Fill and Sign the Credit Inquiry Form

Practical advice on preparing your ‘Credit Inquiry’ online

Are you fed up with the burden of managing documents? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the monotonous routine of printing and scanning papers. With airSlate SignNow, you can easily complete and sign documents online. Leverage the robust features embedded in this intuitive and affordable platform and transform your document management approach. Whether you need to approve forms or collect signatures, airSlate SignNow takes care of everything seamlessly, needing just a few clicks.

Adhere to this step-by-step guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Credit Inquiry’ in the editor.

- Click Me (Fill Out Now) to finish the form on your end.

- Add and assign fillable fields for other parties (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a multi-usable template.

Don’t fret if you need to work with others on your Credit Inquiry or send it for notarization—our solution provides you with everything necessary to complete such tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

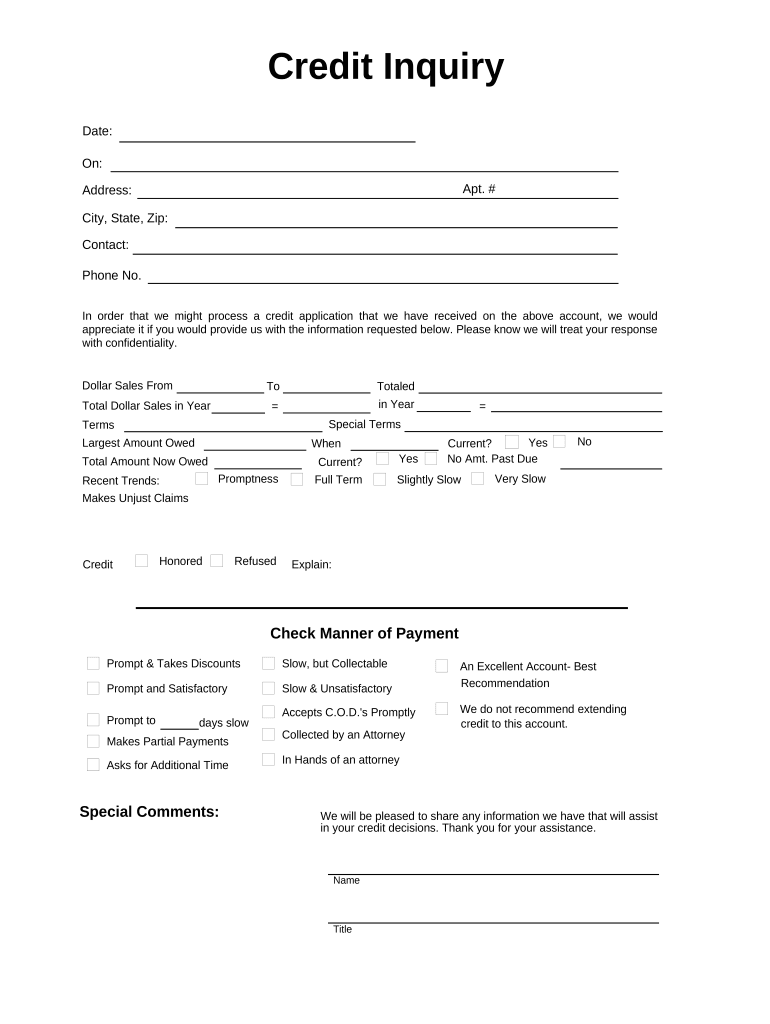

What is a credit inquiry form and how does it work?

A credit inquiry form is a document used by businesses to request a credit report from a consumer reporting agency. With airSlate SignNow, you can easily create, send, and eSign your credit inquiry forms electronically, streamlining your credit application process. This ensures quick access to essential credit information, facilitating better decision-making for your business.

-

How can airSlate SignNow help me manage my credit inquiry forms?

airSlate SignNow simplifies the management of credit inquiry forms by allowing you to create customizable templates that can be sent for eSignature. This not only saves time but also ensures that your forms are compliant and securely stored. You can track the status of each form in real time, making it easier to manage multiple inquiries.

-

Is there a cost associated with using the credit inquiry form feature?

Yes, while airSlate SignNow offers flexible pricing plans, the cost of using the credit inquiry form feature depends on the plan you choose. Our pricing is designed to be cost-effective, ensuring that businesses of all sizes can benefit from our eSignature solutions. You can find detailed pricing information on our website.

-

Can I integrate the credit inquiry form with other software?

Absolutely! airSlate SignNow offers seamless integrations with various CRM and document management systems. This means you can easily connect your credit inquiry forms to your existing workflows, enhancing efficiency and improving data management across your business.

-

What are the benefits of using airSlate SignNow for credit inquiry forms?

Using airSlate SignNow for your credit inquiry forms offers numerous benefits, including improved turnaround times and enhanced security for sensitive information. Our platform provides a user-friendly interface that makes it easy for both you and your clients to eSign documents, reducing paperwork and manual processes.

-

Is airSlate SignNow secure for handling credit inquiry forms?

Yes, airSlate SignNow prioritizes security and compliance. Our platform utilizes advanced encryption and security protocols to protect your credit inquiry forms and any associated data. We are committed to ensuring that your information remains confidential and secure throughout the eSigning process.

-

Can I customize my credit inquiry form in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your credit inquiry forms to meet your specific business needs. You can modify fields, add your branding, and include necessary legal disclaimers, ensuring that your forms are not only functional but also aligned with your company's identity.

The best way to complete and sign your credit inquiry form

Find out other credit inquiry form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles