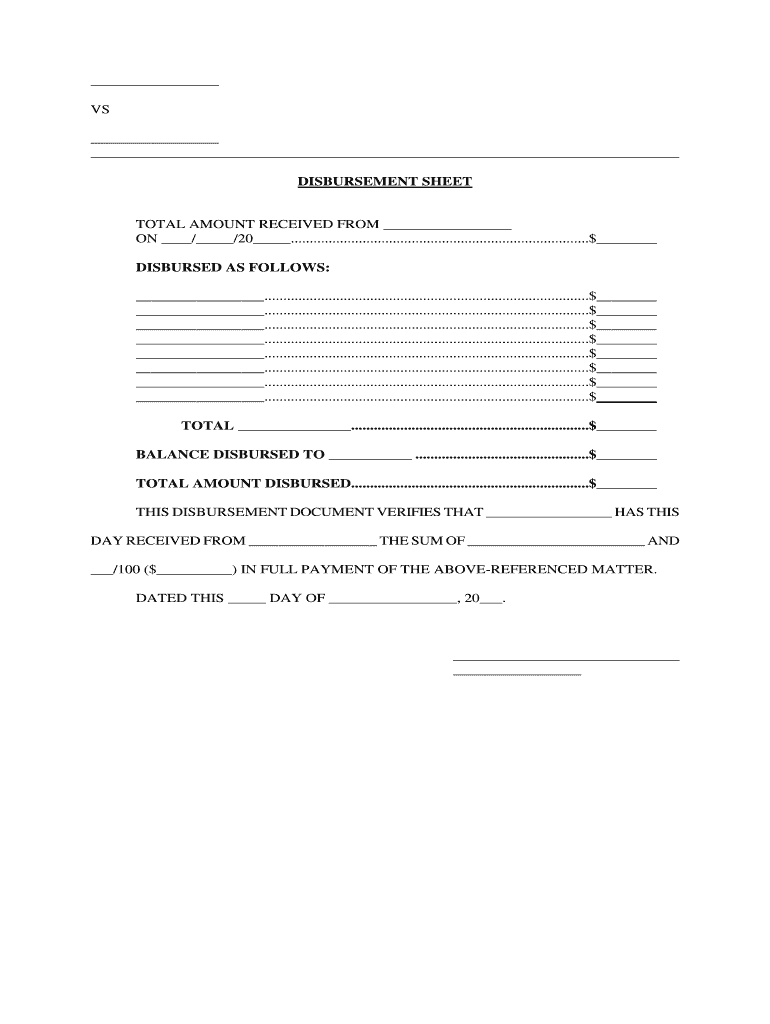

Fill and Sign the What is a Disbursementtax Adviser Form

Valuable advice for preparing your ‘What Is A Disbursementtax Adviser’ online

Are you fatigued by the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier digital signature platform for individuals and businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and approve paperwork online. Utilize the powerful capabilities integrated into this intuitive and budget-friendly platform and transform your method of paperwork management. Whether you need to approve forms or gather signatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Follow this comprehensive guide:

- Log in to your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Open your ‘What Is A Disbursementtax Adviser’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your What Is A Disbursementtax Adviser or send it for notarization—our platform has everything you need to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is a disbursement in the context of tax advising?

A disbursement refers to the payment of funds for a specific purpose, often related to expenses incurred during tax preparation or advisory services. Understanding what a disbursement is can help clients manage their finances more effectively. Tax advisers often clarify these terms to ensure clients are aware of their financial obligations.

-

How can airSlate SignNow help with disbursement documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to disbursements. By using our platform, tax advisers can ensure that all necessary documentation is completed efficiently and securely. This not only saves time but also reduces the risk of errors in important financial transactions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution ensures that you only pay for what you need, making it easier for tax advisers to manage their budgets. For detailed pricing information, visit our website or contact our sales team.

-

What features does airSlate SignNow provide for tax advisers?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These tools are designed to enhance the efficiency of tax advisers when managing disbursements and other financial documents. Our platform is user-friendly, making it accessible for both advisers and their clients.

-

What are the benefits of using airSlate SignNow for disbursement processes?

Using airSlate SignNow for disbursement processes offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Tax advisers can focus more on providing valuable advice rather than getting bogged down by administrative tasks. This ultimately leads to better client satisfaction and improved business outcomes.

-

Can airSlate SignNow integrate with other financial software?

Yes, airSlate SignNow seamlessly integrates with various financial software solutions, allowing tax advisers to streamline their workflows. This integration ensures that all disbursement-related documents are easily accessible and manageable within one platform. By connecting with your existing tools, you can enhance productivity and maintain organization.

-

How does airSlate SignNow ensure the security of disbursement documents?

airSlate SignNow prioritizes the security of your documents through advanced encryption and compliance with industry standards. This means that all disbursement documents are protected from unauthorized access, ensuring confidentiality for tax advisers and their clients. Trust in our platform to keep your sensitive information safe.

The best way to complete and sign your what is a disbursementtax adviser form

Find out other what is a disbursementtax adviser form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles