IRS library

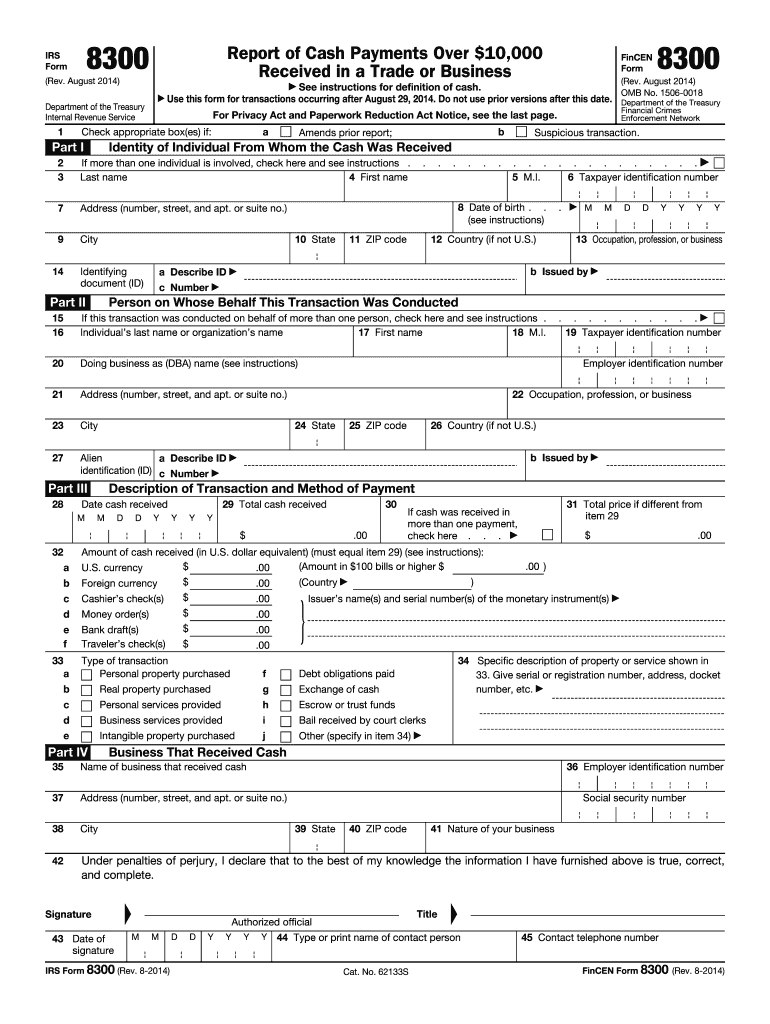

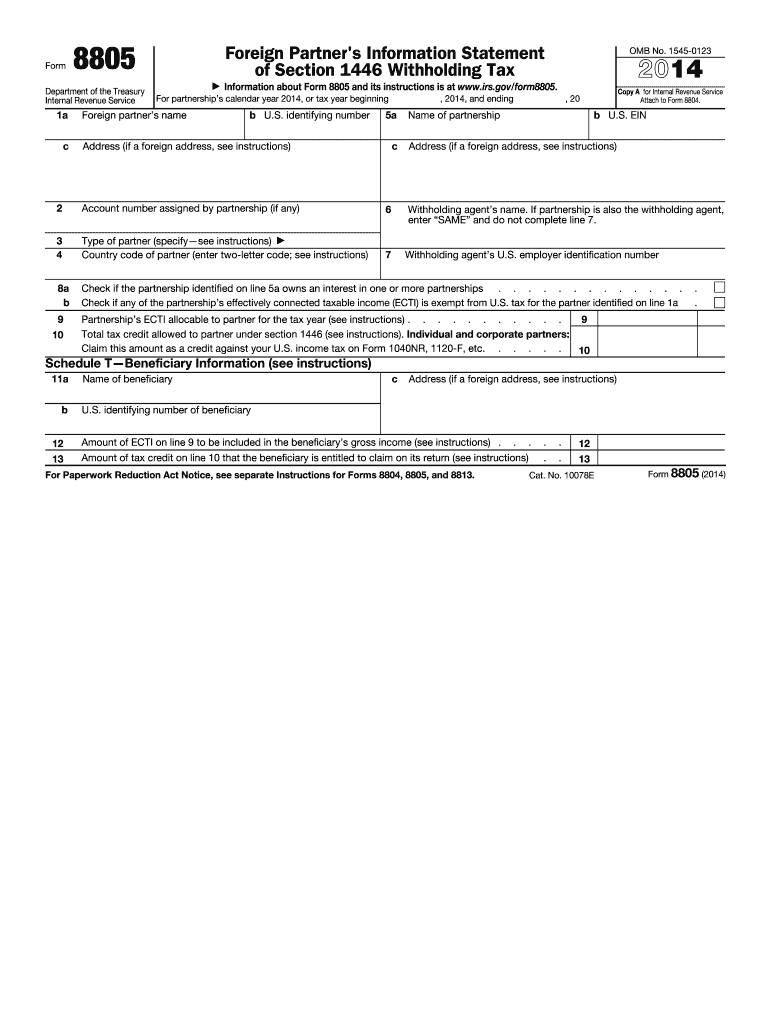

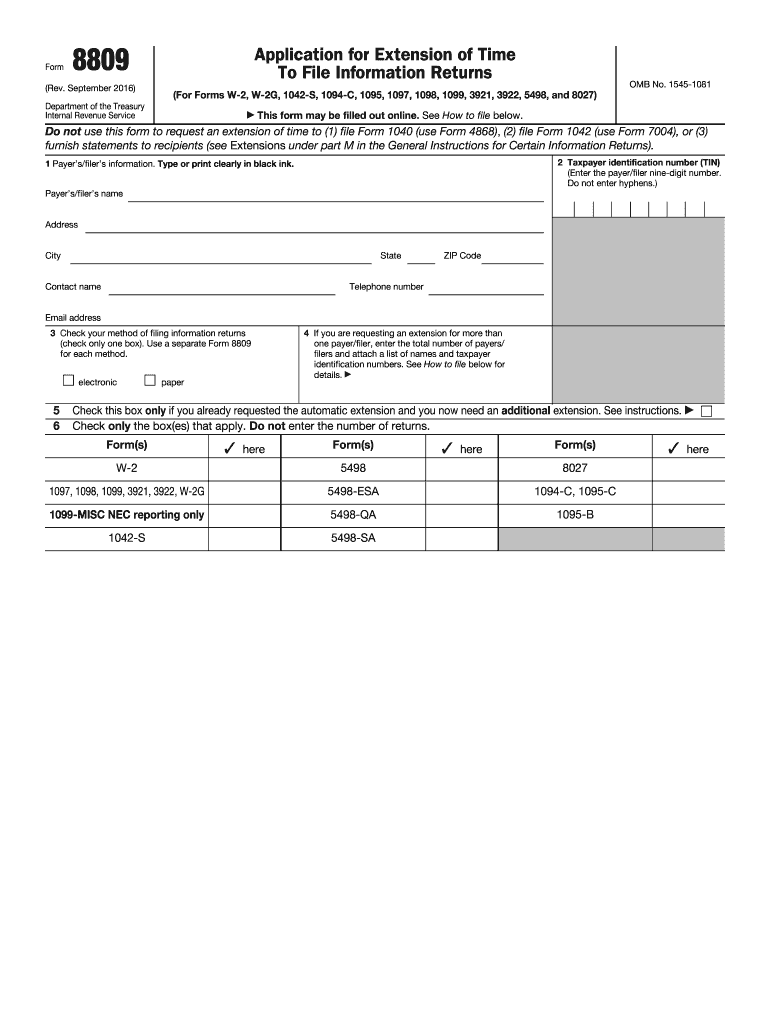

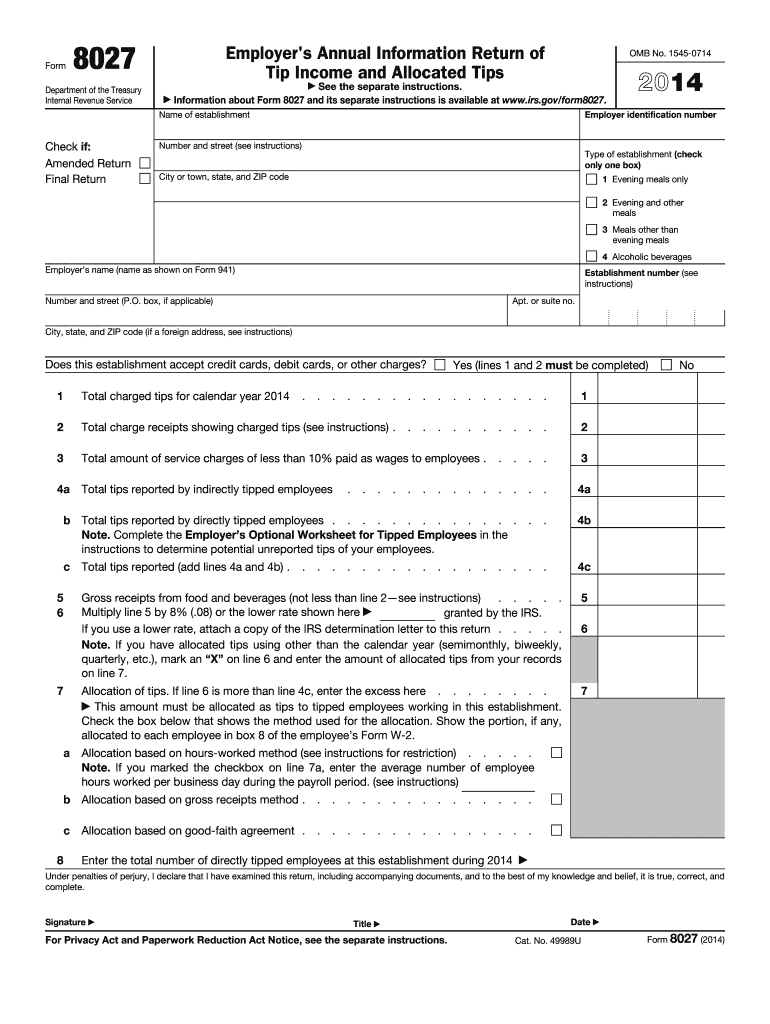

Information returns

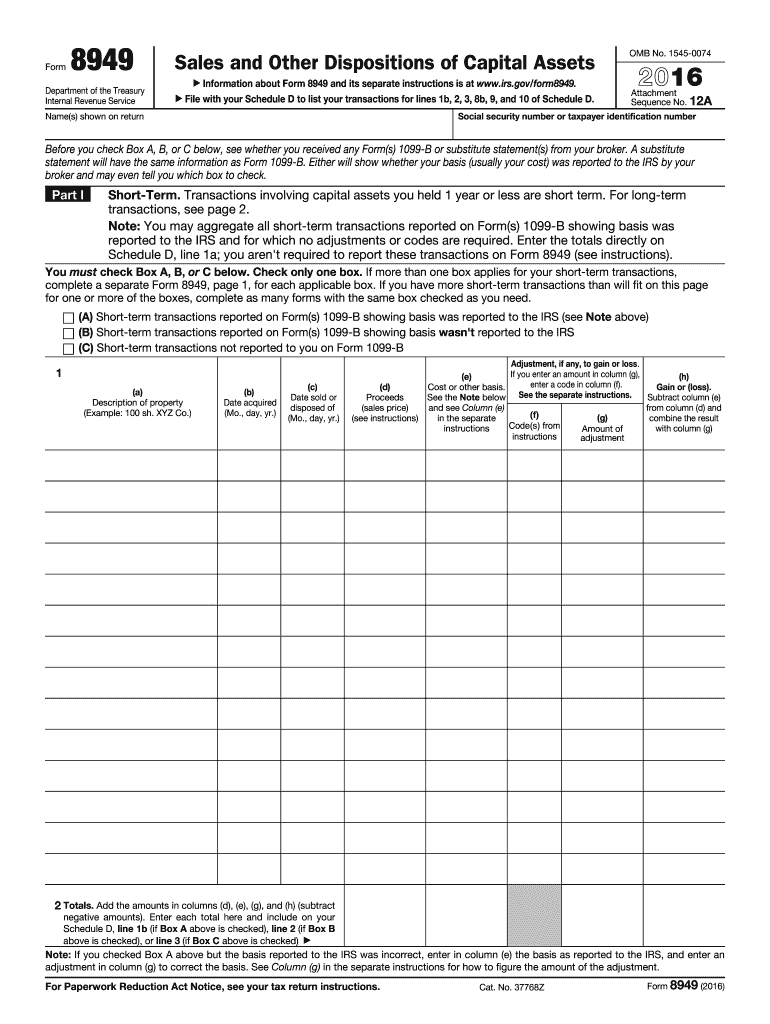

8949 form

Sales and Other Dispositions of Capital Assets is used to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return.

Learn more

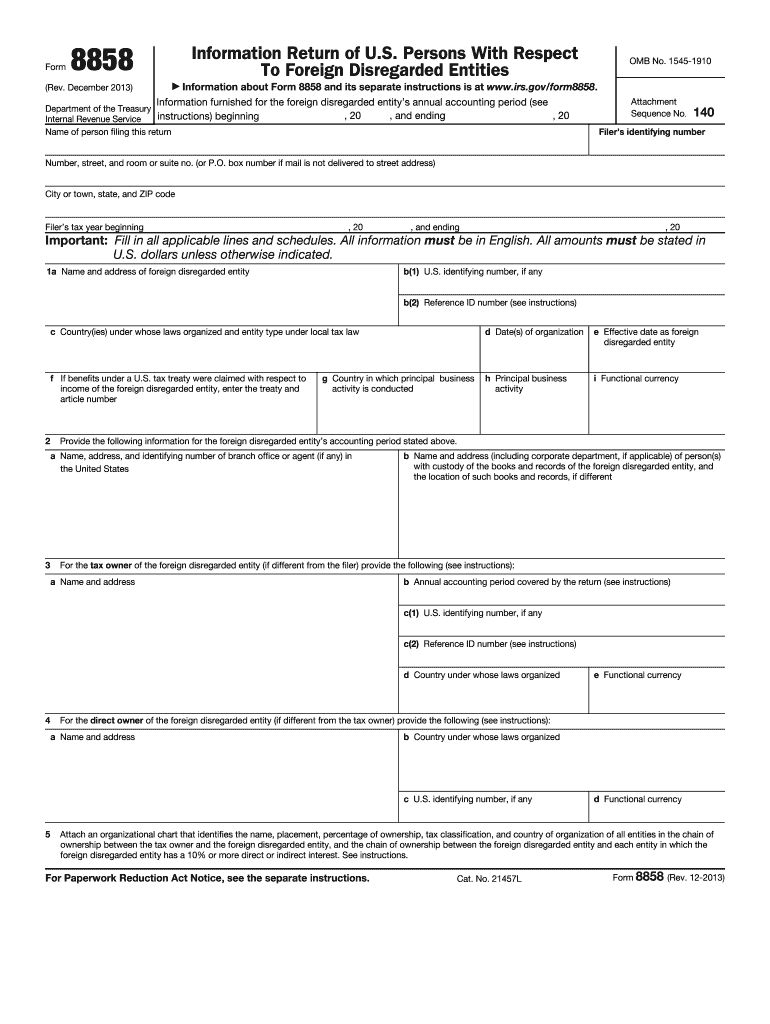

5471 forms

Information Return of U.S. People With Respect to Certain Foreign Corporations

Learn more

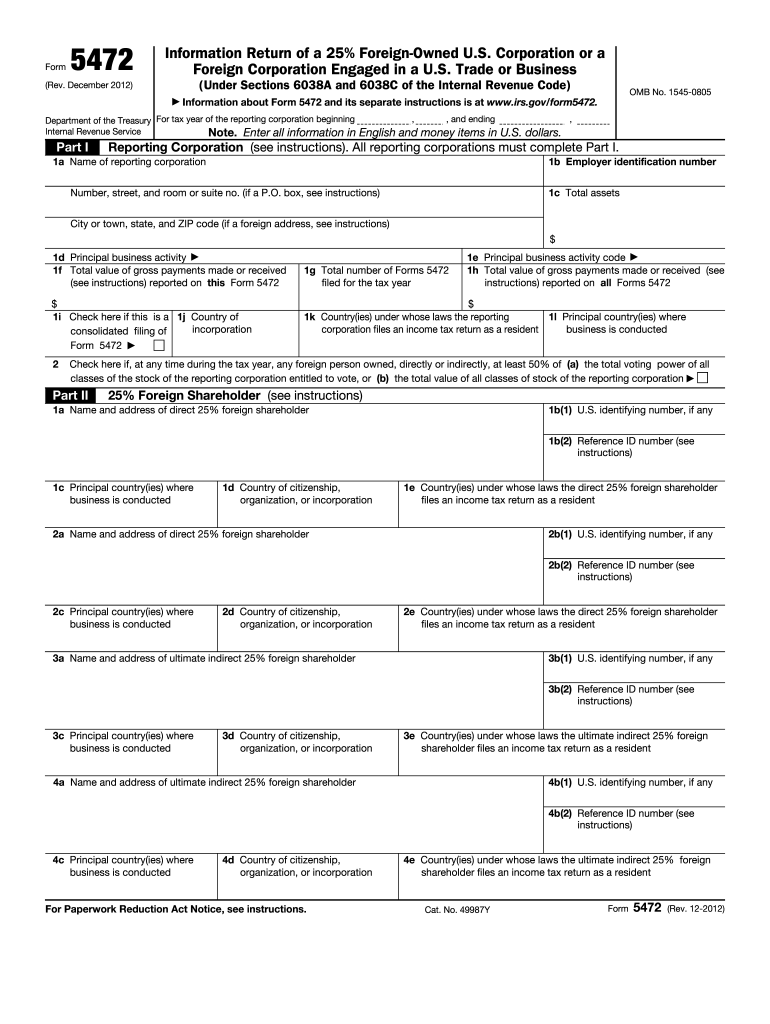

5472 form

Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

Learn more

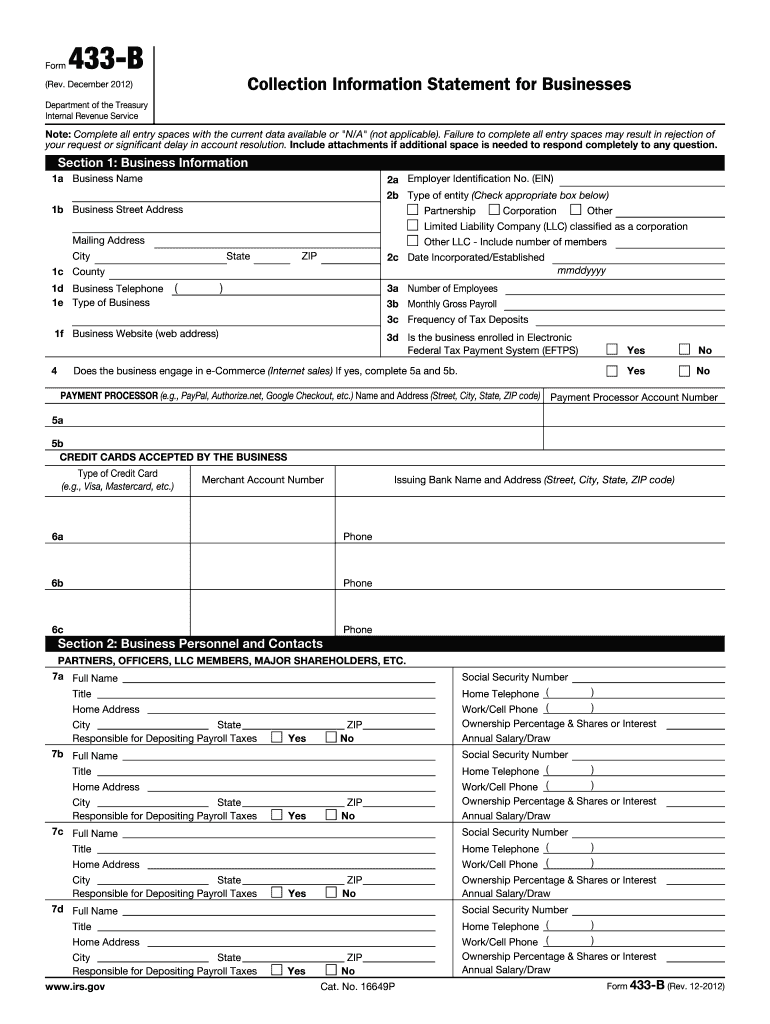

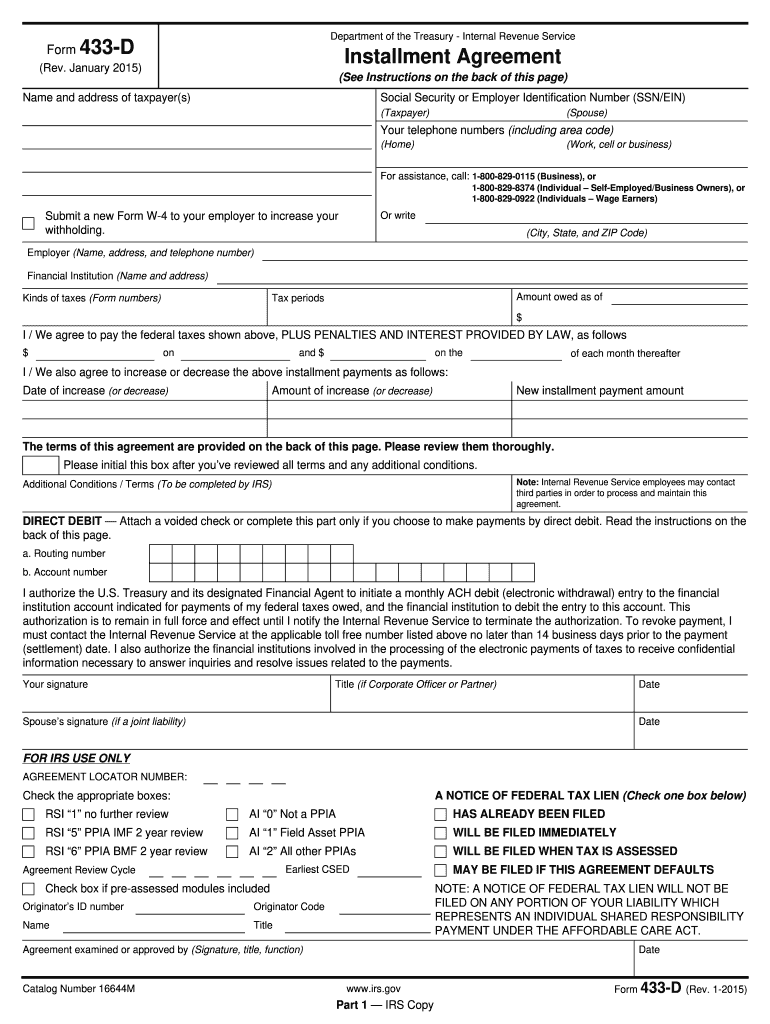

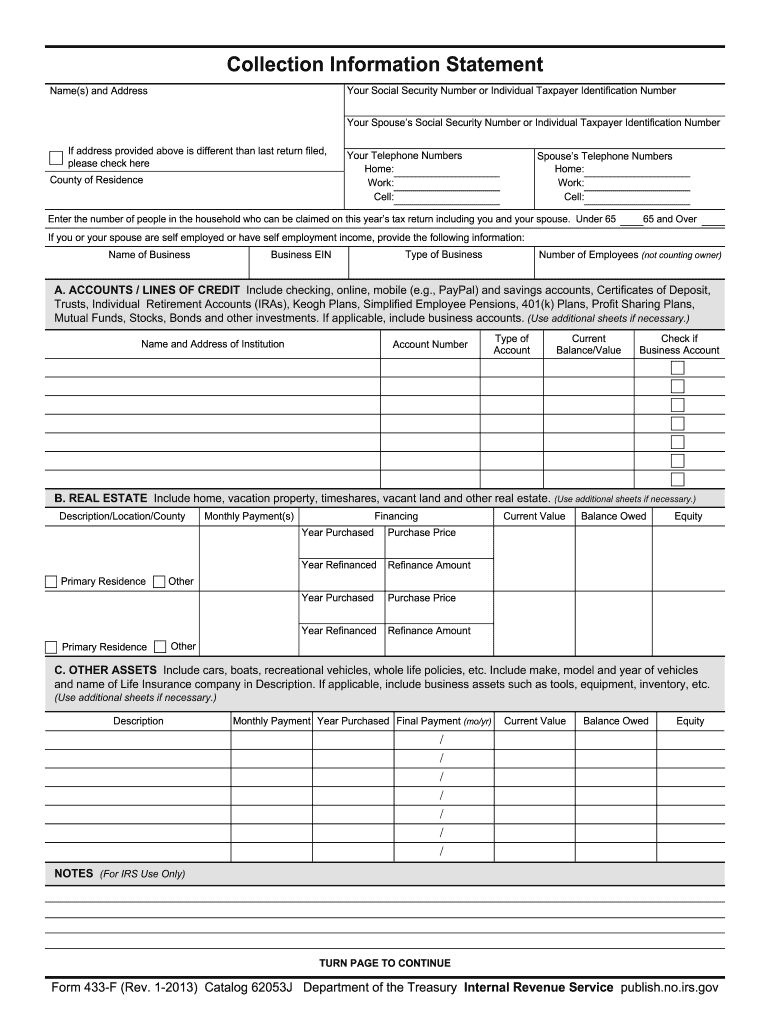

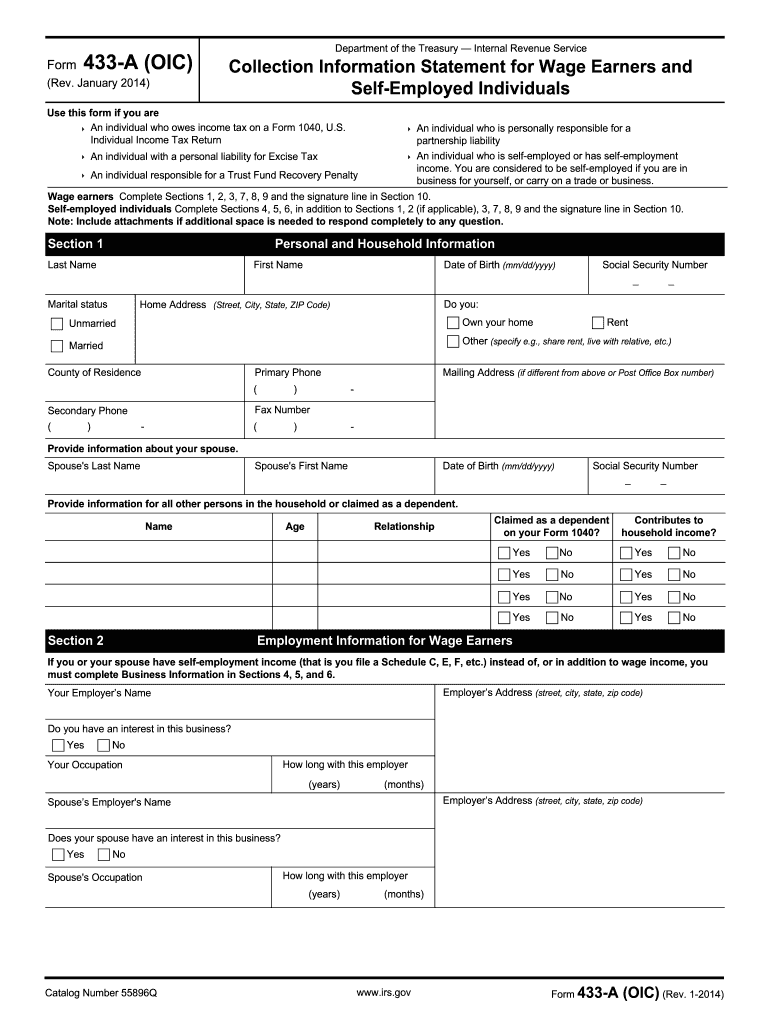

433-A (OIC)

Collection Information Statement for Wage Earners and Self-Employed Individuals

Learn more

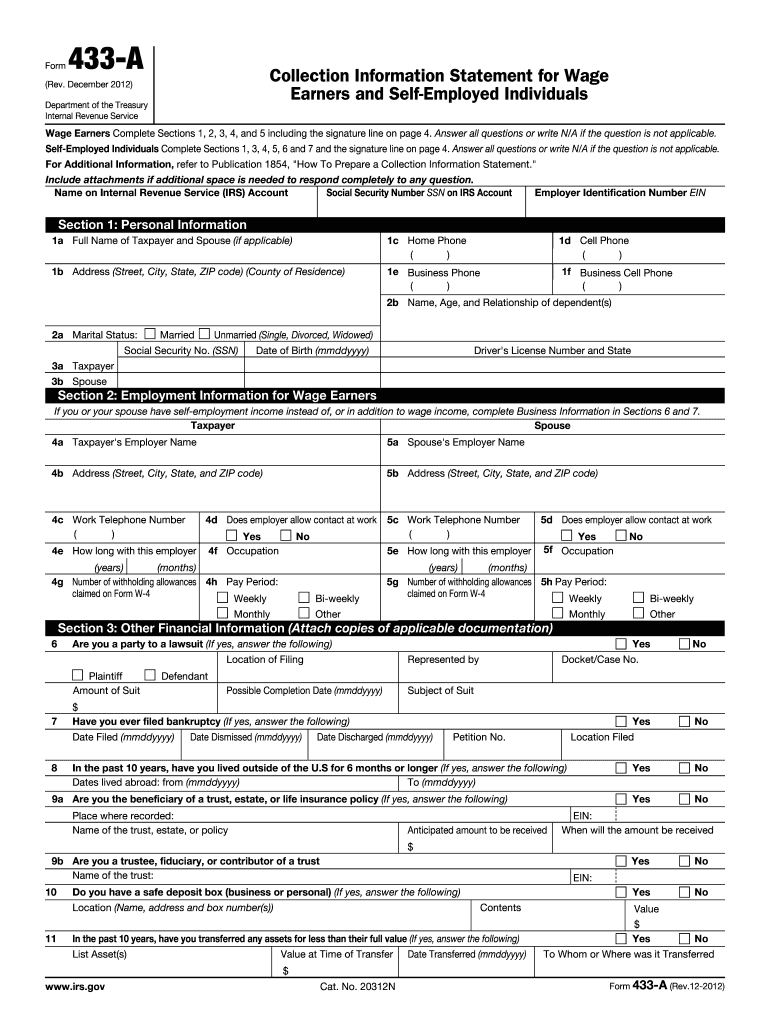

433-A form

Collection Information Statement for Wage Earners and Self-Employed Individuals

Learn more

- 1

-

2