IRS library

1099 forms

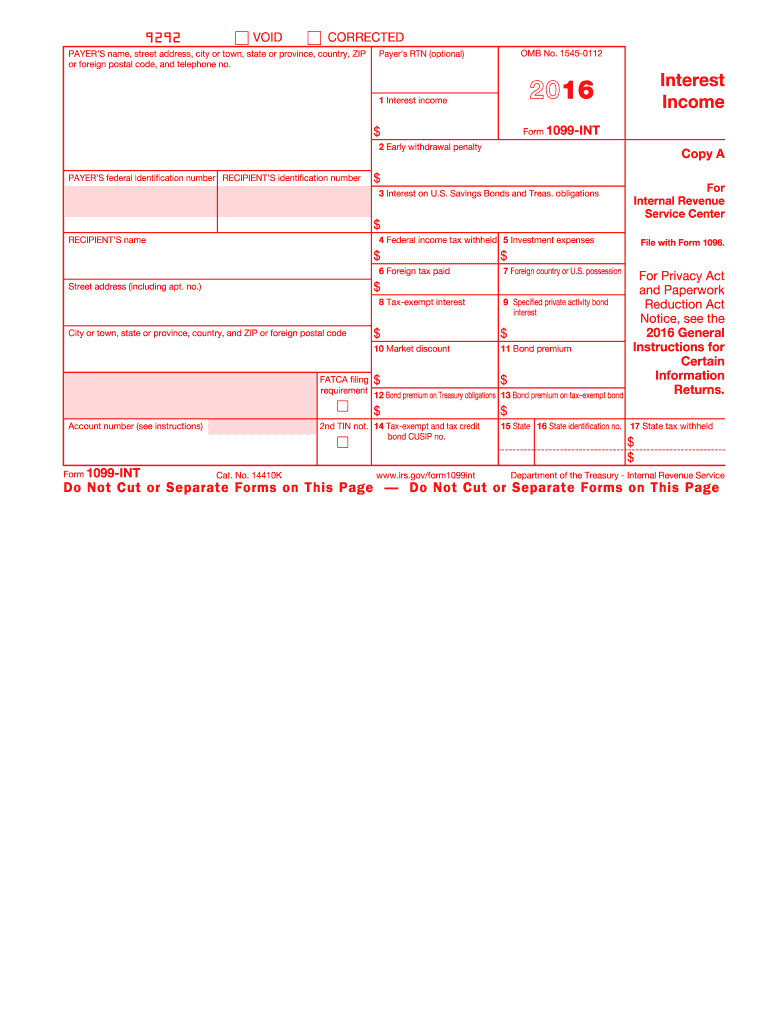

1099-INT form

File this form for each person to whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10 and/or for whom you withheld and paid any foreign tax on interest.

Learn more

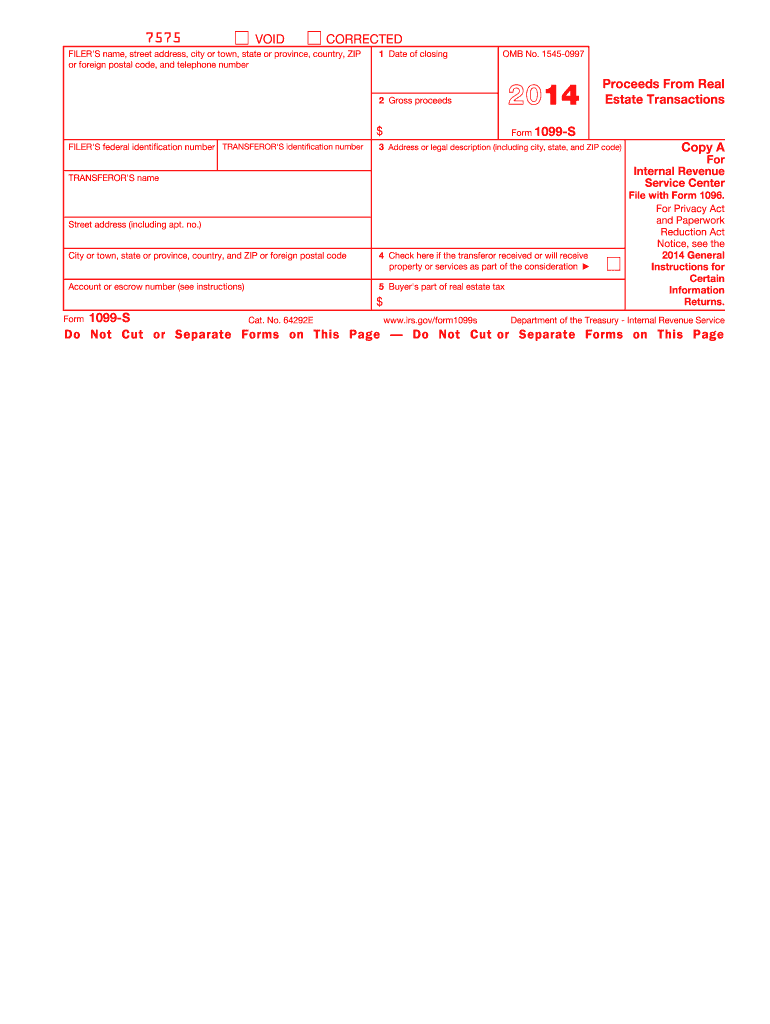

1099-S form

Proceeds from Real Estate Transactions. Use Form 1099-S to report the sale or exchange of real estate.

Learn more

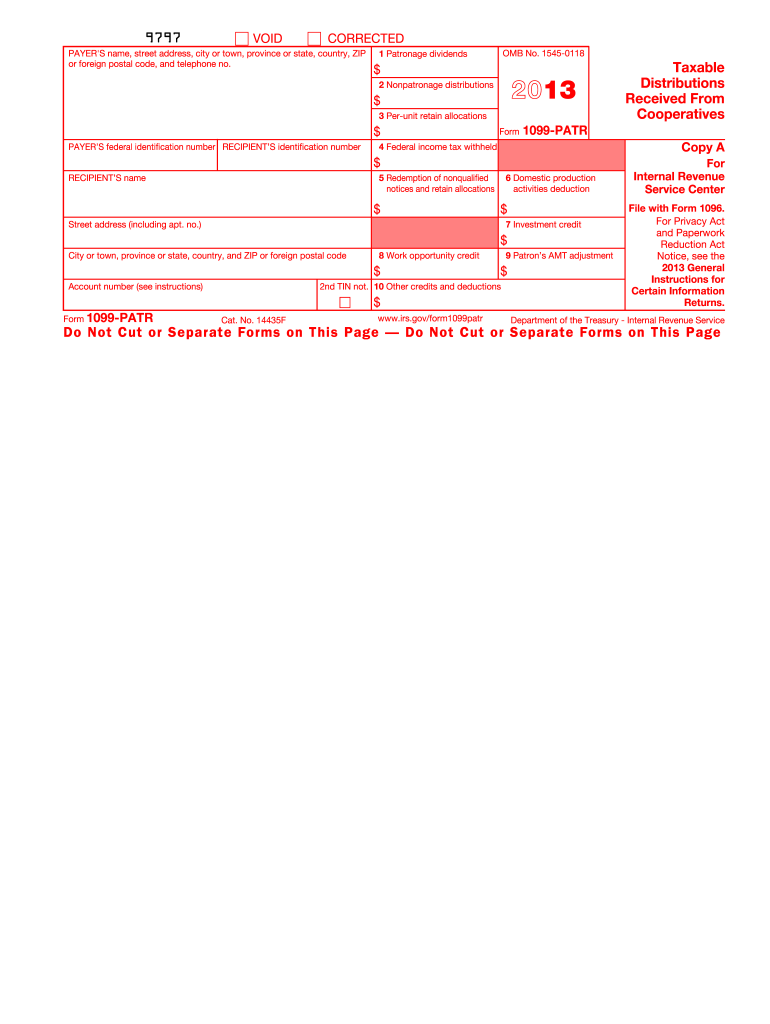

1099-PATR form

Taxable Distributions Received From Cooperatives filed for each person to whom a cooperative paid at least $10 in patronage dividends or other distributions.

Learn more

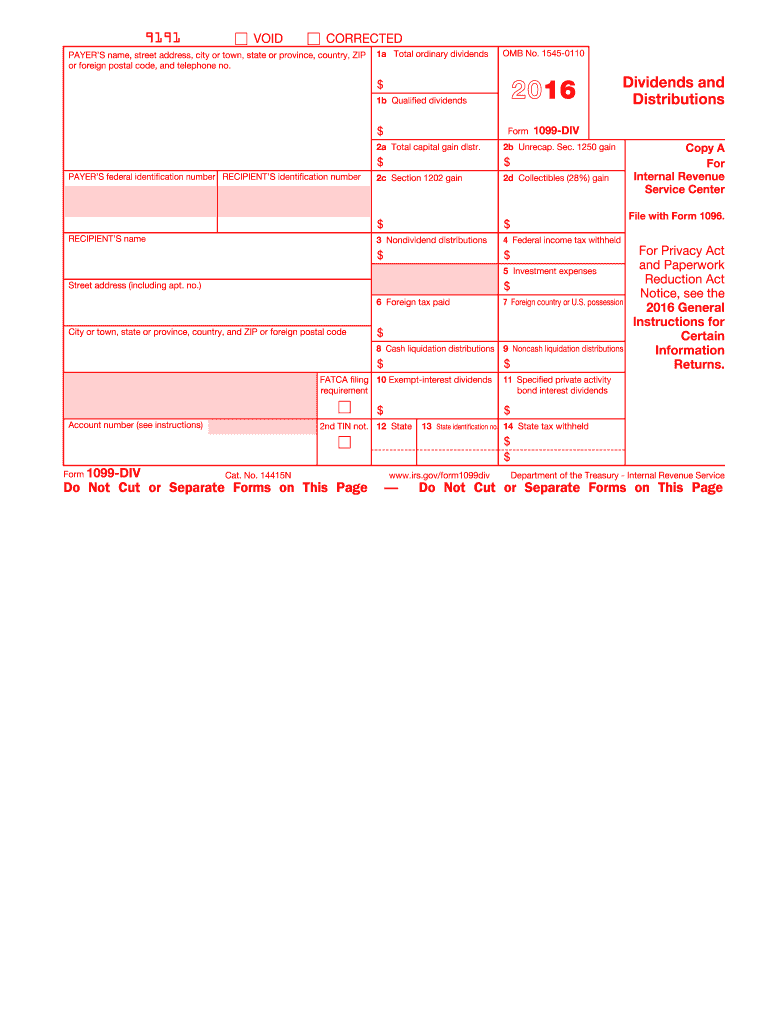

1099-DIV form

This form is used by banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS.

Learn more

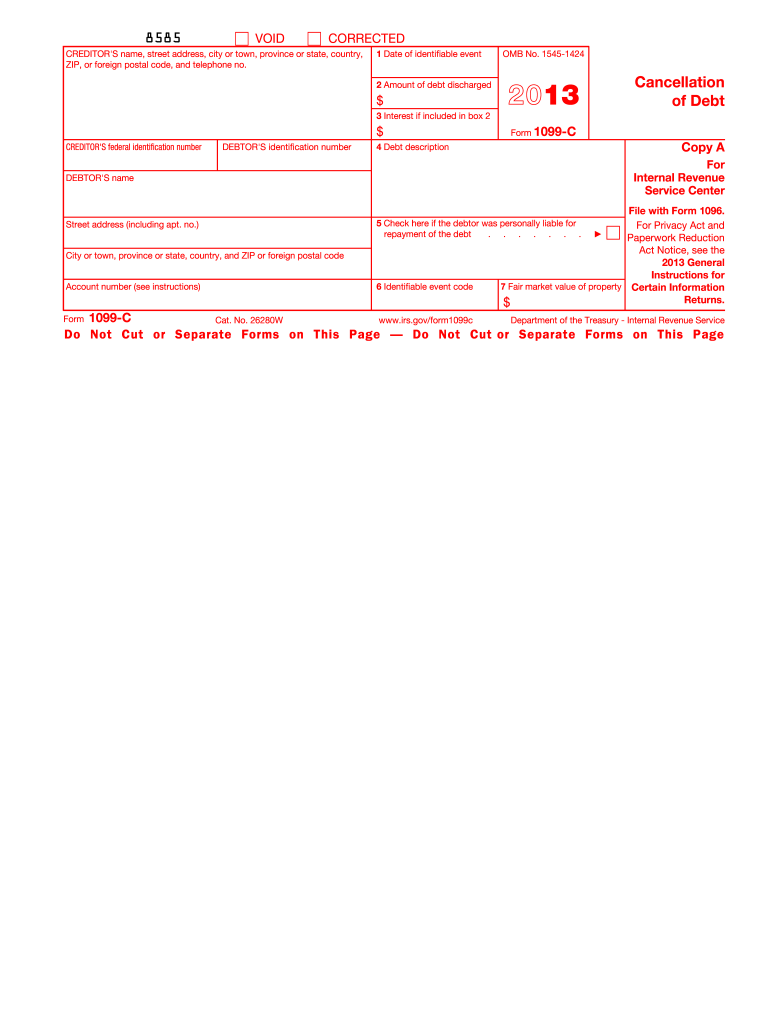

1099-C form

File this form for each debtor for whom you canceled $600 or more of a debt owed to you.

Learn more

1099-G form

Federal, state, or local governments file this form if they made payments of unemployment compensation, state or local income tax refunds, credits, or offsets, reemployment trade adjustment assistance (RTAA) payments, taxable grants, or agricultural payments.

Learn more

-

1

- 2