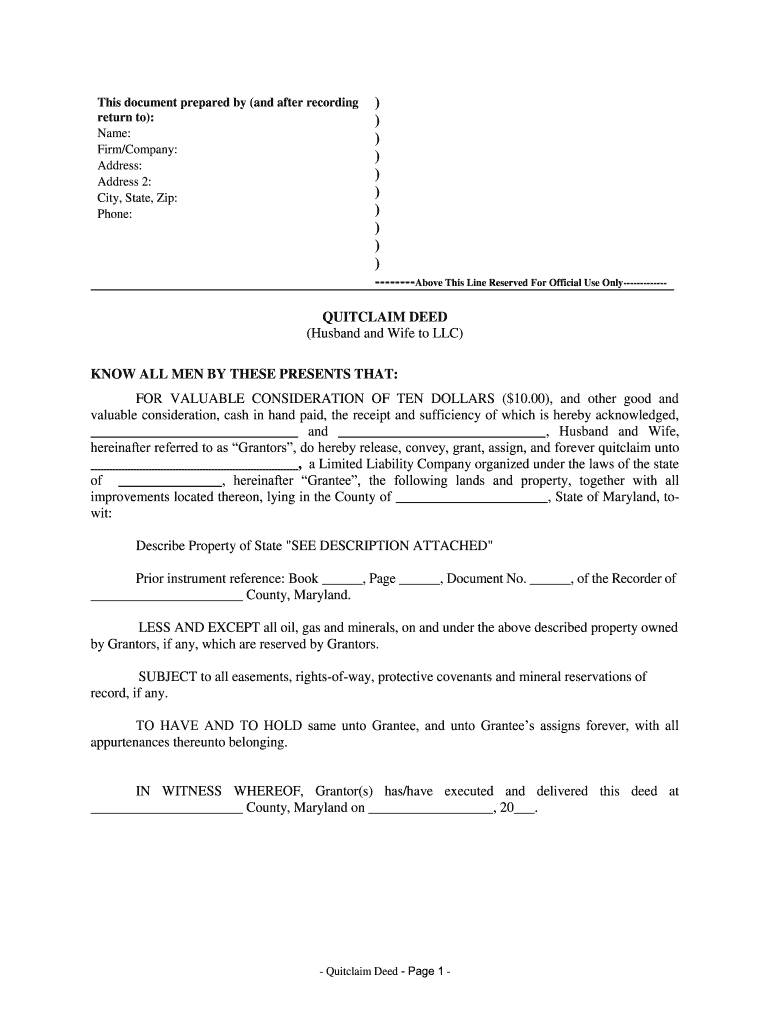

Fill and Sign the Hereinafter Referred to as Grantors Do Hereby Release Convey Grant Assign and Forever Quitclaim Unto Form

Useful tips on preparing your ‘Hereinafter Referred To As Grantors Do Hereby Release Convey Grant Assign And Forever Quitclaim Unto’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature service for both individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Utilize the powerful features embedded in this user-friendly and budget-friendly platform and transform your method of document management. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Follow this step-by-step guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Hereinafter Referred To As Grantors Do Hereby Release Convey Grant Assign And Forever Quitclaim Unto’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and assign fillable fields for other participants (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Hereinafter Referred To As Grantors Do Hereby Release Convey Grant Assign And Forever Quitclaim Unto or send it for notarization—our solution provides everything necessary to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the purpose of the phrase 'Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto'?

The phrase 'Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto' is commonly used in legal documents to clarify the intentions of the parties involved. It ensures that the grantors are formally transferring their rights and interests in a property or asset. Understanding this phrase is crucial for anyone looking to utilize airSlate SignNow for document management.

-

How does airSlate SignNow simplify the eSigning process?

airSlate SignNow simplifies the eSigning process by providing an intuitive platform that allows users to easily send, sign, and manage documents. With features like templates and automated workflows, users can efficiently handle agreements that include phrases like 'Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto.' This streamlines the entire process, saving time and reducing errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while still allowing you to manage documents that include legal phrases such as 'Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto.' Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. This allows you to manage documents that contain phrases like 'Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto' alongside your existing tools. Check our integrations page for a complete list of compatible applications.

-

What security measures does airSlate SignNow implement?

airSlate SignNow prioritizes the security of your documents by implementing robust encryption and compliance with industry standards. This ensures that sensitive information, including documents with phrases like 'Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto,' is protected. Our platform also includes features like audit trails and user authentication for added security.

-

Is airSlate SignNow suitable for legal professionals?

Absolutely! airSlate SignNow is designed to meet the needs of legal professionals who often deal with complex documents. The platform allows for the easy management of legal phrases such as 'Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto,' making it an ideal solution for attorneys and law firms looking to streamline their document processes.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced collaboration. By utilizing features that support phrases like 'Hereinafter Referred To As Grantors, Do Hereby Release, Convey, Grant, Assign, And Forever Quitclaim Unto,' users can ensure that all parties are aligned and informed throughout the signing process.

The best way to complete and sign your hereinafter referred to as grantors do hereby release convey grant assign and forever quitclaim unto form

Get more for hereinafter referred to as grantors do hereby release convey grant assign and forever quitclaim unto form

Find out other hereinafter referred to as grantors do hereby release convey grant assign and forever quitclaim unto form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles