IRS library

Entity returns

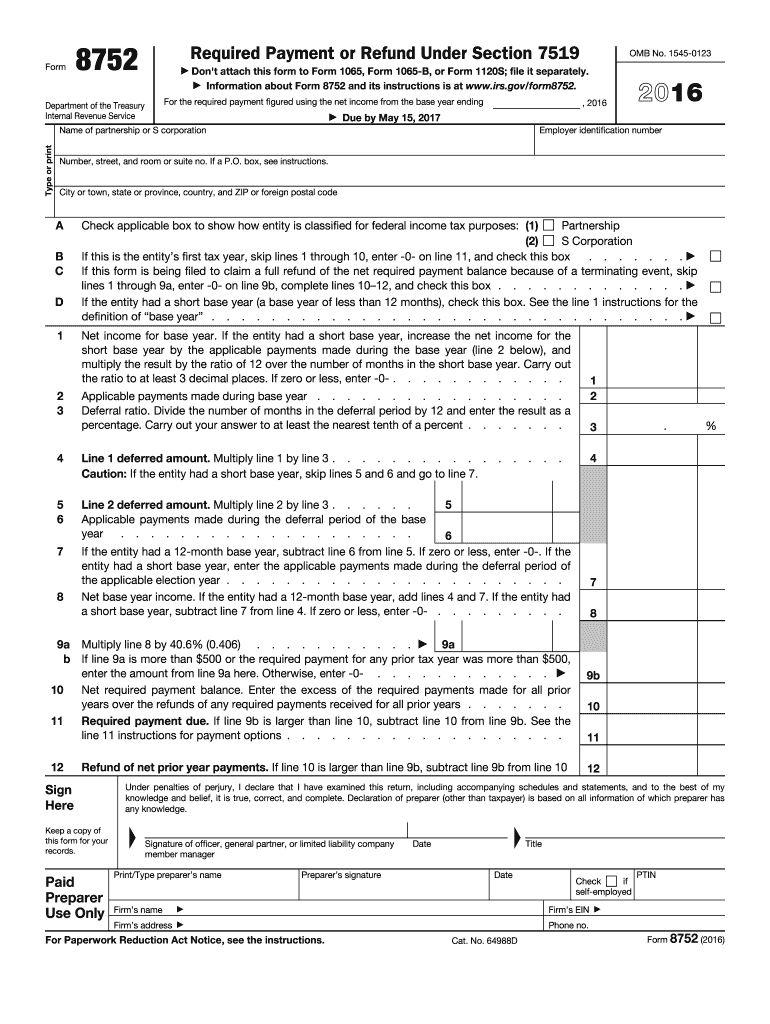

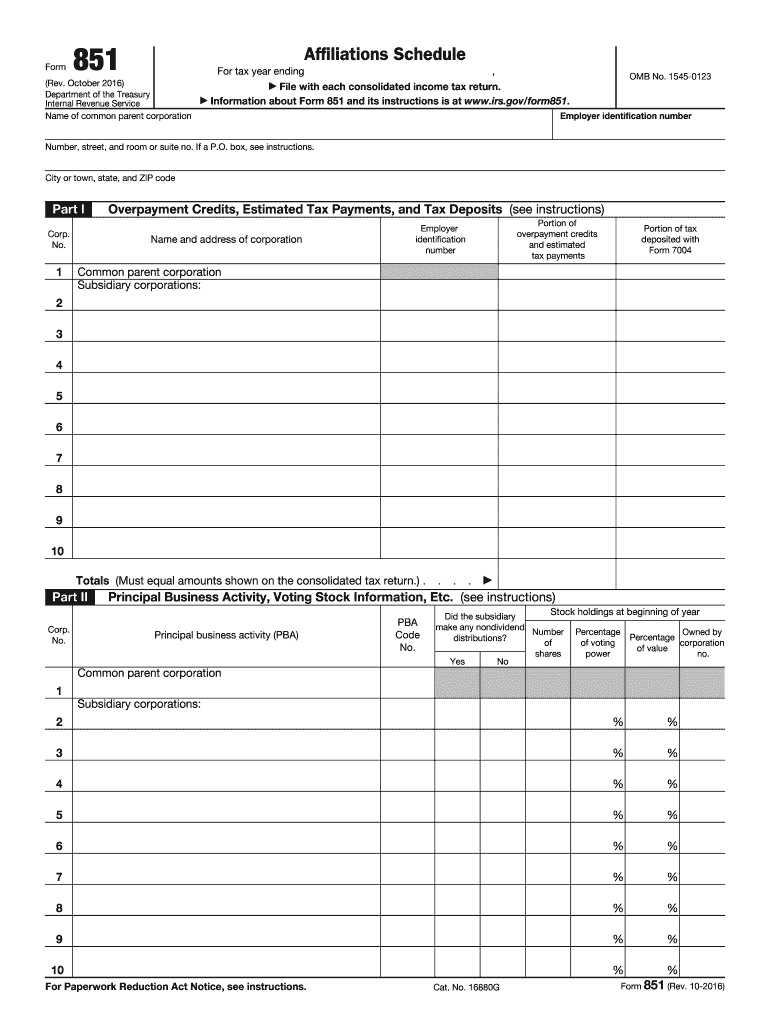

1065 forms

U.S. Return of Partnership Income is used by partnerships for reporting annual taxes.

Learn more

1041 forms

U.S. Income Tax Return for Estates and Trusts is used by estates and trusts for reporting annual taxes

Learn more

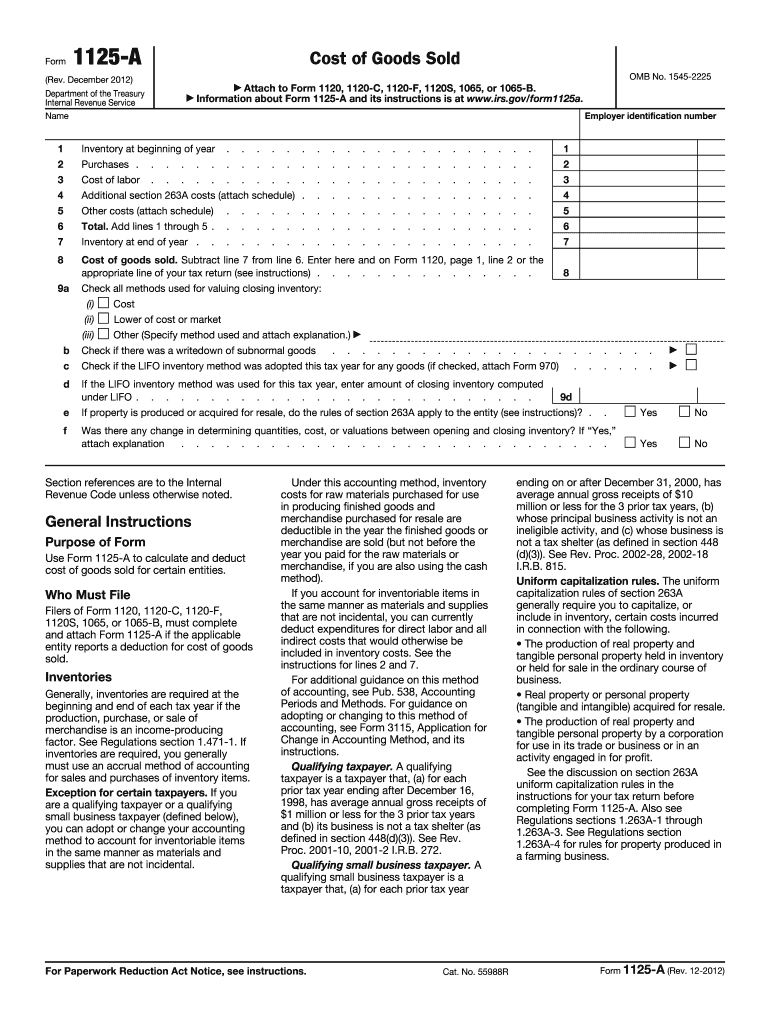

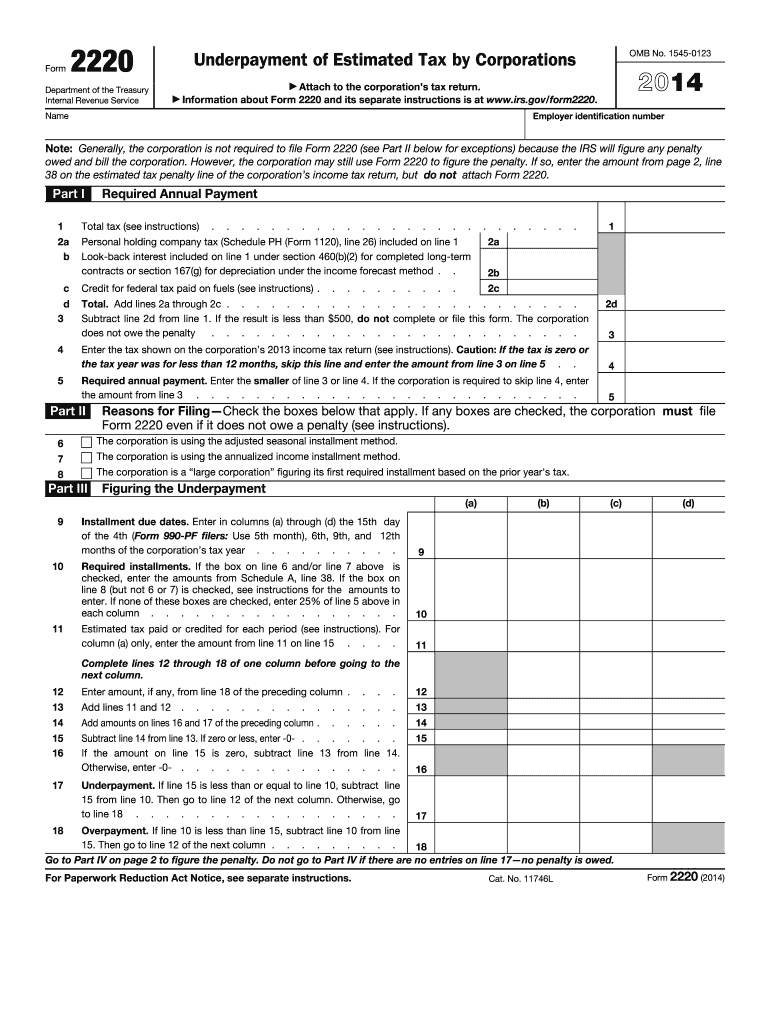

1120 forms

U.S. Corporation Income Tax Return is used by corporations for reporting annual taxes.

Learn more

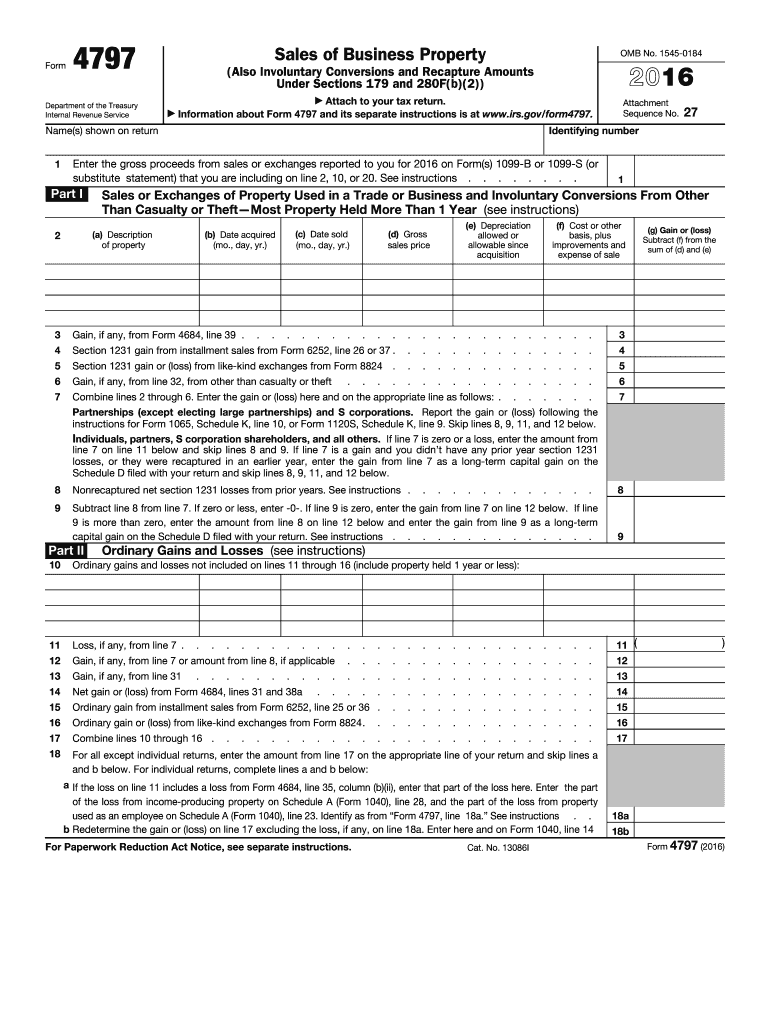

4797 form

Sales of Business Property (Also Involuntary Conversions and Recapture Amounts)

Learn more

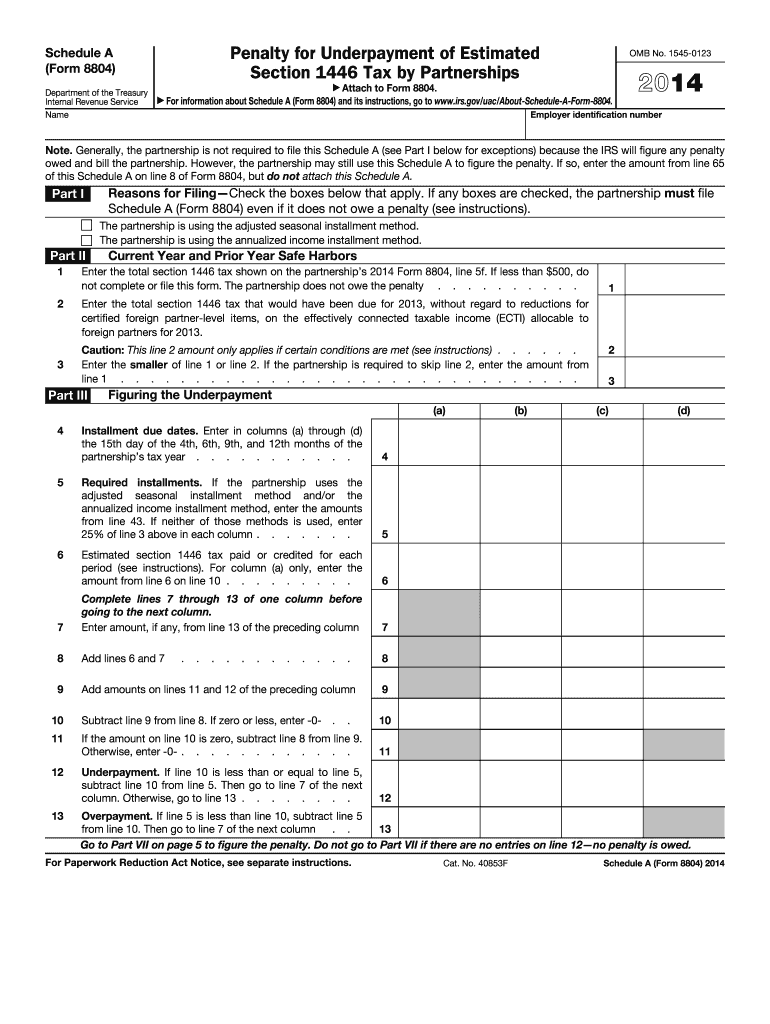

IRS 8804 Schedule A

Penalty for Underpayment of Estimated Section 1446 Tax for Partnerships

Learn more

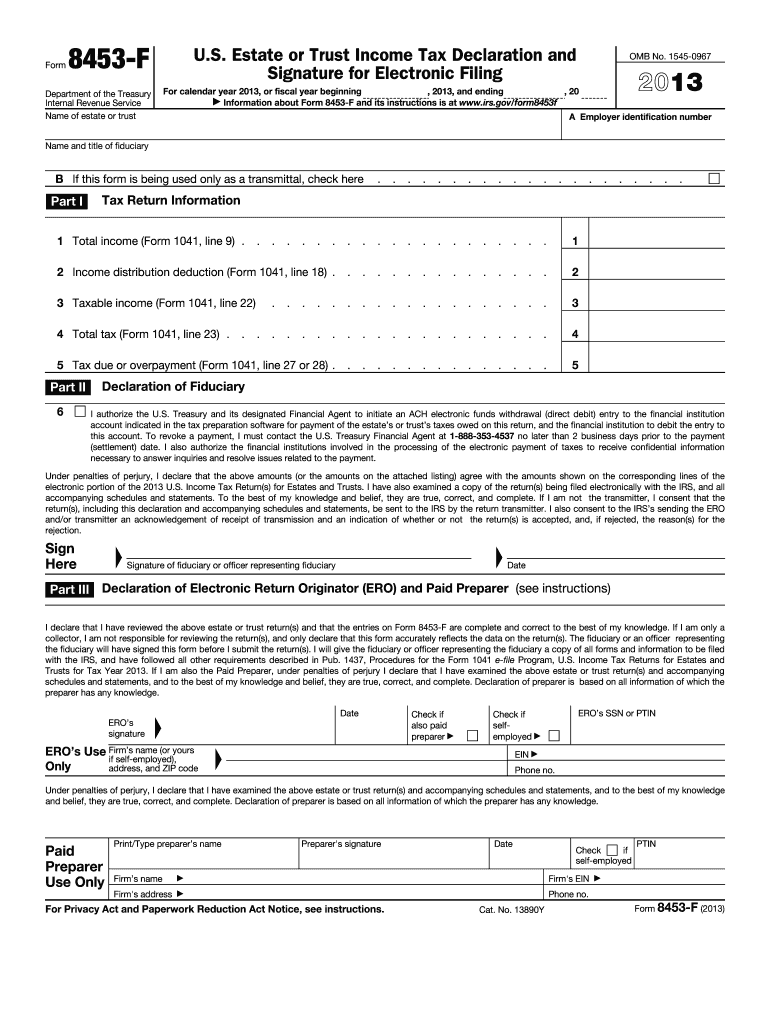

8453-F form

U.S. Estate or Trust Income Tax Declaration and Signature for Electronic Filing

Learn more

8879 forms

Use this form to authorize a signature for an e-filed return filed by an electronic return originator (ERO).

Learn more

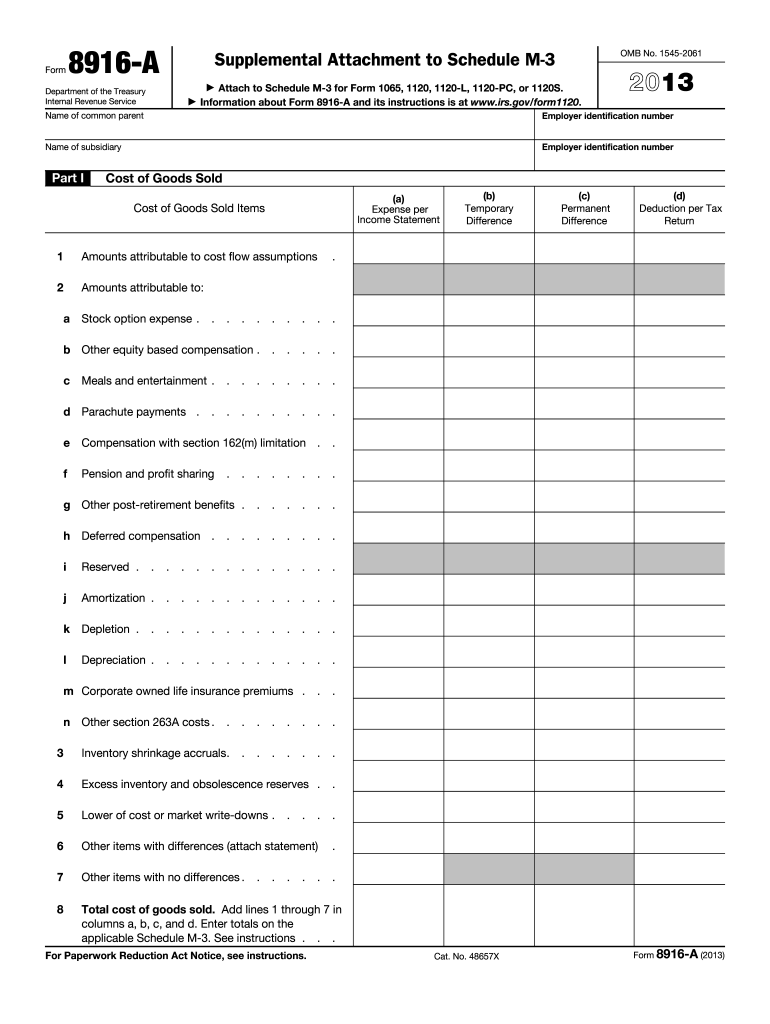

8916-A form

Supplemental Attachment to Schedule M-3. Attach this to Schedule M-3 for Form 1065, 1120, 1120-L, 1120-PC, or 1120S

Learn more

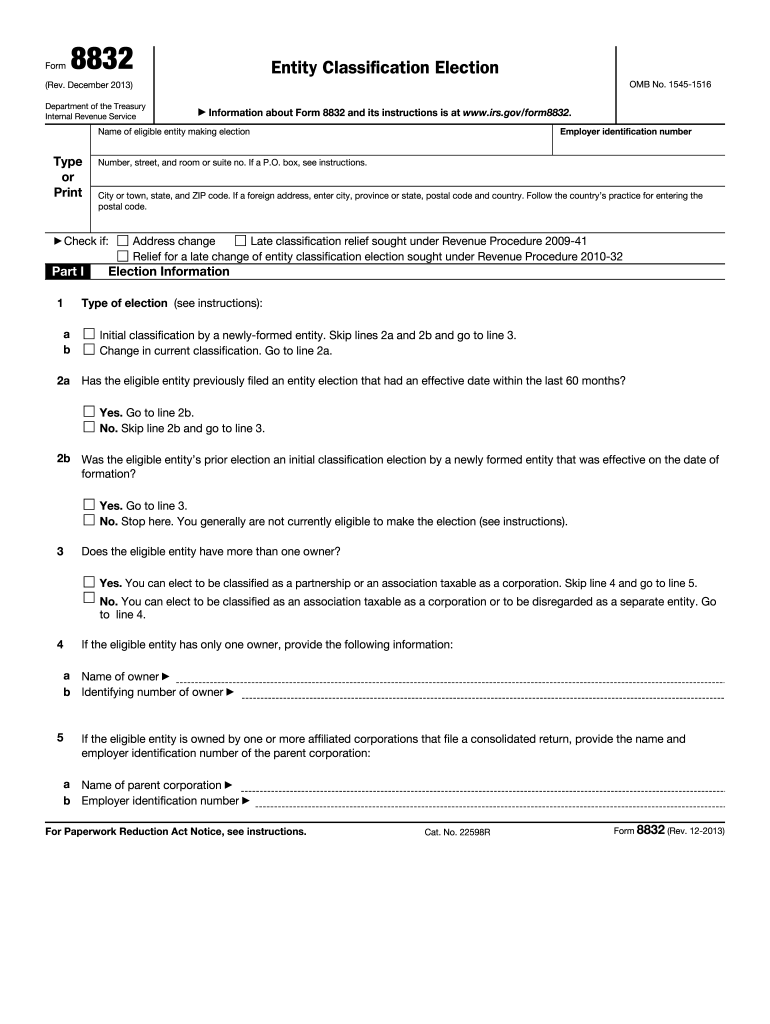

8832 form

Entity Classification Election. Entity uses this form to elect how it will be classified for federal tax purposes

Learn more

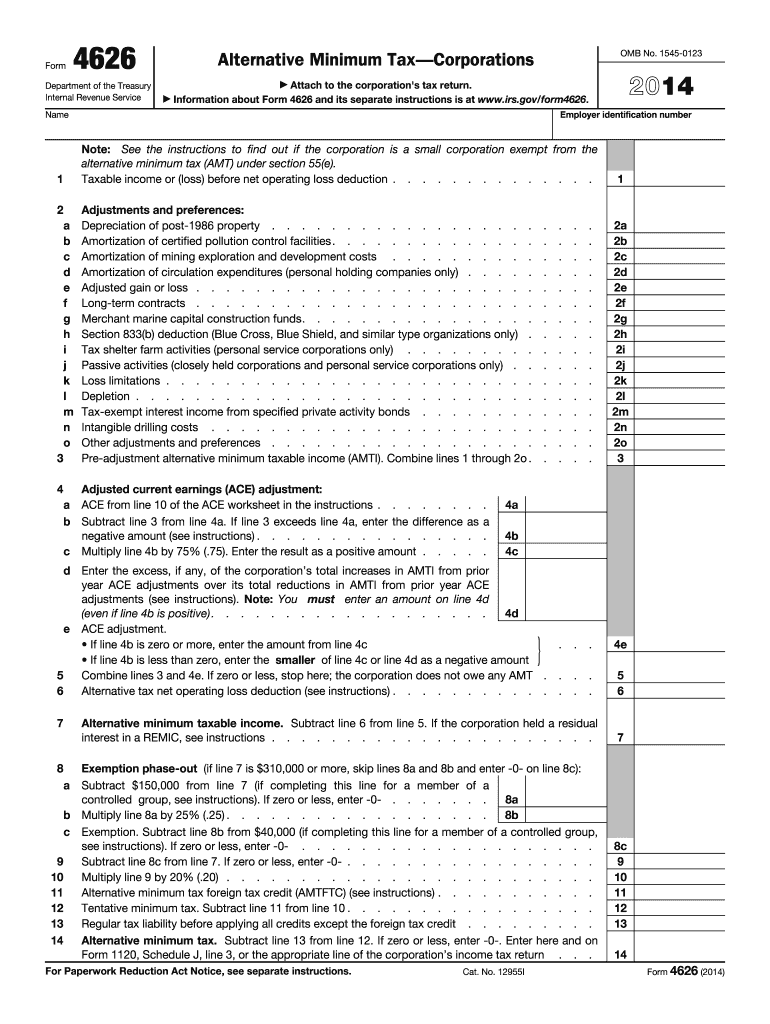

4626 form

Alternative Minimum Tax - Corporations is used by corporations to calculate their alternative minimum tax (AMT) under section 55.

Learn more

-

1

- 2