IRS library

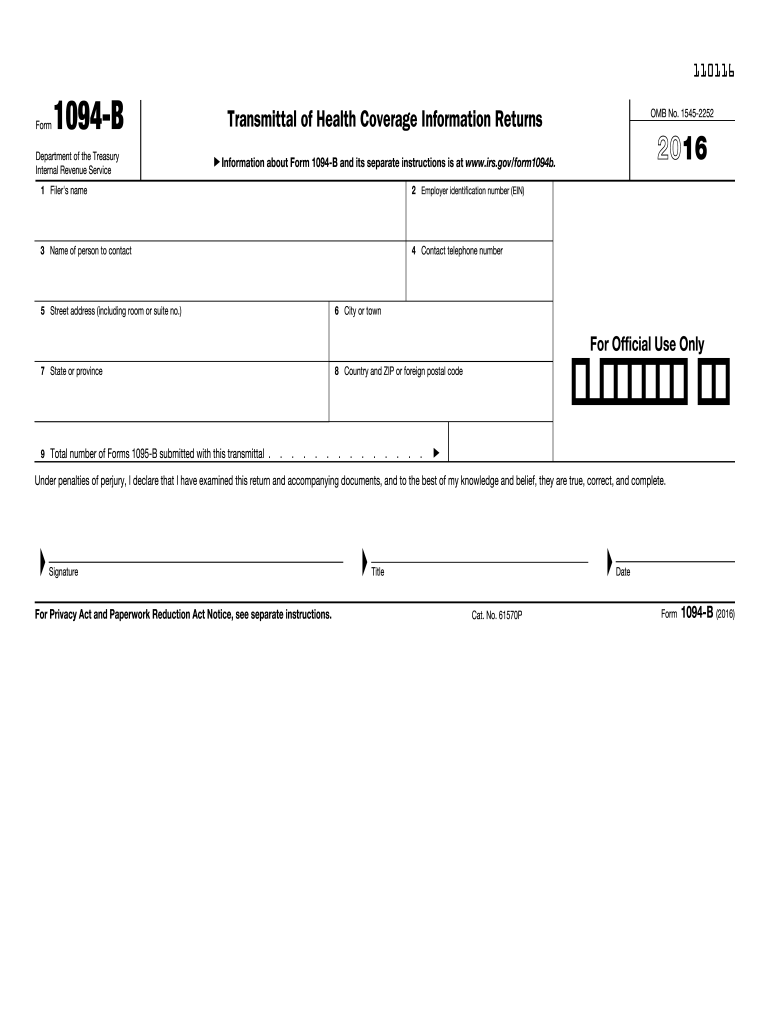

Information returns

1095 forms

Form 1095 series is used to report health care insurance coverage per the individual health insurance mandate

Learn more

1098 forms

Mortgage Interest Statement is used to report interest that a taxpayer has paid on his or her mortgage

Learn more

1099 forms

Form 1099 series is used to report various types of income other than wages, salaries, and tips

Learn more

5498 forms

IRA Contribution Information is used to report contributions and the fair market value of the account to IRS

Learn more

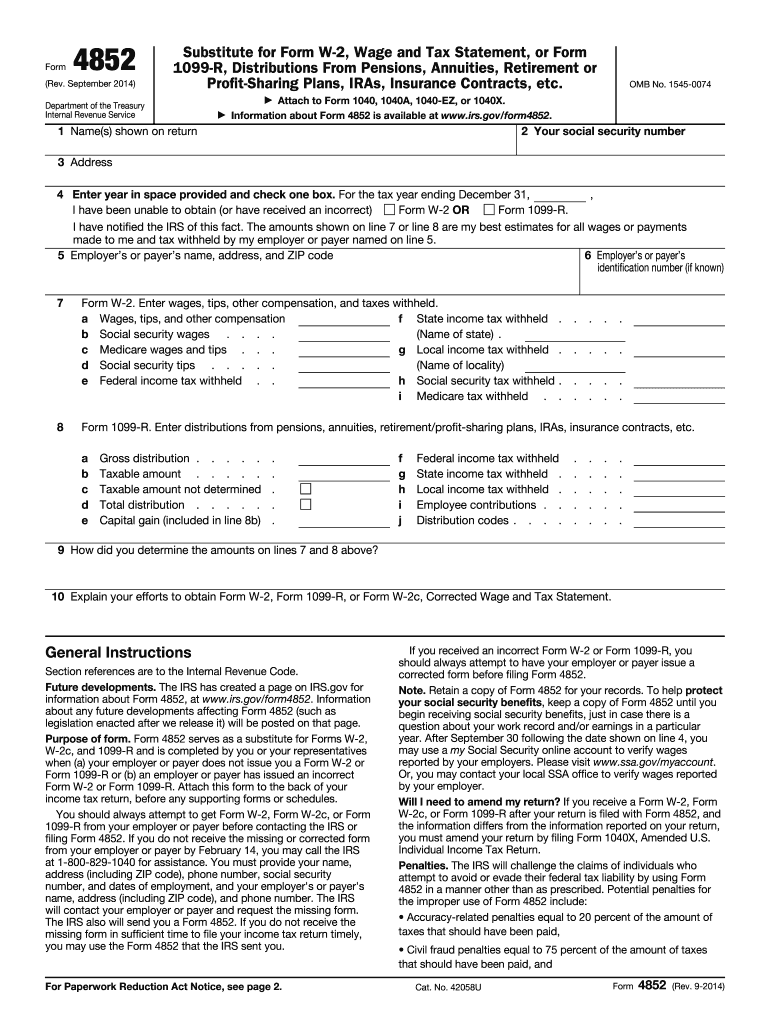

W-2 forms

Wage and Tax Statement is used to report wages paid to employees and the taxes withheld from them

Learn more

W-4 forms

The form W-4 is used by employers to determine the amount of tax withholding to deduct from employees' wages

Learn more

W-7 form

The Form W-7 and related documents are the application for IRS Individual Taxpayer Identification Number (ITIN)

Learn more

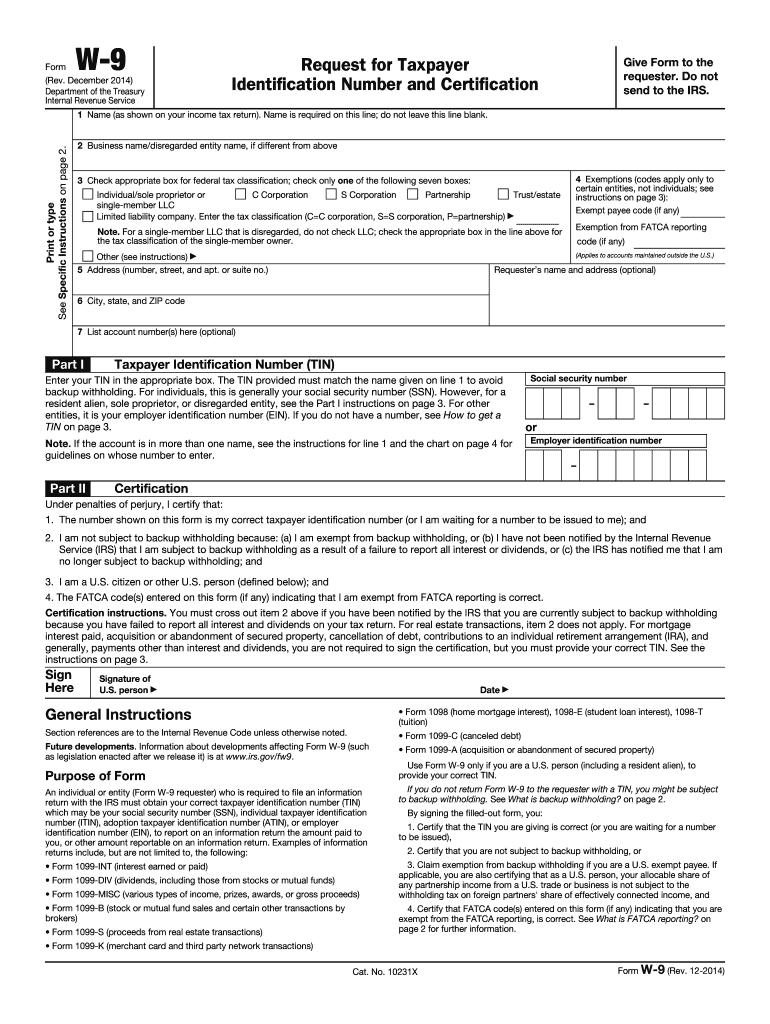

W-9 form

Request for Taxpayer Identification Number and Certification serves to provide third parties with identifying information about a taxpayer

Learn more

W-10 form

Dependent care provider identification is a way to inform an individual that day care service provider can take credits for care of their children

