Fill and Sign the This Enrollment Packet is for Use in the Following Jurisdictionsstates Form

Useful advice for finishing your ‘This Enrollment Packet Is For Use In The Following Jurisdictionsstates’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the top eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the extensive features incorporated into this user-friendly and cost-effective platform to transform your approach to document management. Whether you need to authorize forms or collect eSignatures, airSlate SignNow simplifies the process, requiring just a few clicks.

Follow this detailed guide:

- Access your account or initiate a free trial with our service.

- Hit +Create to upload a file from your device, cloud storage, or our form library.

- Edit your ‘This Enrollment Packet Is For Use In The Following Jurisdictionsstates’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Insert and assign fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you must collaborate with your team on your This Enrollment Packet Is For Use In The Following Jurisdictionsstates or send it for notarization—our platform provides all the tools you need to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

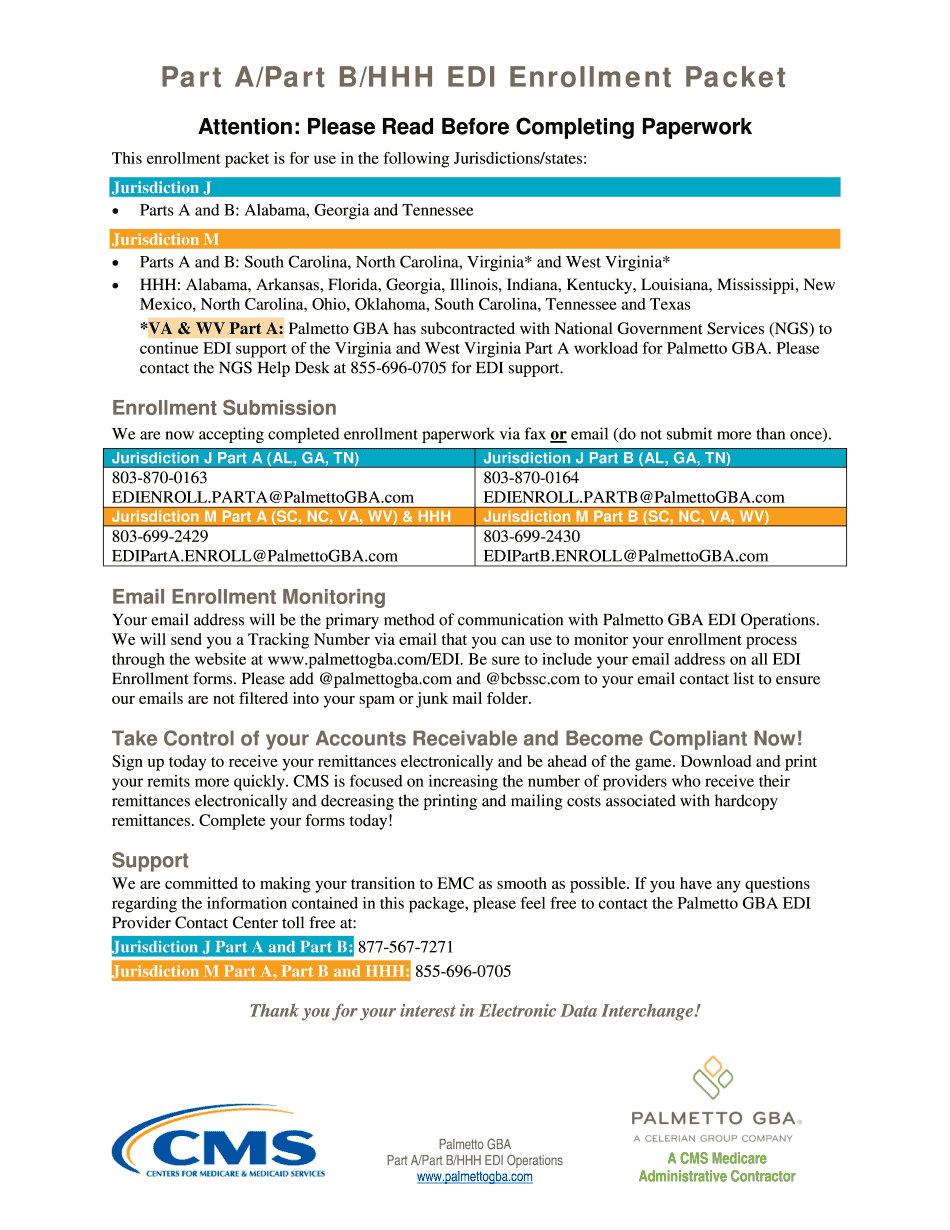

What is a Medicare Edi Enrollment Form?

A Medicare Edi Enrollment Form is a document used by healthcare providers to enroll in the Electronic Data Interchange (EDI) system for Medicare. This form facilitates the secure and efficient exchange of patient data and claims information, ensuring compliance with Medicare regulations.

-

How can airSlate SignNow help with Medicare Edi Enrollment Forms?

airSlate SignNow simplifies the process of completing and signing Medicare Edi Enrollment Forms by providing an easy-to-use platform for eSigning and document management. With our solution, healthcare providers can quickly prepare, send, and receive signed forms, streamlining their enrollment process.

-

Is there a cost associated with using airSlate SignNow for Medicare Edi Enrollment Forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our cost-effective solution ensures that you can efficiently manage your Medicare Edi Enrollment Forms without breaking your budget, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing Medicare Edi Enrollment Forms?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage to help manage Medicare Edi Enrollment Forms effectively. Additionally, our platform allows real-time tracking and notifications, ensuring you never miss a step in the enrollment process.

-

Can airSlate SignNow integrate with other healthcare systems for Medicare Edi Enrollment Forms?

Absolutely! airSlate SignNow seamlessly integrates with various healthcare systems and software, enabling you to manage your Medicare Edi Enrollment Forms alongside your existing tools. This integration enhances efficiency and ensures a smoother workflow across your organization.

-

What are the benefits of using eSignature for Medicare Edi Enrollment Forms?

Using eSignature for Medicare Edi Enrollment Forms offers numerous benefits, including faster processing times, reduced paper waste, and improved security. With airSlate SignNow, you can ensure the authenticity of signatures while maintaining compliance with healthcare regulations.

-

How can I ensure the security of my Medicare Edi Enrollment Forms with airSlate SignNow?

airSlate SignNow prioritizes the security of your Medicare Edi Enrollment Forms by utilizing advanced encryption and secure server protocols. Our platform also includes features such as audit trails and user authentication, ensuring that your sensitive information remains protected.

Find out other this enrollment packet is for use in the following jurisdictionsstates form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles