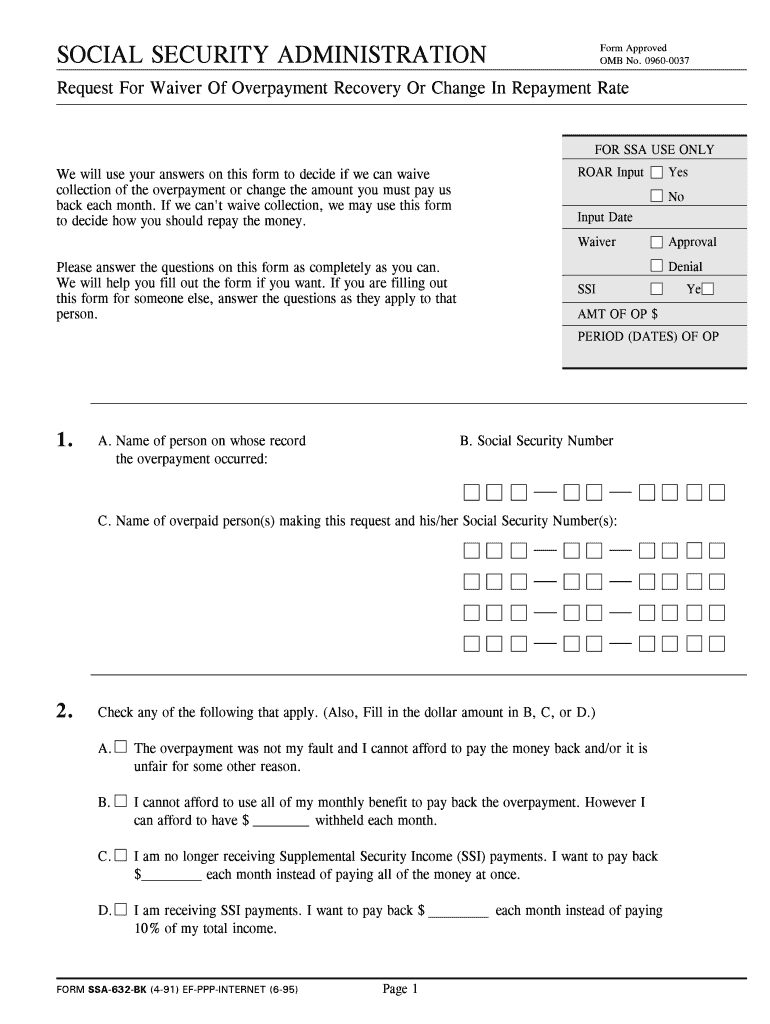

SOCIAL SECURITY ADMINISTRATION

Check any of the following that apply. (Also, Fill in the dollar amount in B, C, or D.)

A. The overpayment was not my fault and I cannot afford to pay the money back and/or it is unfair for some other reason.

B. I cannot afford to use all of my monthly benefit to pay back the overpayment. However I can afford to have $ withheld each month.

C. I am no longer receiving Supplemental Security Income (SSI) payments. I want to pay back $ each month instead of paying all of the money at once.

D. I am receiving SSI payments. I want to pay back $ each month instead of paying 10% of my total income.

FOR SSA USE ONLY

ROAR Input Yes

No

Request For Waiver Of Overpayment Recovery Or Change In Repayment Rate Form Approved OMB No. 0960-0037

We will use your answers on this form to decide if we can waive collection of the overpayment or change the amount you must pay us back each month. If we can't waive collection, we may use this formto decide how you should repay the money. Please answer the questions on this form as completely as you can. We will help you fill out the form if you want. If you are filling outthis form for someone else, answer the questions as they apply to that person.

A. Name of person on whose record B. Social Security Number the overpayment occurred:

1.

C. Name of overpaid person(s) making this request and his/her Social Security Number(s):

PERIOD (DATES) OF OP

Waiver Approval Denial

SSI Yes

Input Date

AMT OF OP $

FORM SSA-632-BK (4-91) EF-PPP-INTERNET (6-95) Page 1

2.

7. A. Have we ever overpaid you before?Yes No

If yes, on what Social Security number?

B. Why were you overpaid before? If the reason is similar to why you are overpaid now, explain what you did to try to prevent the present overpayment.

A. Did you tell us about the change or event that made you overpaid? Yes No

If no, why didn't you tell us?

6.

5. C. How were the overpaid benefits used?

If we are asking you to repay someone else's overpayment:

A. Was the overpaid person living with you when he/she was overpaid?

Yes No

B. Did you receive any of the overpaid money? Yes No

4.

3.

A. Did you, as representative payee, receive the overpaid benefits to use for the beneficiary?

Yes No (Skip to Question 4)

FORM SSA-632-BK (4-91) EF-PPP-INTERNET (6-95) Page 2

C. If you did not hear from us after your report, and/or your benefits did not change, did you contact

us again? Yes No

SECTION I-INFORMATION ABOUT RECEIVING THE OVERPAYMENT

B. Name and address of the beneficiary

B. If yes, how, when and where did you tell us? If you told us by phone or in person, who did you talk with and what was said?

Why did you think you were due the overpaid money and why do you think you were not at fault in causing the overpayment or accepting the money?

C. Explain what you know about the overpayment AND why it was not your fault.

13.

FORM SSA-632-BK (4-91) EF-PPP-INTENET (6-95) Page 3

IMPORTANT: If you answered "YES" to question 13, DO NOT answer any more questions on this form. Go to page 8, sign and date the form, and give your address and phone number(s). Bring or mail any papers that show you receive public assistance to your local Social Security office as soon as possible.

A. Are you now receiving cash public assistance such as Yes (Answer B and C and

Supplemental Security Income (SSI) payments? See Note Below) No

B. Name or kind of public assistance C. Claim Number

A. Did you receive or sell any property or receive any cash (other Yes (Answer Part B)

than earnings) after notification of this overpayment? No (Go to Question 13.)

A. Did you lend or give away any property or cash after notification Yes (Answer Part B)

of the overpayment? No (Go to Question 12.)

B. Who received it, relationship (if any), description and value:

12.

ANSWER 11 AND 12 ONLY IF THE OVERPAYMENT IS SUPPLEMENTAL SECURITY INCOME PAYMENTS (SSI). IF NOT, SKIP TO 13.

10.

Explain why you believe you should not have to return this amount.

9.

SSN: SECTION II-YOUR FINANCIAL STATEMENT

You need to complete this section if you are asking us either to waive the collection of the overpayment or to change the rate at which we asked you to repay it. Please answer all questions as fully and as carefully as possible. We mayask to see some documents to support your statements, so you should have them with you when you visit our office.

EXAMPLES ARE: Current Rent or Mortgage Books 2 or 3 recent utility, medical, charge card,

Savings Passbooks and insurance bills

Pay Stubs Cancelled checks

Your most recent Tax Return Similar documents for your spouse or dependent family members

Please write only whole dollar amounts-Round any cents to the nearest dollar. If you need more space foranswers, use the "Remarks" section at the bottom of page 7.

A. Do you now have any of the overpaid checks or money Yes Amount: $ in your possession (or in a savings or other type of account)? Return this amount to SSA No

B. Did you have any of the overpaid checks or money in your Yes Amount: $ possession (or in a savings or other type of account) at Answer Question 10.

the time you received the overpayment notice? No

11.

FOR SSA USE ONLY

NAME:

16.$ $

$

FORM SSA-632-BK (4-91) EF-PPP-INTERNET (6-95) Page 4

SHOW THE INCOME (Interest, dividends)

EARNED EACH MONTH. (If none explain in spaces below) If paid quarterly, divide by 3.

A. How much money do you and any person(s) listed in question 14 above have

as cash on hand, in a checking account, or otherwise readily available?

B. Does your name, or that of any other member of your household appear, either alone or with any other person, on any of the following?

PER MONTH

$ $

$ $

BALANCE OR VALUE

NAME AGE RELATIONSHIIP (If none, explain why the person is dependent on you)

14.

Members Of Household

List any person (child, parent, friend, etc.) who depends on you for support AND who lives with you.

Assets-Things You Have And Own 15.

$

TYPE OF ASSET OWNER

Enter the "Per Month" total on line (k) of question 19.

SAVINGS (Bank, Savings and Loan, Credit Union)

CERTIFICATES OF DEPOSIT (CD)

INDIVIDUAL RETIREMENT ACCOUNT (IRA)

MONEY OR MUTUAL FUNDS

BONDS, STOCKS

TRUST FUND

CHECKING ACCOUNT

OTHER (EXPLAIN)

TOTALS

A. If you or a member of your household own a car, (other than the family vehicle), van, truck,

camper, motorcycle, or any other vehicle or a boat, list below.

OWNER DESCRIPTION MARKETVALUE LOAN BALANCE (if any)

OWNER YEAR, MAKE/MODEL PRESENTVALUE LOAN BALANCE (if any) MAIN PURPOSE FOR USE

B. If you or a member of your household own any real estate (buildings or land), OTHER than where you live, or own or have an interest in, any business, property, or valuables, describe below.

USAGE-INCOME (rent etc.)

$ $

$

$ $

$

$ $

$

$ $

$ $

$ $

$ $

$ $

$ $

$ $

$ $

SOURCE

Name(s)

TOTALS

C. Is any other person listed YES

in Question 14 employed? NO (Go to Question 18)

19. A. Do you, your spouse or any dependent member of your household

receive support or contributions from any person or organization?

YES (Answer B) NO (Go to question 19)

A. Are you employed? YES (Provide information below) NO (Skip to B)

18. 17.

Monthly Household Income

If paid weekly, multiply by 4.33 (4 1/3) to figure monthly pay. If paid every 2 weeks, multiply by 2.166 (2 1/6) If self-employed, enter 1/12 of net earnings. Enter monthly TAKE HOME amounts on line A of question 19 also.

Monthly pay before deduction (Gross)

Monthly TAKE- HOME pay (Net)

Monthly TAKE- HOME pay (Net)

Monthly pay before deduction (Gross)

$

Monthly TAKE- HOME pay (Net)

B. How much money is received each month? $ (Show this amount on line (J) of question 19)

BE SURE TO SHOW

MONTHLY AMOUNTS BELOW-If received weekly or every 2 weeks, read the instruction at the top of this page.

$

$

TYPE

TYPE

TYPE

Monthly pay before deduction (Gross)

A. TAKE HOME Pay (Net) (From #17 A, B, C, above)

INCOME FROM #17 AND #18 ABOVE AND OTHER INCOME TO YOUR HOUSEHOLD

B. Social Security Benefits

C. Supplemental Security Income (SSI)

E. Public Assistance (Other than SSI)

F. Food Stamps (Show full face value of stamps received)

G. Income from real estate (rent, etc.) (From question 16B)

H. Room and/or Board Payments (Explain in remarks below)

I. Child Support/Alimony

J. Other Support (From #18 (B) above)

K. Income From Assets (From question 15)

L. Other (From any source, explain below)

REMARKS

D. Pension(s) (VA, Military, Civil Service, Railroad, etc.)

Employer(s) name, address, and phone: (Write "self" if self-employed)

Employer name, address, and phone: (Write "self" if self-employed)

Employer(s) name, address, and phone: (Write "self" if self-employed)

FORM

SSA-632-BK (4-91) EF-PPP-INTERNET (6-95) Page 5

B. Is your spouse employed? YES (Provide information below) NO (Skip to C)

$

$

$

$

YOURS

$ $

$

SPOUSE'S

OTHER

HOUSEHOLD MEMBERS

$

$

SSA USE

ONLY

GRAND TOTAL $

FORM SSA-632-BK (4-91) EF-PPP-INTERNET (6-95) Page 6

MONTHLY HOUSEHOLD EXPENSES

If the expense is paid weekly or every 2 weeks, read the instruction at top of Page 5. Do NOT list an expense that is withheld from income (Such as Medical Insurance). Only take home pay is used to figure income.

Show "CC" as the expense amount if the expense (such as clothing) is part of CREDIT CARD EXPENSE SHOWN ON LINE (F).

$ PER MONTH SSA

USE

ONLY

20.

EXPENSE REMARKS Also explain any unusual or very large expenses, such as medical, college, etc.)

P. Any expense not shown above (Specify)

J. Medical-Dental (After amount, if any, paid by insurance)

K. Car operation and maintenance (Show any car loan payment in (O) below)

L. Other transportation

M. Church-charity cash donations

N. Loan, credit, lay-away payments (If payment amount is optional, show minimum)

O. Support to someone NOT in household (Show name, age, relationship (if any) and address)

C. Utilities (Gas, electric, telephone) D. Other Heating/Cooking Fuel (Oil, propane, coal, wood, etc.)

E. Clothing

F. Credit Card Payments (show minimum monthly payment allowed)

G. Property Tax (State and local)

H. Other taxes or fees related to your home (trash collection, water-sewer fees)

I. Insurance (Life, health, fire, homeowner, renter, car, and any other casualty or liability policies)

B. Food (Groceries (include the value of food stamps) and food at restaurants, work, etc.)

A. Rent or Mortgage (If mortgage payment includes property or other local taxes, insurance, etc. DO NOT list again below.

TOTAL

A. Do you, your spouse or any dependent member of your household expect YES (Explain onyour or their financial situation to change (for the better or worse) in the line below)

next 6 months? (For example: a tax refund, pay raise or full repayment NOof a current bill for the better-major house repairs for the worse).

B. If there is an amount of cash on hand or in checking No amount on hand accounts shown in item 15A, is it being held for a NO (Money available for any use)special purpose? YES (Explain on line below)

D. Is there any reason you CANNOT SELL or otherwise convert to cash YES (Explain on any of the assets shown in items 16A and B? line below)

NO

C. Is there any reason you CANNOT convert to cash the "Balance or Value" YES (Explain on

of any financial asset shown in item 15B. line below)

NO

INCOME AND EXPENSES COMPARISON 21.

FORM SSA-632-BK (4-91) EF-PPP-INTERNET (6-95) Page 7

INC LESS THAN

ADJ EXPENSE

INC. EXCEEDS

ADJ EXPENSE

+ $25

$

A. Monthly income

(Write the amount here from the "Grand Total" of #19.

B. Monthly Expenses Write the amount here from the "Total" of #20.

C. Adjusted Household Expenses

D. Adjusted Monthly Expenses (Add (B) and (C))

$

$

22.

$

-

+

$

FINANCIAL EXPECTATION AND FUNDS AVAILABILITY 23.

REMARKS SPACE-- If you are continuing an answer to a question, please write the number (and letter, if any) of the question first.

(MORE SPACE ON NEXT PAGE)

If your expenses (D) are more than your income (A), explain how you are paying your bills. FOR SSA USE ONLY

About the Privacy Act

The Social Security Act (Sections 204, 1631(b), and 1870)

and the Federal Coal Mine Health and Safety Act of 1969

allow us to collect the facts on this form. This form is

voluntary. However, if you do not give us the facts we ask

for, we may not be able to approve your waiver request. If

we cannot collect the overpayment, we may ask the JusticeDepartment to collect it.

Sometimes the law requires us to give out the facts on this

form without your consent. We must give these facts toanother person or government agency if Federal law

requires that we do so or to do the research and auditsneeded to monitor and improve the programs we manage.

We may also give these facts to the Justice Department to

investigate and prosecute violations of the Social Security

Act or we may use the facts in computer matching

programs. Matching programs compare our records withthose of other Federal, State, or local government agencies.

All the Agencies may use matching programs to find or

prove that a person qualifies for benefits paid for ormanaged by the Federal government. Another use is to

identify and collect overpayments or to collect overdueloans under these benefits programs.

FORM SSA-632-BK (4-91) EF-PPP-INTERNET (6-95) Page 8

SIGNATURE OF WITNESS

I know that anyone who makes or causes to be made a false statement of representation of material fact in an application or for use in determining a right to payment under the Social Security Act commits acrime punishable under Federal law and/or State law. I affirm that all information I have given in thisdocument is true.

(REMARKS SPACE (Continued)

PENALTY CLAUSE, CERTIFICATION AND PRIVACY ACT STATEMENT

SIGNATURE OF OVERPAID PERSON OR REPRESENTATIVE PAYEE

WORK TELEPHONE NUMBER IF WE MAY CALL YOU AT WORK (Include area code)

DATE (Month, Day, Year)

HOME TELEPHONE NUMBER (Include area code)

SIGNATURE (First name, middle initial, last name) (Write ink) SIGN

HERE

ENTER NAME OF COUNTY (IF ANY) IN WHICH YOU NOW LIVE

MAILING ADDRESS (Number and street, Apt. No., P.O. Box, or Rural Route)

CITY AND STATE ZIP CODE

SIGNATURE OF WITNESS

ADDRESS (Number and street, City, State, and zip Code)

Witnesses are required ONLY if this statement has been signed by mark (X) above. If signed by mark (X), two witnesses to the signing who know the individual must sign below, giving their full addresses.

ADDRESS (Number and street, City, State, and zip Code)

These and other reasons why facts on this form may be used

or given out are explained in the Federal Register. If youwould like more information, contact us. Time It Takes To Complete This Form

We estimate that it will take you about 25 minutes to

complete this form. This includes the time it will take to read

the instructions, gather the necessary facts and fill out the

form. If you have comments or suggestions on this estimate,

or on any other aspect of this form, write to the SocialSecurity Administration, ATTN: Reports Clearance Officer,

1-A-21 Operations Bldg., Baltimore, MD 21235, and to theOffice of Management and Budget, Paperwork ReductionProject 0960-0037, Washington, D.C. 20503.

Send only

comments relating to our estimate or other aspects of this

form to the offices listed above. All requests for Social

Security cards and other claims-related information should

be sent to your local Social Security office, whose address

is listed in your telephone directory under the Departmentof Health and Human Services.