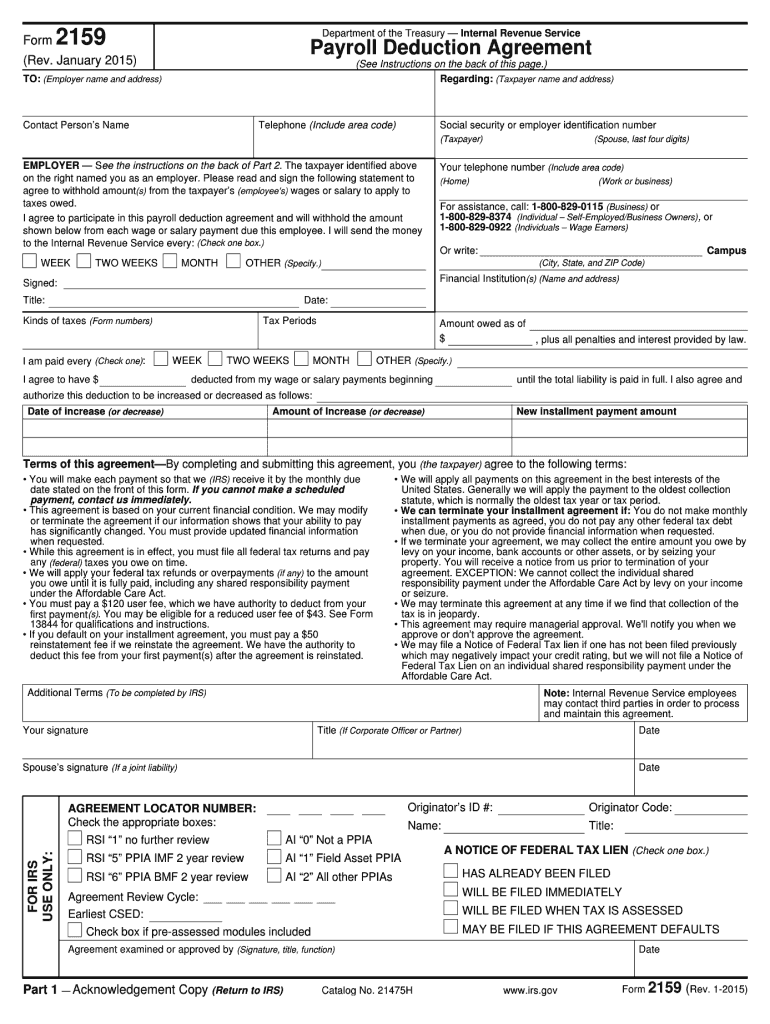

2159 form

Payroll Deduction Agreement

Learn more

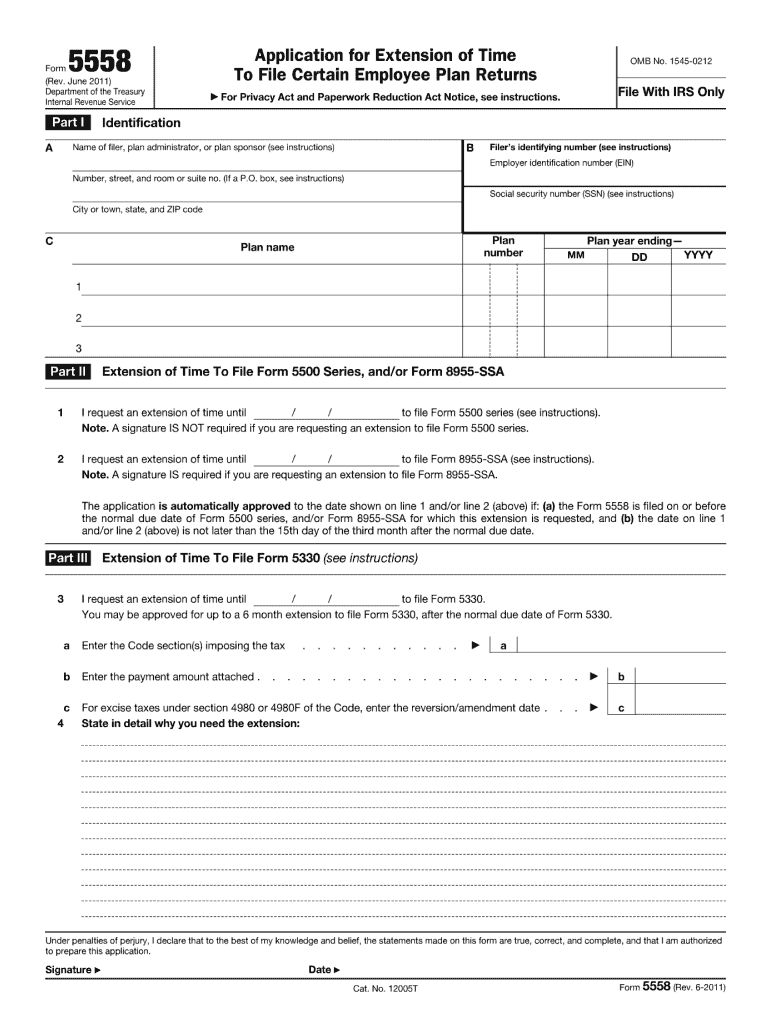

5558 form

Application for Extension of Time To File Certain Employee Plan Returns

Learn more