Morgan Stanley Financials Conference

Francesco Vanni d’Archirafi

CEO Global Transaction Services

February 2, 2011

�Agenda

1. Citi’s Global Transaction Services (GTS)

2. Treasury and Trade Solutions (TTS)

3. Securities and Fund Services (SFS)

4. Positioned for Growth

1

�GTS by the Numbers

12,600,000,000,000 $ assets under custody (12/31/2010)

3,000,000,000,000 $ value of transactions processed daily

333,000,000,000 $ average deposits and other customer liabilities (FY2010)

1,000,000,000 $ invested in new technology annually

119,000,000 prepaid cards issued, representing over $16 billion in funds paid

345 connections to cash and securities clearing systems across the globe

135 currencies handled by GTS’ global platforms and gateways

98 % local employees, providing global experience and local insight

96 countries where we issue commercial cards, 59 with local currency programs

96 countries where we have a banking license; 77 in the EM

93 % of the Fortune 500 companies use GTS to run their daily operations

59 countries where we have a securities clearing branch; expanding in the EM

24 languages available on our online banking platform

#1 cash management bank (Euromoney & Global Finance, 2010)

#1 bank issuer for corporate cards in the U.S. (Nilson Report, 2010)

#1 global trade finance bank (Euromoney, Trade Finance, 2011)

#1 securities services bank of the year (Bank of the Year Awards 2010 – The Banker)

2

�Global Provider of Transaction Services

Treasury

and Trade

Solutions

2010 Revenues

$7.3B

Securities

and Fund

Services

2010 Revenues

$2.8B

Description of business

Key product lines

Cash

Management

• Working capital solutions

• Receivables

• Payments

• Cards

• Liquidity and investments

• Information services

Trade

• Trade financing and trade

services solutions

• Trade services

• Trade finance

• Export agency finance

• Middle/back office support for

beneficial owners and global

investment managers

• Fund services

• OTC/Middle office services

• Global custody

• Securities finance

• Post-trade processing for

broker dealers and global

custodian

• Clearing/Settlement

• Custody/Asset servicing

• Transaction support for global

capital markets issuance

• Agency and trust

• Depository receipts

Investor

Services

Intermediary

Services

Issuer

Services

3

�GTS Financials

NIR

Revenues ($B)

Expenses ($B)

13% CAGR

6% CAGR

Non NIR

$9.8

$10.0

4.5

4.1

4.4

$9.9

$8.1

$6.1

$3.8

$4.6

$5.2

$4.5

$4.9

2009

2010

3.8

2.9

3.2

4.3

5.5

5.7

5.6

2006

2007

2008

2009

2010

2006

2007

2008

Net Income ($B)

Average Deposits (1) ($B)

23% CAGR

15% CAGR

$3.3

$3.7

$3.7

$247

$2.4

$281

$304

2008

2009

$333

$191

$1.6

2006

2007

2008

2009

2010

2006

2007

2010

(1) Includes other customer liability balances.

4

�GTS Financials

Citicorp 2010 Key Metrics ($B)

GTS Revenues ($B)

2010 Revenue $10.0B

GTS

$66

$36

Other Citicorp

$15

$760

By Product

$1,284

SFS

28%

85%

62%

Trade

10%

55%

Cash

Mgmt

75%

86%

93%

By Region

Asia

27%

45%

15%

N.A.

25%

25%

14%

Revenues Expenses Net Income

7%

EOP

Deposits

EOP

Assets

EMEA

LatAm

15%

33%

5

�Intermediating Flows

GDP(1) (PPP $T)

Developed

EM

CAGR

$88

6%

� Drivers are growing, particularly in EM

9%

� These flows translate into a ~$250B market

space for GTS:

$74

$49

48%

51%

39%

52%

61%

2003

2010E

49%

� GTS is in the business of intermediating

flows

4%

• Treasury and Trade Solutions: $200B+

(GTS market share: ~4%; market rank: #1)

• Securities and Fund Services: $40B+

(GTS market share: ~7%; market rank: #4)

2013E

Foreign Direct Investment Inflow(2) ($T)

Developed

EM

$1.1

$1.1

CAGR

10%

Exports ($T)

Developed

EM

CAGR

$20

10%

36%

37%

15%

64%

63%

2010E

2011E

$18

$0.6

49%

53%

17%

$9

34%

66%

2003

51%

47%

2009

2010E

5%

26%

74%

2003

(1) Gross domestic product on purchasing-power-parity (PPP) basis (per IMF, WEO database, October 2010).

(2) Per United Nations Conference on Trade and Development (UNCTAD) Report.

(3) Estimates for Trade available until 2011 (per IMF, WEO database, October 2010).

Sources: IMF, World Economic Outlook Database, UNCTAD.

8%

(3)

6

�Competitive Advantages

Largest Global Proprietary Network

Local Market Knowledge

Superior Product and Service Delivery

Globally-Integrated Technology Platform

and Infrastructure

Deep and Embedded Client Relationships

7

�Global Network

GTS Operates in 96 Countries* and Serves Clients in 140 Countries

Americas

Argentina

Bahamas

Bermuda

Brazil

Canada

Cayman Islands

Chile

Colombia

Costa Rica

Dominican Rep.

Ecuador

El Salvador

Guatemala

Haiti

Honduras

Jamaica

Mexico

Panama

Paraguay

Peru

Puerto Rico

Trinidad & Tobago

Uruguay

US

Venezuela

* and jurisdictions

Europe

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

Austria

Belgium

Bulgaria

Czech Republic

Denmark

Finland

France

Germany

Greece

Hungary

Ireland

Italy

Jersey

Kazakhstan

Luxembourg

Netherlands

Norway

Poland

Portugal

Romania

Russia

Serbia

Slovakia

Spain

Sweden

Asia-Pacific

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

Switzerland

Turkey

Ukraine

UK

;

;

;

;

Middle East / Africa

Algeria

Bahrain

Cameroon

Congo, D.R.

Egypt

Gabon

Ghana

Israel

Ivory Coast

Jordan

Kenya

Kuwait

;

;

;

;

;

;

;

;

;

;

;

;

;

Lebanon

Morocco

Nigeria

Pakistan

Qatar

Senegal

South Africa

Tanzania

Tunisia

Uganda

U.A.E.

Zambia

TTS Network

;

;

;

;

;

;

;

;

;

;

;

;

;

Australia

Bangladesh

Brunei

China

Hong Kong

India

Indonesia

Japan

Macau

Malaysia

New Zealand

Philippines

Singapore

South Korea

Sri Lanka

Taiwan

Thailand

Vietnam

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

TTS and SFS Networks

8

�Global Transaction Services

Serving clients/

no physical

infrastructure

Physical

infrastructure

Proprietary Country Presence

2010 Average Liabilities ($B)

96

333

66

39

C

Peer 1

291

248

62

Peer 2

Peer 3

34

Peer 4

148

25

Peer 5

C

Peer 1

Peer 2

Peer 3

126

110

Peer 4

Peer 5

9

�Did you know…

We are the cash management bank in 16

We are the world’s largest user

countries and direct clearing and custody

of SWIFT, representing 7% of

provider in 25 markets for a global

their volumes

investment bank

We pay over 1 million UK

pensioners living abroad in > 50

countries

We process 13 million

passport applications p.a.

for the US Dept of State

1.4 million US Dept

of Defense

personnel across

45 countries and

25 agencies use a

Citi commercial

card

We handle approximately

90% of the US Federal

Government’s cross-border

payments in 180 countries

and 90 currencies

We manage industry’s

largest rebate program

for a major telecom,

issuing over 1 million

prepaid cards per month

We enable 4 million

customers to make

international mobile

top-ups of prepaid

airtime minutes from

overseas

We bank over 600 shared

service centers globally,

representing >40% of the

shared services industry

We help connect a major energy

company’s supply chain

ecosystem in 63 countries

Citi provides custody

services to GIC across

Asia and in Latin

America

We distribute payroll

and provide critical

services to UN

peacekeeping

missions in Sudan,

Congo, Lebanon,

Ivory Coast, Haiti &

Morocco

Nearly 1 in 3 cross-border securities

transactions are backed by GTS’

global infrastructure

We are 1 of 2 banks

managing the HK

Government’s

procurement program

through our

purchasing cards

We facilitate >60,000

benefit payments a

month in local

currency to

Australians living

abroad in over 100

countries

We process

>2.5 million

transactions a

month –

in-store and

online – for a

global

technology

provider in

Australia

10

�Agenda

1. Citi’s Global Transaction Services (GTS)

2. Treasury and Trade Solutions (TTS)

3. Securities and Fund Services (SFS)

4. Positioned for Growth

11

�Treasury and Trade Solutions

$7.3B(1)

‘Operating System’ for Corporate clients

• Service 99% of Fortune 100, 93% of the Fortune

Global 500

• Deliver processing and working capital

efficiency via automation, centralization

• 1,000+ leading local / regional corporate clients

based in the emerging markets

• Balance-sheet solutions leveraging cash &

trade capabilities

‘Citi Inside’ for Financial Institutions

• Clients include:

400+ of top 500 banks

200 of top 300 asset managers

50% of top hedge funds

Top 10 insurance companies

• Embedded banking infrastructure or

platform provider

• Trusted advisor for market access,

regulatory knowledge and technical skill

‘Digital Infrastructure’ for Public Sector

• Service the governments of ~120 countries

• Over 700 public sector clients globally:

400 Central Government entities

200 Local and Regional Governments

130 Central Banks, SWF’s

• Enable operating efficiencies and

improved service

• Provide greater visibility and control over

financial flows

(1) 2010 TTS Revenues.

12

�TTS – Strategy

Continuing to invest in

our global network

� Most comprehensive and global

liquidity management network

in the industry

� For example, in 2010:

– Expanded local currency

commercial cards to 59

countries

$7.3B(1)

Helping clients manage

accelerating complexity

� Globalization

� Digitalization

– Mobile money

– Digital identity and security

– Information delivery

– Expanded cash management

cross-border sweep to 50

countries

(1) 2010 TTS Revenues.

13

�Agenda

1. Citi’s Global Transaction Services (GTS)

2. Treasury and Trade Solutions (TTS)

3. Securities and Fund Services (SFS)

4. Positioned for Growth

14

�Securities and Fund Services

$2.8B(1)

Investor Services

• Provides Global Custody, Securities Finance, Fund Administration, Advice and Distribution

Support, and Middle Office solutions

• Caters primarily to mutual funds, pension funds, banks, hedge funds, and insurers

• Covers 94 markets worldwide

Intermediary Services

• Provides asset servicing and transaction functions through Direct Custody and Clearing

• Primarily serves broker-dealers, banks and infrastructures, but also increasingly insurers, fund

managers and other global investors

• Covers 59 markets worldwide through industry-leading proprietary network

Issuer Services

• Provides Agency & Trust and Depository Receipt services

• Clients include financial institutions, corporates and public entities

• Covers 70+ countries worldwide

(1) 2010 SFS Revenues.

15

�SFS – Key Differentiators

$2.8B(1)

Unparalleled local market presence

� Proprietary network in 59 countries

� Able to serve clients in 94 markets worldwide

Execution to

Custody

• End-to-end solution that integrates electronic execution and order routing

with clearing and settlement, and custody and asset-servicing

Advanced

Pooling

• Present clients with an aggregated view across jurisdictions, asset classes

and investment styles

PRISM

• A reporting application for CIOs, Portfolio Managers and Risk Managers to

monitor asset flows, performance and key risk characteristics of their

portfolios

Market Guide

• Deliver timely and proactive local market intelligence through on the ground

staff across the broadest proprietary network in the industry

(1) 2010 SFS Revenues.

16

�Agenda

1. Citi’s Global Transaction Services (GTS)

2. Treasury and Trade Solutions (TTS)

3. Securities and Fund Services (SFS)

4. Positioned for Growth

17

�GTS is Well Positioned for Growth

� Fundamental drivers are growing, particularly in EM

•

GTS has unique competitive advantages

•

Highly fragmented market

� Opportunity to grow wallet share with existing clients

� Targeting new client segments (e.g. public sector)

� Continuing to build and invest in network and platform

18

�Fundamental Drivers Are Growing

Rapidly growing number of multinational

corporations particularly in EM

Developed Mkts.

Emerging Mkts.

65,000

78,000

~96,000

21%

24%

29%

79%

76%

435 clients use Citi’s global

network in 21+ countries

# Clients

Revenues

Non US

Domiciled

2007

45%

435

$4.4B

54%

992

$6.0B

61%

71%

US

Domiciled

2002

66

$1.7B

2012E

55%

51+

Countries

46%

21+

Countries

39%

11+

Countries

Source: UNCTAD World Investment Report, Citi estimates.

Note: Multinational is defined as an enterprise that controls assets in a foreign entity.

19

�Leveraging 5,000 Firm Relationships

GTS Client and Revenue Mix (FY 2010)

100%=~23,000

100%=~$9.7B(1)

5%

3%

All Other

GTS Clients(2)

y Up-tier wallet penetration of the

next 2,000 clients

78%

92%

Next 2,000

GTS Clients

9%

Top 3,000

GTS Clients

13%

# Clients

y Deepen relationships with GTS’

top 3,000 clients

y Capture rapidly growing

EM-OECD and EM-EM flows by

servicing needs of emerging

markets champions

y Focus on Top 30+ priority

countries

GTS Client Revenue

(1) Does not equal overall 2010 GTS revenues as non-client attributable revenues are excluded.

(2) Includes revenue from ~39,000 clients transferred to Regional Consumer Banking’s Local Commercial Bank (LCB).

20

�Deepening Relationships with Core Clients

~80% of core clients are long-standing, multi-year relationships

and contribute significantly to overall growth

Energy Client Illustrative Example

Year 2

Depth of GTS Relationship

Year 1

Year 3

T&E

Cards

Malaysia

T&E

Cards

Russia

CEE Cash

Management

Africa Cash

Management

USA

Central

America

A&T UK

& Nigeria

SBLCs

Dom

Republic

SBLCs

Kenya

T&E

Cards

Canada

Regional

Collections,

Pmts,

Liquidity

Mgmt Deal

Africa

Digital

Identity

Mgmt

(Pilot)

Export

LC’s

Ghana

Trade

Services

Africa

Central

America

ARG, BRA,

Receivables

CHL

Collections,

UK

Pmts,

A&T

Liquidity

SBLCs

Africa &

LATAM

Coll/Pmts

Liquidity

Mgmt

Singapore

Year 4

T&E Cards

Singapore

Payroll

Canada

Receivables

Russia

Receivables

Poland

Canada

Collections,

Pmts,

Liquidity

Turkey

Trade

Finance

Receivables

Canada

Dealer

Finance

CEE

Year 5

Year 6

Russia

Supplier

Finance

Western

Europe

Cards

Renewal

North

America

Cards

T&E Cards

UK

Turkey

Cash

Business

Kazakhstan

Cash

Business II

Turkey

Check

collection

Kenya LC

Discounting

Poland

Cash RFP

Kazakhstan

Cash

Management

SPEX

Deposits

Nigeria

WorldLink

Card

Acquiring

North

America

LCs

Mexico Cash

Management

USA

Rebid

Intl USD

Global

Overlay

XML

Dialog

Thailand

Commercial

Cards

Indonesia

One Card

Algeria

Paylink

Dialog

Digital

Identity

eBAM

Dialog

Americas

Europe

Africa

Asia

Time

21

�Targeting New Segments – Citi for Cities

17 of the world’s 20 largest cities are in the emerging markets

y Urbanization: The number of megacities will double in the next 2 decades

y Population Growth: EM represent 87% of the world’s population

y Urban migration: >100 million people move to urban cities each year = >10 NYCs

ICG

GTS

y

y

y

y

y

y

y

Cash management

Procurement management

Payroll management

Collection consolidation

Subsidy distribution

Supply chain optimization

Pension administration

POLICY

&

ADVISORY

y Capital raising / debt structuring

y Asset securitization

y Risk management

CITY

ADMINISTRATION

Mayor’s Office •

City Treasurer • Dept of

Operations • Dept of Finance

• Pension Administrations

GTS / Consumer

URBAN ECOSYSTEMS

Public Services • Roads & Transportation •

Municipal Tax & Utilities • Education •

Hospitals & Healthcare • Ports of Entry • Workplace

y

y

y

y

Banking

Payments

Rewards

Security

22

�Conclusions

GTS is a large scale global provider of transaction services

GTS has unique competitive advantages and is well

positioned to capture growth in global flows

GTS is investing to remain at the forefront of product

capabilities and service

23

�Certain statements in this document are “forward-looking statements”

within the meaning of the rules and regulations of the U.S. Securities

and Exchange Commission. These statements are based on

management’s current expectations and are subject to uncertainty

and changes in circumstances. Actual results may differ materially

from those included in these statements due to a variety of factors,

including the precautionary statements included in this document and

those contained in Citigroup’s filings with the U.S. Securities and

Exchange Commission, including without limitation the “Risk Factors”

section of Citigroup’s 2009 Form 10-K.

24

�Morgan Stanley Financials Conference

Francesco Vanni d’Archirafi

CEO Global Transaction Services

February 2, 2011

�

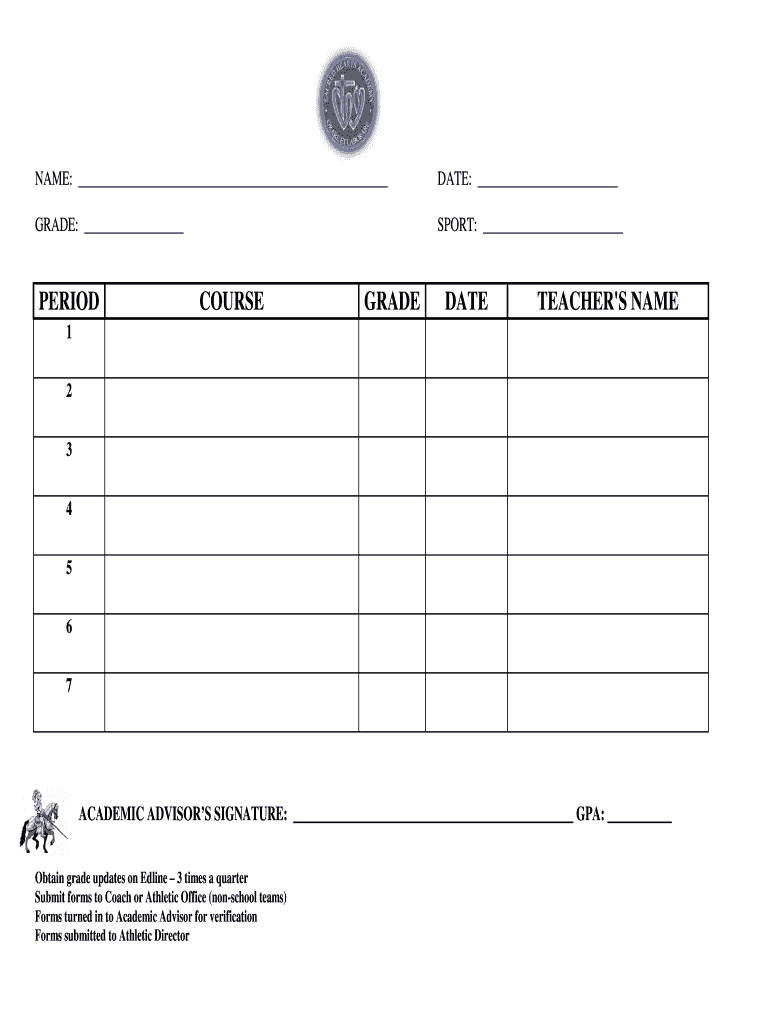

Useful Suggestions for Preparing Your ‘Athletic Progress Report Template’ Online

Are you fed up with the inconvenience of handling paperwork? Your solution is here: airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Wave goodbye to the tedious procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Utilize the powerful features integrated into this user-friendly and cost-effective platform to transform your method of document management. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow takes care of it all seamlessly, requiring just a few clicks.

Adhere to this comprehensive guide:

- Access your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Athletic Progress Report Template’ in the editor.

- Click Me (Fill Out Now) to complete the form from your end.

- Add and designate fillable fields for others (if required).

- Continue with the Send Invite setup to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you want to collaborate with others on your Athletic Progress Report Template or send it for notarization—our platform provides everything necessary to accomplish such tasks. Register with airSlate SignNow today and take your document management to the next level!