Fill and Sign the Credit Card Form Printable

Useful suggestions for getting your ‘Credit Card Form Printable’ online ready

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and small to medium-sized businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and authorize documents online. Take advantage of the robust capabilities embedded in this simple and affordable platform and transform your method of document management. Whether you wish to endorse forms or gather signatures, airSlate SignNow manages it all effortlessly, requiring merely a few clicks.

Follow this detailed guide:

- Access your account or register for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Edit your ‘Credit Card Form Printable’ in the editor.

- Click Me (Fill Out Now) to get the document ready on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your Credit Card Form Printable or send it for notarization—our solution has everything necessary to undertake such tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

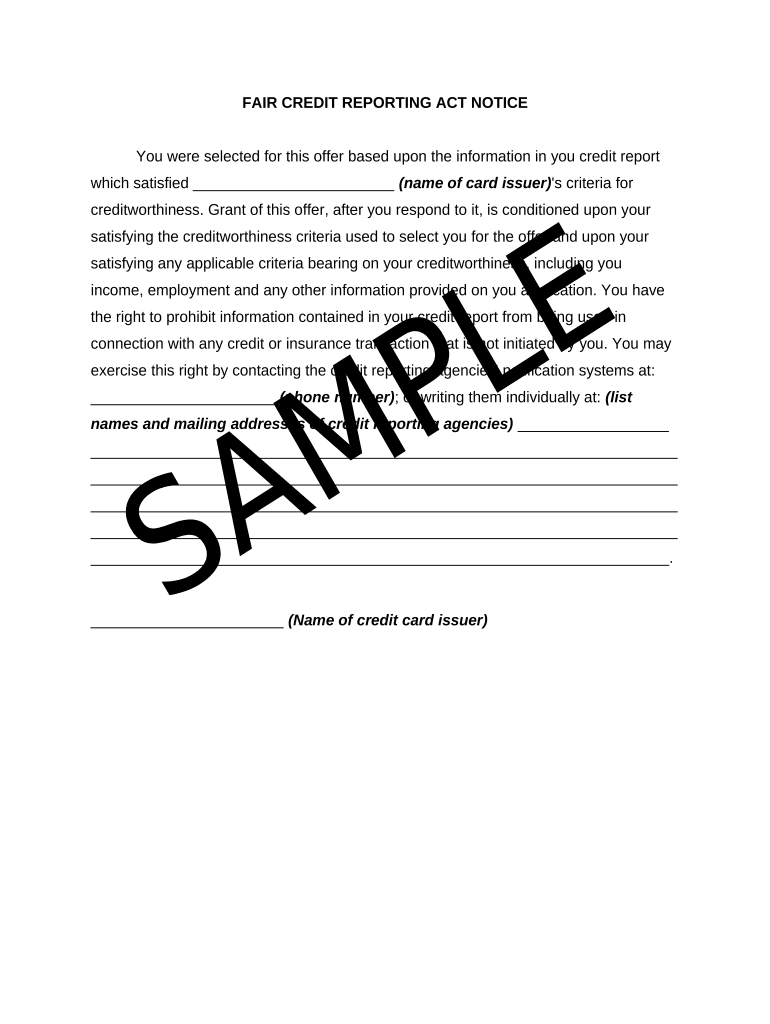

What is a Credit Card Form Printable?

A Credit Card Form Printable is a document that allows users to collect credit card information securely. It can be printed out for manual entry or filled out electronically using airSlate SignNow’s easy-to-use platform. This form simplifies the payment process for businesses and customers alike.

-

How does airSlate SignNow ensure the security of my Credit Card Form Printable?

airSlate SignNow prioritizes security by employing industry-standard encryption and compliance with PCI DSS regulations. Your Credit Card Form Printable is designed to protect sensitive information, ensuring that both you and your customers can transact confidently.

-

Can I customize my Credit Card Form Printable?

Yes, you can fully customize your Credit Card Form Printable to match your business branding. With airSlate SignNow, you can add logos, adjust color schemes, and edit fields to capture all necessary information, making the form uniquely yours.

-

Is there a fee for using the Credit Card Form Printable feature?

airSlate SignNow offers flexible pricing plans that include the use of the Credit Card Form Printable feature. Depending on your chosen plan, you can enjoy a cost-effective solution for creating and managing your forms without hidden fees.

-

What are the benefits of using a Credit Card Form Printable?

Using a Credit Card Form Printable streamlines the payment collection process, making it faster and more efficient. Additionally, it allows for easy tracking of transactions and improved customer experience, which can lead to higher conversion rates for your business.

-

Can I integrate my Credit Card Form Printable with other tools?

Absolutely! airSlate SignNow allows you to integrate your Credit Card Form Printable with various third-party applications, including CRM systems and payment processors. This helps automate your workflow and manage payments seamlessly.

-

How can I share my Credit Card Form Printable with customers?

You can share your Credit Card Form Printable through email, embed it on your website, or share a direct link with your customers. airSlate SignNow makes it easy to distribute your form, ensuring that your clients can access it anytime, anywhere.

The best way to complete and sign your credit card form printable

Find out other credit card form printable

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles