Fill and Sign the Kaiser Permanente Cobra Enrollment Form PDF Meba Mymeba

Useful tips for finishing your ‘Kaiser Permanente Cobra Enrollment Form Pdf Meba Mymeba’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can easily fill out and sign documents online. Take advantage of the extensive features offered by this user-friendly and cost-effective platform to transform your document management process. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages everything seamlessly, needing just a few clicks.

Adhere to this guided procedure:

- Sign in to your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Kaiser Permanente Cobra Enrollment Form Pdf Meba Mymeba’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Add and designate fillable fields for others (if required).

- Proceed with the Send Invite options to obtain eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don't worry if you need to collaborate with others on your Kaiser Permanente Cobra Enrollment Form Pdf Meba Mymeba or send it for notarization—our solution provides everything necessary to complete such tasks. Register with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

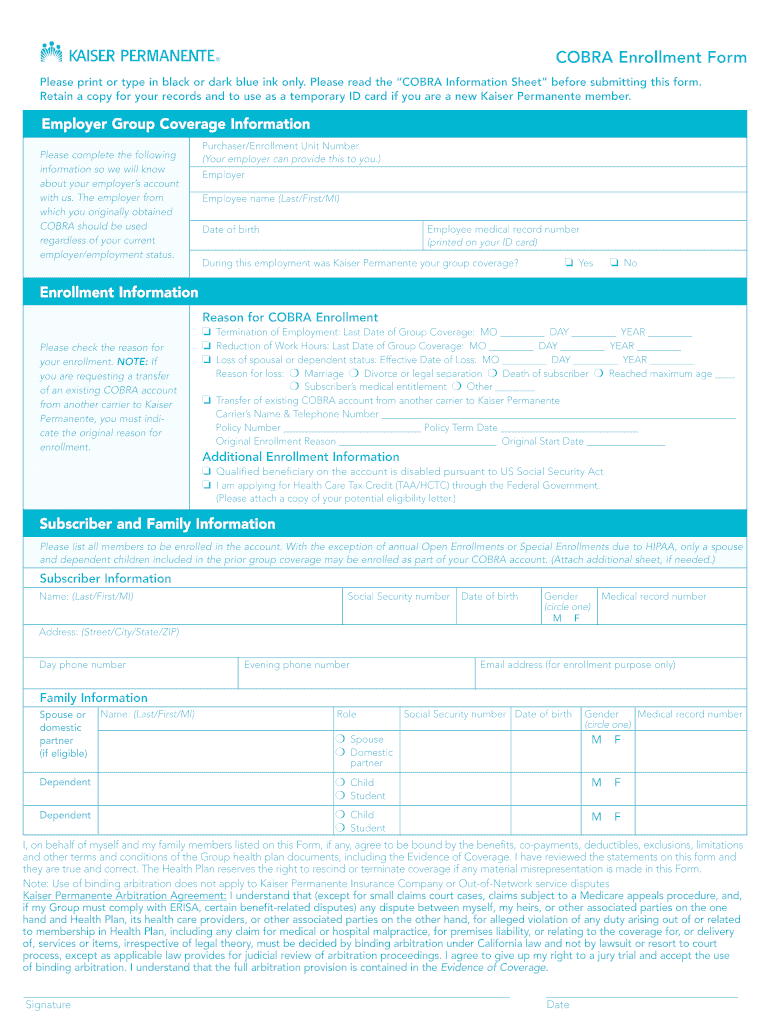

What is the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba?

The Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba is a crucial document that allows eligible members to continue their health insurance coverage under COBRA after leaving employment. This form ensures that you can maintain access to Kaiser Permanente services, providing peace of mind during transitions.

-

How can I obtain the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba?

You can easily download the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba from the official Kaiser Permanente website or your employer's HR department. For convenience, airSlate SignNow also allows you to upload and eSign the form digitally, streamlining the enrollment process.

-

What are the benefits of using the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba?

Using the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba allows you to maintain your health coverage without interruption. This form also simplifies the enrollment process, making it easier for you to manage your health insurance needs during signNow life changes.

-

Is there a cost associated with the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba?

While the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba itself is free to download, enrolling in COBRA coverage may involve premium payments. It's essential to review the associated costs with your employer or Kaiser Permanente to understand what you'll need to pay.

-

Can I fill out the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba electronically?

Yes, you can fill out the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba electronically using airSlate SignNow. Our platform allows you to upload the PDF, fill it out, and eSign it, making the process more efficient and convenient.

-

What integrations does airSlate SignNow offer for the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba?

airSlate SignNow integrates seamlessly with various platforms, allowing you to manage documents like the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba efficiently. Whether you need to connect with your email, cloud storage, or other business applications, our solution enhances your workflow.

-

How does airSlate SignNow enhance the COBRA enrollment experience with the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba?

airSlate SignNow enhances the COBRA enrollment experience by providing a user-friendly platform for managing the Kaiser Permanente COBRA Enrollment Form PDF MEBA Mymeba. With features like eSigning and document tracking, you can complete your enrollment quickly and securely.

Find out other kaiser permanente cobra enrollment form pdf meba mymeba

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles