IRS library

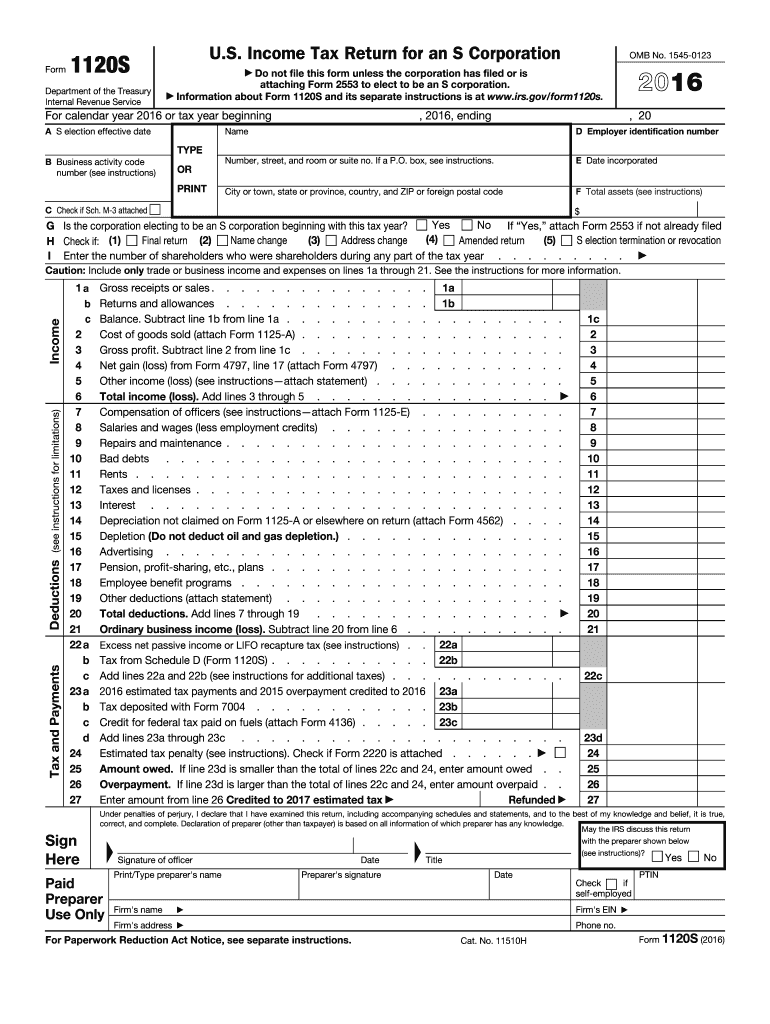

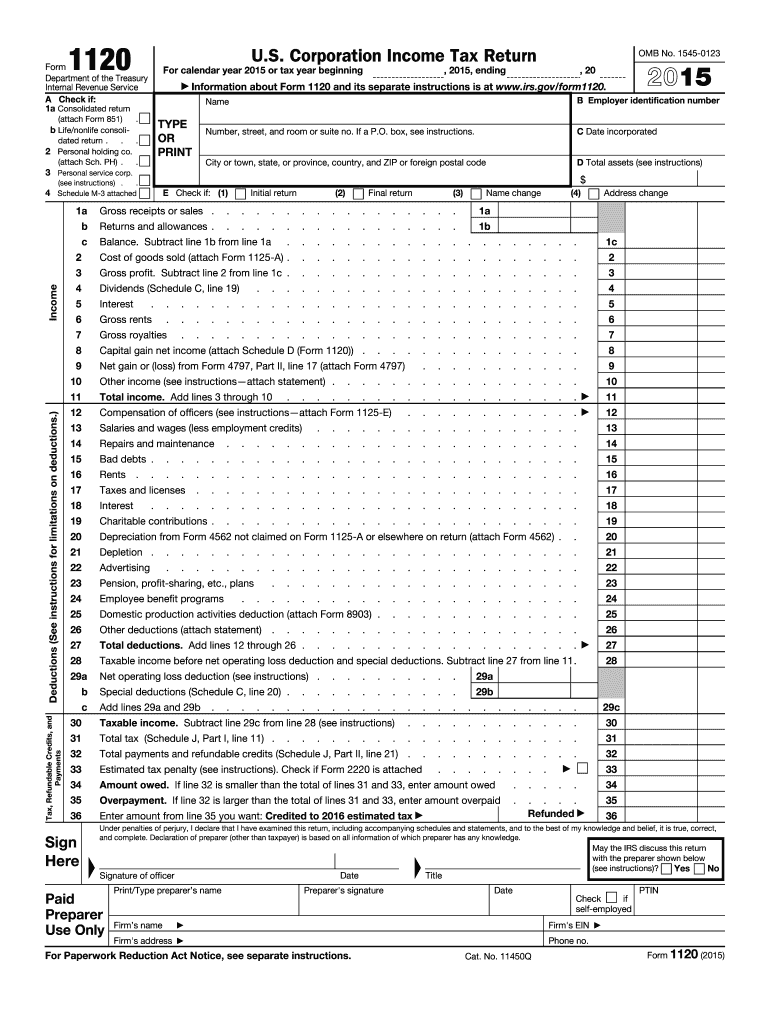

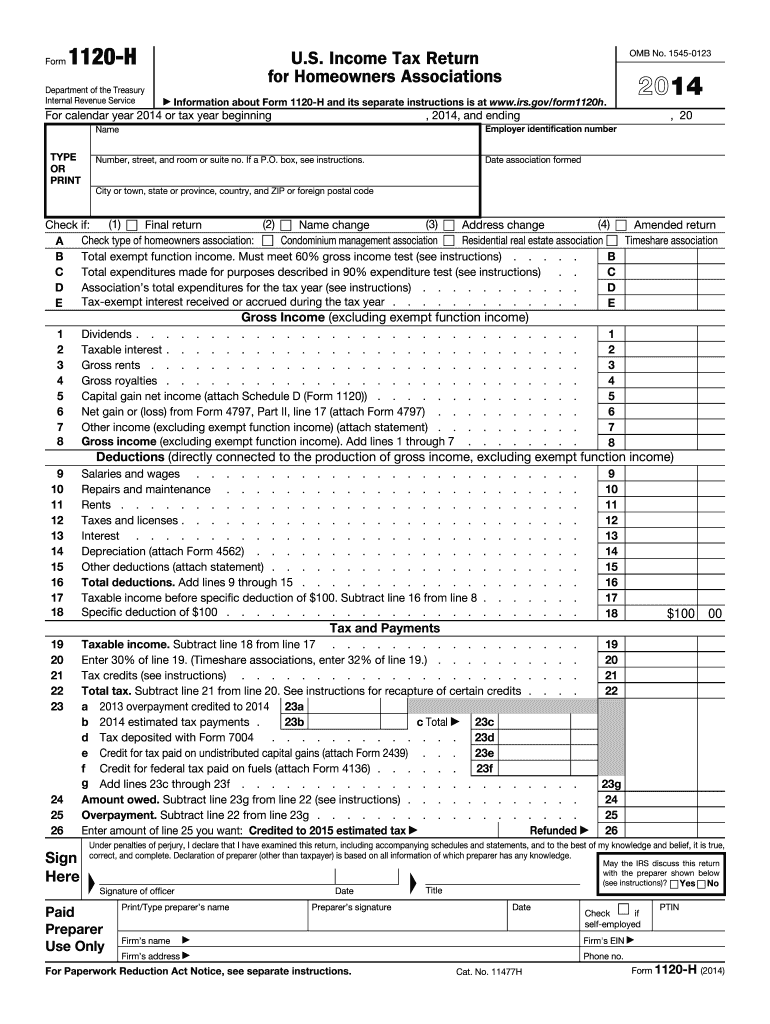

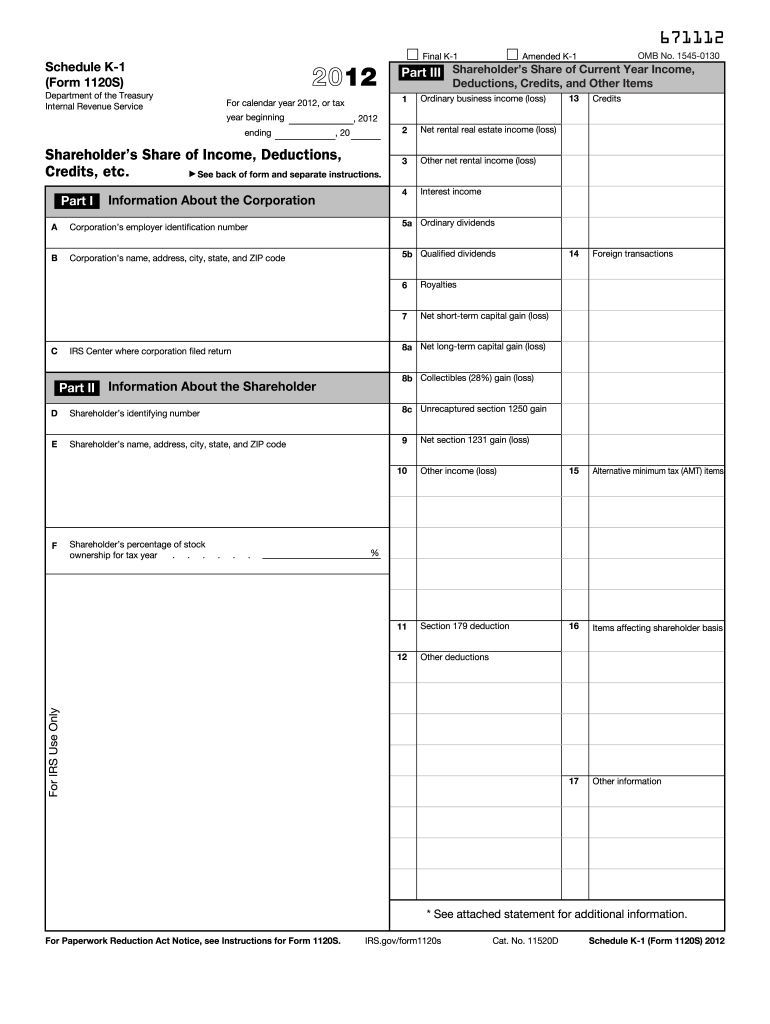

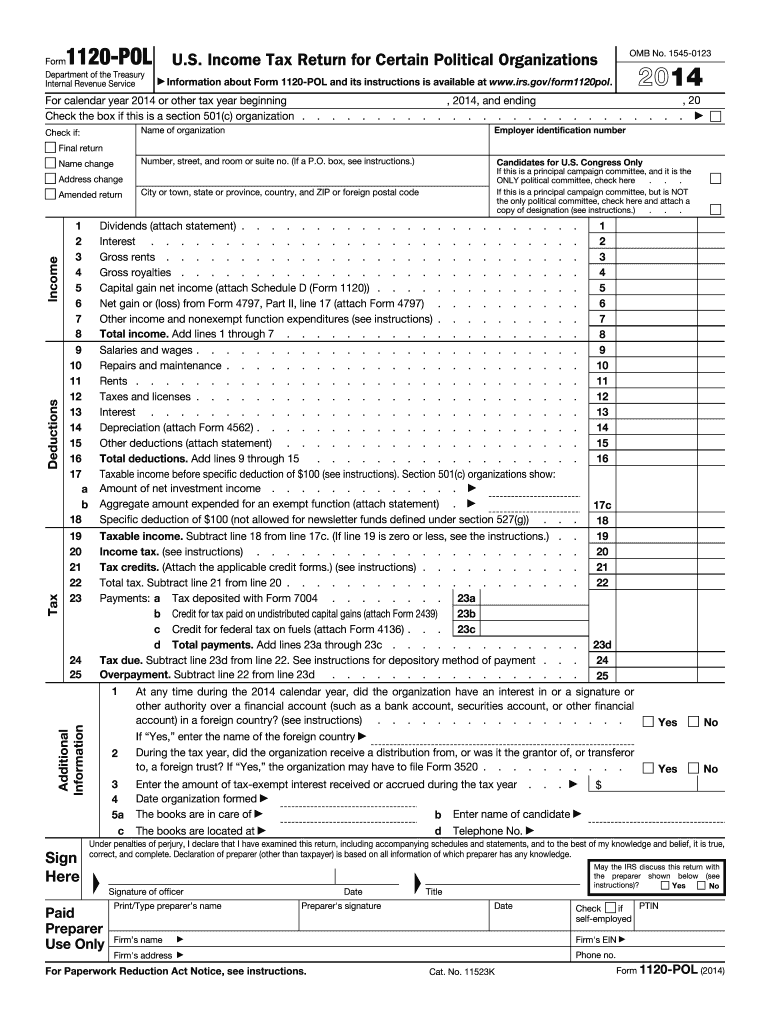

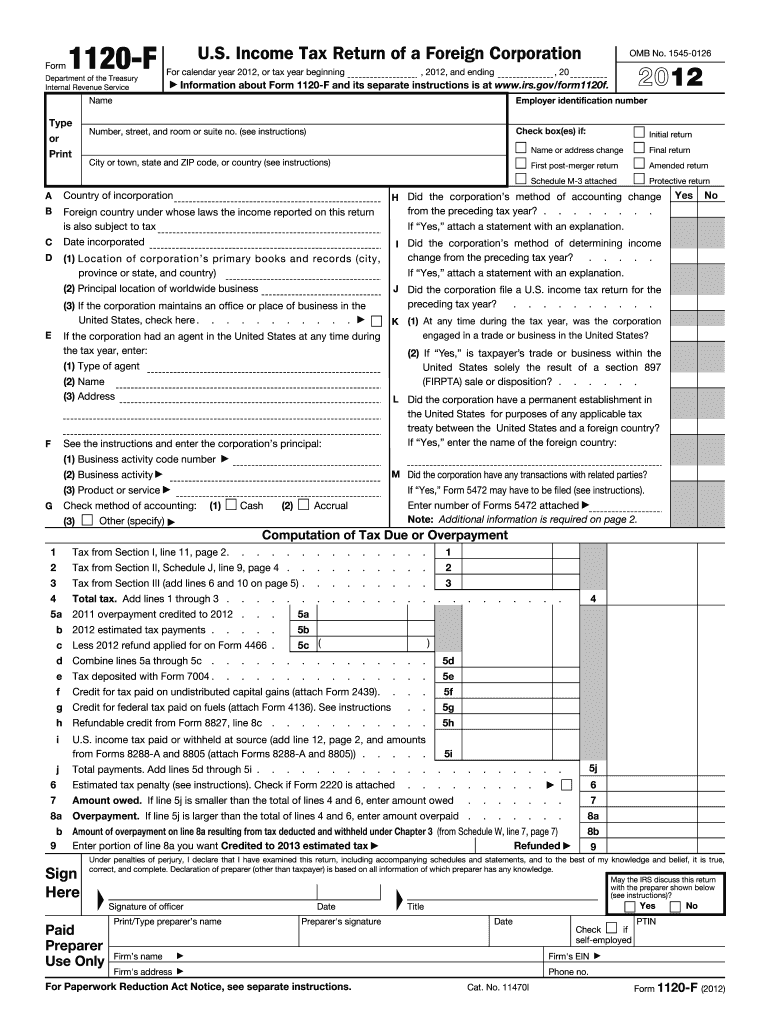

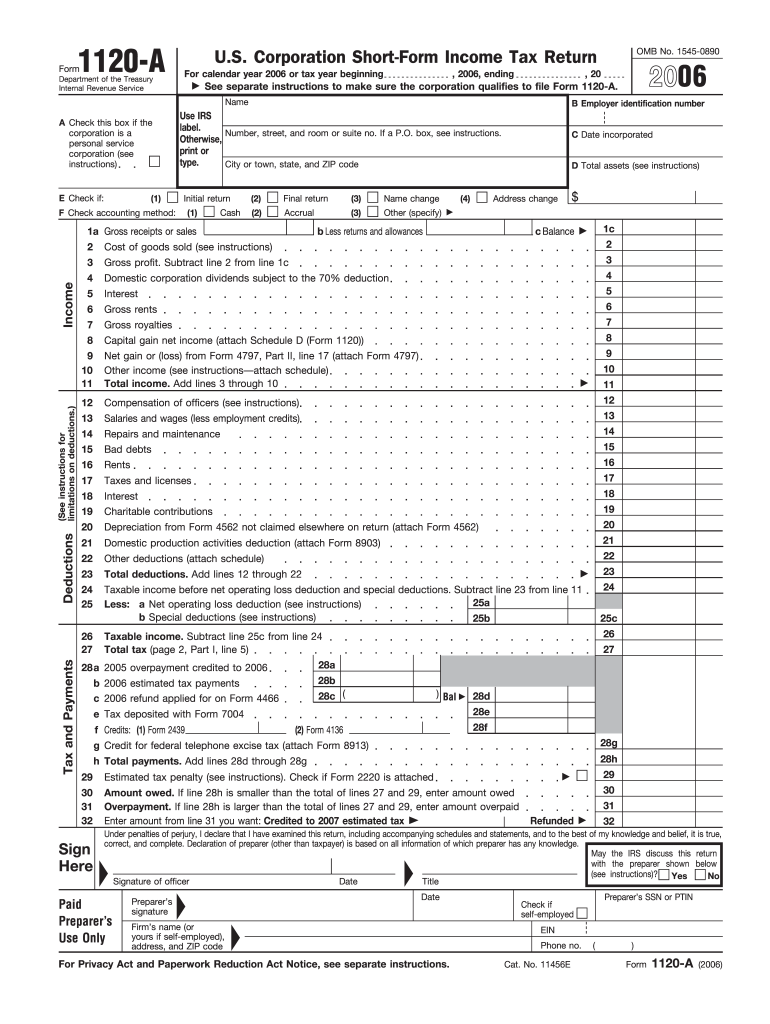

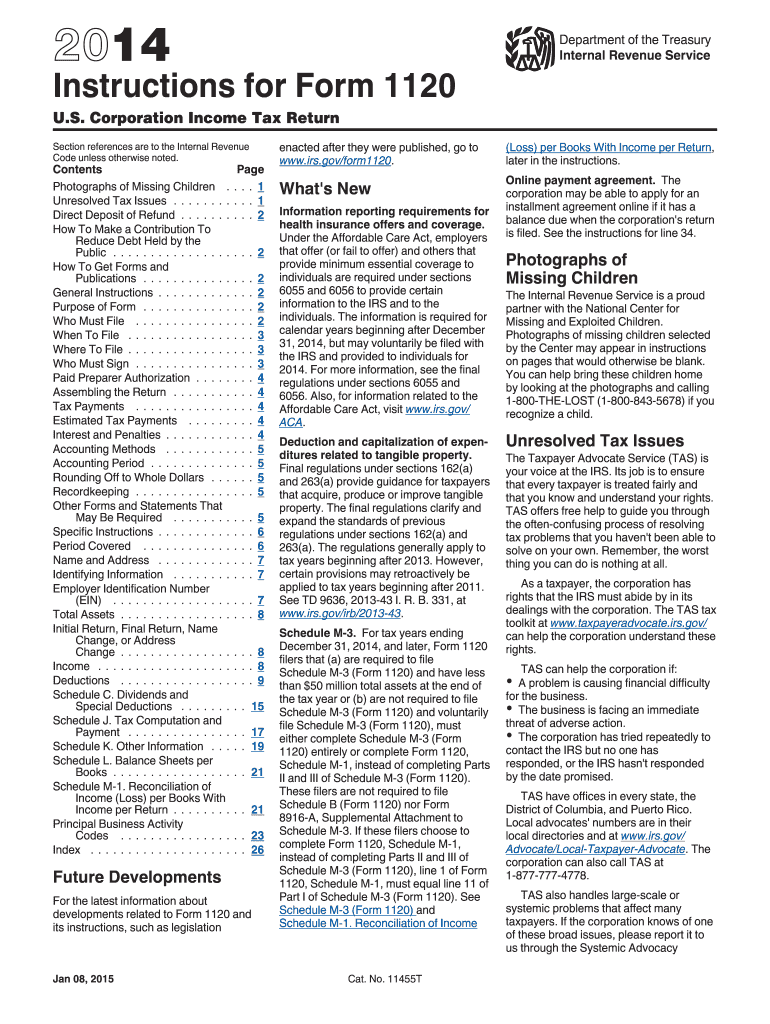

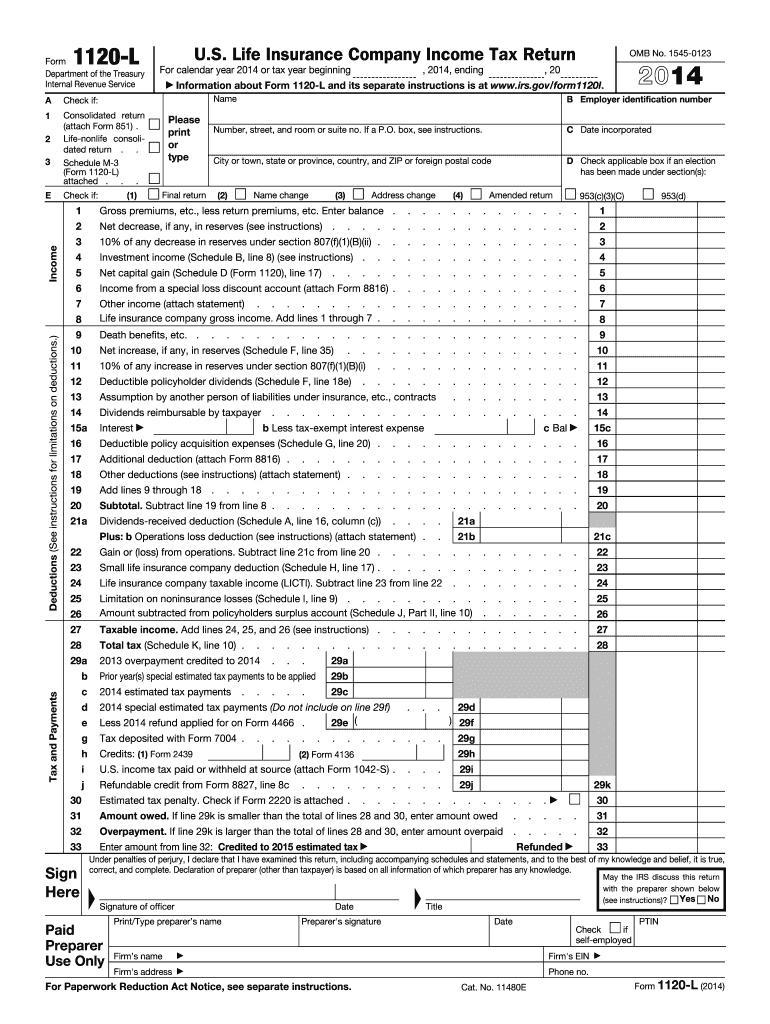

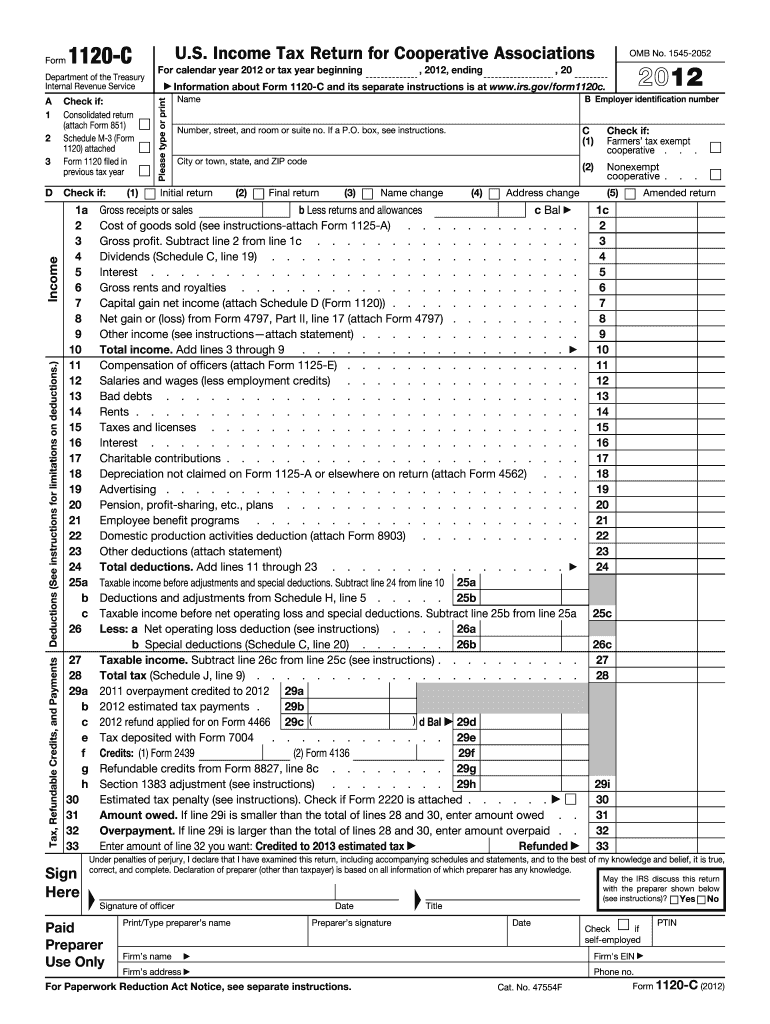

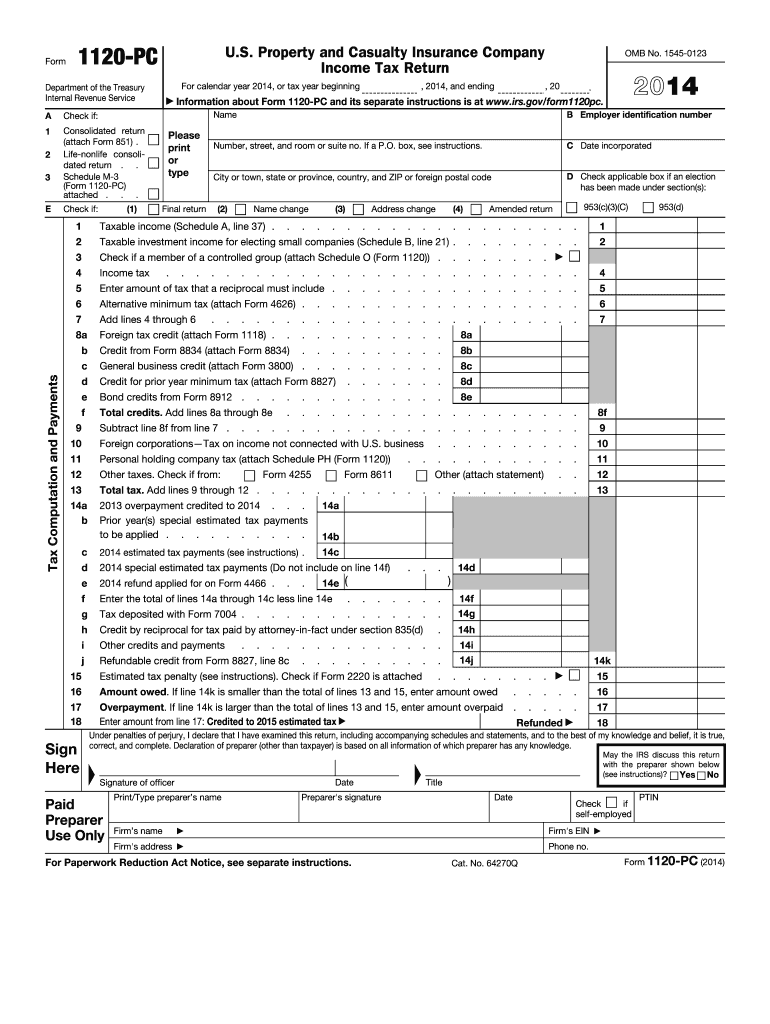

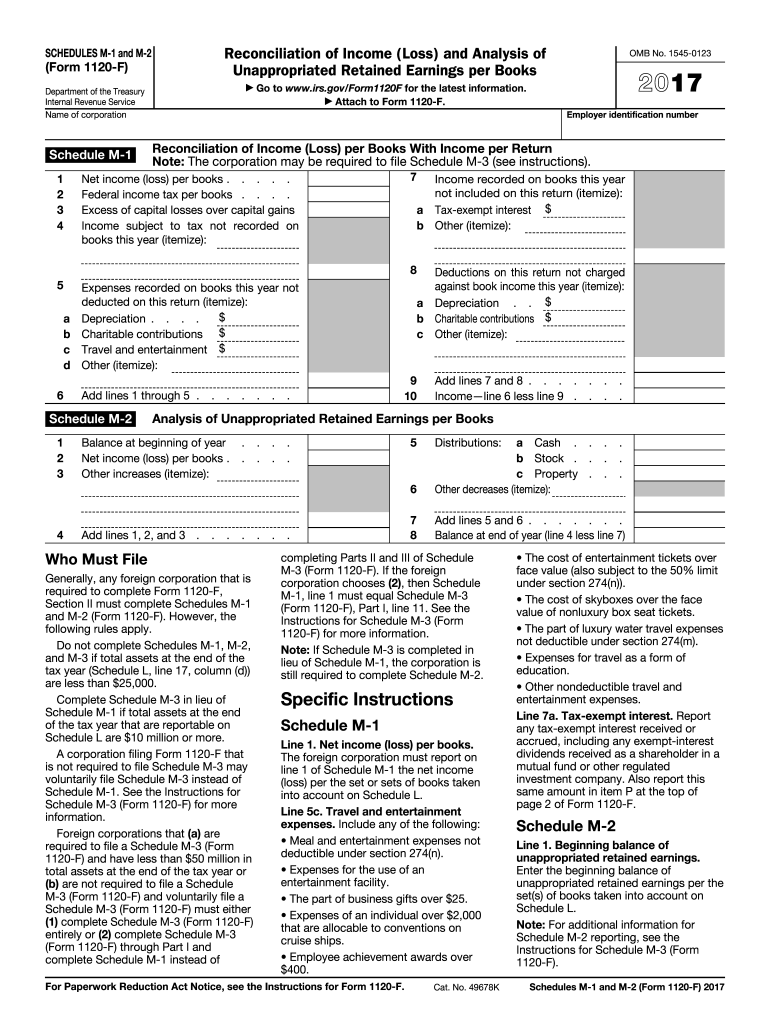

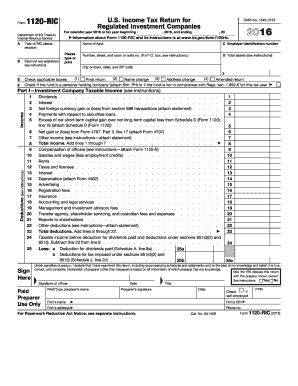

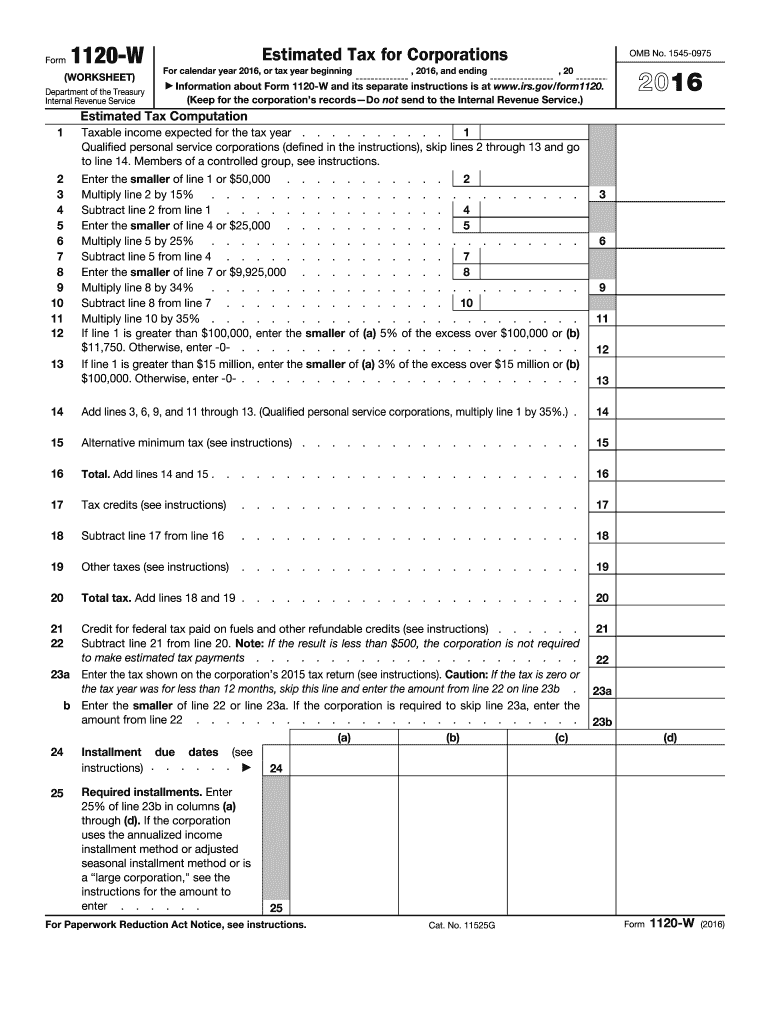

1120 forms

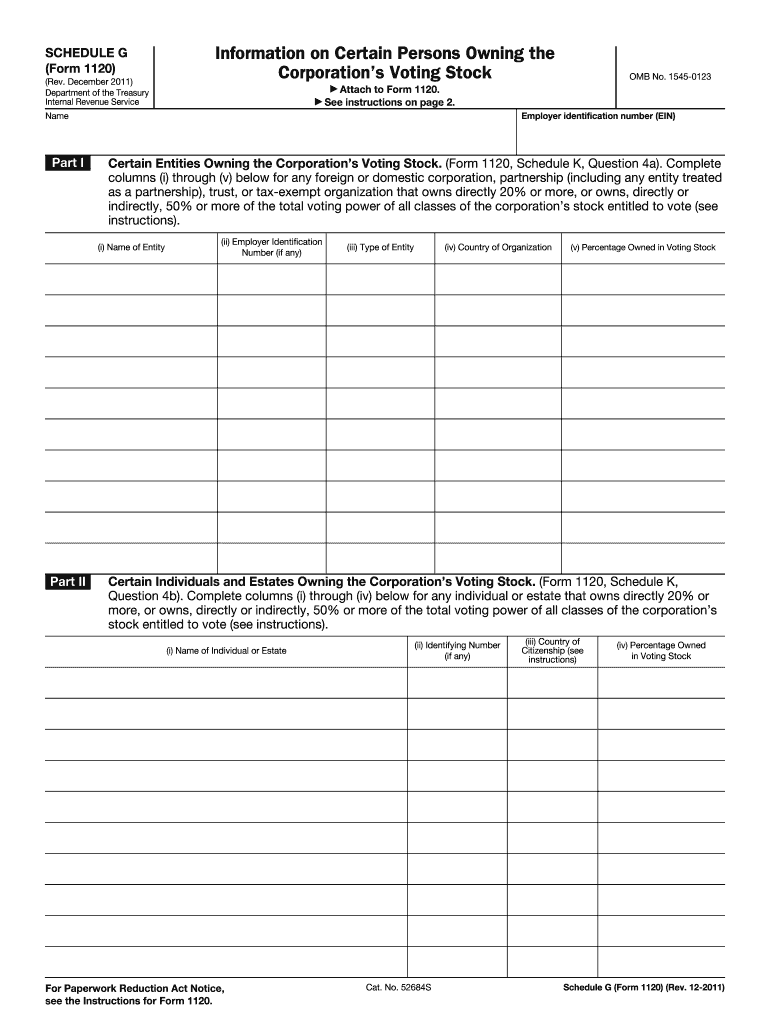

Schedule G (1120 form)