Learn more

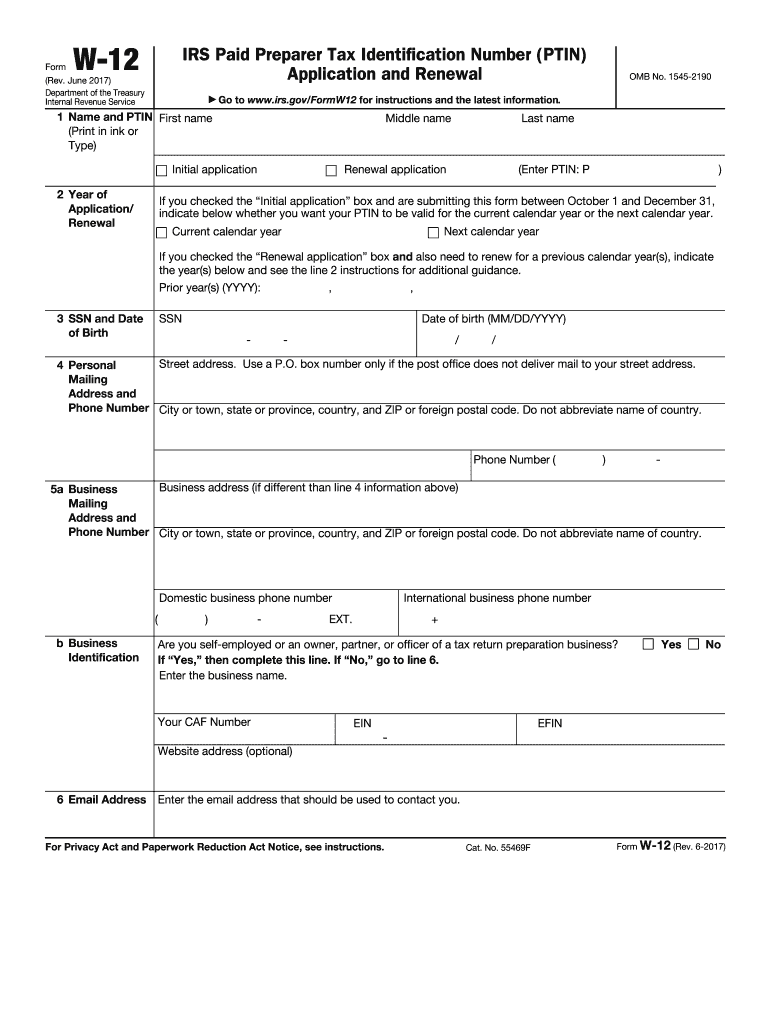

W-12 form

The form W-12 is a form for tax preparation professionals to apply for their ID Number

Learn more

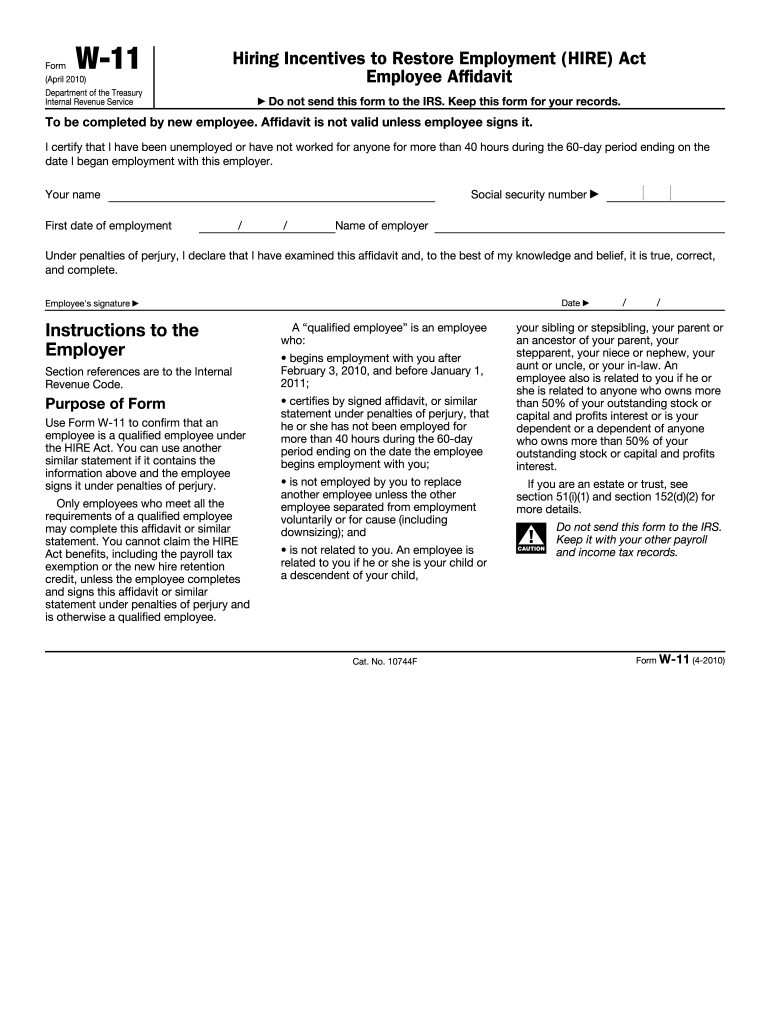

W-11 form

Hiring Incentives to Restore Employment (HIRE) Act Employee Affidavit is to certify that a new employee was previously unemployed

Learn more

3520 Form

Annual Return To Report Transactions With Foreign Trusts and the Receipt of Certain Foreign Gifts

Learn more

-

1

- 2