IRS library

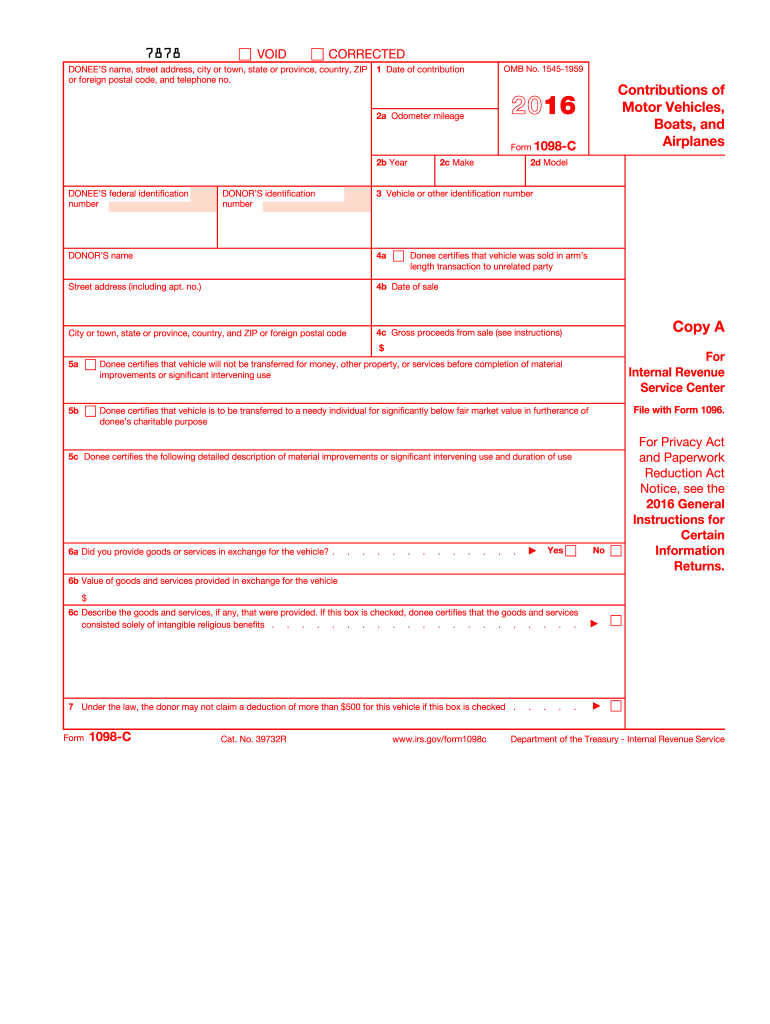

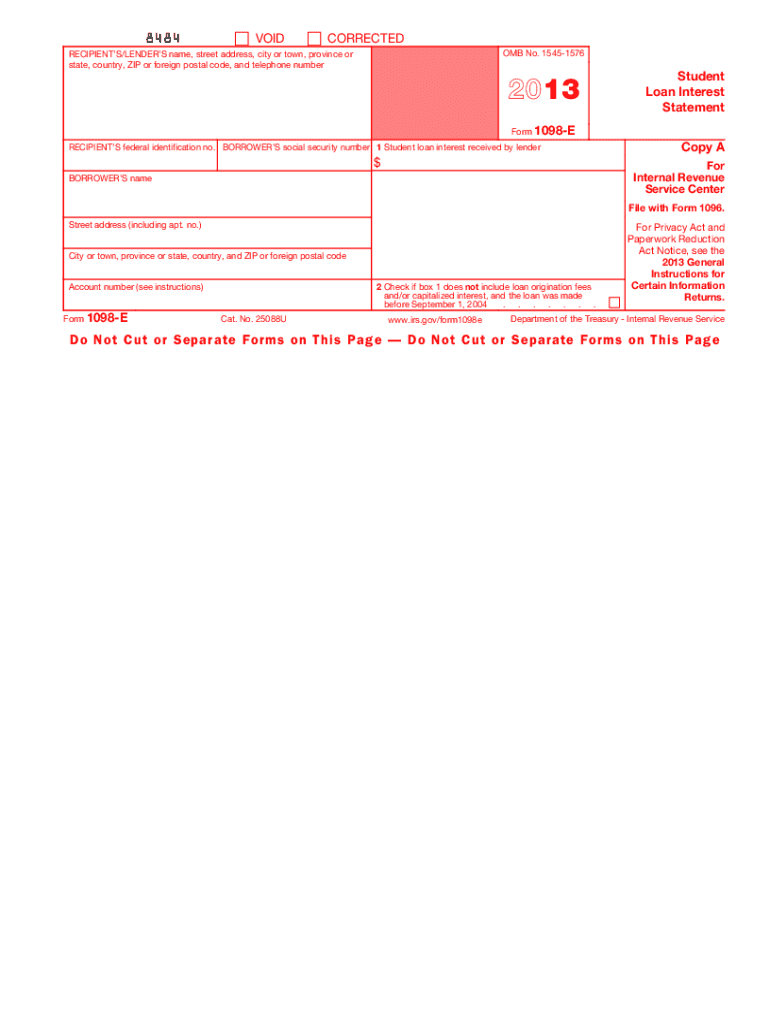

1098 forms

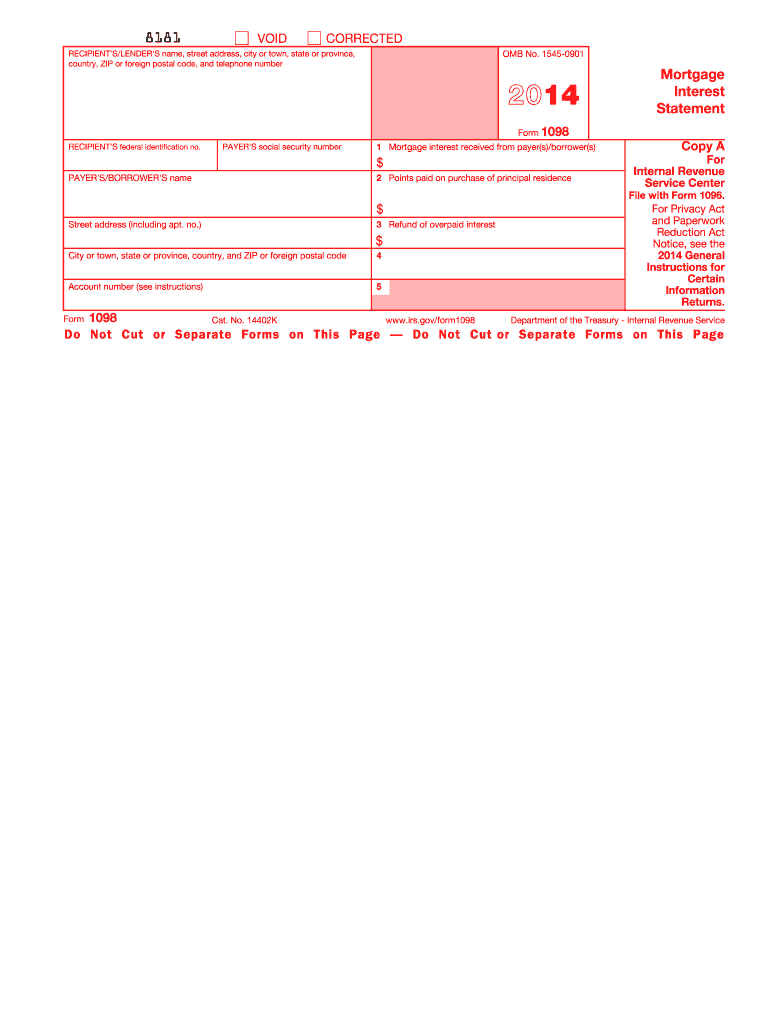

1098 form

The Mortgage Interest Statement is used to report interest that a taxpayer has paid on his mortgage

Learn more

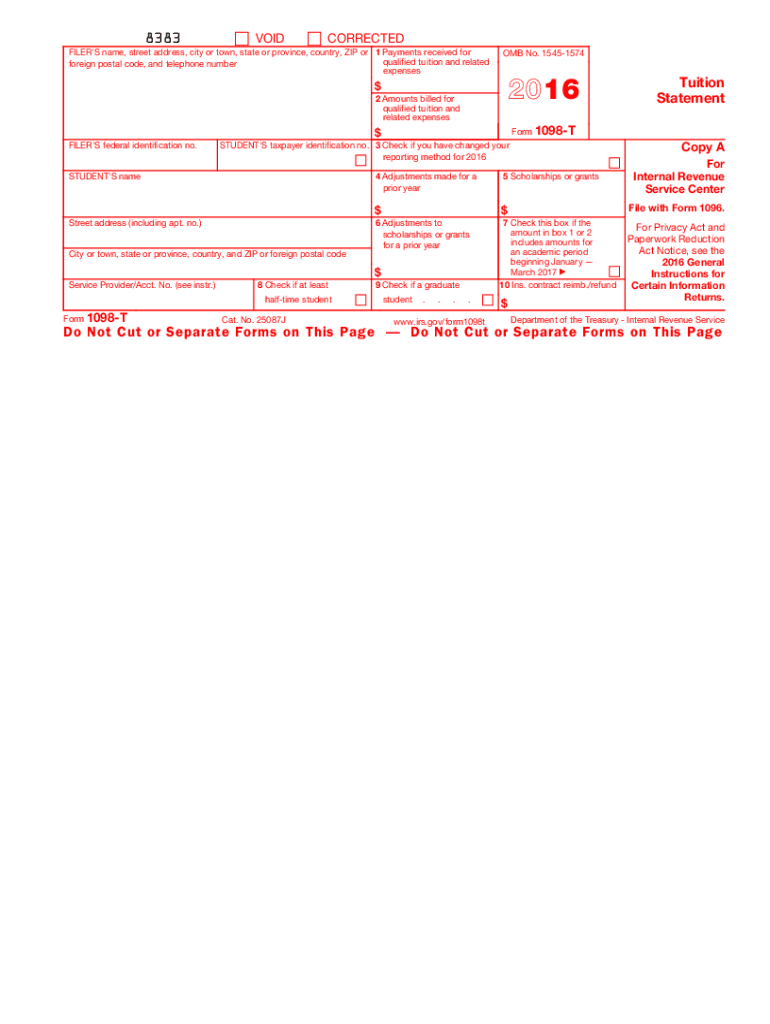

1098-T form

Eligible educational institutions file this form for each student they enroll and for whom a reportable transaction is made.

Learn more