Information on certain persons owning the corporation's voting stock

Learn more

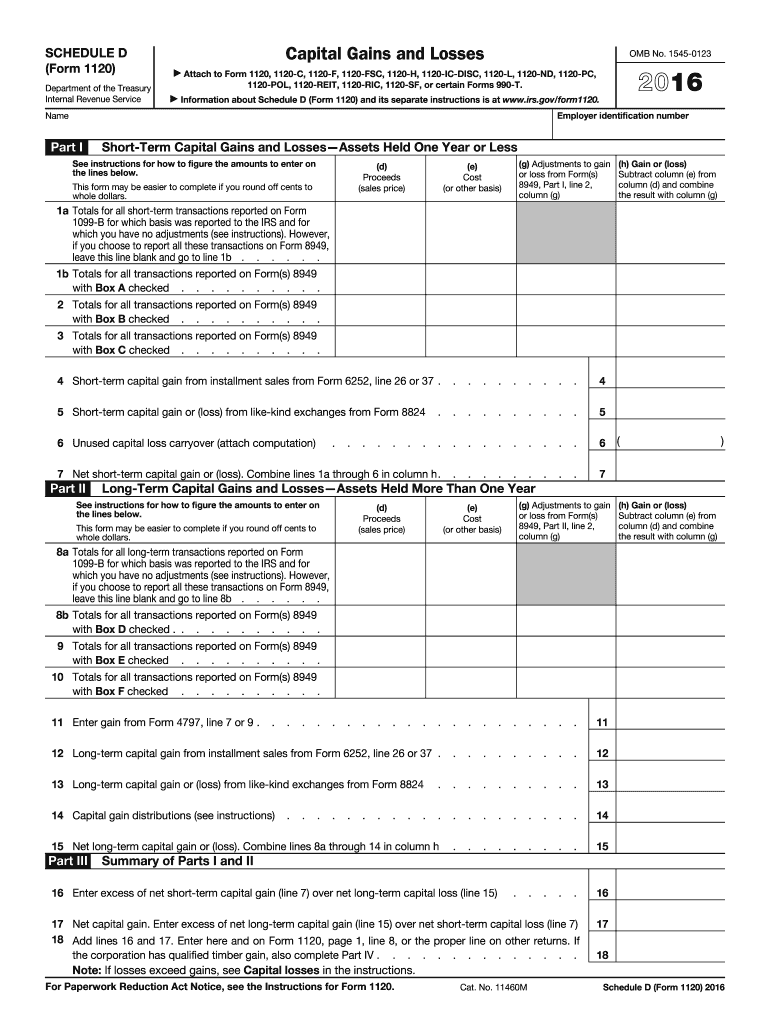

Schedule D (1120 form)

Use this schedule to report gains and losses and attach to Form 1120.

Learn more

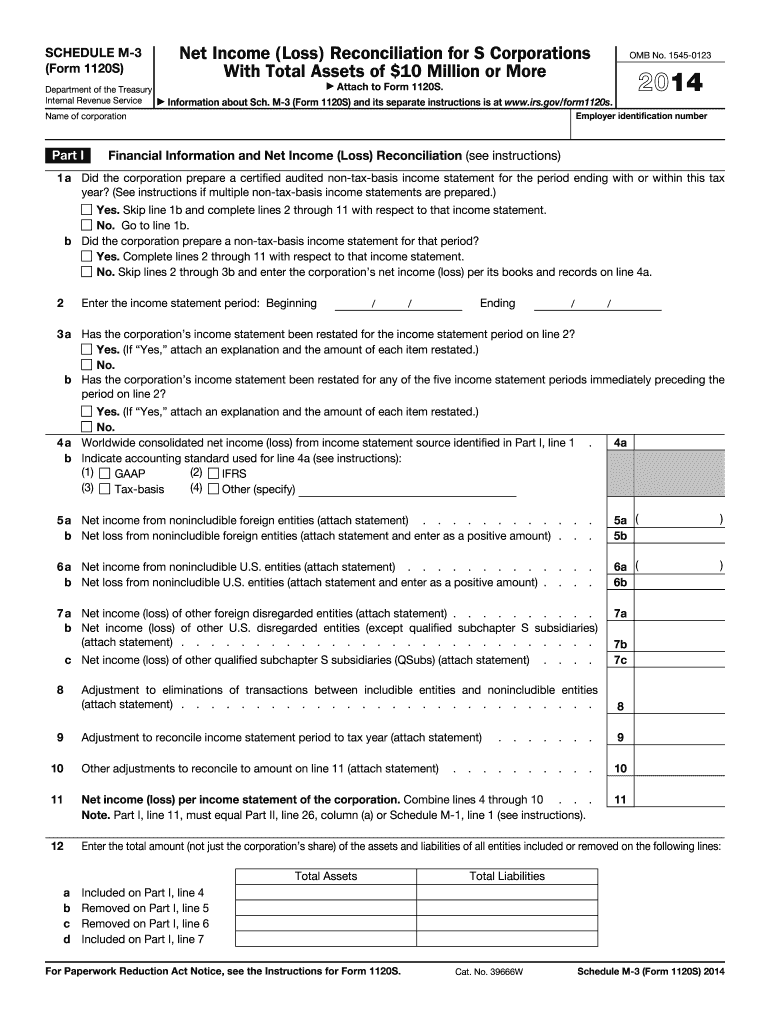

Schedule M-3 (1120-S form)

Net Income (Loss) Reconciliation for S Corporations With Total Assets of $10 Million or More

Learn more

-

1

- 2